Chemical Risks – OPEC+ – Batteries 06-06-2023 - Arhive

Chemical Risks – OPEC+ – Batteries

-In a triumphant declaration before the cameras, Saudi Energy Minister Prince Abdulaziz bin Salman assured the OPEC+ alliance that the other members would adhere to their pledged oil cuts until 2024, while Saudi Arabia would further reduce its production by an additional 1 million barrels per day next month

His satisfaction was evident as he stated, “It is truly a great day for us because the quality of the deal is unprecedented, and I must say the level of cooperation is unparalleled.”

The OPEC+ delegates surrounding him couldn’t help but smile, likely aware that they would continue producing while Saudi Arabia vowed to double down on the cuts. Journalists in the room took notes, curious but possibly hesitant to ask the obvious question that would challenge the prince, who held a strong disdain for dissenting journalists and oil short sellers alike. The question that lingered was: “Your Excellency, doesn’t this agreement actually penalize Saudi Arabia?”

However, the truth behind the OPEC+ summit, the second of its kind since the pandemic, was that there was no groundbreaking deal as described by Abdulaziz. Over the past three years since the COVID-19 crisis plummeted oil prices to negative $40 per barrel, the demand for oil has nearly returned to pre-pandemic levels, albeit with some limitations. These limitations include slower-than-expected oil demand in China, concerns about a global recession, persistent inflation in the United States despite aggressive rate hikes by the Federal Reserve for over a year, and the influence of OPEC+ and its production cuts.

Oil revenues serve as the lifeblood of OPEC member economies, led by Saudi Arabia, comprising a 13-member group whose primary objective is to stabilize oil prices. An additional ten non-OPEC oil-producing countries, including Russia, have closely aligned their production levels with those of the group for pricing purposes. Collectively, the 23-nation alliance is known as OPEC+. Chemical Risks – OPEC+ – Batteries

For major OPEC members like Kuwait and Iraq, over 90% of their revenues come from oil. In the United Arab Emirates, oil accounts for 13% of exports and 30% of GDP, while in Algeria, it contributes to 25% of GDP. In Saudi Arabia, the largest OPEC member, oil represents 70% of total export value and 53% of government revenues. However, according to media reports, the Saudis require at least $500 billion (or potentially as much as $8.5 trillion) to successfully diversify their economy away from oil.

Given this context, it becomes clear why OPEC, particularly Saudi Arabia, which aims for a barrel price above $80 to achieve its ambitious plans, would go to great lengths to attain the desired price. OPEC has historically responded to oil price declines with production cuts, removing millions of barrels of crude oil from the market each day, creating an artificial supply shortage that eventually drives prices higher.

Nevertheless, in the current global economy with the aforementioned constraints, short sellers betting on falling oil prices have often emerged victorious over OPEC, despite oil supplies being among the lowest in recent years. This reality has infuriated Abdulaziz, who assumed office in 2019 and repeatedly warned of making speculators who bet against oil say “ouch” – his preferred expression for inflicting damage.

Over the past four years, the Saudi prince has boasted about his ability to deliver this anticipated “ouch” each time he announced a substantial and unexpected production cut. However, to his detriment, the negative consequences often shifted quickly from short sellers to OPEC, resulting in price drops despite the production cuts.

This context set the stage for the recent OPEC summit. Approximately two weeks before the event, the Saudi energy minister issued yet another warning to oil short sellers to “be careful,” fueling speculation of another production cut. Chemical Risks – OPEC+ – Batteries

However, what truly surprised observers was the intervention of Abdulaziz’s Russian counterpart, Alexander Novak, who expressed his belief that a cut was unnecessary. Dissent had already taken root, and amidst the ensuing controversy following Novak’s comments, the Russian minister accused Bloomberg of misquoting him, without explicitly denying similar rumors reported by other news services, including a Russian newspaper.

In a peculiar turn of events, Bloomberg, Reuters, and The Wall Street Journal were denied media passes to cover the OPEC meeting on June 4-5, with no reasons provided. Prior to the meeting, all three news outlets had published articles challenging the narrative Abdulaziz favored. This development raised eyebrows and further fueled speculation.

The question then arises: Was the outcome of the summit truly a victory for Abdulaziz? According to Reuters, many of the proposed reductions will not have a significant impact since the group has adjusted the targets for Russia, Nigeria, and Angola to match their current production levels. On the other hand, the UAE was granted the ability to raise its production targets. Chemical Risks – OPEC+ – Batteries

The Wall Street Journal confirmed a longstanding observation that OPEC+ production targets are typically determined by Abdulaziz himself (often in consultation with his half-brother, Crown Prince Mohammed bin Salman, the primary architect of Saudi Arabia’s ambitious economic restructuring plan) and then presented as OPEC+ decisions without thorough consultation with other group members.

The market’s reaction to Abdulaziz’s announcement was notable. Prices of US West Texas Intermediate (WTI) and UK Brent crude initially surged by more than $2 per barrel each before the start of normal trading in New York, creating a “gap up” in Asian e-commerce. However, over the following hours, the gains dwindled and eventually settled at slightly above $1 per barrel, stabilizing at the time of writing. Sunil Kumar Dixit, Chief Technical Strategist at SKCharting.com, commented on the price action, stating that while WTI initially opened with a gap at $72, reaching $74.30, the bearish price action largely filled the gap. Dixit outlined potential support and resistance levels and the need for sustained momentum for further bullish movement. Chemical Risks – OPEC+ – Batteries

In what may seem like a gesture for the betterment of the world, Saudi Arabia’s commitment to cutting one million barrels per day in July and potentially repeating the action in August has come to light. Abdulaziz humorously referred to it as the “Saudi lollipop,” likening it to a sweet treat for those desiring higher crude prices.

With the oil market entering its peak demand season during the summer, one would expect crude oil prices to follow an upward trajectory. However, as history has shown, even the most well-laid plans can go awry due to unexpected factors. OPEC+ has experienced eight months of falling prices following two significant production cuts.

John Kilduff, a partner at a New York energy hedge fund, Again Capital, highlighted the observation that the only evident outcome was the Saudis’ commitment to cutting their production to 9 million barrels per day in July, which is three million barrels less than US production. If Saudi Arabia fails to raise prices as desired, they may further reduce their production to 8 million barrels, subsequently impacting US production by four million barrels. Kilduff questioned who would lose market share if not the Saudis, considering Russia’s intention to continue producing 9-10 million barrels.

In reality, the rest of the OPEC+ alliance seems to be conveying a clear message to Saudi Arabia: “You keep cutting, and we’ll keep producing.” As for the lollipop gift, their response might be: “Keep it for yourself, Excellency.” Chemical Risks – OPEC+ – Batteries

Crude Oil Prices Trend

Crude Oil Prices Trend by Polyestertime

-Study Finds: Recycling and Reusing Plastics Carry Chemical Risks

A comprehensive analysis conducted by the Food Packaging Forum, based in Switzerland, has revealed that the recycling and reusing of food-contact plastics can result in the accumulation and release of harmful chemicals. The study, published by Cambridge University Press, highlights the potential negative consequences associated with these practices, as hazardous substances like endocrine disruptors and carcinogens may be emitted during reuse and build up during recycling processes. Consequently, the study emphasizes the need for utmost caution to prevent the presence of dangerous chemicals in plastic materials used for food packaging and the recycling of such materials.

Greenpeace has also recently released a review that aligns with these findings. The Food Packaging Forum, a nonprofit foundation dedicated to disseminating information on chemicals present in food packaging materials and their impact on human health, conducted the analysis. The review drew upon the extensive Database on Migrating and Extractable Food Contact Chemicals, which encompasses over 700 scientific publications related to plastic food contact materials, including packaging, utensils, plates, and baby bottles. Chemical Risks – OPEC+ – Batteries

Troubling discoveries emerged from the study, indicating that discussions on chemical accumulation are often overlooked in discussions about plastics. This issue becomes particularly significant in relation to plastic recovered from ocean cleanups due to the potential presence of persistent organic pollutants. Additionally, the study highlights that some tableware marketed as natural or compostable may actually consist of melamine resin mixed with bio-based powders or fibers like bamboo. Melamine can adversely affect kidney function, and the presence of bio-based fillers reduces material stability, thereby increasing the likelihood of migration of melamine and formaldehyde into the products.

Moreover, the study presents experimental evidence that recycled polyethylene terephthalate (RPET) contains chemical contaminants, including the endocrine-disrupting chemical BPA, as well as the carcinogens benzene and styrene. These contaminants are introduced during use, processing, and recycling, potentially migrating into the food or beverages contained within the packaging. The report emphasizes the urgent need to address the safety assessment of the multitude of chemicals found in both recycled and virgin plastic polymers. Chemical Risks – OPEC+ – Batteries

In light of these findings, the authors call for further research on chemical migration, particularly as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority have been increasingly issuing favorable opinions regarding the suitability of recycling processes for producing food-contact packaging. The study suggests that transitioning to materials with inert properties that can be safely reused might offer a promising approach to reduce the environmental impact of single-use food packaging and minimize the health risks associated with migrating chemicals.

-OPEC+ Engages in Challenging Discussions on Production Cuts and Quotas

• Sources indicate potential cuts of 1 million bpd • OPEC+ considering adjustments to production baselines • Formal meetings delayed by more than 3 hours

According to insider sources, OPEC and its allies convened on Sunday in an attempt to reach an agreement on further production cuts. The group, referred to as OPEC+, faced declining oil prices and the looming threat of an oversupply. Sources reported that the start of formal talks was delayed by at least three and a half hours due to discussions among members regarding production baselines, which are used to calculate cuts and quotas.

Influential members of OPEC, particularly major Gulf producers like Saudi Arabia, sought to persuade under-producing African nations such as Nigeria and Angola to adopt more realistic output targets. These efforts proved to be challenging, according to sources. Meanwhile, the United Arab Emirates, a Gulf producer, sought a higher baseline to reflect its expanding production capacity. Chemical Risks – OPEC+ – Batteries

OPEC+, comprising the Organization of the Petroleum Exporting Countries and its allied nations led by Russia, collectively accounts for approximately 40% of global crude oil production. As a result, their policy decisions can significantly impact oil prices. Several sources familiar with OPEC+ discussions revealed to Reuters that additional production cuts were being deliberated as one of the options during Sunday’s session.

“One of the four sources said, “We are discussing the full package (of changes to the deal).” Three out of four sources indicated that the proposed cuts could reach 1 million barrels per day (bpd), in addition to the existing cuts of 2 million bpd and voluntary cuts of 1.6 million bpd, which were announced unexpectedly in April and took effect in May.

The April announcement initially pushed oil prices up by approximately $9 per barrel, with prices surpassing $87. However, they quickly retreated due to concerns about global economic growth and demand. On Friday, the international benchmark Brent settled at $76.

If approved, the new cuts would bring the total reduction to 4.66 million bpd, equivalent to around 4.5% of global demand. Typically, production cuts take effect the month following their agreement, although ministers could also opt for delayed implementation or maintaining current output levels.

Last week, Saudi Arabia’s Energy Minister Prince Abdulaziz issued a warning to investors who were betting on a decline in oil prices, implying the possibility of additional supply cuts. Chemical Risks – OPEC+ – Batteries

Addressing Baselines for 2023 and 2024

Three OPEC+ sources also revealed that the group intends to address the issue of baselines for 2023 and 2024, which has been a contentious topic in the past. Nigeria and Angola have struggled to meet their production targets but opposed lower baselines, as they could result in actual cuts. Conversely, the UAE has demanded a higher baseline aligned with its growing production capacity, which could lead to a decrease in its share of overall cuts.

Accusations and Denials

Western nations have accused OPEC of manipulating oil prices and undermining the global economy due to high energy costs. Additionally, they have criticized OPEC for aligning with Russia despite Western sanctions related to Russia’s invasion of Ukraine. In response, OPEC insiders have argued that the West’s extensive monetary stimulus over the past decade has fueled inflation and compelled oil-producing nations to act in order to maintain the value of their primary export.

It is worth noting that OPEC has denied media access to its headquarters for reporters from Reuters and other news outlets. Chemical Risks – OPEC+ – Batteries

-Resin Price -Ample Availability Brings Down Prices

Polyethylene and polypropylene were in abundant supply, as prime resin prices peeled off another penny or two

Spot resin trading remained active last week, but it was off the previous week’s pace — the best week of the year, so far, at the PlasticsExchange trading desk — as many market participants got a jump on the long Memorial Day weekend.

Domestic demand showed marked improvement during May: As prices moved lower, spot market deals multiplied, reports the PlasticsExchange in its Market Update. Railcar availability remained quite good for polyethylene (PE) and polypropylene (PP), and prime resin prices peeled off another penny or two. Resellers, in general, have thinned their on-hand stocks. Export interest stayed solid, though weak global demand and competitive offers from Asia into Latin America as well as from the Middle East and Russia into Europe have created challenges for incremental export sales from the United States. Houston prices softened, as traders anticipate lower June offers intended to regain market leadership. Chemical Risks – OPEC+ – Batteries

PE grades drop a couple of cents

The PE market was slightly less active last week, as traders began to wind down for the month. All PE grades dropped a couple of cents on the week, and some buyers that had been holding out took advantage of these discounts with well-timed purchases. High-density (HD) PE was the major mover, with injection grades leading the charge, followed closely by blow molding materials. Low-density (LD) PE film business picked back up after a couple weeks of scant interest, with some scattered linear-low-density (LLD) PE trades peppered in, as well

-PPG opens $30M battery pack application center in China; key coating technologies for EVs

PPG has inaugurated a battery pack application center (BPAC) in Tianjin, China.

The $30-million facility features a full range of capabilities to test the application of PPG coatings technologies, materials and systems for electric vehicle (EV) battery packs, allowing customers to accelerate the development of new EV technologies.

“The new application center is an important milestone in our effort to support our customers in China in the EV battery market. Chemical Risks – OPEC+ – Batteries

The new facility will be an important way for customers to validate our customizable coatings solutions that help them reduce application cost, increase battery life, range and charging speed, and contribute to occupant safety.

—Vincent Robin, PPG global vice president, Automotive Coatings”

The BPAC will include application testing for PPG technologies, including powder coatings, fire protection coatings, dielectric coatings, adhesives and sealants, surface pre-treatment, and e-coat technologies.

Its modular design will allow for independent projects to be carried out concurrently in each of the application areas.

This flexibility will enable development of material and process solutions across the range of current and potential customers. Chemical Risks – OPEC+ – Batteries

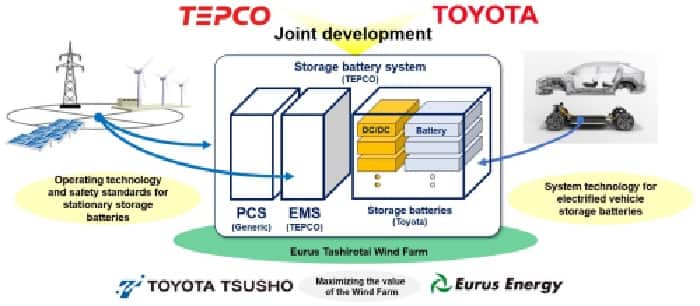

-The storage battery market is expected to continue growing in light of the spread of renewable energy and electrified vehicles, as well as the global trend toward carbon neutrality

It will be necessary to utilize storage batteries for electrified vehicles in the future to meet the increasing demand and needs for energy storage in environmental and economic improvement, participation in the electric power market, and as business continuity plan (BCP) measures among others, both in terms of price and quantity.

To this end, TEPCO HD and Toyota have jointly developed a stationary storage battery system that can be used in combination with existing power conversion systems (PCS) by connecting multiple storage batteries for electric vehicles. The verification project will confirm the system’s operation and performance as well as feasibility, including its potential for business use in the electricity market. Chemical Risks – OPEC+ – Batteries

TEPCO HD will utilize the knowledge and technological capabilities it has cultivated in the electric power business to improve the utilization of renewable energy and meet the BCP needs of its customers, as well as to maintain the balance between supply and demand of electric power in order to build a stable energy supply system.

In addition to aiming for a carbon-neutral mobility society, Toyota will work with Toyota Industries Corporation, Toyota Tsusho Corporation, and Denso Corporation to utilize storage batteries for electrified vehicles that are safe, long-lasting, high quality, low cost, and high performance, as part of its various activities to realize a circular economy.

TEPCO HD and Toyota will evaluate the results of the verification project and work to develop storage battery systems with an eye toward consumer-oriented energy services and balancing electricity supply and demand capabilities in order to meet the energy storage needs of customers.

-Analysis of yearly high polyester polymerization rate from the angle of demand

The nominal polyester capacity has been revised up to 74.85 million tons/year in Jun. According to the data from CCFGroup, the polyester polymerization rate also hit new high at above 92% this week. Current operating rate of polyester market and downstream sector is both high. PFY, PSF and PET fiber chip plants witness high profit and low inventory. The operating rate of PET bottle chip also enjoys support.

Price of PTA and MEG shivers at low level this week dampened by commodity atmosphere and oil price. The polyester products see good profit and low inventory.

The raise of run rate will reduce the cost per ton, which will further push up the profit of producers. Chemical Risks – OPEC+ – Batteries

Polyester companies are still active in ramping up operating rate. Some PFY plants also increase the production of PET fiber chip when they raise the output of PFY.

The inventory of PFY and PSF has hit yearly low now, both consolidating aroura 25 days. The processing spread of polyester products is also high. According to the actual cost in factories, the profit of polyester products has been high, basically around 200-500yuan/mt. The profit of PSF plants may be slightly lower.

The inventory of DTY, yarns and grey fabrics is mounting in Jun. Grey fabric producers witness weakening profit after PFY price increased. The recouping of capital is a problem in the middle of year. Coupled with the coming of heat summer, downstream plants may face bigger pressure to lower run rate. Some plants’ run rate will be supported by orders at hand in short run. New orders are diversified among companies: new orders for knitted fabrics are weaker and those of water-jet fabrics are moderate. Imitation acetic acid and cotton-like products perform better

The inventory of PSF and PFY will have upward space later, which has hit yearly low now. The polyester polymerization rate is expected to be firm in short run, with Jun average estimated at above 90%. As new units will start operation intensively, the fluctuation of PET bottle chip plants’ operating rate should be noted. Chemical Risks – OPEC+ – Batteries

-Turkiye’s Q1 2023 apparel exports to Russia surge amid Ukraine crisis

INSIGHTS

- In the wake of the Ukraine conflict, Turkiye’s Q1 2023 apparel exports to Russia tripled to $181.471 million, making Russia the 7th largest market for Turkish apparel.

- This consistent increase has shown impressive annual growth, with a trade volume of $337.092 million in 2022 compared to $273.818 million in 2021.

- Previously, in Q1 2022, Russia ranked 16th.

Following the conflict in Ukraine, Turkiye’s apparel exports to Russia have more than tripled in Q1 2023, reflecting the changing geopolitical dynamics. Prior to Russia’s invasion of Ukraine, Turkiye exported apparel worth $57.792 million in the final quarter of 2021. This figure soared to $181.471 million during the first quarter of 2023, positioning Russia as the seventh largest market for Turkish apparel exports. Chemical Risks – OPEC+ – Batteries

Turkiye’s exports to Russia have exhibited a consistent quarterly increase, with the exception of the second quarter of last year. The trade volume climbed to $70.032 million in the first quarter of 2022, then dipped to $60.534 million in the second quarter, before rebounding to $95.887 million in the third quarter and $110.637 million in the fourth quarter of the same year. In the first quarter of 2023, the export volume rose to $181.471 million, As per Fibre2Fashion’s market insight tool TexPro.

These exports have also displayed rapid annual growth. Trade volume totalled $337.092 million in 2022, a significant increase compared to $273.818 million in 2021, $213.802 million in 2020, $265.154 million in 2019, and $242.492 million in 2018.

In the first quarter of this year, Russia became the seventh largest market for Turkish apparel, accounting for 3.70 per cent of Turkiye’s total apparel exports of $4.899 billion. Germany, Spain, the Netherlands, the United Kingdom, France, and the United States were larger markets than Russia. Chemical Risks – OPEC+ – Batteries

Russia was the 16th largest market, with a 1.45 per cent share of Turkiye’s total apparel exports during the first quarter of last year. During the first quarter of 2021, Russia had a 1.66 per cent share of the total exports, ranking 15th, as per TexPro.