Automotive – PEF-resin – rPET 03-09-2022 - Arhive

Automotive – PEF-resin – rPET

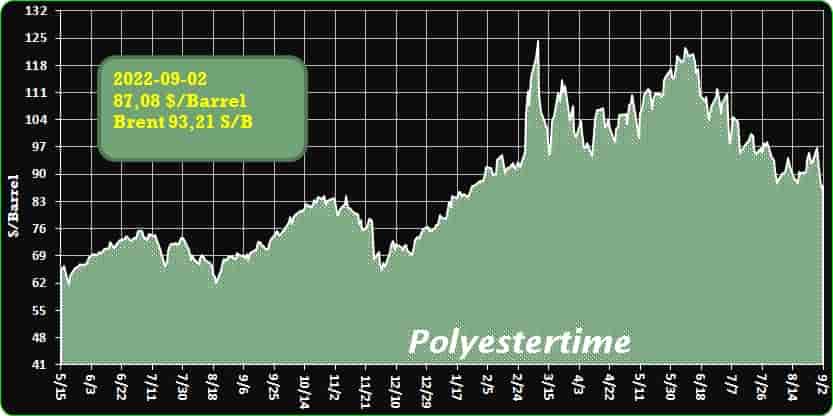

Crude Oil Prices Trend

The „Stiftung Zentrale Stelle Verpackungsregister” (Central Agency Packaging Register) has reclassified the recyclability of polyamides in the minimum standard for assessing the recyclability of packaging subject to system participation pursuant to Section 21 (3) VerpackG: Since September 1, coextruded polyethylene (PE)/polyamide (PA) film structures have been recognized as mechanically recyclable.

“We appreciate the decision of the Stiftung Zentrale Stelle Verpackungsregister,” said Dr. Rolf-Egbert Grützner, Senior Manager Technical Support for Ultramid® extrusion polyamides at BASF. “”It was time to correct the categorization of polyamide 6 and also the related PA6/6.6 co-polyamides and put them on a solid updated basis.”

As early as June 2021, the independent testing and certification facility cyclos-HTP systematically examined and confirmed the recyclability of PE/PA multilayer films on behalf of BASF. Automotive – PEF-resin – rPET

The use of coextruded PE/ PA film structures in multilayer films makes it possible to produce very thin films (downgauging), which significantly reduces the use of plastics and also the amount of waste. BASF will present more about the value-adding use of polyamides at the K plastics trade fair from October 19 to 26 in Düsseldorf.

-Sabic Launches PP Compounds for Automotive Structural Applications

Two new short-glass-fiber-reinforced polypropylene (PP) compounds feature enhanced melt flow, tensile and flexural strength, and flexural modulus.

Sabic has introduced two short-glass-fiber-reinforced polypropylene (PP) compounds offering enhanced performance and processing for demanding automotive under-hood, exterior, and interior applications. Sabic’s PP compounds G3430X and G3440X are advanced grades that surpass high-performing standard short-glass-fiber materials in melt flow, tensile and flexural strength, and flexural modulus.

The two products give customers new opportunities to raise the performance bar for automotive structural components such as brackets, seat structures, and center consoles. Furthermore, thanks to their thin-wall capability, both materials can be used to design parts with lower mass and weight. Automotive – PEF-resin – rPET

“Sabic’s world-class development capabilities and dedication to continuous portfolio improvement have yielded these two exceptional materials, which can empower automotive customers to significantly increase the performance of end applications,” said Abdullah Al-Otaibi, General Manager, ETP & Market Solutions. “The launch of these new Sabic PP compounds is an excellent example of our proactive response to customers’ emerging needs. We have set new industry benchmarks for robust performance and thin-wall capabilities in short-glass-fiber polypropylene, providing critical advantages in the face of escalating automotive requirements.”

Sabic PP compound G3430X grade, with 30% short glass fiber, and Sabic PP compound G3440X grade, with 40%, are said to deliver superior physical properties compared with conventional short-glass-fiber PP materials and high melt flow for easy processing. Both grades balance stiffness and impact for optimal performance in structural parts, with G3440X providing a higher degree of stiffness and greater density than the G3430X grade. In addition to offering superior performance compared with other short-glass-fiber PP compounds, these materials may be candidates for the cost-effective replacement of long-glass-fiber PP in certain low-temperature applications.

-New bio-based Polymer PEF shows low CO2 footprint

The nova-Institute conducted a peer-reviewed Life Cycle Assessment (LCA) of the Dutch company Avantium’s PEF (polyethylene furanoate) applications within the framework of the European PEFerence project.

The study demonstrated that the use of 100% renewable carbon in PEF instead of fossil carbon in PET for producing 250 ml and 500 ml bottles would result in significant reductions in greenhouse gas (GHG) emissions. Avantium plans to start-up the world’s first commercial FDCA plant in 2024. FDCA (2,5-furandicarboxylic acid) is the main building block of PEF.

CO2 is absorbed by plants and released at the end of the product life cycle. Plant-based carbon has a net-neutral impact on the CO2 concentration in the atmosphere. In contrast to this, materials and polymers based on fossil carbon from underground, release additional CO2 into the atmosphere. Automotive – PEF-resin – rPET

Avantium has developed a technology (YXY) to convert plant-based sugars into a fully recyclable polymer. The new 100% bio-based polymer, PEF (polyethylene furanoate) has superior performance properties compared to PET (polyethylene terephthalate).

The main building block of PEF, FDCA (2,5-furandicarboxylic acid) can be produced from sugars (fructose), for example from wheat, corn and sugar beet. FDCA is polymerised with plant-based mono-ethylene glycol (MEG) to make a 100 % plant-based PEF polymer. When fully technologically developed, PEF can also be produced from cellulose and thus from agricultural and forestry waste streams.

Avantium’s current process utilises starch from European wheat. PEF has enhanced barrier properties compared to PET, it is mechanically and chemically recyclable and can also be recycled within the established PET recycling. PEF has a 12 °C higher heat resistance than PET, a 60 % higher modulus and greater strength than PET. This allows the developing of lightweight packaging from PEF with lower resource requirements.

Avantium has already implemented this innovative, plant-based packaging material on a pilot scale and recently started the construction of a 5,000-tonnes-per-year FDCA flagship plant in Delfzijl (the Netherlands). The nova-Institute’s peer-reviewed LCA indicates a significant reduction potential in greenhouse gas emissions and use of fossil resources of PEF compared to PET.

Results of the LCA

The nova-Institute performed a peer-reviewed full cradle-to-grave LCA according to the ISO standards 14040/44. A critical peer-review of the study, including experts of LCA methodology and incumbent packaging solutions, verified that the LCA met the requirements for methodology, data, interpretation, and reporting.

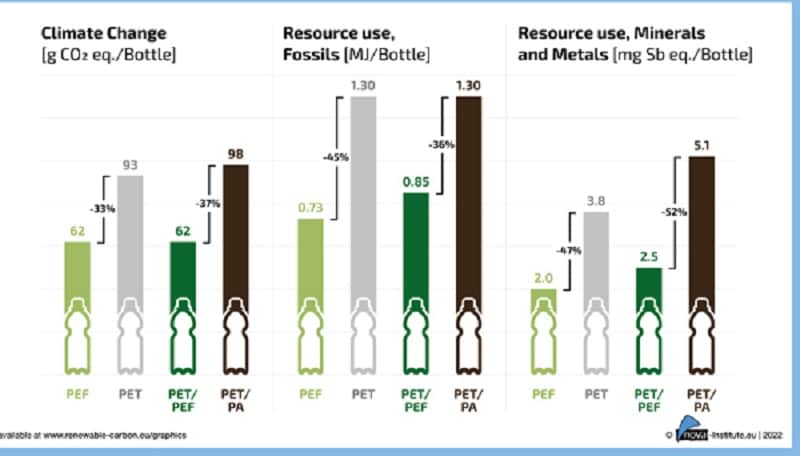

The LCA evaluated 16 different impact categories covering all relevant life cycle stages from cradle-to-grave. The comparative analysis showed that PEF bottles would result in significant reductions in greenhouse gas emissions (-33%) compared to reference PET bottles. PEF would also lead to 45% lower finite resource consumption of fossil fuels and reduce the pressure on abiotic resources (minerals and metals) by 47 % due to the mechanical properties of PEF enabling light-weighting.

However, PET bottles would outperform PEF-bottles in other impact categories mostly arising from the current feedstock supply. Overall, this represents a benefit because climate change and resource use are among the most relevant environmental impact categories in the current political agenda. They are driving the transition from fossil to renewable carbon. Automotive – PEF-resin – rPET

Multilayer bottles

In addition to monolayer PEF bottles, PEF can also be used for multilayer packaging. Multilayer bottles can be an option when the required shelf life cannot be guaranteed by monolayer packaging. PEF offers a good passive barrier for O2 and CO2 and could potentially contribute towards reducing the environmental footprint of packaging solutions by increasing the shelf life of products, enabling a reduction in the weight of packaging, and by improving recyclability.

In this LCA, 250 ml PET/PEF multilayer bottles with 10 % of PEF were also assessed and compared to reference PET/PA bottles with a typical 7% of PA (polyamide). The analysis showed that significant reductions of around 37% in GHG emissions could be achieved by replacing the PA layer with PEF, mainly attributed to the recyclability of the PET/PEF system over the non-recyclability of the PA-containing system. This replacement would also contribute to a significant reduction of finite resources demand (-37% and -52% of fossil fuels and minerals and metals, respectively).

Development potential

PEF is a relatively new material and not yet commercially available. PET is a conventional product that has been on the market for over 40 years and is produced in a highly established process that runs close to maximum efficiency at a very large scale. It is expected that the commercialisation and growth of the PEF market will lead to substantial economic, technological, and environmental optimisations covering the full value chain. The impact originating from the plant-based feedstock could also be further reduced by a switch to lignocellulosic feedstocks such as second-generation biomass. This will be tested at Avantium Renewable Polymers in the framework of the BBI-JU PEFerence project, and should confirm that the YXY process can use second-generation biomass when it becomes available at commercial volumes and pricing. An update of the LCA is planned afterwards.

-Ceresana examines the world market for Masterbatches

Global demand for plastic masterbatches is expected to rise to almost 5.5 million tonnes by 2031, according to Ceresana, which has published the third, completely revised edition of the “Masterbatches” market study.

“Small granules with a big effect: plastics only become colourful, durable and usable through the incorporation of additives. Therefore, granules with a high concentration of colourants, other additives or fillers, so-called masterbatches, are often added to the raw polymers in the production of plastics,” the market research agency said in a statement.

Precise Dosing, Easy Processing

Polyethylene and other thermoplastics can also be modified with powders, pastes or liquids. In comparison, however, masterbatches facilitate processing because granules allow the additives to be distributed more evenly in the raw polymer. Pre-mixed concentrates with precisely defined properties increase process reliability. They also allow the cost-effective purchase of raw polymers in large quantities, which can then be modified for specific applications, the report said.

Colour masterbatches contain pigments or dyes. Additive masterbatches contain, for example, stabilizers, antioxidants, antistatic agents, flame retardants or other plastic additives. Combination masterbatches with different additives are also possible. The concentrates are embedded in a polymer carrier material that is compatible with the plastic to be modified and, for example, complies with the regulations for medical devices, food contact or bioplastics.

Coloured Masterbatches Are in Demand

Currently, granules with white pigments are the most widely used type of masterbatch: In 2021, around 1.4 million tonnes were sold worldwide. The plastics industry primarily uses the white pigment titanium dioxide (TiO2) to colour toys, electrical appliances, automotive parts, furniture and plastic films, for example, but also to protect them against UV radiation. Titanium dioxide is followed by colour masterbatches which include, for example, inorganic and organic pigments, as well as effect pigments.

Price relief is expected to continue through the fourth quarter for nine major commodity and engineering resins, driven by widespread supply/demand imbalances.

Prices of nine volume commodity and engineering resins had either dropped or were heading downwards at the end of August. Flat or declining prices were projected through this quarter, barring any major disruptive event, such as a hurricane. The key factors behind this trend include inflation-driven demand destruction across the supply chain, significant supplier inventory buildup, lower feedstock prices and lower exports due to slowed global demand and relatively high prices for North American resins. Logistical issues continued to be an issue, with extended lead times at ports, as well as rail congestion, which has surged demand for ready-to-go truckloads. Very competitively priced imports are yet another factor for certain resins, including PVC, PC and nylon 6.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior analysts from PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. of polyolefins at distributor/compounder Spartan Polymers. Automotive – PEF-resin – rPET

PE Prices Sinking

Polyethylene prices in August were poised to drop by 6¢/lb, with potential for another, more modest drop in September and flat pricing this month, according to David Barry, PCW’s associate director for PE, PP and PS; Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets; and The Plastic Exchange’s CEO Michael Greenberg.

These sources noted a significant buildup in supplier inventories as a slowdown in domestic demand followed the slump in exports. They noted that PE suppliers, which have been consistently running plants at high operating rates (>90%) over the last few years, were planning to throttle back production. Dow, for one, announced that it would cut its operating rates globally by 15% “due to supply-chain issues.” RTi’s Chesshier noted that while other suppliers expected to scale back production rates, some also had opted for earlier planned plant maintenance shutdowns.

PCW’s Barry ventured that demand was likely to improve globally this month but noted that there was concern among some market participants about the impact of new capacity being brought on by PE “newcomer” Shell. At the end of August, Greenberg characterized spot-market activity as “uninspired,” with buyers holding off on large orders in anticipation of lower prices. “Some processors were out seeking prime truckloads for immediate shipment at offgrade railcar pricing, but suppliers seemed more disciplined not to cave to these offers,” he reported, also noting there was plenty of prime PE available for export at deeply discounted prices. Automotive – PEF-resin – rPET

PP Prices & Demand Slipping

Polypropylene prices in July dropped by a total of 7¢/lb – 4¢ of that in step with propylene monomer and 3¢ in lower profit margin for suppliers. August prices were expected to move up 1¢ to 2¢/lb along with monomer, according to PCW’s Barry, Spartan Polymers’ Newell, and The Plastic Exchange’s Greenberg. However, these sources anticipated further “non-monomer” margin reductions though year’s end.

-Evergreen orders additional extrusion lines for Ohio rPET facility

The company says the added capacity makes the Clyde, Ohio, site one of the largest rPET facilities in the world.

Recycled polyethylene terephthalate (rPET) producer Evergreen has confirmed to Recycling Today it has ordered two additional extrusion lines for its facility in Clyde, Ohio.

The completion of production expansion at its Clyde facility in July made Evergreen one of the three largest producers of rPET in North America, with 217 million pounds of annual capacity, but CEO Omar Abuaita says the addition of the two extrusion lines will make the Clyde site the largest rPET facility in the world. Automotive – PEF-resin – rPET

“Out of the two additional lines, one is already on order and we’re working on the sixth line,” Abuaita says.

Prior the to addition, the Clyde facility had an annual capacity of 113 million pounds of food-grade rPET. The two lines add an additional 27 million to 30 million pounds of capacity each, giving the site an annual capacity of up to 173 million pounds.

Abuaita says customers have been eager for the company to up its production capacity even after the $22 million Clyde upgrade, but Evergreen held off until it could secure enough supply to justify the expansion.

“Our customers would love for us to double our footprint and double our throughput,” he says. “We’d love to do that as well, and we’re willing and able, but until we have security of supply, we don’t do that. That’s not our style.”

He adds, “The reason for that is, the way we go about it is we don’t promise customers supply we cannot fulfill and we wait until we secure the raw material. Once we have security of supply of raw material, we are more than able and willing to write a check for another line or another greenfield facility.”

The Clyde expansion began in 2021 and included a 54,000-square-foot addition that can process 11.8 billion PET bottles annually. The investment included $5 million under the American Beverage Association’s Every Bottle Back initiative in partnership with the Ohio Beverage Association and New York-based Closed Loop Partners.

Last year, Evergreen added facilities in Albany, New York; Amherst, Nova Scotia; and Riverside, California. Automotive – PEF-resin – rPET

Automotive – PEF-resin – rPET