Bioplastics – Recycling-Technology 11-08-2022 - Arhive

Bioplastics – Recycling-Technology

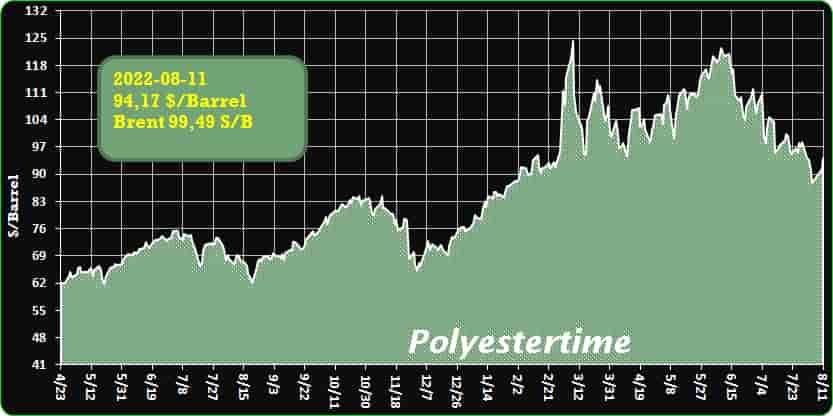

Crude Oil Prices Trend

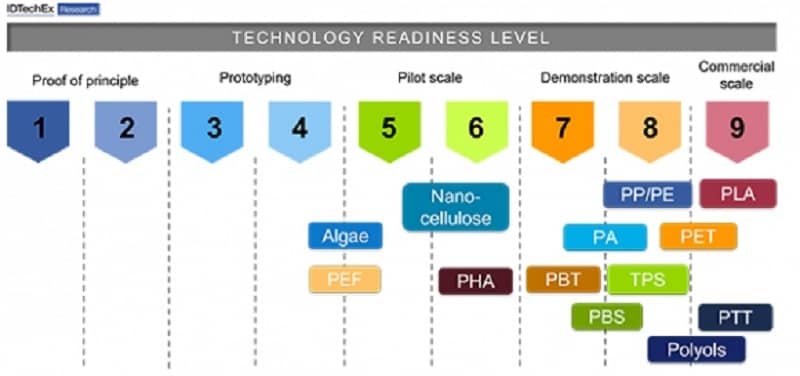

-Bioplastics to Rapidly Expand With CAGR 10.1%, Says IDTechEx

As bioplastic materials transition from being a “nice-to-have” to materials with a very strong, viable business case, manufacturers are racing to keep up with demand. Brand-owners, striving to hit their decarbonization targets by taking the initiative to transition to bioplastics, are generating a stronger brand-owner pull than ever before. This demand is further exacerbated by legislators around the world, who are cutting down on fossil-based plastic use with single-use plastic bans.

Together, these major factors are pressurizing players across the bioplastics industry to commercialize their materials and ramp up production. With all this activity, IDTechEx forecasts global annual bioplastics production capacity to grow at a CAGR of 10.1% over the next ten years. Bioplastics – Recycling-Technology

IDTechEx have released their latest research on bioplastics in the report “Bioplastics 2023-2033: Technology, Market, Players, and Forecasts”, which evaluates the technologies and trends that are bringing more sustainable biobased materials to the plastic industry. In the report, IDTechEx evaluates the technologies for polymerizing synthetic biobased polymers and extracting naturally occurring polymers. It tracks the huge industry activity that has been happening and discusses the trends and challenges surrounding bioplastics, considering these in a granular 10-year forecast.

– Battle for biobased bottles

Plastic bottles are a massive fossil-based problem for drink makers. Currently, manufacturers can produce bottles made from partially biobased polyethylene terephthalate (PET), but there is no 100% biobased solution commercially available. That is because one building block of PET, called terephthalic acid (TPA) remains a material made from fossil oil. Two options are vying to replace fossil-based TPA in plastic bottles. One is to develop a biobased TPA to get 100% biobased PET. The other is to switch out TPA entirely for another similar but entirely biobased acid. This would make another polymer, polyethylene furanoate (PEF), which hopes to disrupt the biobased PET market as a cheaper alternative with superior properties.

For now, both options have yet to produce on a commercial scale, but 100% biobased PET is close. In their new report, IDTechEx compares biobased PET and PEF and discusses the future of the plastic bottle industry. Bioplastics – Recycling-Technology

-Norway-based fully automated waste sorting plant maximises recovery rates with TOMRA sorters

The ROAF wqste sorting plant, situated in Skedsmokorset, near Oslo, is a fully automated waste sorting plant featuring TOMRA’s optical sorters and ranks second in sorting municipal solid waste by volume in Norway.

Having abolished the separate collection of plastics in 2015, the facility has increased its recovery rates of organics and plastics while maximising its recycling efforts.

ROAF collects and sorts waste from seven surrounding municipalities, where plastics were formerly collected at the curbside separately from paper, cardboard and residual waste. Unfortunately, many recyclables still found their way into the household waste fraction and were thus incinerated. To optimise resource recovery and mitigate the negative impact of incineration, TOMRA and ROAF examined the household waste composition and came up with a new business model to introduce a new waste management approach for the municipalities served. Bioplastics – Recycling-Technology

Mixed waste sorting drives up resource recovery

The new approach includes a change in the region’s waste management and collection practices and the construction of a new sorting facility. ROAF now operates a three-container waste collection system wherein inhabitants dispose of biowaste in green bags and throw it together with plastics and residues in the municipal solid waste container, which is collected by a ROAF truck and transported to the sorting centre. A second container gathers paper and cardboard whereas the third one is used to dispose of glass and metal packaging.

The second part of the new business model was the construction of the world’s first fully automated sorting plant for MSW. After a three-year period of extensive planning, German plant builder STADLER constructed the plant in just three months and was awarded the German-Norwegian business award for its efforts in 2014.

The trommels, bag openers, ballistic separators, eddy current separators, overhead magnets, and vibratory screens work in unison with TOMRA’s most advanced optical sorters. Sixteen AUTOSORT’s process 40 tonnes of waste per hour. From this, the units recover biowaste, paper, and plastics with high levels of accuracy.

Once the organics, along with the residues collected curbside, arrive at the sorting plant they are fed into the facility, where three of TOMRA’s AUTOSORT systems separate green bags from the remaining waste.

hese are sent to a biogas site where the organics are converted into biogas for refuelling the plant’s collection trucks and bio-fertilisers. The remaining waste bags undergo further sorting steps. Bioplastics – Recycling-Technology

-Spot Resin Market Experiences Swift, Steep Readjustment

Spot Prime and off-grade resin prices continue to crumble.

The dismal demand and ample supply that characterized the commodity resin markets the last week of July spilled over into the first week of August, reports the PlasticsExchange in its Market Update. Spot prices for both prime and off-grade resins continued to crumble, and the continued flow of aggressively priced offers kept most processors pinned to the sidelines. Bioplastics – Recycling-Technology

The lack of buying did not deter producers from pelting the marketplace with resin — they seem determined to find a level that will spur demand.

Spot resin prices have been going through a swift, steep period of readjustment, notes the PlasticsExchange. Polyethylene (PE) resin prices peeled back another penny last week, while polypropylene (PP) dropped another three cents, creating extraordinarily discounted spot buying opportunities compared with prevailing contracts. Export offers also felt the pressure, as producers chased large-volume international orders hoping to liquidate some of their inventory.

July PE resin contracts wipe away May increase

July PE contracts decreased $0.03/lb, wiping away the contentious increase garnered in May, reports the PlasticsExchange. July PP contracts dropped an average of $0.07/lb, including a pass-through polymer-grade propylene (PGP) cost saving plus an additional $0.04/lb or so in margin reduction. The onslaught of offerings in early August indicated that the July purge did not sufficiently clear the supply overhang. The PlasticsExchange believes the prevailing negative sentiment could continue until a catalyst emerges to alter the current downward trajectory in resin prices. As such, processors are again pushing for additional price relief for August. Bioplastics – Recycling-Technology

-Covestro Sells Additive Manufacturing Business to Stratasys

Additive manufacturing is a highly competitive sector, said Covestro, and Stratasys is better positioned to support further growth of the business.

Additive manufacturing pioneer Stratasys Ltd. has signed a definitive agreement to acquire the additive manufacturing materials business of Covestro AG.

The acquisition is expected to be immediately accretive upon closing, and will include R&D facilities and activities; global development and sales teams across Europe, the United States, and China; a portfolio of approximately 60 additive manufacturing materials; and extensive IP comprising hundreds of patents and patents pending.

The purchase price is approximately €43 million ($43.8 million), plus additional inventory, less certain liabilities. In addition, there is a potential earn out of up to €37 million ($37.7 million), subject to the achievement of various performance metrics, said Stratasys in its announcement. Bioplastics – Recycling-Technology

Covestro has been part of Stratasys’ third-party materials ecosystem, and the acquisition will benefit customers using multiple Stratasys 3D-printing platforms. Stratasys is already a distributor of Covestro’s Somos resins. Covestro brought Somos resins into its fold when it purchased DSM Functional Materials in October 2020 for €1.6 billion ($1.63 billion).

“Additive manufacturing is a growing, but also highly competitive market,” commented Covestro Chief Financial Officer Thomas Toepfer. “We are convinced that Stratasys offers the optimal conditions to support the further growth of our former additive manufacturing business in this field.”

“Innovative materials are the fuel of additive manufacturing and translate directly into the ability to create new use cases for 3D printing, particularly in the production of end-use parts like dental aligners and automotive components,” said Stratasys CEO Dr. Yoav Zeif. “The acquisition of Covestro’s highly regarded additive manufacturing business positions us to further grow adoption of our newest technologies. We will now have the ability to accelerate cutting-edge developments in 3D-printing materials, and advance our strategy of providing the best and most complete polymer 3D-printing portfolio in the industry,” said Zeif. Bioplastics – Recycling-Technology

-Next-Gen Cleanflake Recycling Technology Debuts

Avery Dennison is first label manufacturer to enable rigid plastic recycling for its polymer films portfolio, which could divert 200 billion plastic containers from landfill.

While brands and converters seek solutions to increase the circularity of plastic packaging, Avery Dennison Label and Packaging Materials has removed a key obstacle to plastic recycling with the introduction of next-generation AD CleanFlake technology. This breakthrough extends CleanFlake benefits to the company’s core film portfolio, combining with its high-density polyethylene (HDPE) recycling compatibility.

Avery Dennison lays claim as the first label manufacturer to enable rigid plastic recycling across its film portfolio, providing brands and converters solutions that support recycling processes without compromising performance to meet sustainability goals.

AD CleanFlake technology is recognized by the Association of Plastic Recyclers, European PET Bottle Platform and Recyclass, for enabling recycling by working with the rigid plastic recycling processes to either remove cleanly (for PET) or remain with the package (for HDPE), resulting in good quality flakes, the conservation of virgin resources, and less landfill waste. The AD CleanFlake Portfolio has the potential to divert more than 200 billion rigid plastic bottles and containers from landfills. Bioplastics – Recycling-Technology

-Challenging times for automotive specialist

Although it is well positioned for e-mobility and sustainability, low production volumes, geopolitical developments and a sharp rise in inflation impacted profitability at automotive components supplier Autoneum during the first half of 2022.

In a slightly declining market, with global automobile production falling by 1.8% in the first half of 2022 compared to the previous year, Autoneum increased revenue in local currencies by 0.5% to CHF 888.7 million, reaching the previous year’s level. Despite the challenging environment, Autoneum also achieved a positive operating result of CHF 6.4 million although net income dropped to a loss of CHF 12.8 million.

Since the outbreak of war in Ukraine, new bottlenecks in global supply chains – a lack of cable harnesses, in particular – have impacted vehicle manufacturers’ production volumes and therefore dampened revenue and earnings development for the automotive supply industry in the first half of 2022, especially in Europe.

In addition, revenue in Asia declined because of the coronavirus-related lockdowns in China in the second quarter. Bioplastics – Recycling-Technology

In contrast, Business Group SAMEA (South America, Middle East and Africa) was able to considerably increase its revenue.

“Current geopolitical developments substantially affected business performance in the first half of 2022,” the company said.

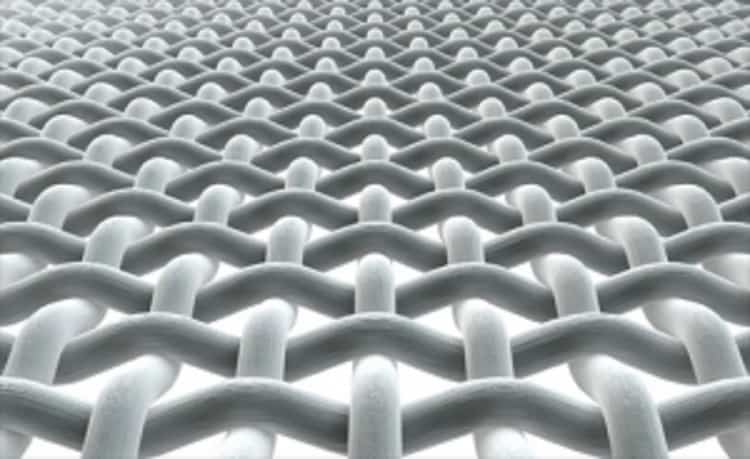

–What is polyester? What are the advantages?

Polyester fiber, which is a synthetic fiber, can also be resynthesized. So, polyester fiber, it’s really durable and wears well!

What is “polyester”? What is “fiber”? And what are the two phrases together?

It is called “polyester fiber“, that is, the public generally known as “polyester”, is made of organic diacid and diol condensation of polyester by spinning synthetic fibers, belonging to polymer compounds. Invented in 1941, is the current synthetic fibers of the first major species.Because of its high fiber strength, it has strong wrinkle resistance, good shape retention and elastic recovery ability.Of course, more importantly, the “polyester” fabric is durable, wrinkle-resistant, non-iron, and non-sticky.It has good resistance to various chemical substances, little damage caused by acid and alkali, and is not afraid of mildew and insects. Bioplastics – Recycling-Technology

Is there any defect in polyester fiber?Having said that, some people have to ask, does “polyester fiber” have no shortcomings? Yes, of course, everyone has shortcomings, how can fabrics have no shortcomings?

Its disadvantages are poor moisture absorption, weak water absorption, poor melting resistance, easy to absorb dust, and poor air permeability. In addition, the dyeing performance is not good, and it is more troublesome to dye with disperse dyes at high temperature.

-Extended Producer Responsibility: Gateway to the Circular Economy or Stealth Tax?

A key part of California’s single-use plastics law, Extended Producer Responsibility eventually could lead to cost savings through better product design and materials recovery, according to one analyst. Bioplastics – Recycling-Technology

The concept of Extended Producer Responsibility (EPR) is poised to have tremendous impact on the plastics industry. Proponents see it as a necessary tool to create sustainable materials and products for a circular economy. Naysayers devine a new tax levied on manufacturers. One thing we can all agree on, however, is that it’s coming to the USA.

A term introduced in 1990 by Swedish academic Thomas Lindhqvist, EPR is a means of holding manufacturers accountable for their products throughout their life cycle, particularly the methods and costs of their disposal.

The concept of Extended Producer Responsibility (EPR) is poised to have tremendous impact on the plastics industry. Proponents see it as a necessary tool to create sustainable materials and products for a circular economy. Naysayers devine a new tax levied on manufacturers. One thing we can all agree on, however, is that it’s coming to the USA.

A term introduced in 1990 by Swedish academic Thomas Lindhqvist, EPR is a means of holding manufacturers accountable for their products throughout their life cycle, particularly the methods and costs of their disposal.

EPR is a key component of California’s just-enacted single-use plastics law, which requires all packaging in the state to be recyclable or compostable by 2032 and reduces plastic packaging and foodware by 25% in 10 years. The law also mandates a phased approach to recycling single-use plastics. Plastics industry members must contribute $5 billion over 10 years to combat plastic pollution. Bioplastics – Recycling-Technology

Such initiatives are a mixed bag. On the one hand, they incentivize producers to collect, sort, and recycle waste. On the other hand, consumers are likely to pay higher prices, as costs associated with EPR compliance are passed on.

Martin Koehring, head of the World Ocean Initiative and Senior Manager for sustainability, climate change, and natural resources at Economist Impact, offered PlasticsToday his assessment of the pros and cons of EPR mandates, using the California law as a focal point.

“California has ambitious targets for post-consumer recycled plastics, including material that is made from the items that consumers recycle every day,” he noted. “This means a key priority must be to significantly improve the recycled plastic value chain, including via advanced technologies.”