Artificial grass – Mega batteries 06-05-2023 - Arhive

Artificial grass – Mega batteries

-Rimac, after cars, now “mega batteries”

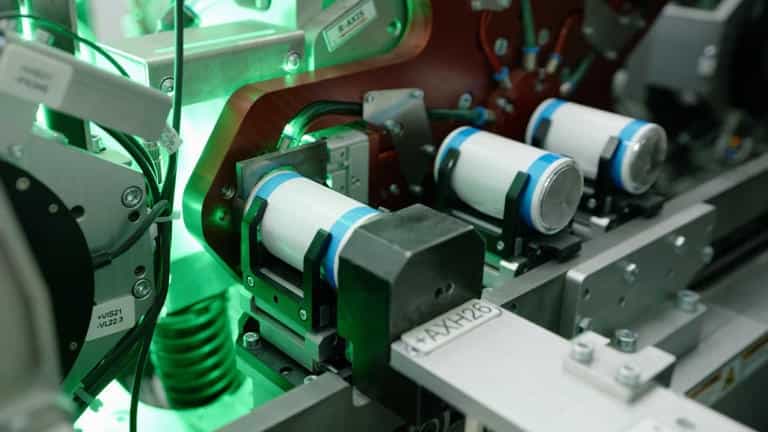

Rimac Energy, the new division of the Croatian brand dedicated to stationary storage systems, has been launched.

While we know Rimac as a producer of electric hypercars and a supplier of architectures and components to other brands worldwide, the Croatian brand is ready to take another step towards the energy transition with the introduction of Rimac Energy, an internal brand tasked with developing next-generation stationary storage systems. By the end of the year, the first systems will be available.

Leveraging their expertise in the electric field gained over the past few years, Rimac is opening this new operating area.

As the brand highlights, the Rimac Energy division has been active as a specialized team within the brand for 18 months and includes around 60 employees.

The first product of this new direction of the Balkan company is a storage system with a novel architecture capable of reducing efficiency losses by up to 50% compared to other alternatives already on the market. Artificial grass – Mega batteries

According to Rimac, there are already several companies interested in the project, including a “leading renewable energy company.” The first units will be produced by 2023, while mass production will begin in 2025. Rimac will reveal the details of this new solution later this year.

Rimac Campus is almost ready Regarding facilities, the inauguration of Rimac Campus, the new over 100,000 square meter headquarters of the company under construction on the outskirts of Zagreb, is approaching.

It will be inaugurated in the coming months and will be able to accommodate over 2,500 employees. The Campus will be carbon-neutral and will not only have production lines, but also a restaurant, museum, and showroom.

Outside, a track will be built to test the next electric cars. Costing over €200 million, the Croatian plant will be fully operational in 2024 and will be open to tourists and enthusiasts.

-Possible stop to rubber infill in artificial turf fields In late April, the Reach Committee voted to ban the use of recycled rubber in fields with artificial grass

This risks the recycling targets for end-of-life tires in Italy.

The Ecopneus consortium has raised the alarm about the risk that one of the main uses of rubber infill obtained from the recycling of end-of-life tires, which concerns infill for synthetic grass fields, may be interrupted.

This is envisaged by a resolution suggesting the ban, approved on April 26 in Brussels by the European Reach Committee.

The transition period is eight years, says Ecopneus, but the consequences are expected long before the end of this period.

The proposed restriction must be evaluated and voted on in the EU Parliament and Council in the next three months. Artificial grass – Mega batteries

If ratified, the ban is likely to prejudice the achievement of the sustainability objectives of the end-of-life tire sector, which recovers more than 100% of the target imposed by law each year in the form of material or energy.

According to the consortium, about 400,000 tonnes of tires for cars, trucks, and motorcycles are transformed each year into a reusable material with high performance for multiple applications, from road asphalts to sports surfaces, anti-trauma pavements, and anti-vibration systems.

Currently, around 90% of artificial soccer fields in Europe use recycled polymeric infill from end-of-life tires because no other technological solution is capable of replacing rubber in terms of performance and availability on the market.

Ecopneus emphasizes that advanced technical and sustainability requirements are adopted in the construction of synthetic grass sports surfaces, including the reduction of the risk of material dispersion.

“Thanks to the use of physical barriers, grids, brushes, and mandatory paths (already partially provided for in the approval specifications of the League), this risk can be reduced to over 97%. Artificial grass – Mega batteries

This is demonstrated by an increasing number of studies carried out in Italy and abroad (particularly in Spain and Denmark) that show the effectiveness of these devices, which are easy to install and have sustainable costs for a facility.”

In Italy, around 5,000 sports facilities, soccer, futsal, and rugby fields are covered with synthetic grass, of which over 1,600 are approved by the National Amateur League.

If the ban were to enter into force, thousands of amateur sports associations would be forced, in perspective, to replace their synthetic grass fields.

Ecopneus and Unirigom, the main representatives of the end-of-life tire management and recycling sector, have convened a meeting in Rome on May 23, which will be attended by all technical and institutional stakeholders. Artificial grass – Mega batteries

-Tesla unveils its plans for a “Lithium Lab” to invent the batteries of the future

The company has applied for a new building permit in Nevada, where it already has a Gigafactory, to develop new production methods and technologies for batteries.

During Tesla’s Investor Day, it was announced that in order to achieve their goal of selling 20 million cars by 2030, they must produce 10 times the current amount of batteries. To meet this demand, Tesla is now taking action by applying for a permit to create a research and development facility called the “Lithium Lab”.

The Lab will be built in Sparks, Nevada, near Reno, and will be dedicated to studying new production methods and technologies for batteries. The building will require mechanical, electrical, and hydraulic modifications as well as small architectural updates to support the installation of equipment and the optimization of processes.

This new project further intensifies Tesla’s commitment to the battery supply chain. The company is already involved in the lithium sector in several ways and is currently building a new lithium refinery in Corpus Christi, Texas, which will pioneer a new processing technique to transform lithium into lithium hydroxide for batteries.

In addition, Tesla has expressed interest in extracting lithium in Nevada using a new technique, although the company has not revealed much about it since the initial announcement in 2020.

-Verdeco Recycling, a company that reprocesses and formulates post-consumer PET flake into rPET pellets, is set to open a new innovation center and manufacturing facility in Greenville, South Carolina in June 2023.

The company’s acquisition by EU-based private equity firm, CUDOS Group in 2020, has led to this major expansion.

By planting new roots in South Carolina, Verdeco is well-positioned to collaborate with strategic partners and suppliers, further advancing their mission to provide unmatched value in the circular, sustainable rPET economy.

Verdeco CEO, Rob Bindner, has expressed excitement for the opportunities the new innovation center will provide for strategic partners to explore custom formulations, performance attributes, and aesthetic inspirations in line with their sustainability vision. With the addition of this South Carolina location, Verdeco will have an extra 90 million lbs of rPET capacity, in addition to their existing locations in California and Indiana, which together provide 120 million lbs of capacity. Artificial grass – Mega batteries

The new location will also enhance Verdeco’s ability to solve customer supply chain challenges and offer even the most complex formulations.

-Hydrocarbon processing reported that OC Oerlikon, a Swiss industrial group, experienced a nearly 14% decrease in orders in Q1 due to soft demand for filaments in China impacting its polymer business.

Despite this setback, the company exceeded market forecasts for sales and operating income, resulting in an over 2% increase in its shares during early trading.

While revenue for the quarter rose by 5.4% to 735 MM, driven by a 12.5% increase in its surface solutions division, the operational core earnings (EBITDA) fell by 3.8% to ?116 MM. Oerlikon had planned to cut 800 jobs from the polymer processing division in February 2023, and the layoffs are set to begin in September.

The polymer processing business, which serves the textile, automotive, and chemicals industries, experienced a 28% drop in first-quarter orders to 298 MM, contributing to Oerlikon’s total order intake of ?681 MM for the quarter, down from 790 MM last year. Baader Helvea analyst Michael Roost commented that while sales and EBITDA exceeded expectations, the margin development was “a touch underwhelming,” and polymer processing orders were below expectations. Artificial grass – Mega batteries

However, Oerlikon expressed confidence that the situation in China would improve soon.

-Despite challenging industry conditions, Alpek S.A.B. de C.V. has maintained its dividend

The company, headquartered in San Pedro Garza García, Greater Monterrey, Mexico, is a leading producer of PET and PTA in the Americas, and also produces polypropylene and caprolactam.

Its Q1 2023 report revealed that sales volumes were down by five per cent compared to the same period in 2022, with plastics and chemicals sales decreasing by 13%.

Production volumes were higher than sales, with Q1 2023 production at 1.381 million tonnes.

Although both margins and EBITDA were affected, the company declared a dividend of US$159 million.

Alpek has reviewed its capital expenditure strategy, delaying some projects until the current situation stabilises. Artificial grass – Mega batteries

CEO Jorge Young reported that oil prices have stabilised, while PP prices have increased in the USA despite a disconnect in prices between the Americas and the Far East. Additionally, Alpek’s PET resin operations at its Cooper River site in South Carolina have been shut down indefinitely.

-“Who produces the most electric vehicle batteries?

From January to March of this year, 133 GWh of batteries were produced. Here are the companies leading the pack ahead of BYD and LG.

The electric vehicle battery sector continues to grow, as confirmed by a report from South Korean analysis firm SNE Research. According to the report, global production reached 133 GWh in the first three months of this year, a 38.6% increase from the same period in 2022.

Although the growth rate has slightly slowed down compared to the past, the sector is still expanding rapidly, led as always by Chinese giants.

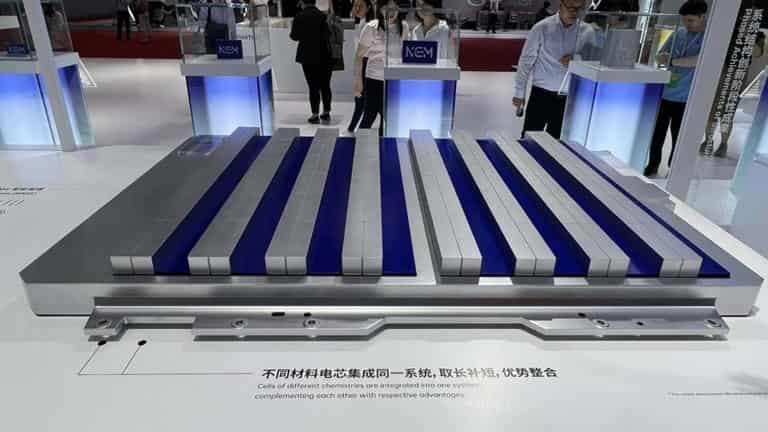

CATL maintains the lead For the first quarter of 2023, the world’s largest battery producer remains CATL, which delivered a whopping 46.6 GWh of batteries. Behind them, in second place, is BYD with 21.5 GWh, and LG Energy Solution with 19.3 GWh in third.

- CATL: 46.6 GWh and 35% market share

- BYD: 21.5 GWh and 16.2% market share

- LG Energy Solution: 19.3 GWh and 14.5% market share

- Panasonic: 11.9 GWh and 9% market share

- SK On: 7.1 GWh and 5.3% market share

- Samsung SDI: 6.5 GWh and 4.9% market share

- CALB: 5.7 GWh and 4.3% market share

- Gouxuan: 2.9 GWh and 2.2% market share

- EVE: 2.4 GWh and 1.8% market share

- Sunwoda: 1.9 GWh and 1.4% market share

China still unbeatable

Apart from the absolute production numbers, the company with the highest growth rate in these first few months of the year was BYD, with a 115% increase. The company solidifies China’s lead in the sector, with six of the top 10 companies headquartered in the country, together accounting for over 60% of global production.

South Korea comes in second, with a 24.7% market share. It has lost 1.3% compared to last year, but can count on the strong performance of SK Innovation (+5.1%) and especially LGES (+37.5%) and Samsung SDI (52.9%).