SINGAPORE (ICIS)–Asia’s naphtha prices have slumped on ample supply, as have spot premiums, with deep-sea cargo flows from the west set to rise, according to traders.

SINGAPORE (ICIS)–Asia’s naphtha prices have slumped on ample supply, as have spot premiums, with deep-sea cargo flows from the west set to rise, according to traders.

Open-spec naphtha prices stood at $637.75/tonne CFR (cost and freight) Japan for first-half August delivery at the close of trade on 26 June, little changed from the previous day.

Open-spec naphtha prices stood at $637.75/tonne CFR (cost and freight) Japan for first-half August delivery at the close of trade on 26 June, little changed from the previous day.

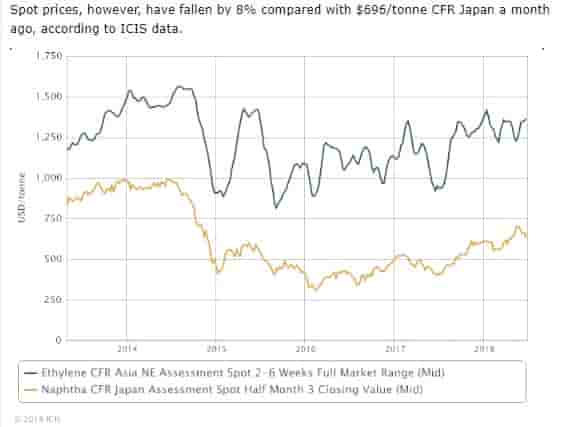

Spot prices, however, have fallen by 8% compared with $696/tonne CFR Japan a month ago, according to ICIS data.

Market expectations of greater excess arbitrage flows from Europe and the Mediterranean weighed on sentiment.

This was reflected in recent end-user spot cargo purchases that fetched notably lower premiums than before.

Taiwan’s Formosa Petrochemical (FPCC) purchased around 100,000 tonnes of spot naphtha at a premium close to $5.00/tonne to its pricing formula for delivery to Mailiao.

In contrast, FPCC paid a premium of $7.00-9.00/tonne to its pricing formula for second-half July supplies.

In a similar vein, South Korea’s Yeochun NCC (YNCC) secured a total of around 125,000 tonnes of spot naphtha at a premium near $5.50/tonne to spot CFR (cost and freight) Japan quotes.

The premium level for first-half August delivery to Yeosu was down from the firm’s earlier purchase of second-half July supplies done at a premium near $10/tonne to spot CFR Japan quotes.

At the same time, YNCC is seeking, via a separate tender, term supplies for a 12-month period from September with discussions ongoing.

This coincides with easing premiums on the back of a well-supplied market.

“Naphtha is softening … because of weak western [and gasoline] markets,” a southeast Asia-based market source said.

Asia’s naphtha crack spread against prompt-month August ICE Brent crude futures stood at $74.20/tonne on 26 June, sliding from week-earlier levels at $77.40/tonne. The crack spread has since also slumped from above $80/tonne mark throughout the first-half of June.

Naphtha’s forward market structure or the intermonth time spread has also narrowed considerably, reflecting the softer market.

The spread between first-half August and first-half September stood at $6.00/tonne in backwardation. This backwardated spread was much wider at $16.00/tonne this time last month.

But the market is not expected to flip into a contango in the coming weeks, taking into account downstream petrochemical demand that is generally steady, according to market sources.

On deep-sea cargo flows, an estimated near 1.4m tonnes of naphtha from the west is estimated to potentially land in Asia in July, more than average monthly volumes of about 1.2m tonnes.

Picture: Singapore port (Photographer: JW Alker/imageBROKER/REX/Shutterstock)