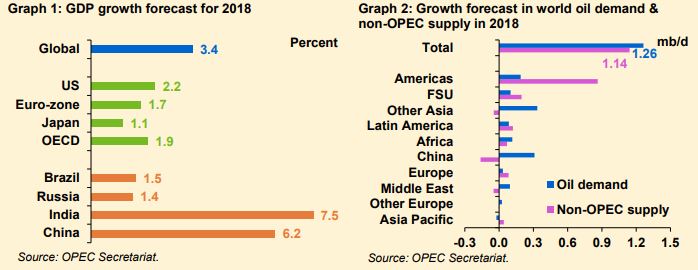

OECD growth is forecast at a slightly lower level, while non-OECD economies are forecast to see some better growth. India is forecast to successfully improve its GDP growth level due to the implementation of economic reforms. Both Brazil and Russia are forecast to expand their recovery further in 2018. China will see lower growth than in 2017, although still the second-highest growth rate of major emerging economies, with domestic consumption providing a greater contribution. Stability in the oil market remains a key determinant for global economic growth in the coming year. Geopolitical developments and the pace of monetary policy normalisation in major economies will also require close monitoring.

World oil demand growth in 2018 is estimated at 1.26 mb/d, slightly less than in the current year and broadly in line with the average growth seen over the last five years, to total 97.65 mb/d (Graph 2). Factors driving global oil consumption in 2018 are expected to be the ongoing growth in the world economy; road transportation demand propelled by steady vehicle sales in the US, China and India; capacity additions and expansions in the petrochemical sector, particularly in the US; and new capacities of propane dehydrogenation plants in China. Uncertainties to the 2018 oil demand forecast include the higher level of substitution towards other fuels, efficiency gains, subsidy reductions, and digitalisation and technological developments. OECD consumption is foreseen to rise by around 0.19 mb/d in 2018. Non-OECD demand is expected to increase by 1.07 mb/d, with China and India as the major contributors.

Non-OPEC oil supply for 2018 is forecast to grow by 1.14 mb/d, higher than the 0.80 mb/d growth expected for 2017, to average 58.96 mb/d. On a country basis, the main contributors to growth next year are expected to be the US with 0.86 mb/d, Brazil with 0.22 mb/d, Canada with 0.17 mb/d, and Russia with 0.17 mb/d. Leading the declines in non-OPEC oil supply will be Mexico with 0.17 mb/d and China with 0.16 mb/d, mainly due to an absence of new projects and heavy declines in mature fields. US shale output is expected to be somewhat impacted by cost inflation and a decline in well productivity as operators expand production beyond so-called ‘sweet spots.’ Continued production ramp-ups support supply in Brazil, while Canada is also forecast to expand its oil output, particularly from oil sands.

Russia’s oil supply growth forecast takes into account the continuation of voluntary production adjustments into 1Q18. Based on the above forecasts, projected non-OPEC supply and OPEC NGLs growth will slightly outpace incremental world oil demand, resulting in demand for OPEC crude in 2018 of 32.2 mb/d. This represents a decline of 0.1 mb/d from the current year, which compares to an expected increase of 0.3 mb/d in 2017 over a year earlier. A better-than-expected improvement in the global economy could contribute further to oil demand growth in the coming year, accelerating the ongoing rebalancing in the oil market and supporting market momentum in 2018.

Source: OPEC

This reflects a continued improvement in the global economy. Given the gradual ongoing recovery, the extraordinary stimulus of the past years is expected to be reduced further on both the fiscal and particularly the monetary side.

This reflects a continued improvement in the global economy. Given the gradual ongoing recovery, the extraordinary stimulus of the past years is expected to be reduced further on both the fiscal and particularly the monetary side.