SINGAPORE (ICIS)–China has limited options to respond to the US’ planned tariffs on as much as $500bn additional Chinese goods, and may have to resort to non-tariff countermeasures on what the Asian powerhouse deemed as “trade bullying”.

China has vowed to adopt a tit-for-tat approach on any trade barrier that the US will put up.China options limited counter USA proposed tariffs

The first shots in the US-China trade war were fired on 6 July, when the US implemented 25% tariffs on $34bn worth of Chinese imports, prompting a similar response from China.

The trade war between the world’s two economic giants escalated as the US on 10 July threatened to slap 10% tariffs on additional $200bn worth of Chinese goods, including key chemical feedstocks such as naphtha and ethane.China options limited counter USA proposed tariffs

“The key uncertainty now is how China will respond to [US President Donald] Trump’s latest ‘tit’,” Singapore-based UOB Global Economics & Markets Research.

“The Chinese has significantly less room to match US’ actions like-for-like as China’s total imports from the US were less than the additional amount of $200bn goods that is targeted for the 10% tariff,” it said in a note.

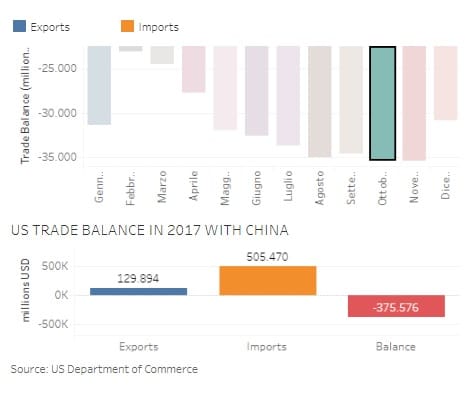

In 2017, China’s total imports from the US stood at $130bn, while US’ imports of Chinese goods and services totaled around $500bn.China options limited counter USA proposed tariffs

Japan-based Nomura Global Economic Research expects the US’ latest tariffs to take effect around 15 October, after the two-month public review of the list and the slated August hearings are completed.China options limited counter USA proposed tariffs

“After a relatively calm weekend following the initial round of US tariffs and China’s response on 6 July, we view this as a significant escalation in the US-China trade dispute,” it said.China options limited counter USA proposed tariffs

Given that the new list has an amount bigger than the US’ actual exports to China in 2017, Beijing could hit $100bn of US products with a higher tariff rate of 20% in response, Nomura said.China options limited counter USA proposed tariffs

“However, China could also respond by resorting to non-tariff barriers,” it said without elaborating.China options limited counter USA proposed tariffs

Trump, however, intends to impose tariffs on up to $500bn worth of Chinese goods, with the value possibly exceeding its actual Chinese imports in 2017.

The US’ planned tariffs were meant to reduce the US’ $370bn trade deficit with China.

Based on official data, the US accounted for more than a fifth of China’s overall exports of $2.26tr last year.China options limited counter USA proposed tariffs

Building a wall of tariffs against each other could hit domestic consumption hard as it would translate to higher prices of affected goods, and has a strong potential to slow down economic expansion.

“While there still remains hope for some resolution instead of further spiraling trade measures, the outlook has become more uncertain,” UOB said.

The US’ initial round of tariffs, targeting $50bn of Chinese imports, was primarily on capital goods, while the new list involving $200bn worth of goods, is almost equally split between capital and consumer goods, Nomura said.China options limited counter USA proposed tariffs

Machinery and electrical equipment remains the most heavily targeted group, consistent with the Trump administration’s approach of taking aim at certain machinery and electrical equipment outlined in Beijing’s “Made in China 2025” plan.

In response, China may opt to curtail US service exports to the country. These include tourism, education and banking services which are worth more than $50bn per year, and the US currently enjoys a surplus with China on this segment, UOB said.

“We maintain our view that the full impact of the trade actions will likely be felt only in 2019 and will remain watchful of the trade numbers in the coming months to assess the potential impact on 2018 growth,” it said in a note.China options limited counter USA proposed tariffs

China’s GDP growth had steadily slowed down over six years from 2011. The world’s second biggest economy surprised with a stronger growth of 6.9% in 2017, but is projected to post a weaker growth of around 6.5% this year.

The growth projection was made before the trade war started.

The US economy, on the other hand, is on its second year of accelerating growth.

The International Monetary Fund (IMF), in its April World Economic Outlook report, forecast a 2.9% growth for the world’s biggest economy this year from 2.3% in 2017.

Additional reporting by Joey Chua