Be rational about influence of rising crude oil on PTA – Crude oil PTA - Arhive

On Nov 30th, 2016, OPEC members reached an agreement in oil production curtailment, which pushed crude oil prices up dramatically.

By Dec 5th, Brent crude oil futures surged to $54.94/bbl, the highest level since Jul, 2015.

Although some analysts questioned whether OPEC’s production curtailment would be carried out enough, the curtailment is inevitable.

Accordingly, U.S. oil index broken through curtail neckline of weekly k line, while weekly KD was above $50/bbl and weekly MACD was above zero axis.

With unchanged uptrend, crude oil futures were estimated to break through $57/bbl in 3-4 weeks and reach peak between $57-63.8/bbl, averaging about $60/bbl.

Crude oil prices would be under large pressure after breaking through $60/bbl, because oil drills in U.S. began to recover and shale oil cost had collapsed.

According to Reuters, in Bakken Shale Play, North Dakota, petroleum companies have accessed to as low drilling cost as that in Iran and Iraq.

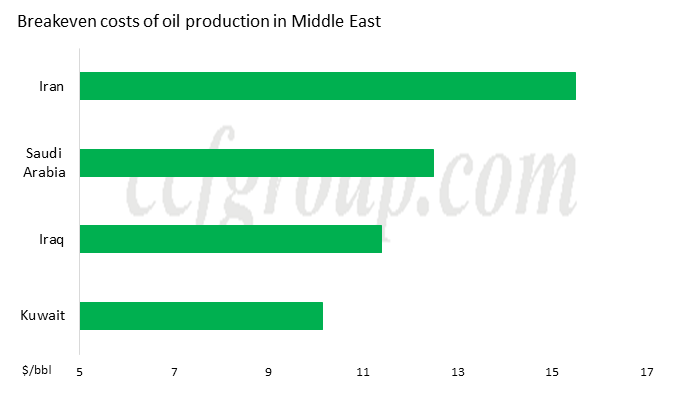

Among oil producers in Middle East, the breakeven costs of oil production are $10.15/bbl in Kuwait, $11.38/bbl in Iraq, $12.5/bbl in Saudi Arabia and $15.5/bbl in Iran respectively.

IEA official once said:” If OPEC’s oil production curtailment agreement helps oil price back to $60/bbl, we will see significant improvement of shale oil production in U.S.”

If crude oil prices return to $60/bbl, how will it affect PTA market?

Based on the calculation, the total transfer cost of naphtha will be pushed to $540/mt.

Since weak PX fundamentals may be hard to totally transfer the increment of naphtha, PX processing margin may narrow from $360/mt to $320/mt.

Accordingly, PX prices are estimated $860/mt when crude oil returns to $60/bbl. Considering $795/mt of average ACP, comprehensive average PX price may rise to $830/mt.

PTA raw material cost is only around 4,550yuan/mt or 4,700yuan/mt even totally based on spot PX calculation. Therefore, PTA futures may only tick up to the high level in previous fluctuation.

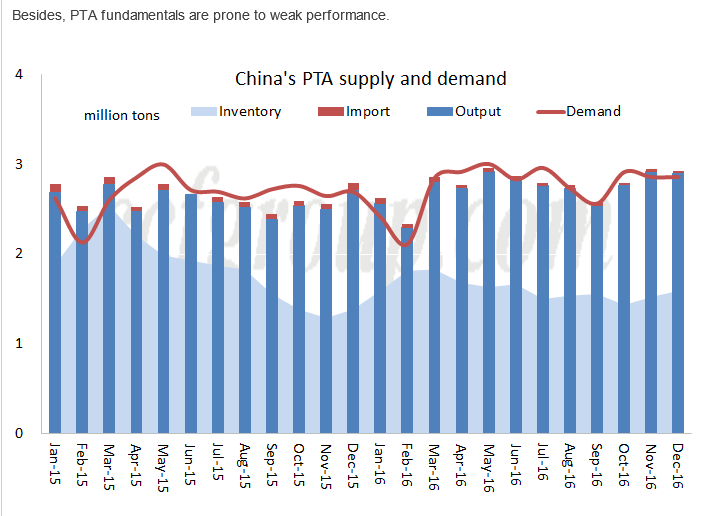

PTA output of December is assessed to 2.9 million tons and import volume may be around 30 KT. PTA supply may be 2.93 million tons.

As to the demand side, polyester output may be 3.2 million tons. Plus non-polyester use and exports, total demand for PTA may be around 2.85 million tons.

PTA supply may outnumber PTA demand thus PTA inventory is expected to increase by 50-100 KT.

In total, even if crude oil prices hike to $60/bbl, it may not push up PTA cost apparently. Besides, PTA fundamentals are moderately weaker than those in previous time. Therefore, we should be rational about the influence of rising crude oil on PTA market.