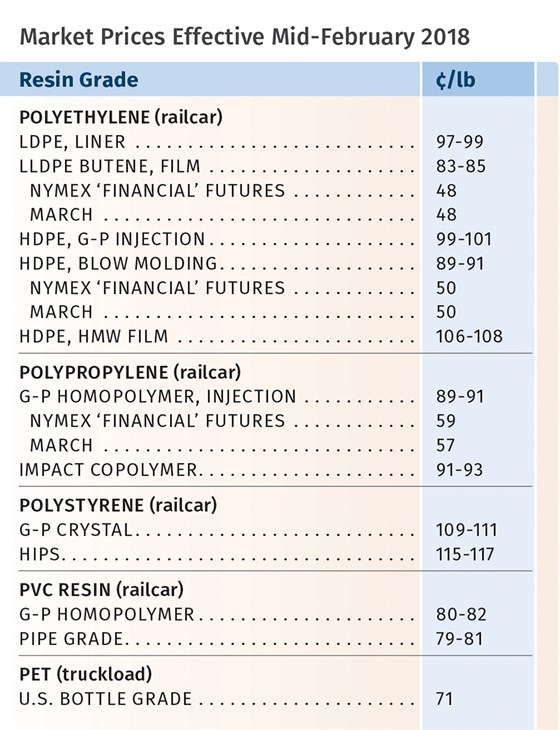

Prices of PP and PET moved up in January, while PE, PS, and PVC held even. But rising prices were projected for February, March and into the second quarter for all resins but PP. The latter was heading into a downward correction after prices spiked significantly in step with propylene monomer. Factors behind the overall upward movement include higher oil prices and export demand for resins, planned and unplanned polymer and feedstock plant outages, and expected strong demand in the second quarter.

Those are the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas; Michael Greenberg, CEO of the Plastics Exchange in Chicago; and Houston-based PetroChemWire (PCW).

PE PRICES HEADED UP

Polyethylene prices were flat in January after most processors saw at least a 3¢/lb reduction in December, according to Mike Burns, RTi’s v.p. of client services for PE. However, suppliers announced a 4¢/lb price increase for Feb. 1 and at least three of them issued an additional hike of 3¢/lb for March 1.

Said Burns, “Export markets are very strong and oil prices are very high. Unless these factors change drastically, processors ought not expect any more PE price reductions.” Greenberg reported a slowed PE spot market as spot prices rose by as much as 9¢/lb in January—swinging from a discount to contract level. PCW characterized spot PE prices as flat to higher in early February amid balanced-to-tight supply. PCW cited strong consumer sentiment as boosting domestic resin consumption, while a combination of planned and unplanned outages kept output in check, despite the ongoing ramp-up of new capacity.

PCW reported that DowDuPont is expected to start up its new 772-million-lb/yr tubular LDPE plant in Plaquemine, La., by the end of the first quarter. Westlake maintained its force majeure on LDPE homopolymers, while Formosa PE units in Point Comfort, Texas, were running at reduced rates due to the outage of its Olefins 1 unit. ExxonMobil was heading into a one-month turnaround of its Baton Rouge HDPE/LDPE facilities, while Nova Chemical’s Corunna, Ont., ethylene cracker was unexpectedly shut down in late January.

PP PRICES TURNING BACK DOWN

Polypropylene prices moved up 9¢/lb in January, in step with propylene monomer contracts, after a 2¢/lb increase in November and December. But a reversal appeared to be taking place before January’s end, with spot monomer prices dropping by as much as 13¢/lb, according to Scott Newell, RTi’s v.p. of PP markets.

Newell characterized the January increase as “all cost-push, driven by propylene monomer due to shortages.” Full ramp-up of the new Enterprise Product Partners propylene production unit was delayed into January; Dow’s propylene unit was still out after an unplanned shutdown; and other minor monomer production outages were cropping up.

Both Newell and PCW described the market as very volatile—pushing prices of both monomer and PP way above the rest of the world. Both also reported that the result was significant demand destruction, both domestic and foreign, due to high U.S. PP prices. PCW referred to reports of downstream customers pulling orders for a variety of finished PP goods, preferring to wait until prices moderate.

Newell foresaw a turnaround taking place—predicting PP prices to be flat to down for February, based on lower monomer contract prices as supply improved. While the price volatility is difficult to gauge, he anticipated a correction for both monomer and PP by this month and did not expect PP suppliers to attempt margin expansions. In early February, Greenberg reported that spot PP prices dropped 4¢/lb on average, following a sharp drop in spot monomer prices down to 52¢/lb, after peaking at 68¢/lb. Monomer price forecasts for the spring months were even lower.

PS PRICES MOVING UP

Polystyrene prices were flat in January, as benzene contract prices dropped by 11¢/gal, which represents a 1¢/lb decrease in PS production costs. However, PS suppliers issued price hikes of 2-7¢/lb for Feb. 1, attributing their action to a substantial rise in spot styrene monomer prices. This was due to a number of planned and unplanned global monomer outages, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS and PVC, who ventured that PS prices would move up last month, but on the lower end of the increases being sought. “There is a lot of negotiation taking place due to downward pressure from benzene but upward pressure from styrene,” Kallman said.

PCW also reported that the 7¢/lb target for price increases was expected to be revised downward. It also reported that Total Petrochemicals notified customers in early February that it had sufficient styrene monomer supplies to restart the two smaller PS lines at its Carville, La., plant that were shut down after severe winter weather. Initially, the company reduced rates on its two larger PS units and idled the two smaller units as it evaluated the extent of styrene monomer production loss at the adjacent Cosmar plant. RTi’s Kallman predicted that PS prices in March would be flat, particularly if benzene prices dropped further, as monomer production issues were resolved.

While the first quarter continued to reflect the slow season for PS, demand is expected to be strong in the second quarter.

PVC PRICES INCREASE; MORE UNDERWAY?

PVC prices were flat in January, but suppliers issued a 3¢/lb price increase for Feb. 1, followed by a 4¢/lb increase for March 1, according to RTi’s Kallman and PCW. The latter reported that some suppliers were warning of an April price hike, as well. Among the contributing factors cited by suppliers, according to PCW , is that too much margin was lost as a result of the December 1¢/lb decrease, 2-3¢/lb resets in fourth-quarter 2017 contract negotiations, and financial losses during Hurricane Harvey.

Kallman noted that overseas demand was very good as global prices rose, so that U.S. export prices have been increasing, putting pressure on domestic prices. But he added, “There are opposing forces at work—a substantial decrease in February ethylene prices is expected, which will yield a discount off the 3¢/lb increase.” While he ventured that suppliers would implement 1-2¢ of the February increase, he expected that it would be delayed to this month along with the March increase—allowing suppliers to implement 4-5¢/lb by April, the start of the construction season, which is anticipated to be strong this year.

PET PRICES UP

PCW reported that domestic bottle-grade PET resin ended January at 71¢/lb for bulk-truck shipments delivered to the Midwest, up 2¢/lb from December. Supply was limited due to P&G Chemicals idling PET plants in Apple Grove, W. Va., and Altamira, Mexico, in October when M&G subsidiaries filed for bankruptcy protection.

One of Altamira’s two production units was restarted in mid-January. Meanwhile, imported PET with an IV of 78 or higher was at 65¢/lb, delivered duty-paid (DDP) to the West Coast, and 67-70¢/lb DDP to the East Coast and Chicago area, plus 2-5¢/lb for inland freight, up 1-2¢/lb from early January. Cost of North American PET feedstocks—PTA, MEG and PX, averaged 58.4¢/lb in January, down from 73¢/lb in December.

However, PCW ventures that PET prices will likely rise in March as anti-dumping duties go into effect (March 5) on U.S. PET imports from five countries—South Korea, Brazil, Indonesia, Taiwan, and Pakistan—which account for about 40% of all U.S. imports. PCW projects PET prices will likely rise from the current level of 70-71¢/lb to the mid-70¢/lb range for domestically produced PET resin in truckload and bulk-truck spot business, and 2-4¢/lb lower for bulk-truck and railcar business tied to published PET feedstock indexes. Imports of PET from the five countries started to drop in December 2017. PCW expects import prices to rise 2-4¢/lb above the levels noted above.

Related Topic

Prices Commodity Resins PP PE PS PVC PET Prices Commodity Resins PP PE PS PVC PET Prices Commodity Resins PP PE PS PVC PET Prices Commodity Resins PP PE PS PVC PET Prices Commodity Resins PP PE PS PVC PET Prices Commodity Resins PP PE PS PVC PET Prices Commodity Resins PP PE PS PVC PET Prices Commodity Resins PP PE PS PVC PET