Carbon-fiber – FDCA-PEF-technology 24-02-2022 - Arhive

Carbon-fiber – FDCA-PEF-technology

Avantium N.V., a leading technology company in renewable chemistry, has published Life Cycle Assessment (LCA) data for its bottles made from PEF (polyethylene furanoate): a plant-based, fully recyclable plastic material with superior performance. nova-Institut GmbH recently completed the ISO[1]certified LCA to assess the potential environmental impact of monolayer PEF and multilayer PET/PEF bottles.

Compared to the incumbent fossil-based PET bottle designs, significant improvements in carbon footprint of around 35% in greenhouse gas (GHG) emissions can be achieved depending on the chosen application.

This is also combined with the biogenic nature of the emissions (from renewable carbon) that a PEF bottle would release at end-of-life, which do not contribute additionally to global warming. Carbon-fiber – FDCA-PEF-technology

Once PEF is commercially available, substantial economic, technological, and environmental optimisations are expected within the value chain, leading to further reduction of its environmental impact.

Compared to fossil-based PET bottle solutions, the use of renewable feedstock (high-fructose syrup from wheat) in PEF results in clear reductions in GHG emissions throughout the entire life cycle. A second driver for the lower carbon footprint of PEF bottles is the improved barrier and mechanical properties of PEF, enabling a substantial reduction in material usage compared to PET bottles.

For monolayer PEF bottles, this results in 33% lower GHG emissions, and 37% reduction for multilayer PEF/PET bottles. In addition, as all plants absorb carbon during growth, an inherent advantage of PEF-based products is the temporary storage of carbon dioxide. Carbon-fiber – FDCA-PEF-technology

At the end-of-life of a PEF-based product (i.e. when PEF can no longer be recycled and is incinerated), this biogenic carbon re-enters the natural carbon cycle, whereas fossil-based plastics release carbon at the end-of-life that has been locked up in the ground for millions of years, increasing that total carbon amount of carbon in the atmosphere.

Some non-EU companies report carbon-negative climate change results for their bio-based materials, taking this short-term carbon storage into account.

European LCA standards and methods do not allow carbon discounting based on temporary storage and therefore this is not included in this LCAi . Further improvements foreseen This LCA study is the basis for assessing the sustainability benefits of Avantium’s current PEF applications.

It enables identification and quantification of further technology development, as well as opportunities for improvement in the value chain. Further improvements may consist of the use of renewable energy, different feedstock sources, process optimisation and recycling of PEF. Carbon-fiber – FDCA-PEF-technology

For instance, in this LCA, the current energy mix of the Netherlands, which still contains a low percentage of renewable energy, was assessed. It is foreseen that the use of both renewable heat and electricity will become the norm in the near future.

Recent energy optimisation work for an FDCA plant at industrial scale has already shown that energy consumption can significantly be reduced, resulting in a further improved LCA. Furthermore, this LCA study still assumes that PEF will initially end up in an open-loop recycling stream with relatively low recycling rates.

Sufficient market growth will enable an individual closed-loop material recycling stream with high efficiencies. Carbon-fiber – FDCA-PEF-technology

The PEF process is expected to become much more efficient, in both energy integration and achieved yields. Substantial further GHG emission and other environmental benefits will be achieved when these factors have been realised. Avantium will conduct another LCA study once those improvements are materialised.

-Quva completes acquisition of PET preform manufacturer

As planned, Belgian investment company Quva (Kortrijk; www.quva.com) has taken over the Dirk de Cuyper family’s block of shares in compatriot PET bottle and preform manufacturer Resilux (Wetteren; www.resilux.com – see Plasteurope.com of 22.12.2021). Carbon-fiber – FDCA-PEF-technology

Quvadec, an acquisition entity set up for the purchase, now holds 57.51% of the total of 2 mn shares and plans to pay around EUR 270 mn in the deal.

With this stake, Quva, the investment vehicle of Belgian entrepreneur Pascal Vanhalst, has exceeded the threshold under Belgian law for making a mandatory offer for the remaining Resilux shares. According to the Belgian financial supervisory authority FSMA, such a squeeze-out offer is planned but has not yet been made to the remaining shareholders. Carbon-fiber – FDCA-PEF-technology

-French auto supplier Faurecia sees higher sales in 2022

French car parts group Faurecia , which sealed its takeover of Germany’s Hella in early February, on Monday forecast a rise in annual sales, as it expects semiconductor shortages to ease from the second half of 2022.

Faurecia now sees full-year sales of 17.5 billion to 18 billion euros ($19.89 billion to $20.45 billion), up from 15.6 billion euros recorded last year.

The group said it will release full-year guidance for the combined group with Hella along with first-quarter sales figures on April 28. Carbon-fiber – FDCA-PEF-technology

The combined group, which will continue to equip cars under the name of Forvia, is set to become the seventh-largest automotive supplier in the world.

“Our most exciting challenge for 2022 will be the great opportunity to combine our operations and teams with Hella to create a powerful group, which is far more than the sum of the two preexisting companies,” Faurecia CEO Patrick Koller said in a statement, adding that Forvia is now fully on track to deliver on its ambitions.

Faurecia, which supplies car seats, dashboards and fuel systems to automakers, also said it expects its operating margin to be between 6% and 7% in 2022 compared to last year’s 5.5%. Carbon-fiber – FDCA-PEF-technology

Its full-year net loss shrank to 79 million euros from a year-earlier loss of 379 million euros.

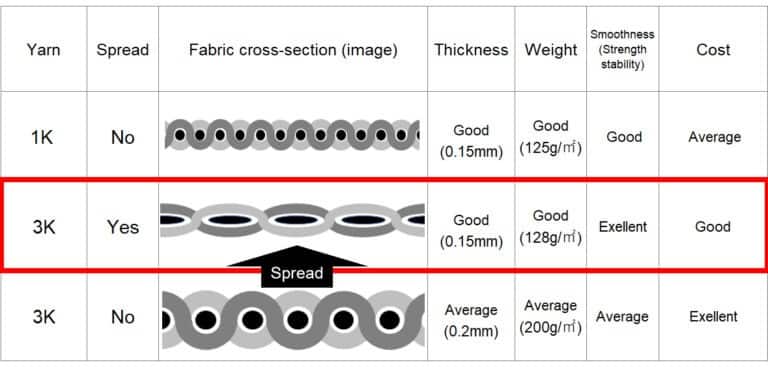

-Teijin releases thinner spread-tow carbon-fiber fabric

Japanese chemicals company Teijin has launched what it says is a lightweight, strong and cost-effective spread-tow carbon-fiber woven fabric.

The new woven fabric is made with 3K (3,000) carbon-fiber filament yarn for applications requiring low weight and design flexibility, such as motorsport, automotive interior materials and sporting goods. Using its in-house tow-spreading technology, Teijin says it has succeeded in thinning the 3K fabric from a molding thickness of 0.2mm to approximately 0.15mm, the same as that of 1K woven fabric when molded. Carbon-fiber – FDCA-PEF-technology

Thanks to the flat undulations of the fabric’s intersecting yarns, the company says that CFRP made using the fabric offers superior smoothness, resulting in more stable strength compared with CFRP made with 1K carbon-fiber woven fabric (according to the company’s in-house research). Furthermore, the high efficiency of Teijin’s special tow-spreading technology reduces the fabric cost below that of conventional 1K carbon-fiber woven fabric. Carbon-fiber – FDCA-PEF-technology

-Asia naphtha strengthens on tight supply; backwardation widens

Asia’s naphtha prices extended gains to stay at multi-year highs on Tuesday, fuelled by rallying crude oil futures on the back of supply constraints.

The product’s intermonth spread for first-half April and first-half May widened to $25/tonne in backwardation, from $8/tonne a month earlier, with prompt-month prices notably higher than forward months – reflecting firm fundamentals.

This is the widest backwardation since December 2019.

At midday, open-specification naphtha indicative prices for first-half April delivery averaged at $895.00/tonne CFR (cost and freight) Japan, up $30/tonne from the previous day’s close. Carbon-fiber – FDCA-PEF-technology

Spot naphtha prices remain at highs near the $900/tonne levels since early September 2014, ICIS data shows.

At noon, ICE Brent crude oil futures surged above $97/bbl on the back of heightened tensions between Russia and Ukraine.

“Crude oil [prices] is the main issue … fundamentals are strong due to tight supply and a closed [west-east naphtha] arbitrage,” said a northeast Asia-based market source.

Increased naphtha demand for gasoline-blending in Europe is expected to curb naphtha flows into Asia, which may already be happening.

Compounding the tight supply scenario is the prospect of lesser overall supply from the Middle East amid refinery turnarounds. Carbon-fiber – FDCA-PEF-technology

The tight supply is overshadowing stable demand for naphtha in Asia, while downstream producers continue to monitor margins for olefins that remain squeezed.

-Bonding solutions showcase in Miami

Brückner and its US representative Fi-Tech will present new machine concepts and solutions in thermofusion ovens, dryers, coating and heat-setting lines for fabric finishing at the firthcoming IDEA 2022 nonwovens trade fair in Miami, Flordia, from March 28-31. Carbon-fiber – FDCA-PEF-technology

Nonwovens always require a bonding process after the fabric formation, in which loosely-laid fibres are bonded into resilient composite webs. For this purpose, and depending on the process, different ovens and dryers are used. Brückner offers the specific know-how and supplies the necessary lines for all applications. The company’s production programme also includes different impregnation and coating units, as well as slitting and winding equipment.

Brückner’s customers produce geotextiles, filter media, hygiene and medical textiles and fabrics for the automotive and transport industry. For each customer, an individual solution and a corresponding line layout is designed.

The company has recently realised several new installations in the field of highloft nonwovens and geotextiles. For the production of highloft nonwovens, the Supra-Flow BX double-belt thermofusion oven is used and operates according to the air-through principle. Carbon-fiber – FDCA-PEF-technology

It can be perfectly adapted to product requirements in terms of flow speed, flow direction and temperature on a field-by-field basis. Typical end products include mattresses, bedspreads, upholstery, wiping cloths, automotive components and insulating materials. The Supra-Flow BX can produce nonwovens up to a thickness of 280mm and basis weights of a maximum 8,000gsm. The available working widths vary between 2.4 and 5.2 metres at production speeds of up to 100 m/min.

Carbon-fiber – FDCA-PEF-technology