Technician shortage also addressed in survey

Technician shortage also addressed in survey

Congress and the Trump Administration are currently exploring ways to reform the U.S. Environmental Protection Agency’s Renewable Fuel Standard.

Congress and the Trump Administration are currently exploring ways to reform the U.S. Environmental Protection Agency’s Renewable Fuel Standard.

There are a number of alternatives being discussed, all of which will have a significant impact on the recreational boating industry. Will E15 be expanded in the fuel supply? Will better alternatives like biobutanol be promoted?

We surveyed our readers via email in May to find out more about their views on ethanol and other service department challenges. Respondents were a mix of individuals working in the industry including dealers, manufacturers, marina personnel, and more.

ETHANOL CONCERNS REMAIN

Boating Industry readers continue to report seeing problems with engines and other boat components caused by ethanol.

Eighty-five percent of our respondents said they have seen damage to engines or other components caused by ethanol in their business. That was down from 92 percent last year and 87 percent in 2016.

“We have experienced continued issues with ethanol,” said one Maryland boat dealer. ‘It is tearing up rubber components. Customers are required to spend a lot more on additives to help prevent damage.”

According to our readers, ethanol remains a cause of boat repairs in their businesses. Almost 6 percent of readers said that based on what they are seeing in their businesses, more than half of the necessary repairs are being caused by ethanol-related issues. While that figure is down from nearly 15 percent reported last year, almost 55 percent of respondents reported that more than 20 percent of problems were being caused by ethanol. Those numbers have held basically steady over the last three years of Boating Industry’s spring ethanol survey.

E15 CONCERNS EASE SLIGHTLY

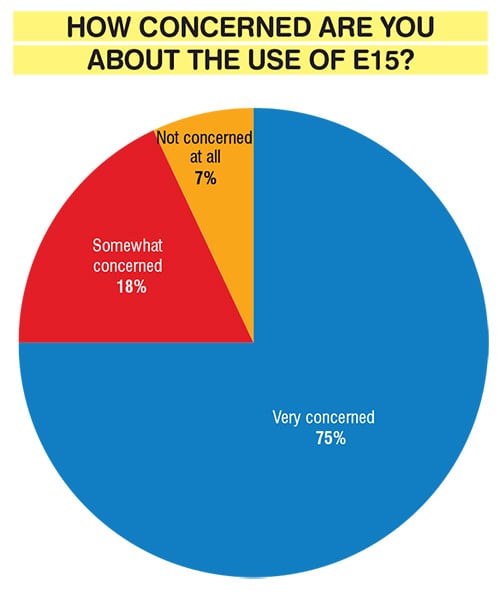

Boating Industry readers continue to be worried about the use of E15, with 75 percent saying they are very concerned about it. An additional 18 percent were somewhat concerned. Last year, 85 percent of readers were very concerned.

The Renewable Fuel Standard was introduced by Congress to help shift the country away from fossil fuels and towards renewable green alternatives. The National Marine Manufacturers Association has endorsed and helped market biobutanol, an E15 alternative, and supports the “Look Before You Pump” campaign to raise public awareness of proper fueling.

The larger concern identified by the industry is the danger of misfueling by boaters who fill up at a roadside station and may not be aware of the potential danger.

Only fuels containing up to 10 percent ethanol (E10) are permitted for use in recreational boats, and anything greater voids many marine engine warranties.

Last summer, the EPA asked the public how much ethanol it wanted to be added to the nation’s gasoline supply, and recreational boaters as well as many other owners of gasoline engines and vehicles spoke up against increasing ethanol volumes.

A report from the Iowa Department of Revenue shows that ethanol-free gas is a more popular fuel choice than E15 and all ex fuels (E20, E85) combined, with Iowans purchasing more than 200 million gallons of ethanol-free fuel in 2016.

Boat Owners Association of The United States (BoatUS), says citizens of the No. 1 ethanol-producing state in the nation choosing ethanol-free fuel for their own personal vehicles and equipment is another example of the need for RFS reform.

“The use of ethanol is politically-driven,” said a Wisconsin dealer. “Simply using the alternative biobutanol, which can be produced from the same equipment used for producing ethanol, has real benefits with far less negatives.”

Earlier this year, Harris Poll conducted its annual fuel survey of U.S. consumers on behalf of the Outdoor Power Equipment Institute.

In that study, 11 percent of consumers reported using an ethanol blend to fuel their equipment, up from 7 percent in 2015.

The study also found that 38 percent of consumers are more likely now than in years past to believe higher ethanol blends are a safe replacement for any gasoline.

Researchers also found that roughly two thirds of Americans (66 percent) believe ethanol-free gas should be more widely available at gasoline filling stations.

More than half of consumers (51 percent) fill up their portable gas tank with the same fuel used to fill their vehicle, the study stated, and roughly two thirds (66 percent) admitted they used the least expensive gasoline grade whenever possible.

Most Boating Industry readers consider themselves to be fairly well informed about ethanol issues.

More than 50 percent said they know a lot about the pros and cons of ethanol, while an additional 43 percent said they know something. Only 5 percent said they know a little bit about the issue; last year 2 percent of readers said they knew nothing or a little bit about ethanol.

On the other hand, respondents believe there’s still work to be done in educating consumers about potential ethanol challenges. Only 1 percent said their customers know a lot about the issue, while 22 percent said their customers know some about ethanol. Sixteen percent of survey respondents said their clients know nothing about ethanol, while 61 percent know a little bit about it. That represents a slight change from 2017, when a total of 57 percent of those surveyed said their customers knew nothing or only a little bit about ethanol.

TECHNICIAN SHORTAGE CONTINUES

We also asked readers about other service department challenges and the top concern of survey respondents is still finding and keeping good service technicians.

Of those respondents that have a service department, 79 percent said it was very difficult to find qualified service techs. An additional 13 percent said it was somewhat difficult. Only 4 percent said that it was neither easy or difficult, while 4 percent said it was easy.

That challenge has only gotten more pronounced for many readers. Fifty-nine percent of those with service departments said it was more difficult this year than in the past and 27 percent said it was much more difficult. Only 2 percent said it was easier, while 32 percent said it is about the same.