Biocrudes – CPL-benzene – PCR 03-01-2023 - Arhive

Biocrudes – CPL-benzene – PCR

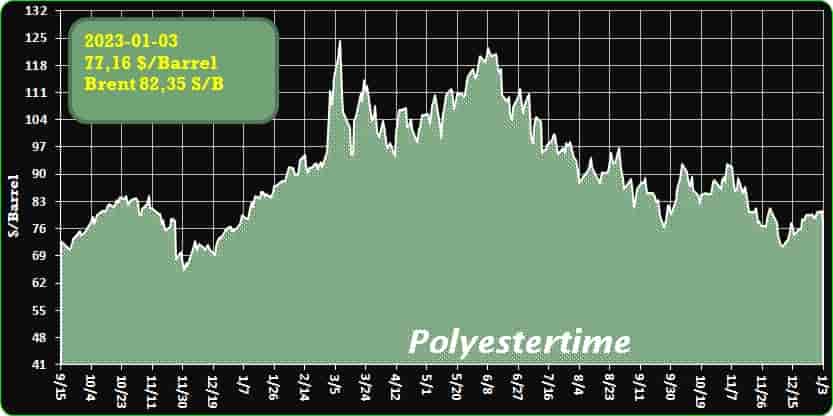

Crude Oil Prices Trend

Crude Oil Prices Trend Polyestertime

-Is Plastics Recycling a Flop?

Environmental watchdog cites low recycling rates and urges an end to single-use plastics

Despite decades of efforts to promote recycling, the amount of plastic waste generated in the U.S. continues to climb while total recycling rates have declined to single digits, the environmental watchdog Greenpeace says in a new report.

The assessment, Circular Claims Fall Flat Again , is a followup to a 2020 Greenpeace USA survey, and it found little has changed: Plastic recycling basically doesn’t work, with only 5% to 6% of the total output in the U.S. recycled each year.

Lower costs for producing virgin plastic resins, increasingly complex plastic goods that thwart recycling, and the toxicity of recycled plastics all contribute to the difficulty of turning recycled plastic into new products, particularly food-grade packaging, the report says. Biocrudes – CPL-benzene – PCR

Only two of seven common types of plastic—PET #1 and HDPE #2 plastic bottles and jugs—are widely accepted at the country’s 370 material recovery facilities (MRFs), Greenpeace said. Reprocessing capacity remains below thresholds set by the Ellen MacArthur Foundation’s New Plastics Economy, a benchmark report advocating a circular economy.

“The high recycling rates of post-consumer paper, cardboard, and metals in the U.S. prove that recycling can be an effective way to reclaim valuable natural material resources,” Greenpeace said. “Plastic recycling in particular has failed because the thousands of types of synthetic plastic materials produced are fundamentally not recyclable.”

Because of the risk of toxicity in recycled plastics, post-consumer household plastic waste is not being used in new food-grade products neither globally nor in the U.S. and probably never will be, Greenpeace said.

The recycling industry sharply disagreed with the findings, and claimed that Greenpeace skewed the data to make recycling look less successful than it actually is. (Separately, representatives from more than 150 countries gathered in South America at the end of November to begin negotiating a treaty that would reduce plastic waste, as the Washington Post reports. And a recently introduced bill in Congress would set targets for reducing plastic production. There’s more about that here from Grist.)

Greenpeace said society is at a decision point on plastic waste. “Instead of continuing on this false path, companies in the U.S. and around the world must urgently phase out single-use plastics by replacing their packaging and reuse and refill systems and offering packaging-free products,” the report said.

An environmental advocacy group called The Last Beach Cleanup was equally critical in a report published earlier this year. It accused the plastics and recycling industries of waging “a decades-long misinformation campaign to perpetuate the myth that plastic is recyclable.” Not only is the recycling rate abysmally low, the group said, it would be even lower if it included the plastic that is collected for recycling but ultimately is burned instead. Biocrudes – CPL-benzene – PCR

Recycling rates have declined since 2018 as China and other countries have stopped accepting plastic waste from the U.S. Total plastic waste increased to more than 35 million tons in 2018 (the last year covered in reports on municipal waste from the Environmental Protection Agency) while the recycling rate has remained below 10%.

“The U.S. plastic recycling rate peaked at a dismal 9.5% (including exports) and is now in an irreversible decline to eventual insignificance,” the Last Beach Cleanup said.

The group advocated a ban on single-use plastics, the creation of more water refill stations to eliminate wasteful packaging, and programs that increased the availability of reusable food and beverage containers.

Recycling industry disagrees

While environmental advocates accused the plastic industry of intentionally misleading the public about recycling, the industry said it’s the other way around.

“Americans overwhelmingly support recycling,” the Association of Plastic Recyclers said in a statement earlier this fall, “but too often their enthusiasm is met with discouraging and usually misleading data points.” Biocrudes – CPL-benzene – PCR

Low recycling rates cited by the EPA and others include containers, packaging, and durable goods intended to last for many years as well as plastics never intended for recycling, such as plastic garbage bags. However, the types of plastics that most Americans use—such as water and soda bottles, yogurt tubs and the like—do get recycled at a much higher rate, according to the trade group.

The most recent information available for PET and HDPE bottles dates from 2020 and shows a recycling rate of 28%, the association said. Polypropylene (PP) bottles are recycled at the rate of 17% and other 8% of other PP rigid containers are recycled.

In an upbeat assessment of the recycling industry, the group said that plastic recycling is responsible for more than 200,000 jobs in the U.S. and succeeded in processing nearly 5 billion pounds of post-consumer plastics into new products.

Both the recycling industry and its critics agree on a couple of points. One is that the boom in shale gas production and drilling has helped drive down the cost of virgin plastics, making recycled products that much less attractive. Another is that plastic packaging has become more complicated, making recycling and processing more difficult.

The way out of the plastic mess, the group said, is to recycle more plastic, not less.

“Today, the market demand for recycled plastic material is outpacing the supply of post-consumer plastic that is being collected and processed,” it said. “As a result, it is now imperative to grow the supply of post-consumer plastic material. The U.S. will need to double or triple collection of most plastic resin types to keep up with corporate sustainability commitments and the projected demand for products made from 25% or 50% [post consumer plastic].” Biocrudes – CPL-benzene – PCR

Recycling rates for PET and HDPE bottles could exceed 40% with existing processing facilities if more plastic were recycled.

Recyclers also acknowledged that the U.S. needs to develop “robust” public policies for better product and packaging design, simplify recycling, and encourage the demand for recycled content.

“It is unfortunate that Greenpeace and other critics of plastics are focused on attacking the one solution to the plastic packaging sustainability problem that works: recycling,” Kara Pochiro, APR’s vice president of communications and public affairs, said in an email.

She continued, “There will always be plastic packaging, so it is essential that it is sustainable. Recycling is a vital vehicle to do this.

If we want to be serious about tackling the plastic problem, we must be serious about strengthening recycling. Misleading reports like this, which can discourage consumers from recycling, are not only destructive to our communities, but also to the environment and the economy.” Biocrudes – CPL-benzene – PCR

Visiting a local recycler

Among the country’s 370 recycling plants is ecomaine, a nonprofit owned by 20 area communities and housed in a 30,000-sq.-ft. facility in Portland, Maine. It serves a total of 73 municipal members and is one of two such plants in the state.

What started in 1978 as an operation to bale trash is now a sophisticated handler of paper, metal, cardboard, and plastic capable of sorting 150 tons of mixed recycling per day. It’s a single-sort facility, meaning households throw all recyclables into a single bin—cardboard, paper, glass, metal, and plastic. Plastics #1 through #7 make up only 2% of the total.

On a recent tour of the plant, Matt Grondin, ecomaine’s director of communications and public affairs, explained the process by which mountains of unsorted household are sorted, packaged, and ultimately readied for shipment elsewhere (see the Gallery for more photos).

Initially scooped up by bucket loaders and hoisted onto a conveyor, the refuse climbs into the upper reaches of the plant where it is directed to a variety of sorting lines and devices. There are machines that crush glass (no market for that these days), others that spear slabs of cardboard, and even one that chemically analyzes plastic and culls out PET containers with a puff of air. Where automated devices aren’t effective, ecomaine employees stand next to conveyors as streams of material rush by, plucking out different types of material by hand.

What goes in one door as truckloads of mixed refuse comes out the back door as neatly baled blocks of cardboard, paper, and plastic. Biocrudes – CPL-benzene – PCR

Ecomaine sells all of the plastic it handles, with #2 HDPE (high density polyethylene) commanding the highest per ton rates ($1437 per ton in fiscal 2021), followed by #1 PET ($182 per ton), and finally #3-7 mixed plastic, which sold for $57 per ton last year. That last category is the hardest to unload, Grondin says, but ecomaine sells it nonetheless. Because it’s comprised of mixed resins, it goes into products where appearance and exacting performance specs aren’t important.

Ecomaine’s success also is a clue to why plastic recycling rates may be so low elsewhere. Grondin estimates the cost of building a plant like this could range to $25 million, which helps explain why even relatively desirable plastics like #2 HDPE gathered in smaller communities go to a landfill or are burned in a waste-to-energy plant.

“There are 115 cities and towns, mostly in central/eastern Maine, that contract with a regional organization called the Municipal Review Committee,” Grondin said in an email. “Their facility has been closed down for almost three years, and all materials, trash, and recyclables alike, have either gone to PERC, a waste-to-energy plant, or a landfill.”

Plant operators hope to reopen in the spring, he added, but when they do only some of the plastic will be recycled for new products while the rest will be turned into plastic briquettes to be used as fuel. Biocrudes – CPL-benzene – PCR

“Other towns might handle their own separated recyclables, and market those themselves or through the Maine Resource Recovery Association, which acts like a broker,” he said. “Often, these towns might take just #2 plastics, sometimes #1 and #2, but often not #3-#7, which will end up in a landfill or waste-to-energy plant.”

Some communities may have no access to plastic recycling at all. The problem is widespread. Greenpeace estimates that only 60% of the U.S. population has access to municipal collection services for PET #1 bottles and jugs and HDPE #2 bottles and jugs. That number falls precipitously with other types of plastic, down to just 5% for plastic cups, 3% for plastic trays, and 0% for plastic cutlery and straws. The EPA recently announced $100 million in grants aimed at improving local recycling options.

Construction waste is another story

If plants like ecomaine can find ready markets for even the least desirable types of plastic, how does it do with construction plastic waste—various kinds of plastic plumbing, plastic decking off-cuts, vinyl siding scraps, and housewrap remnants? Plastic building materials typically last for decades, but when buildings are razed or renovated, the amount of waste can be significant. And in new construction, scraps and off-cuts are unavoidable.

If the material is sorted at the job site, can it be recycled?

Not at recycling facilities like ecomaine. Grondin says the plant is not permitted to accept construction and demolition debris either at the recycling plant or its sister waste-to-energy facility across the street.

That kind of plastic waste goes to a landfill where it is used to cover up raw trash to control litter and ward off pests. Biocrudes – CPL-benzene – PCR

This type of plastic waste accounts for a large portion of non-recyclable plastics that Greenpeace uses in its calculation of total plastic waste, Grondin said.

In a recent post at GBA, Fernando Pages Ruiz described a post-consumer recycling program for vinyl siding developed by manufacturer Kaycan. Storm-damaged siding was ground into a granular material used to make the substrate for new siding. The program was successful, according to the company, and the Vinyl Siding Institute lists a number of manufacturers who participate in recycling efforts.

But how widespread the practice, and how other types of plastic waste can be recycled, isn’t clear.

-Review of co-processing of biocrudes in oil refineries

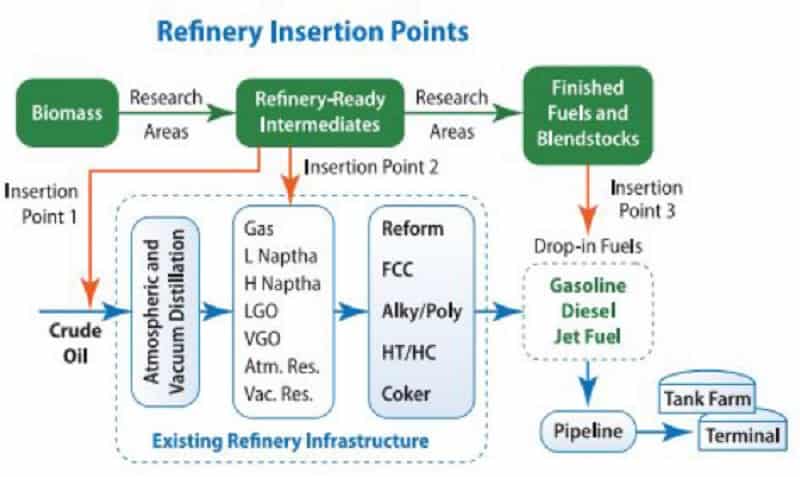

Liquid intermediates from pyrolysis and hydrothermal liquefaction (HTL) can be co-processed in an oil refinery along with conventional crude oil. In an open-access paper in the journal Energy & Fuels, a team from VTT Technical Research Center of Finland, with colleagues from Pacific Northwest National Laboratory (PNNL) and Ghent University, provides an overview of co-processing options for such bio-liquids.

Fast pyrolysis and hydrothermal liquefaction (HTL) are both processes for producing liquid fuels from dry/solid or wet biomass. Biocrudes – CPL-benzene – PCR

In fast pyrolysis, biomass is quickly heated to around 500 °C in the absence of oxygen. After pyrolysis, the vapors are condensed to give a dark brown fast pyrolysis bio-oil (FPBO). The major compound groups in FPBO are water (20–25 wt %), carboxylic acids (∼ 5 wt %), aldehydes, ketones, and furfurals (25 wt %), sugar-like material (30–35 wt %), and lignin-derived compounds (20 wt %). The presence of these oxygen-containing unsaturated compounds gives FPBO limited stability during storage and poor miscibility into conventional fuels.

In HTL, wet feedstock is liquefied in a hot (250–374 °C) and pressurized (4–22 MPa) water environment into biocrude oil. Typically, alkaline conditions are used to modify the ionic medium to favor certain base-catalyzed condensation reactions, which can lead to aromatic oil formation. In comparison to FPBO, the biocrude from HTL is more deoxygenated and then more hydrophobic with less dissolved water. The biocrude is more viscous but less dense than FPBO. The major compound groups identified in biocrude include acids, alcohols, cyclic ketones, phenols, methoxyphenols, and more condensed structures, like naphthols and benzofurans. Biocrudes – CPL-benzene – PCR

Oxygen must be removal from FPBO and HTL biocrude to obtain a product with similar properties compared to fossil fuels. Typically, the removal of oxygen takes place through three types of reactions: decarboxylation (oxygen removal as CO2); decarbonylation (oxygen removal as CO); and hydrodeoxygenation (HDO, oxygen removal as H2O). Upgrading the liquid intermediates can be problematic, however.

One attractive option for upgrading the liquid intermediates from pyrolysis and HTL is to co-process them in an oil refinery. This concept was first suggested by VEBA OEL (now part of BP) in 1995, but at that time, it was not seen as competitive compared to other biomass alternatives as well as in comparison to crude oil. The advantage of this approach is the use of decentralized pyrolysis and HTL plants, which can be located near the biomass production site. Only the biocrude is transported to a centralized refinery, which reduces transportation costs as a result of the increase of the volumetric energy of the oil compared to the original biomass.

Many oil refineries have different configurations and product profiles, including fuels, chemicals, and asphalt. There are therefore many possible locations for inserting the biocrude in a refinery, depending upon the nature of the biocrude and target product. The proposed feeding locations for the biocrude in the refinery are (1) before the pre-distillation phase without any treatment for the biocrude, (2) in some of the processing units after mild upgrading of the biocrude, or (3) with the finished or nearly finished fuel after high-severity upgrading of the biocrude. Biocrudes – CPL-benzene – PCR

Inserting of the upgraded biocrude with the petroleum fuels as finished fuels represents the lowest risk for the refinery, while inserting it at the pre-distillation phase poses the highest risk. The greatest benefit for the refinery is achieved if the biocrude is introduced in some of the processing units after mild upgrading. Both cracking and the capability to remove oxygen from the biocrude is required from these processing units, and therefore, co-processing could potentially take place in the fluid catalytic cracker, hydrotreater, or hydrocracker.

-EFSA Determines Plastic Produced by Poly Recycling is Food Safe

The European Food Safety Authority (EFSA) has determined the food safety of plastic polyethylene terephthalate (PET) when produced by a recycling process called Poly Recycling for use in food contact materials.

Poly Recycling involves the input of washed and dried PET flakes originating from collected post-consumer PET containers, including no more than 5 percent PET from non-food consumer applications. The flakes are heated in a reactor before being extruded.

The EFSA Panel on Food Contact Materials, Enzymes, and Processing Aids conducted a risk assessment on the food safety of PET produced by Poly Recycling, The risks associated with the use of recycled plastic materials and food contact materials come from the possible migration of chemicals into the food in amounts that would endanger human health. Biocrudes – CPL-benzene – PCR

The quality of the input, the efficiency of the recycling process to remove contaminants, and the intended use of the recycled plastic are crucial points for risk assessment.

Considering the high temperatures used during the Poly Recycling process, the possibility of contamination by microorganisms was discounted. Therefore, EFSA’s evaluation focused on the chemical safety of the final product. Biocrudes – CPL-benzene – PCR

The panel concluded that temperature, pressure, and time in the reactor of step are critical for decontamination efficiency. The panel also determined that Poly Recycling is able to reduce foreseeable accidental contamination of post-consumer food contact PET to a concentration that does not give rise to concern for a risk to human health if:

- It is operated under conditions that are at least as severe as those applied in the challenge test used to measure the decontamination efficiency of the process

- The input material of the process is washed and dried post-consumer PET flakes originating from materials and articles that have been manufactured in accordance with the EU legislation on food contact materials and contain no more than 5 percent of PET from non-food consumer applications

- The recycled PET is used at up to 100 percent for the manufacture of materials and articles for contact with all types of foodstuffs, including drinking water, for long-term storage at room temperature, with or without hotfill.

EFSA recommends periodic verification that the input material to be recycled originates from materials and articles that have been manufactured in accordance with the EU legislation on food contact materials and that the proportion of PET from non-food consumer applications is no more than 5 percent. Biocrudes – CPL-benzene – PCR

-CPL-benzene processing fee forecast for H1 2023

The chart above shows the trend of CPL-benzene price difference so far this year, and we found that the worst time was in the third quarter. In the fourth quarter, after an upward correction in CPL price from October to November, CPL-benzene price difference seems to have built a new platform after a persistently weak market pattern in December.

From a micro trading level, although CPL has been weak, but the recent daily CPL trading price has showed strong resilience. Biocrudes – CPL-benzene – PCR

Some factories take advantage of their low transportation fee and lowered their price delivered to East China market to as low as 11100yuan/mt, but other main suppliers still stick to the position of 11200yuan/mt. CPL spot has been kept range-bound between 11100 and 11400yuan/mt for nearly a month. Judging from the poor processing price of the specimen in the worst time in the past, the author originally thought that the 11000yuan/mt line would be easily breached, but the firm performance of CPL in the past month was still a little unexpected.

There comes the question, what happened from the third quarter to December to take CPL processing fee to an upper level? If you look for the cause from the supply and demand relationship between upstream and downstream, you will find that the answer may come from the commissioning of the new PA6 plant in Shandong mentioned earlier.

In previous articles, we have expressed that with the commissioning of new PA6 devices in Shandong, including Hualu Hengsheng and Shandong Juheshun, CPL merchant sales volume in Shandong has decreased significantly, which constitutes a certain support to spot prices. From the chart above, we can see that this obviously leads to an increase in CPL processing fee. The situation in December seems to indicate that with after this part of the new PA6 capacity is released, spot CPL processing fee repair may not be a short-term change. Biocrudes – CPL-benzene – PCR

In the coming period of time, when no more new devices are put into production in the upstream and downstream, we must make some adjustments to the understanding of the supply and demand of North China-East China CPL. At this stage, the most extreme state that CPL processing fee may be to current stage, which is 11200-6600=4600yuan/mt. Of course, there are still some variables that need to be examined. For instance, Shanxi Lanhua Sci-tech and Shandong Luxi Phase II have not yet formed effective supply. In the end, the limit CPL processing fee of this “new phase” may have to be further observed and revised. Overall, it is a high probability event that the CPL processing fee should be higher than 4000yuan/mt in the third quarter of 2022.

Theoretically, CPL processing fee is a comprehensive function index related to upstream and downstream capacity, operating rates and other factors. In the short term, from a micro point of view, we come to the conclusion that the processing fee may have been reduced to the relative limit at this stage.

To make this conclusion, we have controlled the analysis variables, and it is possible that a series of PA6 plants in Shandong from October to November are the main factors leading to the pick-up of processing fees. Logically, this makes sense. But what is the processing fee B? we still need to wait for the impact after the restart of Shanxi Lanhua and Luxi Phase II next week. Biocrudes – CPL-benzene – PCR

The longer-term significance is that from the end of 2022 to the third quarter of 2023, only the last 60kt/year plant of Lunan Chemical will be put into operation in the whole East and North China. Based on this, we can assume that if the weak market situation before the Spring Festival can test the limit low CPL processing fee (B) in the current supply and demand state, then it is very likely to be the limit low processing fee in the first half of 2023.

-Egypt allocates more land for renewables, green hydrogen

Egypt allocates more land for renewables, green hydrogen Egypt’s Primer Minister Mostafa Madbouly (center) chairs a cabinet meeting. Photo by the Egyptian Cabinet on Facebook

December 30 (Renewables Now) – Egypt’s Cabinet on Thursday approved several proposals that support the deployment of renewable energy and green hydrogen in various regions of the country. Biocrudes – CPL-benzene – PCR

At a meeting in the New Administrative Capital chaired by prime minister Mostafa Madbouly, the Cabinet decided to allocate 141,075 feddans (228.8 sq mi/592.5 sq km) of state-owned land in the Matrouh Governorate in the northwest of the country for renewable energy projects. The New and Renewable Energy Authority (NREA) is authorised to offer the land to investors under the usufruct scheme.

In addition, a number of land plots in Sohag and Aswan Governorates in southern Egypt were made available for new wind projects.

The Cabinet approved also the allocation of a further 303.3 hectares (749.4 acres) in Matrouh for establishing production capacities for green hydrogen and green ammonia. The decision supports Egypt’s ambition to become a regional hub for green energy exports. Biocrudes – CPL-benzene – PCR

The renewable energy sector in the North African country was given a solid boost this year, especially during the COP 27 climate summit that took place in Sharm El-Sheikh in November. During that month, Egypt agreed projects that will increase its green energy capacity by 55 GW.

-Prices of Volume Resins Drop–Except for PE

The downward trajectory appears to be continuing into the first quarter for most resin prices, though PE and possibly PP may remain somewhat stable.

Heading into January, prices of all the major volume resins continued to slump, with the exception of PE, which appeared to have stabilized in the late fourth quarter, owing largely to a significant reduction in plant operating rates. Factors contributing to the downward trajectory for most of these resins include diminished demand, higher inventories across the supply chain, and lower feedstock costs. Also supporting this trend is significant new capacity brought on stream in PE and PP, and competition from lower-priced imports of PS, PET, ABS, PC, and nylon 6. Biocrudes – CPL-benzene – PCR

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior analysts from PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers.

PE Prices Flat

Polyethylene prices in November appeared to remain unchanged, and suppliers pushed back their announced price hikes of 5¢ to 7¢/lb, so the pricing outlook for December-January was likely to continue relatively flat, according to David Barry, PCW’s associate director for PE, PP, and PS; Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets; and The Plastic Exchange’s CEO Michael Greenberg.

Barry noted that demand was quite diminished, with one industry player citing October sales as the lowest in two years. “There is also lots of inventory still waiting to set out for exports due to both some continued shipping logistics issues and not much global demand.” He expected suppliers would continue to run plants at rates in the low 70% range, and they would need to lower export prices further to get material moving. Chesshier noted that due to large inventories of both resin and finished goods, many processors were planning for extended shutdowns. She did not see demand making much of a comeback in the first quarter. Biocrudes – CPL-benzene – PCR

Going into December, The Plastic Exchange’s Greenberg noted that spot PE market demand was relatively healthy, with HDPE blow molding and LLDPE film and injection grades in the lead and LDPE activity more limited. “More balanced supply/demand factored into the rollover for October contracts and we expect the same for November, even as new capacity is still hitting the market,” he reported. All three sources noted that significant new capacity from Shell and Baystar (the new 50/50 joint venture between Borealis and Total Energies), which represents a 10% domestic capacity increase, was another factor for projections of relatively flat pricing.

PP Prices Staying Low?

Polypropylene prices in November were expected to drop by 2¢/lb, as propylene monomer contracts were settling 1¢/lb higher, but another 2¢/lb slice of supplier margin was coming off, according to Barry, Greenberg and Spartan Polymers’ Newell. The November decrease followed a 15¢/lb drop in October. In December-January, these sources generally saw prices as likely to stay put.

Barry ventured that suppliers were unlikely to give back any more margin but also did not expect prices of propylene to go any lower. Domestic PP is now the lowest priced globally, according to Newell. Barry noted that buying patterns in first quarter had some potential of returning to more normal levels. He noted that some processors were building up inventory at year’s end due to attractive pricing. Biocrudes – CPL-benzene – PCR

Newell noted that domestic demand has been very weak and cited a 10.3% drop within a 12-month period, along with resin and finished-goods inventory accumulation. Supplier inventory days were at 43.5 versus the usual 32 to 34 days, despite suppliers having dropped their operating rates to around 72%. Newell did not expect to see demand return to any where near normal levels within the first quarter. All three sources noted that the significant new capacity brought on stream by Heartland Polymers and ExxonMobil will also impact the market.

PS Prices Down

Polystyrene prices in November had a chance of holding even, despite some suppliers’ announced hikes of 3¢ to 4¢/lb based on an uptick in benzene price, because market fundamentals did not support any upward movement, according to both PCW’s Barry and RTi’s Chesshier. Meanwhile, spot PS prices for November were down 2¢/lb and GPPS and HIPS tabs sunk 3¢/lb lower. Biocrudes – CPL-benzene – PCR

Barry saw PS prices for December-January as likely to drop, as benzene prices were collapsing. Benzene contracts for November rose to $3.26/gal but spot benzene was trading at $2.52 for December. “December benzene contracts could drop by 50¢gal to 60¢/gal, which would translate to a 5¢/lb to 6¢/lb decrease in PS prices,” Barry noted. The implied styrene cost based on a 30% ethylene/70% benzene formula was down nearly 4¢/lb by the last week of November to 39.7¢/lb. Chesshier said there was potential for a 6¢ to 7¢/lb drop in December and projected that further decreases would come this month, barring some major global production interruption. Demand has been very soft both domestically and globally; PS suppliers have run plants at historically low rates in the 60-65% range; and high volumes of attractively priced PS imports are coming into the U.S. market.

PVC Tabs Tumble Lower

PVC prices for November and December were expected to drop in the double-digit range, following the 5¢/lb October dip, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd.

She reported that industry pundits were indicating prices would drop by 6¢/lb in November and again in December. Similarly, Kallman saw potential for a total drop of 10¢ to 14¢lb by year’s end. Biocrudes – CPL-benzene – PCR

These sources anticipated further price decreases through the first quarter. Todd expected a decline of 3¢/lb for this month and 2¢/lb each in February and March. “The continued price erosion is predicated on high producer inventories, weak demand and falling export prices,” she explained. Kallman emphasized the significant drop in export prices, which ultimately affect domestic prices, noting that the gap was at 30¢/lb or more.

PET Prices Slipping

PET prices dropped by 1¢ to 1.5¢/lb in November and were poised to drop by another 1.5¢ to 2¢/lb in December, based on feedstock costs. Characterizing domestic supply as ample, RTI’s Kallman foresaw a similar drop in prices this month based on lower seasonal demand along with competition from lower-priced imports. Biocrudes – CPL-benzene – PCR

ABS Dives Even Lower

ABS prices dropped in the vicinity of 20¢ to 30¢/lb in the third quarter and continued to drop on the order of 10¢ to 15¢/lb in the fourth quarter, according to Kallman. He characterized the market as very well supplied, with slower demand in both automotive and electronics, along with lower feedstock costs and continued competition from lower-priced imports. He ventured that first-quarter ABS prices could be flat to lower by 5¢ to 10¢/lb.

PC Tabs Continue Downward

Polycarbonate prices dropped on the order of 5¢ to 10¢/lb in the third quarter and appeared to be sinking 10¢/lb lower by the end of the fourth quarter, according to RTi’s Kallman. He expected first-quarter PC pricing would be flat to lower, owing to a well-supplied market despite indications of lowered production rates. Softer demand in automotive and construction, lower feedstock costs, and inexpensive imports were other driving factors. Biocrudes – CPL-benzene – PCR

Prices of Nylon 6, 66 Plunge

Nylon 6 prices dropped 5¢ to 10¢/lb in October-November after falling 20¢ to 22¢/lb in August. Another substantial price drop in December-January was very likely, according according to RTi’s Chesshier. Factors driving the action are slowed demand and lower feedstock costs. But the biggest factor is arrival of imports from Asia priced at 20 to 30% lower than domestic resin. This was of great concern to suppliers, who needed to drop prices further before year’s end in fear of losing more business, according to Chesshier.

Nylon 66 prices fell in the third quarter for both resins and compounds on the order of 8¢ to 15¢lb, with compounds on the lower end, and it appeared that another drop of the same proportions was underway in the fourth quarter, according to RTi’s Kallman. He characterized the market as well supplied with slowed demand in automotive and construction, along with lower feedstock costs. He ventured nylon 66 prices in first quarter would be flat to a bit lower.

-Project CaSino investigating calcium-sulfur batteries

The joint European project “CaSino” is investigating the potential of the calcium sulfur (Ca-S) battery as an alternative to lithium-ion batteries. The project consortium consists of five research institutions, two industrial companies and an industrial advisory board and is coordinated by DLR Stuttgart. It is funded with €3 million by the German Federal Ministry of Education and Research (BMBF).

Lithium is a stellar element for an electrochemical cell in many ways—it combines a high power storage capacity and cell voltage with fast ion migration. This enables compact batteries and fast loading and discharging. Biocrudes – CPL-benzene – PCR

However, lithium-based systems have an increased risk of fire, as dendrites can form with repeated charging, which in the worst case lead to an internal short circuit. In addition, the lithium deposits on earth are limited and not available on all continents, mining is controversial and it can only be recycled extensively.

Calcium—a multivalent metal like aluminum, magnesium and zinc—is 400 times more common and therefore inexpensive, as well as worldwide and equally distributed. Like lithium, it has a high storage capacity and cell voltage and is also safer in terms of short circuits, as calcium does not form typical dendrites in operation.

The biggest challenge when using calcium is its reactivity and formation of surface layers, whether in contact with air or moisture, or even with the electrolyte used in the battery. The oxidized surfaces later block ion diffusion and thus prevent efficient loading and unloading. The development of a compatible electrolyte thus plays a key role. In addition, soluble polysulfides are generated when using a sulfur cathode, which can also block the Ca anode. Biocrudes – CPL-benzene – PCR

The CaSino project has now set itself the goal of achieving significant progress in terms of cycle stability and energy density of calcium sulfur batteries through innovative material development. These steps are accompanied by experimental investigations, advanced analysis methods and extensive modeling work. The BMBF-funded joint project is coordinated by the Institute of Technical Thermodynamics of the German Aerospace Center in Stuttgart during the three-year project duration.

From the consortium, the Karlsruhe Institute of Technology (KIT) and its Helmholtz Institute Ulm (HIU) play a pioneering role in the field of research on calcium batteries. With a non-corrosive boron-based electrolyte, KIT has laid the foundation for the further investigation of Ca batteries. This recent development now allows a more stable loading and discharge of Ca batteries over hundreds of cycles. Based on this, KIT, together with IoLiTec GmbH, the specialist for ionic liquids, aims to further improve the already established KIT electrolyte.

The Research Institute for Precious Metals and Metal Chemistry (fem) addresses the need for thin and structured Ca anodes, while the DLR Institute of Technical Thermodynamics develops tailor-made coatings to protect against passivation.

The electrochemical characterization of the new materials will be extended by innovative structural and morphological analysis methods (analytical electron and ion microscopy) at the Institute of Natural Sciences and Medicine (NMI) at the University of Tübingen. Furthermore, the experimental activities are supported by atomistic simulations at the University of Ulm as well as continuum simulations and modeling of the Ca-S cell at the DLR Institute of Technical Thermodynamics. Biocrudes – CPL-benzene – PCR

Finally, a comprehensive consideration of economic and ecological aspects by EurA AG should highlight the potential of the Ca-S system in terms of sustainability, costs and recyclability compared to state-of-the-art battery materials.

The project will continue to be accompanied by an industry advisory board consisting of the companies Alantum, Varta, CustomCells and Accurec. All integrated institutions and companies work together towards the goal of demonstrating the performance of this sustainable energy storage technology based on calcium and sulfur in an industry-compatible battery cell for use as stationary storage.

Biocrudes – CPL-benzene – PCR