LONDON (ICIS)–Polyethylene terephthalate (PET) in Europe has been in such disarray that recent events could impact discussions concerning 2019 contract negotiations, even at this early stage.Europe PET drama 2019 contract negotiations

“Customers will push for contracts and producers will try to avoid contracts or increase the spread on contract if it is linked to raw materials, that’s for sure.

“Customers will push for contracts and producers will try to avoid contracts or increase the spread on contract if it is linked to raw materials, that’s for sure.

“There will be a huge impact on 2019 negotiations. Producers will definitely increase their spread. It is the same situation as the end of 2017. Maybe 2019 you will buy better on spot! The spread for 2019 contracts will be much higher [than in 2018],” a reseller said.Europe PET drama 2019 contract negotiations

As an industry, PET rarely fails to surprise. Last year and the first half of 2018 were no exception. Both periods heralded a series of unpredictable incidents that proved harmful to both sellers and buyers.

Globally, financial difficulties, bankruptcy, environmental and antidumping decrees, even a hurricane formed, the essence of 2017.

This resulted in a heavily contracted European market in 2018, as both sides were keen not to fall into similar traps, and to secure volumes for the year ahead.

This year began on a tense note, within a finely balanced market. Having eventually secured material, including scarce imports, many customers began to feel more comfortable with their volumes by the end of the first quarter.

Demand looked disappointing and March hosted several planned shutdowns.

Availability worsened when BP’s upstream purified terephthalic acid (PTA) plant in Geel, Belgium, failed to resume production after maintenance, and declared force majeure.Europe PET drama 2019 contract negotiations

The domino effect included a force majeure on PET, other producers exiting the lucrative spot market and reducing output to a technical minimum, the combination of which was disastrous on supply.Europe PET drama 2019 contract negotiations

“Right now there is no choice of when it will go back to normal. There is no piece of news that tells me when it will normalise. Nobody has a clue,” a buyer said.

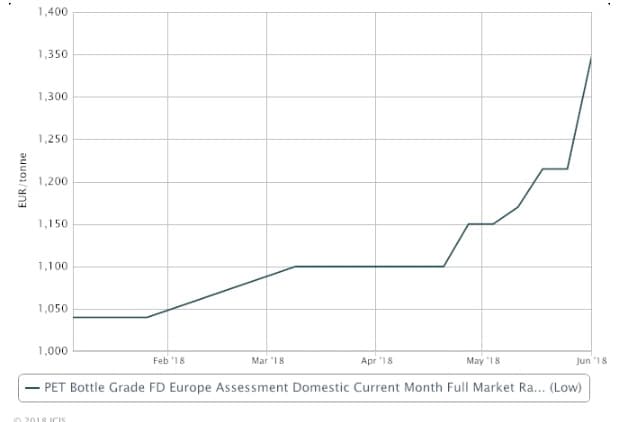

Prices climbed 30% from January to June, peaking at €1,350-1,400/tonne FD (free delivered) and soaring over €250/tonne in the second quarter alone.

Peaking being the operative word, as while the market is still tight and there is a possibility for further increases, from June there has been a change of mood.

Production output looks better in June, as PTA becomes more available and PET production begins to ramp up.

There is no doubt material will be short, snug at the very least, through June and July, but come August, September or even as late as October, depending on what imports arrive and on how demand fairs, the market should balance out.

A typical cycle for PET is five years, and there is unlikely to be a general excess of product much before 2020.

“The Corpus Christi (M&G) start up would make [the market] non deficit, probably the problems at JBF will be resolved and there may be product from the Middle East, then we will see the opposite situation. But it won’t happen in the next six months, and the question is if it happens in one or one and a half years,” a second buyer said.

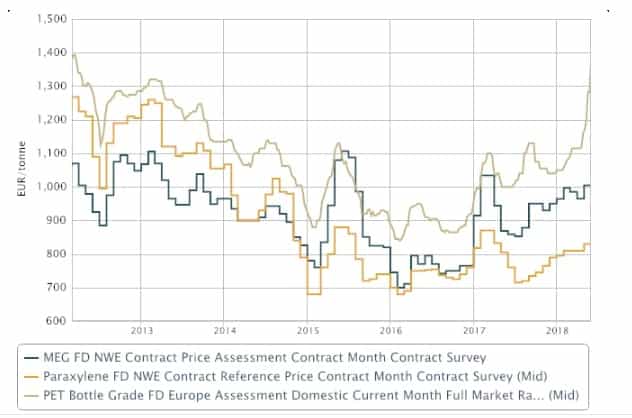

The surprisingly short 2017 market sparked a change in 2018 contract strategies, whereby accounts became largely contractual and more dependent on raw material movements.

This lack of flexibility coupled with the awkward supply situation has resulted in significant discrepancies between high spot and relatively low contract prices so far this year. The gap has been quoted as ranging between €200-300/tonne for raw material plus models.

The industry is now wondering how this will impact 2019 negotiations.

“It is early days…We still have a high percentage of cost-plus models based on raw materials. The question is…do we want still this high cost-plus models in our portfolio? The ones on raw materials or with floors and caps will be reconsidered,” a seller said.

It may be that sellers continue pushing for more contracts based on raw materials as opposed to market- or index-based, but with higher conversion fees over feedstocks.

“…Europeans increased the conversion fee over raw material formula from 2017 to 2018, and I am sure in 2019 they will increase again,” a third buyer said, echoing comments from others.

Nothing is clear at the moment, and much depends on the situation at the time of negotiation.

“When closing 2018 deals I thought this is a one year exception and we will probably switch back to index-based contracts in 2019. Now I am not sure anymore. I think we will need another couple of months to get the mood and to some degree it will be difficult. If you want to go stronger on indices there will be resistance from suppliers,” a fourth buyer said.

Imports usually fill in any gaps in supply, but exchange rates have not been favourable for euro-based buyers. So, although the lack of availability has made for an interesting and dynamic market, other macroeconomic parameters can influence matters from one day to the next.

“Asia has not been competitive for Europe this year. If the exchange rate hits 1.40 by the end of the year [euro to dollar], then everything can change,” a trader said.

A priority for buyers will surely be reliability of supply. So, while the element of surprise in terms of availability provides some certainty that the trend of contracts will continue, there may be a shift in who goes where for volumes.

Contracts based on raw materials have been favourable to clients who could try to extend them into next year. Suppliers are likely to attempt to increase margins for cost-plus models, and this will put some customers off.

Once normality returns to supply/demand, perhaps buyers will notch the first half of 2018 up as a bad experience, and if/when the bubble bursts, it may not actually have much of an impact on future pricing negotiations.

“Now we are seeing a balloon. There is tightness in the market but…it’s an exaggeration. Every year there is a new story or new sensation,” a buyer said.

For now, the market remains tight, the mood feels like it’s lightening on both sides, and 2019 negotiations are far from being finalised.

PET is used in fibres for clothing, containers and bottles for liquids and foods, thermoforming for manufacturing, and in combination with glass fibre for engineering resins.

Picture source: imageBROKER/REX/Shutterstock