Second shale revolution is on the horizon – In less than two decades, Permian Basin operators have unleashed a shale revolution that has virtually tripled crude production from the region and upended global energy markets -Second shale revolution - Arhive

Second shale revolution Second shale revolution Second shale revolution Second shale revolution Second shale revolution Second shale revolution Second shale revolution Second shale revolution Second shale revolution Second shale revolution Second shale revolution

Second shale revolution is on the horizon

Data scientist calls for pooling data to help optimize production from Permian’s shales

By Mella McEwen mmcewen@mrt.com, Midland Reporter-Telegram

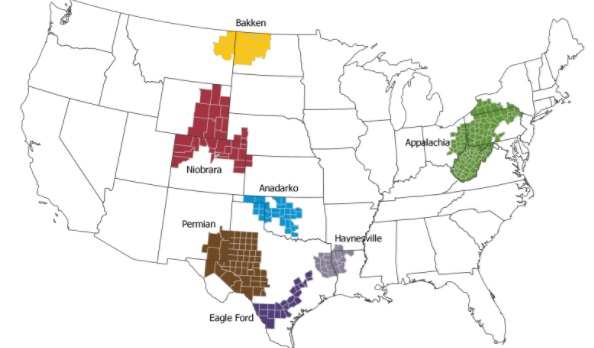

USA shale fields

In less than two decades, Permian Basin operators have unleashed a shale revolution that has virtually tripled crude production from the region and upended global energy markets.

In less than two decades, Permian Basin operators have unleashed a shale revolution that has virtually tripled crude production from the region and upended global energy markets.

Now a second revolution is on the horizon as operators prepare to re-enter those wells that launched the first revolution and implement secondary recovery projects. That can consist of operators reinjecting gas into the reservoir to restore pressure and then producing the additional crude and natural gas.

“It looks like the second shale revolution will be huge,” said Lewis Matthews, data scientist with CrownQuest Operating.

He said the Permian Basin has been producing for close to 100 years and “we’re not even close to getting all the oil.”

CrownQuest alone has 200 years of drilling inventory, said Matthews, who expects companies such as Concho Resources and Pioneer Natural Resources have similar inventories.

The Permian Basin is renowned for its stacked plays – up to 3,000 feet of potential producing formations, some of which have yet to be developed.

“The number of benches we’re looking at today, we know there’s more there,” Matthews said.

Matthews discussed this coming revolution and its challenges during a recent quarterly luncheon of the Petroleum Professional Data Management association at Midland College’s Petroleum Professional Development Center.

The challenges of the second revolution will be similar to those of the first: optimizing spacing and completion techniques, but with additional cycles of injecting gas to repressure the reservoirs, he said. But operators are using what he called heterogeneous completion techniques and relying on heterogeneous geology, geophysics, geomechanics and geometry.

Just as a doctor would not prescribe the same identical medication for each patient, “each well requires unique spacing and completion,” he said.

But devising unique spacing and completions for each well requires data, and data is in short supply, Matthews said.

“We have tiny data sets on spacing and completions,” he said. “The newest wells are the most interesting and the most economic. But a single operator may have a data set that’s tiny – 10 to 20 wells if they’re lucky.”

As the industry turns to advanced technology such as machine learning to help find the best drilling locations and improve operations efficiencies and production, he said data on just 20 wells isn’t enough.

That’s why he spent the last year calling for a consortium solution, whereby operators pool data and help speed the cycle of machine learning.

Matthews said operators are very protective of their data. But he points out that all the core acreage has been leased, so sharing data wouldn’t result in one operator leasing prospective acreage out from under another operator.

“What I look to do is establish a central place for operators to see data. Like a map where they can see what data is available and make a deal with that operator for the data,” he said.

Matthews said it speeds up the process because if an operator hasn’t traded data on a well before, he has to ask if he should “derisk” sharing that data. Now, having done that, the next operator can see what’s available, he said.

“In the bigger picture, I’m seeking to speed up the cycle of scientific reproduceability,” he said. He compared that to service companies unveiling a new product and other service companies then devising their own products in a similar vein.

He said attitudes have changed in the year he’s touted establishing a consortium. A year ago, he said the bigger producers weren’t interested. But now “folks are coming up to me and saying they like the idea, it would be difficult to sell internally but they want to start. The smaller, private equity-backed companies have been more nimble.

“You have to ask yourself, ‘What’s the opportunity cost for the time it takes to optimize production alone versus sharing data?’” he said.

Related Topics

–Five oil signals to watch as 2018 pits OPEC vs shale – Crude Oil signals 2018 OPEC shale