PCR Prices – Nonwoven – rPET 08-06-2023 - Arhive

PCR Prices – Nonwoven – rPET

Crude Oil Prices Trend

Crude Oil Prices Trend by Polyestertime

-LyondellBasell, headquartered in Ferrara, Italy, has successfully exported its chemical recycling technology to Germany

The company has established the first pilot plant with MoReTec (molecular recycling technology) in Ferrara, which enables the breakdown of post-consumer plastic molecules, including previously unrecoverable multi-layer and mixed materials. As a result, pyrolysis oil is produced, replacing fossil-based virgin naphtha in the steam cracking process used to obtain monomers like ethylene and propylene. These monomers are crucial for producing new polymers, including recycled plastics suitable for complex applications such as food packaging and biomedical use.

The success of the pilot plant in Ferrara, which has a treatment capacity of 50 tons of plastic material per year, has paved the way for the construction of an industrial plant in Wesseling, Germany, near Cologne. The German plant, utilizing LyondellBasell’s technology, will have a capacity of approximately 50,000 tons per year and is scheduled to be operational in 2026. PCR Prices – Nonwoven – rPET

The company plans to continue its research and development efforts to further increase production volume, highlighting the scalability of the technology.

Gabriele Mei, Vice President of Catalysis and Industrial Process and President of Basell Poliolefine Italia, explains the strategic choice of Germany for the new plant, citing the local presence of a cracker plant capable of utilizing pyrolysis oil from chemical recycling to generate new monomers and plastics. However, Italy, particularly the Ferrara hub, remains central to LyondellBasell’s development strategy. The company is committed to advancing processes and products that contribute to the circular economy and address climate and sustainability concerns.

LyondellBasell’s CEO, Peter Vanacker, emphasizes the importance of sustainability and the company’s commitment to achieving its goals. Under the Circulen brand, LyondellBasell has already produced and marketed over 175,000 tons of recycled polymers created from renewable sources since 2019. The company aims to reach a production volume of at least 2 million tons by 2030. PCR Prices – Nonwoven – rPET

The research and development conducted in Ferrara play a pivotal role in LyondellBasell’s overall operations. Italy accounts for around 40% of the global R&D budget, with approximately 700 R&D employees worldwide, 400 of whom are based in Ferrara. The Giulio Natta research centre, located within the petrochemical plant in Ferrara, is responsible for one-third of LyondellBasell’s 6,000 patents. The company anticipates hiring around 90 employees in Italy in 2023, with 80% of them being allocated to the Ferrara site.

-Toray to Recycle Glass-Fiber-Reinforced PPS in Europe

The carbon footprint of the material with 50% recycled content has been independently certified to be around 45% lower than virgin PPS.

Japan’s Toray Industries and its marketing and sales subsidiary, Toray Resins Europe GmbH (TREU), have developed a recycling process for glass-fiber-reinforced polyphenylene sulfide (PPS) resin scrap generated by injection molding. The new process leverages proprietary compounding technology developed in collaboration with tolling partner MKV GmbH Kunststoffgranulate, a compounding company based in Beselich, Germany, that specializes in recycling engineering and high-performance plastics. The recycled PPS resin has 50% recycled content and retains at least 90% of the mechanical strength of virgin injection grades. PCR Prices – Nonwoven – rPET

Testing, certification, and research institute SKZ – Das Kunststoff-Zentrum (Plastics Center) has calculated and verified that PPS made with this recycling process can deliver a carbon footprint that is around 45% lower than virgin PPS. The calculation was conducted based on international LCA standards ISO 14040, ISO 14044, and ISO 14067, “Carbon footprint of products.”

TREU supplies PPS resin to customers throughout Europe and is beginning to promote the recycled PPS grades under the Ecouse Torelina brand. Ecouse (pronounced Eco-use) is Toray’s integrated, worldwide brand for recycled materials and products.

Glass-fiber-reinforced PPS offers flame and chemical resistance as well as long-term durability. Consequently, it has diverse applications, including electric vehicles and other automobiles, electrical and electronic equipment, and water-related parts.

Previously, Toray announced that wholly owned subsidiary Toray Advanced Materials Korea would increase annual production capacity for Torelina PPS resin by 5,000 tonnes/year at a plant in Gunsan, Korea, starting in December 2024. PCR Prices – Nonwoven – rPET

-Stora Enso Oyj : is laying the foundation for the future of circular packaging in Oulu, Finland

The future of packaging is circular and to be achieved with solutions that are net positive for both climate and biodiversity. This future is already taking shape in Oulu, a city in northern Finland, where the foundation stone for Stora Enso’s new board line was laid on 30 May.

We at Stora Enso believe that renewable materials will shape the future of circular packaging. In this future, plastics will be replaced with renewables, all packaging will be recyclable, and low emissions are harmonized with high quality standards.

To shape this future into reality, the founding stone of our new, high-volume consumer board line in Oulu, a city of approximately 200 000 inhabitants in northern Finland, was laid on 30 May. PCR Prices – Nonwoven – rPET

When ready in 2025, the new facility will have the capacity to produce up to 750 000 tonnes of renewable packaging materials from well managed northern forest fiber. The new capacity empowers our customers to make more sustainable choices for their food and beverage packaging, as it allows for the utilisation of renewable materials and promotes circular design principles: bio-based, recyclable, low carbon, and offers alternatives to plastic.

“This investment is at the heart of our growing packaging segments. Cartonboards are versatile, growing grades where we already have profound knowledge and a solid understanding of our customers’ needs and wishes. These new materials support plastic replacement solutions but also grow in their current traditional end-uses,” says Andreas Birmoser, SVP, BU Consumer Board, Stora Enso.

-Prices fall further as low demand persists

R-PET suffers strongest downward price pressure

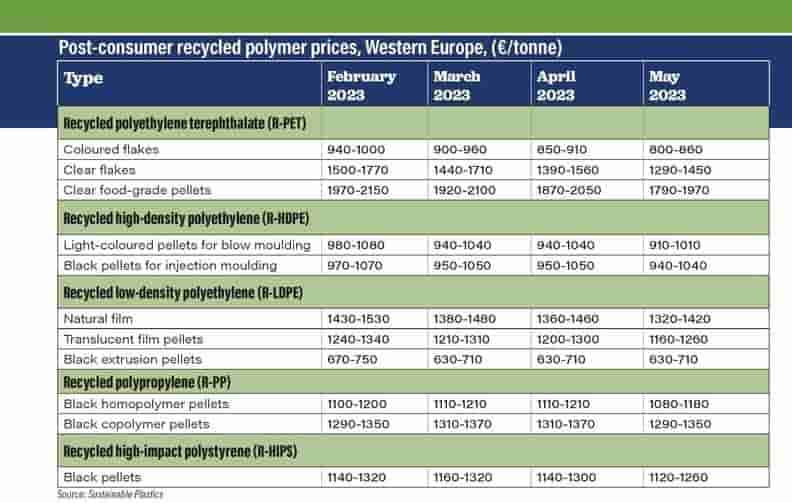

In April, recycled standard thermoplastic prices continued to drift lower, although at a slower rate than in the previous month. Low incoming orders remains the major drag on prices along with competition from the falling cost of virgin materials.

R-PET prices saw the steepest price reduction in April with clear flake prices down by €100/tonne over March levels; food-grade pellets and coloured flake prices fell €50/tonne. R-LDPE prices fell by €10-20/tonne while R-HDPE prices were either unchanged or increased by up to €10/tonne. R-PP prices were also unchanged; R-HIPS prices softened by around €20/tonne. PCR Prices – Nonwoven – rPET

Standard recyclate prices continued to drift downward in May as a result of ongoing weak demand and competition from off-spec virgin material and imports. Price movements did however vary quite considerably. R-PET clear flake prices once again saw a triple-digit drop; other R-PET grades also registered large price declines. Most other categories saw price reductions of between €10-40/tonne. R-LDPE extrusion black prices were unchanged.

Low demand continues to characterise the market for recycled plastics with order activity well below what would normally be expected for the time of year. Demand weakness can be easily explained by the slowdown in European economies and weakness in key end use markets for recyclate such as construction and packaging. Recyclate is also facing growing competition from the falling cost of off-spec virgin material and competition from cheaper imported material from the Far East.

Recyclers have continued to curb output to avoid a build-up of excess stocks; yet there has been no major shortage of material reported.

In June, standard recyclate prices are likely to fall further but at a slower rate. There is some hope that the early signs of a revival in demand may become more widespread by next month.

Recycled polyethylene terephthalate (R-PET)

In April, R-PET clear flake prices fell by €100/tonne with R-PET clear food-grade pellet and coloured flake prices down by €50/tonne. R-PET prices have fallen because of the availability of competitively-priced imports from Vietnam and substitution by the less expensive off-spec virgin material. In addition, the cost of clear and coloured bottle scrap has fallen across Europe. PCR Prices – Nonwoven – rPET

While producers continue to curb production rates supply was more than sufficient in April to meet demand because of the additional imports from Asia. While seasonal demand from the beverages sector is growing, processors are increasingly turning to cheaper imports from Asia or using the virgin PET material.

In May, prices have softened further as a result of continuing weak demand and competition from cheaper imported material. Clear flake prices have fallen by €100/tonne, clear food-grade pellet prices are down by €80/tonne and coloured flake prices have fallen by €50/tonne.

-Post-consumer PET bottles: European recyclers under enormous pressure

For seven months, PET recyclers have been hoping for a turnaround in sales. But the situation on the market for recycled PET remains gloomy and May brought no improvement. Demand for recycled pellet (rPET) and flakes remained extremely weak, while both post-consumer bottles and recyclate stocks are rising. There are no signs of improvement in June either, according to market participants. Fewer and fewer companies are honouring contracts and still using recycled PET in the production of new bottles and film PCR Prices – Nonwoven – rPET

The pressure is immense: German market insiders report that buyers will try to renegotiate offers if they receive cheaper offers from other recyclers. Flakes from neighbouring countries are also being offered at favourable prices in Germany because the recyclers there are finding hardly any buyers in their domestic markets. High levels of recyclate supply in Europe come at a time when demand is very weak overall, market participants report.

The further erosion in primary PET prices is increasing the pressure on recyclers. Stocks of both PET bottles and flakes continue to grow. The warmer temperatures since the end of May are expected to significantly increase post-consumer bottle arisings.

-PET imports to impact EU recycled content targets

A major increase in PET imports threatens the competitiveness of the EU’s industry, along with its objective to improve the waste management of plastics. PCR Prices – Nonwoven – rPET

Between 2021 and 2022, imports of PET have doubled reaching 1.9 Mt, with India, China, and Türkiye among the biggest exporters in terms of volumes and value, followed by Indonesia, Egypt, and Vietnam. With the increase, imports represented nearly 30% of the total demand for PET in Europe in 2022, compared to only 23% in 2020. Given the strong divergences in energy, labour and environmental costs in the EU compared to the rest of the world, this important market shift puts the European industry under a lot of pressure.

“Following these concerning market developments, the EU has initiated an anti-dumping proceeding against China for the imports of PET throughout 2022”, said Herbert Snell, PRE PET Working Group Vice Chair and Managing Director at Multiport GmbH – MultiPet GmbH part of the Veolia Group. “Among the allegations, the issued notice reflects a likelihood that increased dumped imports would have a negative impact on the performance of the EU industry”, he added.

The growing imports could be explained by the heightened demand for rPET in the EU, driven by the 2025 recycled content targets of 25% for beverage bottles, and the consequent rise in rPET prices on the continent. PCR Prices – Nonwoven – rPET

“It needs to be ensured that recycled PET imported to the EU at significantly lower prices is compliant with the stringent EU food contact regulation, and therefore does not put at disadvantage the efforts made for creating a robust rPET industry in Europe”, stated Casper van den Dungen, Vice-President of Plastics Recyclers Europe. He continued: “This will additionally require full verification of the traceability of imported polymers by end users to avoid using self-declarations as the means of reporting recycled materials participating to the EU targets”.

Consequently, ensuring the enforcement of EU rules for goods and materials from outside the continent is key to protecting the ‘Made in the EU’ and maintaining a level playing field for all actors.

-Cinte Techtextil China, the leading trade show for technical textiles and nonwovens, is scheduled to take place from September 19-21, 2023, at the Shanghai New International Expo Centre

With four months remaining until the event, international suppliers have already booked more than double the floor space compared to the previous edition. The previous edition attracted 366 exhibitors from eight countries and regions.

A significant highlight of this year’s fair is the return of the European Zone to the fairground. This high-traffic zone is expected to welcome both new and returning exhibitors who are eager to showcase their products to the thriving domestic market in China. Roberto Galante, plant manager of FMMG Technical Textiles (Suzhou) Co Ltd, expressed the immense potential of the Chinese market and the demand for high-quality overseas brands. PCR Prices – Nonwoven – rPET

Among the confirmed exhibitors, key industry players will be present in the European Zone, including Bekaert from Belgium, showcasing their range of conductive yarns and micro cables; Fil Man Made Group from Italy, specializing in quality staple yarns; Sanitized from Switzerland, offering hygiene and material protection functions; and Scantech from France, known for their X-ray online measurement and control systems for nonwoven materials.

In addition to the European Zone, a wide array of international suppliers will showcase their diverse product applications across various categories at the fairground. These categories include Coating & Bondtec, Fibre & Yarn, Nonwovens Equipment, Technology & Machinery, and Testing Equipment & Certification. Notable exhibitors from Europe in these categories include Autefa Solutions, Reifenhauser Heinsberg, Reifenhauser Reicofil, and Sicam.

Chinese suppliers will also play a significant role in complementing the international contingent at the fair. Domestic exhibitors such as Shanghai Shenda Kebao New Materials, SIJIA New Material (Shanghai), Zhejiang Jinda New Materials, and Zhejiang Hailide New Material are eager to connect with new buyers and strengthen existing business relationships. PCR Prices – Nonwoven – rPET

The fair’s product categories encompass 12 application areas, covering a wide range of uses in modern technical textiles and nonwovens. From upstream technology and raw materials providers to finished fabrics, chemicals, and other solutions, the fair provides a comprehensive platform for the entire industry.

Cinte Techtextil China is organized by Messe Frankfurt (HK) Ltd, the Sub-Council of Textile Industry, CCPIT, and the China Nonwovens & Industrial Textiles Association (CNITA).