Circular-economy – Plastic-recycling 24-12-202 - Arhive

Circular-economy – Plastic-recycling

-Recyclers throttle output to counter weak demand

Clear R-PET prices under severe pressure

European standard recyclate prices fell across the board during both November and December. The price decline was less steep during the last two months compared to October as measures to curb output was leading to a better overall market balance.

R-HDPE prices have fallen between €40-80/tonne over the last two months, R-LDPE prices are down between €20-50/tonne while R-PP prices are €50/tonne lower. R-PET prices have shown the steepest falls with reductions of €130/tonne for coloured flake, €180/tonne for clear food grade pellets and €280/tonne for clear flake.

This month, R-PET clear flake prices are under extreme pressure, not only from low demand but also from competitively-priced imports. As a result, recyclers had to slash clear R-PET prices by up to €150/tonne. Circular-economy – Plastic-recycling

The ongoing low levels of demand continues to push recyclate prices on a downward trajectory. Converters are buying less material as a result of the economic downturn and growing competition from declining primary material prices. The demand position was further weakened over the last two months by converters destocking ahead of the end year balance sheet accounting practices, and therefore buying just sufficient recyclate to cover their immediate production needs.

Standard recyclate prices are likely to remain under pressure at the start of the new year. Demand is expected to pick up only slowly as processors return to work after the holidays and begin to replenish stocks. Some recyclers may decide to undertake plant maintenance programmes while others may even consider leaving their plants closed for an extended period given the weak demand.

Recycled polyethylene terephthalate (R-PET)

In November, R-PET recyclers managed to widen their profit margins by passing through only a small proportion of a cost decline onto processors. Clear bottle scrap costs fell by around €160/tonne while R-PET clear flake and R-PET food-grade pellet prices fell by €50/tonne and €80/tonne, respectively. R-PET coloured flake prices fell by only €25-30/tonne largely due to more robust demand from Eastern Europe.

Ordering remained well below expectations, although there was a small increase in demand from the beverage sector. Circular-economy – Plastic-recycling

While recyclers have continued to reduce production in line with the lower demand, there was no noticeable shortage of material.

Destocking by converters combined with the short production month further exacerbated an already weak demand position and led to a collapse in R-PET prices. Clear flake material also faced stiff competition from imported recyclate. R-PET clear flake prices fell by €140-150/tonne with coloured flake and clear food grade pellet prices down by €100/tonne, well in excess of the €50/tonne reduction in the cost of bottle scrap.

Recycled low-density polyethylene (R-LDPE)

R-LDPE prices continued to fall in November albeit at a slower rate compared to the previous few months. Transparent film pellets and black extrusion pellet prices fell by €10-20/tonne while natural film grade prices were roughly stable. Yet again, recyclers were unable to factor in higher energy costs.

Supply was in better balance with demand as recyclers cut production even further in response and the low demand. The subdued demand is due mainly to competition from lower primary material prices and the economic downturn.

In December, R-LDPE natural film prices fell by €50/tonne with translucent film pellet prices down by €30/tonne. Demand was further suppressed by destocking by converters ahead of end year balance sheet accounting. Circular-economy – Plastic-recycling

Recycled high-density polyethylene (R-HDPE)

In November, R-HDPE prices fell once again in response to the very weak demand. Coloured blow moulding pellet and black injection moulding pellet prices fell by €15-20/tonne.

While there appears to have been a small uptick in automotive sector sales, demand from most other sectors remained low. R-HDPE is facing growing competition from the falling price of primary material and the economic downturn is also restraining sales. Recyclers have curbed production even further in response to the low demand. There was however sufficient material available to cover contracted volumes.

In December, R-HDPE prices fell by €30-50/tonne as a result of lower input costs and a further deterioration in demand. Converters bought only sufficient material to cover their immediate needs ahead of the end year accounting.

Recycled polypropylene (R-PP)

R-PP recyclers throttled production even further in November in response to continuing low demand. Nevertheless, this was insufficient to prevent R-PP prices from slipping by a further €30-40/tonne.

While the automotive sector registered a small demand upturn in November, there was little improvement across other end use sectors. Competition form the falling primary material prices and the looming recession are the main factors restraining R-PP demand.

R-PP prices fell by just €10/tonne in December amid continuing production curbs and weak demand. Circular-economy – Plastic-recycling

Recycled high-impact polystyrene (R-HIPS)

In November, R-HIPS prices fell by €20/tonne in response to continuing low demand. Recyclers have reduced output even further to match the lower sales volumes. Competition from virgin material was not an issue here as primary HIPS prices remain well above R-HIPS prices.

In December, R-HIPS prices fell by €50/tonne as a result of falling costs and low demand.

-Recyclability and beyond: How policymakers can accelerate the circular economy

Recognising the role of chemical recycling

But what about the recycling processes themselves? Europe has historically depended heavily on mechanical recycling, reforming monomaterial (polyethylene) plastic into Post Consumer Recyclate (PCR) products. But critical products – the packaging that keeps our food safe and fresh, the plastics used in surgical equipment and hygiene products – cannot currently contain mechanically recycled plastics due to strict food contact and safety requirements. We also cannot use recyclates from these products to make new ones for similar reasons. This presents a challenge when mechanical recycling accounts for over 99 per cent of recycling volumes in Europe today.

We can start to tackle this issue via recognition of the role, and the need for upscaling, of chemical recycling. Whilst we cannot and should not disregard mechanical recycling, we need to see mechanical recycling as a complementary technology to chemical recycling. Chemical recycling has a role to play in cases where mechanical recycling is not possible or cannot deliver the desired quality outputs. Chemical recycling transforms plastics waste back into a raw material to be turned back into the equivalent of virgin plastic. In short, we can turn discarded food packaging back into food packaging, helping close the loop and enabling the use of recycled plastics at scale. Circular-economy – Plastic-recycling

Using this method, we can also take a far greater range of plastics waste back – including recyclable flexible films once they’ve been sorted, further increasing the recycling rates. Much of this type of waste currently is going to landfill or being incinerated. It’s worth noting too that in addition to solving the plastics waste issue, chemical recycling reduces the need for virgin fossil feedstock, with a long-term goal of improving overall carbon footprint.

Industry Voice: Dow’s Carolina Gregorio explains the changes policymakers need to make to support industry level transition to a circular economy

We all know that giving waste a second life is more carbon-efficient than incinerating it, but reaching a definition on what makes an item ‘recyclable’ is one of the most complex challenges policymakers currently face.

Public focus on the issue has only increased following the European Commission’s proposals for a revision of its packaging and packaging waste legislation in November 2022.Circular-economy – Plastic-recycling

The proposal states that packaging (all materials) entering the EU market must meet design for recyclability criteria. The criteria states that packages must have a minimum of 70 per cent recyclability compatibility as of 2030, and packaging must be recyclable at scale from 2035. Plastic packaging will also need to comply with minimum mandatory recycled content targets, which in some cases are not ambitious enough to drive investments in the recycling industry.

Of course, turning any directive into a regulation is in itself a welcome step towards harmonised rules across Europe, ensuring a well-functioning market. Yet, the recent Circular Economy Package – of which this regulation is a central part – is not a silver bullet that automatically streamlines the scattered and varied recycling infrastructure in Europe.

Dow, and the wider industry, are already incorporating ‘design for recyclability’ criteria into products: huge progress has been made over the past decade. However, we need more than just goals and ambitions to transform the way we make, consume and reuse plastic, with clear definitions on recyclability. Attention must now be focussed on how government can support the scale up of plastics recycling, following a technology-neutral principle, to support a transition towards an economy that is truly circular.

Moreover, policymakers must also recognise that plastics value chains bear significant circularity potential. Further regulatory action is needed across the plastics value chain to reduce its carbon and environmental impact, namely through improvements to the waste sorting and collection process, and a clear calculation method. This would mean that all recycling technologies, including chemical recycling, contribute to recycled content targets.

Legal frameworks for labelled content

This leads to our next ask. Chemical recycling processes produce raw materials that can be used again by industry to make new plastics, but the current plastics processes are complex with multiple inputs-outputs streams. We need a legal framework to set out how we can label the quantity of recycled content within a product. There is currently no recognised accounting framework in Europe which allows all chemical recycling processes to be counted towards circular goals. We need a clear calculation method for measuring the recycled content in our products and packaging to meet the EU targets, with recognition of the role of a mass balance approach. Circular-economy – Plastic-recycling

A mass balance accounting system will be familiar to those in the renewables sector, where it refers to the creation of an overall electricity system that sells only as much renewable electricity as is actually produced. In the case of recycling, this would mean a standardised set of rules determining the use of recycled content packaging when both recycled and virgin feedstock have been used. This approach must be in line with the EU waste hierarchy: that is, not allow the use of waste for fuel as recycling. To meet consumer demand for essential products, renewable and bio-based feedstocks are processed together with non-renewable feedstocks, meaning that the renewable content is not always physically traceable throughout the complex production process.

Since feedstocks cannot be switched entirely in one go, we need a ‘chain of custody’ model. This means tracking the net quantity of sustainable inputs as they move through the system, ensuring that we are not seemingly producing more sustainable products than is possible based on the initial feedstock quantities. It also means that existing infrastructure can be maximised to gradually upscale the newer recycling technologies, reducing cost and the environmental impact of building new plants in the short term. We ultimately keep carbon in the loop for longer.

The EU Circular Economy Package is certainly ambitious. At Dow, we’re confident that the technology exists to make a circular economy a reality – we’ve demonstrated this through our ongoing partnerships with industry leaders on advanced recycling such as Mura Technology and Valoregen. We are reaching a transformative stage; the benefit of this technology will not be seen by society unless policymakers take steps to support industry: via intra-EU waste movement facilitation, supporting the upscaling of chemical recycling, and the legal recognition of mass balance. The strict time frames Europe has set – packaging recyclability and minimum recycled content targets by 2030, and recycling at scale by 2035 – make action all the more urgent. Circular-economy – Plastic-recycling

-Amcor report states 96% of its rigid packaging portfolio is recycle-ready

Amcor has announced that 96% of its rigid packaging portfolio is now recycle-ready and folding cartons are 100% recyclable.

The packaging giant has recently released its 2022 sustainability report, which also stated that 83% of its flexible plastic packaging portfolio now has a recycle ready solution, that it is maintaining production of recycle-ready solutions at 74%, and has more than doubled the amount of recycled content purchased since FY2019.

The company also said renewable energy usage was up by 146% compared to 2021, waste-to-disposal down by 33% compared to 2019, and that it had purchased nearly 410,000 metric tons of biomaterials.Circular-economy – Plastic-recycling

Ron Delia, chief executive, said: “I am proud to announce a new target on recycled content that will see us work toward 30% recycled material across our portfolio by 2030. This is a significant increase beyond our previous target of 10% by 2025 and will play a critical role in our responsible packaging strategy.”

“Last year, 74% of the packaging we produced was recycle-ready, and 83% of our flexible packaging portfolio had recycle-ready alternatives available.”

“Our customers require packaging that meets their needs in terms of functionality and performance, with a broad choice of high-performing material options, and that delivers outstanding sustainability benefits. The redesign of our product portfolio included the launch of the new Amcor EcoGuard brand, which allows customers to quickly identify packaging options that offer more sustainable features. We also expanded on our sustainability leadership by launching proprietary product innovations such as our AmFiber platform and recycle-ready AmPrima films.

“Alongside improvements in infrastructure and consumer education, we believe these new products hold the key to the journey to a more sustainable, circular economy for packaging.”

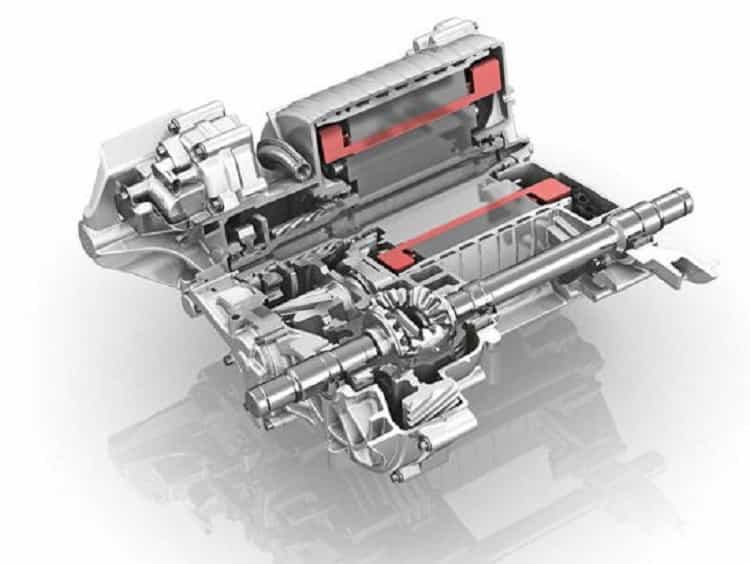

-ZF will be an electric car giant: orders for 25 billion euros

The German company will switch from producing automatic transmissions to making zero-emission powertrains. This is how it prepares for the future

The electric car doesn’t just change the strategies of car manufacturers. Even related industries have to deal with the ecological transition. Thus, for example, the transmission giant ZF is moving fast towards electric motors and other components for high-voltage powertrains. Circular-economy – Plastic-recycling

And there is good news: the increase in orders in this new business far exceeds the contraction in requests for supplies for devices related to internal combustion cars. The transformation of ZF was addressed in detail by Stephan Schuckmann, member of the board of directors of the German giant, during an interview with Automotive News Europe.

How orders change

“We have been engaged on the electrification front for years, but people know us above all for our work on the subject of transmissions – said Schuckmann – however, a year and a half ago we made a historic decision: to interrupt the development of all applications directly connected to heat engines and focus exclusively on electrical propulsion schemes”.

The choice is dictated by the numbers: according to forecasts, ZF will still receive many orders for automatic gearboxes until 2025, then that part of the business will slowly run out. But the company has already received orders worth 25 billion euros to make components dedicated to electric cars or plug-in hybrids.

A production to be reorganized

To cope with the change, ZF is reviewing its entire production chain, updating existing factories and building others, such as the one that has just been inaugurated in Shenyang, China, or those that will soon be built in Serbia and Mexico.

In addition to the factories and production processes, with the latter becoming increasingly digital and automated, ZF is also working on the retraining of the workforce, supporting huge investments to prepare its employees to competently face the new challenges associated with electric mobility . Circular-economy – Plastic-recycling

Why still ZF?

However, ZF looks to the future with confidence. Schuckmann explained that “the know-how of engineers and technicians is based on decades of experience and allows a lot of knowledge to be applied also in the field of electrification. In ZF it is possible to create highly efficient systems thanks to the deep integration of the various components and this guarantees customers reliable and cutting-edge powertrains”.

The orders mainly concern electric motors, electronics and various mechanical components, which are supplied in bulk and with a high degree of integration. We also work on individual components, with customers who want to develop some specific parts in-house, but the bulk is represented by complete powertrain units.

Beyond the powertrain Circular-economy – Plastic-recyacling

ZF’s commitment to future mobility is not limited to components. The company, for example, will present a new digital platform at CES in Las Vegas that will allow vehicles to communicate with each other quickly and safely. It’s called ProConnect and is based on the ZF ProAI supercomputer, which ZF calls the most powerful in the automotive field.

There is more. ZF, which is in constant contact with the companies that produce chips, could decide to get involved firsthand in the production of semiconductors. “It’s a very attractive thing – said Schuckmann – and it’s possible that sooner or later we decide to jump into this sector”.

-Amcor, Licella partner on advanced plastic recycling initiative in Australia

The facility at Melbourne will have an annual processing capacity of 20,000t waste plastic in first stage.

Amcor Australia & New Zealand (ANZ), a unit of Amcor has signed a memorandum of understanding (MOU) with Australia-based Licella to invest in an advanced plastic recycling facility.

Located in Melbourne, the planned facility will have annual processing capacity of 20,000t waste plastic in stage one.Circular-economy – Plastic-recycling

The facility will leverage Licella’s Cat-HTR technology.

The technology enables a circular economy for both natural polymers (biomass) and man-made polymers (plastic).

Licella Holdings chief executive officer Dr. Len Humphreys said: “We are delighted to partner with Amcor as we develop our first Australian advanced recycling facility, with our Cat-HTR technology that enables soft plastic to be repeatedly recycled into food-grade post-consumer recycled content, which is rapidly increasing in demand both locally and globally.”

The facility, which is claimed to be one of the first advanced recycling facilities in Australia, will support Amcor and Licella’s commitment to offer local circular economy for soft plastics in the country.

It will also expedite Amcor’s goal for 30% recycled content across its portfolio by 2030.

The partners have gained approval from the Victorian Environmental Protection Agency for this stage of the project.

They plan to negotiate on final terms and arrangements, which will be subject to respective internal approvals.Circular-economy – Plastic-recycling

Amcor Flexibles Asia Pacific president Mike Cash said: “Amcor is proud to be part of the solution, supporting the development of new technologies and creating a local circular economy for soft plastics in Australia.

“We are proud to be able to help deliver a local supply of food-grade recycled content that can enable more customers to participate in a circular economy.”

Amcor ANZ and Licella have previously collaborated on a feasibility study for Licella to validate a local supply chain for food-grade recycled soft plastic.

-Coca-Cola launches 100% recycled PET bottles in Bangladesh

When PET plastic bottles are recycled and recycled material is used to turn old bottles into new bottles, PET bottles can have a lower carbon footprint than some other types of packaging

Coca-Cola Bangladesh is taking a meaningful step towards supporting a circular economy by introducing bottles made from 100% recycled PET plastic (rPET), excluding caps and labels, across the country. Circular-economy – Plastic-recycling

When PET plastic bottles are recycled and recycled material is used to turn old bottles into new bottles, PET bottles can have a lower carbon footprint than some other types of packaging, reads a press release.

The new rPET packaging for Coca-Cola’s Kinley water bottles is available in 2-liter packages with plans to expand to all other Coca-Cola products and sizes.

Each bottle has an exclusive label with a powerful and simple message, “Made from 100% recycled plastic.” This announcement is a significant step for the Coca-Cola system in Bangladesh to grow its circular economy vision and help reduce plastic pollution.

The safety of rPET packaging thoroughly complies with The Coca-Cola Company’s strict global standards for food-grade rPET packaging as well as the country’s local standards.

As a start, consumers can expect the same refreshing taste of Coca-Cola’s products in a more sustainable package in all retail outlets.

Ta Duy Tung, Managing Director of Coca-Cola Bangladesh said: “Plastic waste management has become a huge issue globally and the availability of Coca-Cola beverages in recycled PET bottles is in support of a circular economy in Bangladesh. To achieve this, it is critical we have enough supply of food-grade recycled plastic to meet demand.”

He further added: “This is why together with our bottling partners, the Coca-Cola system in Bangladesh is investing in the collection and recycling of PET plastic bottles. It is our ambition is to help collect and recycle the equivalent of all the plastic bottles we bring to the market.”

The Coca-Cola Company has a global World Without Waste vision to collect and recycle the equivalent of every bottle and can it sell by 2030. But it’s not just about collecting and recycling bottles, it’s also about using less virgin material per bottle.

As such, the company has a global goal to use at least 50% recycled content in its packaging by 2030.Circular-economy – Plastic-recycling

ASM Mohiuddin Monem, Additional Managing Director of Abdul Monem Limited, the bottler of Coca-Cola in Bangladesh mentioned: “PET plastic bottles have value beyond their first use. Our new bottles made with food-grade rPET are recyclable and can become another bottle. Recycled PET is a big move in the right direction and is aligned with the Department of Environment’s multi-sectoral National Action Plan for Sustainable Plastic Management. Abdul Monem Ltd. is proud to be pioneering this sustainability initiative as a part of the Coca-Cola System in Bangladesh.”

To build awareness and encourage action on recycling in Bangladesh, Coca-Cola Foundation is partnering with SR Asia and Cordaid Bangladesh, to collect waste plastic bottles and strengthen the waste management system, in Dhaka South City Corporation and Dhaka North City Corporation respectively.

In the past, Coca-Cola Foundation has partnered with BRAC for project Bondhon, which improved the lives of waste workers.

The Coca-Cola Company now offers 100% rPET bottles in more than 30 markets around the world.

Coca-Cola launches 100% recycled PET bottles in Bangladesh

When PET plastic bottles are recycled and recycled material is used to turn old bottles into new bottles, PET bottles can have a lower carbon footprint than some other types of packaging

Coca-Cola Bangladesh is taking a meaningful step towards supporting a circular economy by introducing bottles made from 100% recycled PET plastic (rPET), excluding caps and labels, across the country.

When PET plastic bottles are recycled and recycled material is used to turn old bottles into new bottles, PET bottles can have a lower carbon footprint than some other types of packaging, reads a press release.Circular-economy – Plastic-recycling

The new rPET packaging for Coca-Cola’s Kinley water bottles is available in 2-liter packages with plans to expand to all other Coca-Cola products and sizes.

Each bottle has an exclusive label with a powerful and simple message, “Made from 100% recycled plastic.” This announcement is a significant step for the Coca-Cola system in Bangladesh to grow its circular economy vision and help reduce plastic pollution.

The safety of rPET packaging thoroughly complies with The Coca-Cola Company’s strict global standards for food-grade rPET packaging as well as the country’s local standards.

As a start, consumers can expect the same refreshing taste of Coca-Cola’s products in a more sustainable package in all retail outlets.

Ta Duy Tung, Managing Director of Coca-Cola Bangladesh said: “Plastic waste management has become a huge issue globally and the availability of Coca-Cola beverages in recycled PET bottles is in support of a circular economy in Bangladesh. To achieve this, it is critical we have enough supply of food-grade recycled plastic to meet demand.”

He further added: “This is why together with our bottling partners, the Coca-Cola system in Bangladesh is investing in the collection and recycling of PET plastic bottles. It is our ambition is to help collect and recycle the equivalent of all the plastic bottles we bring to the market.” Circular-economy – Plastic-recycling

The Coca-Cola Company has a global World Without Waste vision to collect and recycle the equivalent of every bottle and can it sell by 2030. But it’s not just about collecting and recycling bottles, it’s also about using less virgin material per bottle.

As such, the company has a global goal to use at least 50% recycled content in its packaging by 2030.

ASM Mohiuddin Monem, Additional Managing Director of Abdul Monem Limited, the bottler of Coca-Cola in Bangladesh mentioned: “PET plastic bottles have value beyond their first use. Our new bottles made with food-grade rPET are recyclable and can become another bottle. Recycled PET is a big move in the right direction and is aligned with the Department of Environment’s multi-sectoral National Action Plan for Sustainable Plastic Management. Abdul Monem Ltd. is proud to be pioneering this sustainability initiative as a part of the Coca-Cola System in Bangladesh.”

To build awareness and encourage action on recycling in Bangladesh, Coca-Cola Foundation is partnering with SR Asia and Cordaid Bangladesh, to collect waste plastic bottles and strengthen the waste management system, in Dhaka South City Corporation and Dhaka North City Corporation respectively.

In the past, Coca-Cola Foundation has partnered with BRAC for project Bondhon, which improved the lives of waste workers.

The Coca-Cola Company now offers 100% rPET bottles in more than 30 markets around the world. Circular-economy – Plastic-recycling

-Prices under pressure from low demand and falling costs

The LyondellBasell Berre site in France. The cracker at the site, offline since a fire in August 2022, will not go back onstream until early 2023

November saw a mixed price picture for European standard thermoplastics. The month began with polymer producers attempting to pass through the increase in feedstock costs in full onto processors. However, very low demand and competition from imports kept a firm lid on planned price hikes. Circular-economy – Plastic-recycling

Polyolefin prices generally followed an upward trend following six consecutive months of falling notations. L/LDPE prices increased by €15-20/tonne after the C2 contract price was settled €35/tonne higher. HDPE blow moulding prices nudged €10/tonne higher while blown film and injection moulding prices were mostly rolled over. For PP, specialty product prices increased by €10-20/tonne while commodity product prices was largely rolled over.

PVC, polystyrene and PET prices, on the other hand, declined further. Base PVC prices dropped by €70/tonne, polystyrene prices fell by €50-60/tonne and PET resin prices were down by €60/tonne last month.

In December, standard thermoplastic prices declined across the board as a result of lower feedstock costs and weak demand and exacerbated by converters reducing stock levels prior to end-of-year accounting.

Polyethylene and polypropylene prices had fallen by just less than the €25/tonne and €30/tonne respective reductions in the ethylene and propylene reference prices by mid-December. Further price concessions were expected as larger customers were to negotiate price agreements later in the month.

Base PVC prices have continued to decline with a fall of €50/tonne by mid-December. Polystyrene prices saw a triple-digit reduction following the €132/tonne fall in the styrene monomer reference price. PET prices plunged by a further €50/tonne amid considerable market turbulence. Circular-economy – Plastic-recycling

Demands very low

Polymer demand has continued at a very low level across most end-use markets during the last two months. While demand has picked up slightly for the food and pharmaceuticals packaging sectors, demand from most other markets is well below normal levels. In December, order activity is further constrained by the short production month and by converters reducing stock levels prior to the year-end accounting.

Supply tight

European producers have trimmed production and brought forward plant maintenance programmes to counteract the low demand. There is however sufficient material available to meet the needs of converters. Supply has also been supported by a steady inflow of imported material. The high European prices and lower freight rates are tempting producers to divert more of their cargoes to Europe.

A summary of the latest production issues is presented below:

- TotalEnergies resumed its PS production in France by end of November. Still, sources reported that it will take some time to lift the force majeure. Overall PS availability is expected to improve after two months of absence of the producer

- A fire at the Versalis site at Dunkerque, France on the weekend of 10th December has shut down the cracker and also the polyolefin downstream plants

- The 350,000tonnes/year LDPE plant in Ruwais, Abu Dhabi run by Borouge is expected to resume operations by end-2022

- The LyondellBasell cracker in Berre, France, offline since a fire in August 2022, will not go back onstream until early 2023Major maintenance work on the OMV cracker in Burghausen, Germany is complete, and the plant is being gradually restarted.

January outlook

The outlook for standard thermoplastic prices at the start of the New Year is unclear. Much will depend on whether demand rebounds after a period of very low ordering activity. Local supply will remain tight due to production curbs, but import pressure is likely to prevail. Crude oil prices are rebounding in mid-December on an unclear supply outlook amid an ongoing shutdown at key North American crude pipelines and further easing of China’s strict Covid measures. Circular-economy – Plastic-recycling

PET

In November, European PET prices continued to tumble as a result of over-supply, weak demand and competitively-priced Asian imports. PET contract prices fell by around €60/tonne over the month as a whole. European PET resin remains over-supplied despite production cutbacks by European producers. Asian imports are also widely available, often at very aggressive prices. Converters’ stock levels are more than adequate to cover the very low demand.

The PET market turmoil accelerated into December with prices tumbling by around €50/tonne by mid-month. While the November paraxylene cost finally settled down by €40/tonne, PET producers struggle to pass through higher utility costs.

While European producers have curbed output to counteract the weak demand, converters are increasingly turning to more aggressively-priced Asian material. December is traditionally a weak month for PET demand, and further price concessions are likely to follow. Circular-economy – Plastic-recycling

Circular-economy – Plastic-recycling