Hydrogen – Biomass – Enzymes 23-12-202 - Arhive

Hydrogen – Biomass – Enzymes

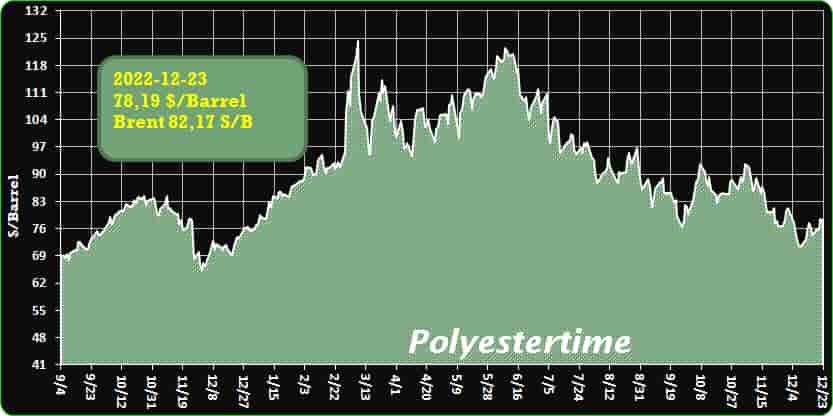

Crude Oil Prices Trend

Crude Oil Prices Trend

-Total of seven dutch hydrogen projects get subsidy worth €783.5m

The Dutch Government announced that seven electrolyser projects in the Netherlands for producing renewable hydrogen have received subsidies totalling €783.5 million.

The second wave of significant projects of common European interest (IPCEI) hydrogen funded the seven projects, which have a combined capacity of 1.15 GW.

Seven projects total, three of which are in Rotterdam got the subsidy. Orsted Hydrogen Netherlands Holding, Rotterdam Hydrogen Company, H2ermes, Air Liquide Industrie, HyCC/H2-Fifty, and Engie Energie Nederland are the firms engaged.

According to the Dutch government, the 1.15 GW of electrolysis capacity exceeded the country’s 2030 climate agreement objective by more than 25%.

According to the National Climate Agreement, electrolysis in the Netherlands will be expanded to have an installed capacity of roughly 500MW by 2025 and 3–4 GW by 2030.

Due to their importance to the Dutch Hydrogen Strategy, offshore wind turbines are most likely to supply the electricity generated for the electrolysers.

ICIS data show that the breakeven price for hydrogen produced under a 10-year Power Purchase Agreement (PPA) beginning in 2025 is €4.75/kg.

In order to meet its climate goals, the Dutch government has also stated that it will look to import hydrogen into the Port of Rotterdam. To that end, a number of Memorandums of Understanding (MoUs) have already been signed with numerous nations in various worldwide regions. Hydrogen – Biomass – Enzymes

-What if the Japanese are right? Let’s see how hydrogen could beat electric

If you’re following the green transition in more detail than you’re talking about politics in terms of private transport, then you may have noticed that while the vast majority of European manufacturers are moving to battery electric vehicles, many Japanese manufacturers seem to be aiming much more instead. on hydrogen technology.

And in some cases not only the fuel cell (FCEV), but also real internal combustion engines, with cylinders and pistons, which burn hydrogen instead of petrol, while still guaranteeing an enormous reduction in the pollution generated at the exhaust.

I’m not saying that any European or American brand has not even developed a fuel cell vehicle, just look at Iveco, Opel or Renault with some of their concepts, but certainly the production and financial commitment is not comparable to the Japanese one.

In particular, there are no physical projects in Europe and the USA for the use of hydrogen as a fuel for heat engines – and I emphasize physical because Porsche has actually worked deeply on it so far as a virtual project. Hydrogen – Biomass – Enzymes

The question therefore seems obvious: is it a mistake not to focus everything on electric as in Europe, or have the Japanese seen ahead longer than us?

Hydrogen Fuel Cell or from combustion: the differences and the performance

Let’s make a summary to understand what are the differences between the hydrogen that burns in fuel cells and that in combustion engines, both technically and economically, and in terms of production.

Basically, a hydrogen combustion car makes its own classic heat engine work – the same one that runs on petrol – reconverted to use hydrogen as fuel. Virtually nothing therefore changes in the basic operation of the engine compared to what we already know, if not for the different chemical composition of the fuel, the different energy efficiency and the great reduction of polluting agents produced in the exhaust.

A fuel cell car, on the other hand, is philosophically closer to an electric car: the heat engine is made up of several cells that can burn hydrogen to obtain chemical energy, which will then be converted into electricity to be stored in a small vehicle battery or directly to the electric motor to move the wheels.

The real difference, then, is that the fuel cell car (often abbreviated to FCEV) is a car that has an electric drive train to move the wheels and draws its energy from the conversion of hydrogen. Hydrogen – Biomass – Enzymes

One could say that the best efficiency should come from the fuel cell, at least on paper and looking at pure energy efficiency. In this sector, this term refers to the amount of initial energy that is transformed into effective kinetic energy of the wheels. The classic internal combustion engine, due to the friction between the numerous mechanical components and heat dispersion, has a relatively low efficiency: it is estimated that the very modern V6 engines of Formula 1 cars cannot exceed an energy efficiency of 33% – that is, at most only one third of the potential chemical energy of the fuel is transformed into effective kinetic energy. And we are talking about internal combustion engines among the most efficient in circulation.

The electric motor, on the other hand, manages to transform approximately 85% of the initial energy into kinetic energy – that is to say, it has a very high energy efficiency and this means being able to exploit much better the amount of energy produced by the conversion of hydrogen in the fuel cells , compared to a piston engine.

But, there is a but: let’s consider the costs.

A heat engine – which is now more than 120 years old – is certainly better known, better tested and also much less expensive to produce than fuel cells, and even cheaper than batteries for storing electricity.

On the other hand, the real electric motor makes a difference, which usually has lower costs than one might think precisely because it has been in use for many years in various other sectors.

-LG Chem and GS EPS to Build Biomass Power Plant

LG Chem will team up with the eco-friendly energy company GS EPS to convert heat sources into biomass fuel.

The company announced on Dec. 20 that the two companies signed the main contract for establishing a biomass power plant that will produce industry-use steam and electricity using waste wood at the Yeouido LG Twin Tower with the attendance of executives from both companies. This agreement follows up the conclusion of the heads of agreement (HOA) signed by the two companies in June of last year.

LG Chem and GS EPS will establish the biomass power plant called “Yeosu Green Power” by investing a total of 320 billion won at the LG Chem Hwachi Plant in Yeosu with the goal of beginning operations by the first half of 2026.

The biomass power plant will turn waste wood from homes and industrial sites in Korea, which are usually incinerated or buried, into the form of woodchips to be used as raw materials. As waste wood is treated as a resource that cannot be recycled, power generation using it is not viewed as using forest resources as energy. Therefore, it is recognized as sustainable biomass. Hydrogen – Biomass – Enzymes

GS EPS is Korea’s first private power producer, and it possesses accumulated business capacity and operational know-how in the eco-friendly energy and generator sector, as well as a domestic woodchip supply chain network.

Yeosu Green Power is expected to produce steam (heat source) and electricity needed for LG Chem’s Yeosu Hwachi Plant, thereby reducing carbon emissions by 400,000 tons annually. This is equivalent to planting 2.8 million pine trees.

The two companies anticipate that this will accelerate the age of carbon neutrality by using sustainable fuels and contribute to constructing a circular economy.

Also, the electricity produced by the power plant will be sold directly to LG Chem through the renewable energy power purchase agreement (PPA).

Regarding this cooperation, GS EPS CEO Jung Chan-soo said, “We will continue our partnership with LG Chem, which is the leading company for net-zero in Korea based on the core eco-friendly energy capacities of GS EPS.”

LG Chem Petrochemicals Company President Noh Kug-lae commented, “Carbon reductions through this biomass will become a key element for achieving 2030 carbon neutrality together with major initiatives currently being promoted such as recycling, biomaterials, etc.,” while adding, “LG Chem will continue its efforts to become a company that leads eco-friendly innovation.”

-Will spandex market warm up?

The operating rate of fabric mills slightly increased in the first half of Dec. Orders for some circular knitted double-faced fabrics chased up slightly. Sales of spandex for the earband of mask improved. Apparently more spandex plants cut or suspended production from late-Oct to Nov due to soft demand and collapsing cost. Current operating rate of spandex plants has fallen to below 60%. With eased pandemic prevention and control policies, price of some raw materials of textiles and apparels started increasing recently. Players held slightly recovering anticipation toward demand for textiles and apparels in the first half of 2023. Will spandex market warm up? Hydrogen – Biomass – Enzymes

Operating rate: slanting low at the end of year

Spandex capacity was at 1121.5kt/year in Chinese mainland now, up by 15.4% on annual basis. The yearly run rate of spandex producers will obviously descend. Current operating rate of spandex plants has fallen by 24 percentage points over early-Q4 to 59%. With subdued domestic and export demand, spandex companies controlled run rate at the end of year. On one hand, some new spandex units from leading companies cut or suspended production with muted demand. On the other hand, some leading companies slashed run rate or suspended production due to stagnated sales of some varieties. Apparently more small and medium-sized companies curtailed or stopped production. The inventory of spandex was substantially depreciated in end-Q2 and Q3. Spandex producers controlled the inventory of finished goods and feedstock when price of PTMEG kept reducing. Most purchased PTMEG to cover the pressing demand.

Operating rate of spandex plants has been low now. Some factories who did not cut operation earlier will scale down or suspend production after New Year’s Day holiday. However, some units who have slashed production earlier may resume operation after inventory dropped. The run rate of spandex plants may have limited downward space later.

Demand: rigid demand grows and replenishment has potential to improve

The operating rate of fabric mills was low now but has increased slightly in some regions with eased pandemic prevention and control policy. Rush orders for some circular knitted rib fabrics grew and the production of single-faced LYCRA fabric and cotton/spandex air covered fabric also increased. The operating rate of warp knitting plants slightly rose, especially warp knitting plants in Haining with 10 percentage points of run rate increment. Demand for KN95 and N95 mask surged recently with alleviated pandemic prevention and control policy, which stimulated sales of spandex 70-280D.

Ordinary mask still mainly used spandex 35D-70D with not very high quality, but some turned to adopt quality spandex after the inventory of spandex with inferior quality was lowered. Hydrogen – Biomass – Enzymes

Market players have shown apparently recovering mindset with eased pandemic prevention and control policy, having “strong” expectation from holding weak mindset. Fabric mills will gradually start Spring Festival holiday from late-Dec to early-Jan. Rigid demand for spandex will be muted. As the COVID infection peak is approaching in Zhejiang and Jiangsu, the production of fabric mills may be impacted to a certain extent. Some mills may be forced to shut down for holiday in advance. The downstream replenishment demand before and after the Spring Festival holiday should be noted.

Spandex value chain has a long periodicity. Supply glut is still expected to dampen the market atmosphere before and after the Lunar New Year’s holiday. High cash flow of spandex is still worrying for downstream players. Price of spandex is anticipated to shiver at bottom at the beginning of 2023.

-Versalis acquires DSM Proesa technology

In Italy, Versalis, Eni’s chemical company, has acquired the technology to produce enzymes for second-generation ethanol from DSM, said Biofuelsdigest.

The agreement has a strategic value for Versalis as it integrates with proprietary Proesa® technology, applied at the Crescentino plant for the production of sustainable bioethanol and chemical products from lignocellulosic biomass, improving the competitiveness of technology and production. Hydrogen – Biomass – Enzymes

The acquisition of this technology strengthens Versalis’ position as a leader in chemistry from renewable sources. This agreement also provides an important boost to both the Crescentino plant development program and the Proesa technology, which bolsters the path towards decarbonization for the Eni chemical company.

DSM enzymes have already been successfully tested at Versalis research centers for their use in conjunction with the proprietary Proesa technology. Furthermore, starting from the technology acquired, Versalis plans to proceed with research activities to ensure further development in this area.

We remind, Versalis Dunkerque cracker offline after fire. A major fire broke out this Friday evening, around 10:50 p.m. on the site of the petrochemical plant based in Mardyck, classified Seveso, in the industrial port of Dunkirk, said Francebleu.

Firefighters extinguished the fire overnight at 1:30 a.m. No injuries are reported. A significant number of firefighters from the North lent a hand to the plant’s own fire department, as required by procedure in this type of situation. The operation lasted from 10:50 p.m. to 1:30 a.m. Hydrogen – Biomass – Enzymes

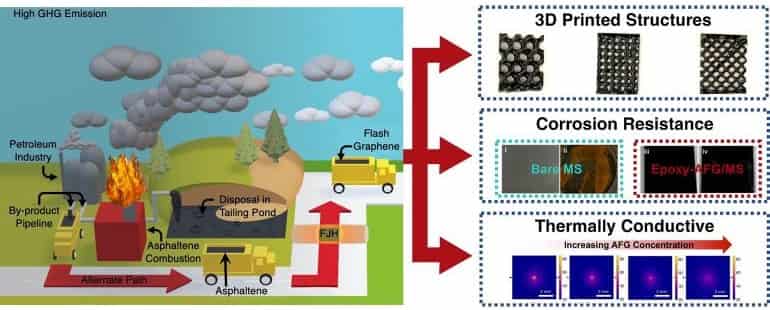

-Researchers Turn Asphaltene into Graphene for Composites

“Flashed” byproduct of crude oil could bolster materials, polymer inks.

Asphaltene, a byproduct of crude oil production, is a waste material with potential. Rice University scientists are determined to deliver on this potential by converting the carbon-rich resource into useful graphene, with prospects for use in composite materials.

Muhammad Rahman, an assistant research professor of materials science and nanoengineering, is employing Rice’s unique flash Joule heating process to convert asphaltenes instantly into turbostratic (loosely aligned) graphene and mix it into composites for thermal, anti-corrosion, and 3D-printing applications.

The process makes good use of material otherwise combusted as a fuel or discarded into tailing ponds and landfills. Using at least some of the world’s reserve of more than one trillion barrels of asphaltene as a feedstock for graphene would be good for the environment, as well. Hydrogen – Biomass – Enzymes

“Asphaltene is a big headache for the oil in dustry, and I think there will be a lot of interest in this,” said Rahman, who characterized the process as both a scalable and sustainable way to reduce carbon emissions generated by burning asphaltene. Rahman is a lead corresponding author of the paper in Science Advances, co-led by Rice chemist James Tour, whose lab developed flash Joule heating; materials scientist Pulickel Ajayan; and Md Golam Kibria, an assistant professor of chemical and petroleum engineering at the University of Calgary, Canada.

Asphaltenes are 70% to 80% carbon already. The Rice lab combined the petrochemical with about 20% carbon black to add conductivity and flashed it with a jolt of electricity, turning it into graphene in less than a second. Other elements in the feedstock, including hydrogen, nitrogen, oxygen, and sulfur, are vented as gases. “We try to keep the carbon black content as low as possible because we want to maximize the utilization of asphaltene,” Rahman said.

“The government has been putting pressure on the petroleum industries to take care of this,” said Rice graduate student and co-lead author M.A.S.R. Saadi. “There are billions of barrels of asphaltene available, so we began working on this project primarily to see if we could make carbon fiber. That led us to think maybe we should try making graphene with flash Joule heating.”

Assured that Tour’s process worked as well on asphaltene as it did on various other feedstocks — including plastic, electronic waste, tires, coal fly ash, and even car parts — the researchers set about making things with their graphene. Saadi, who works with Rahman and Ajayan, mixed the graphene into composites, and then into polymer inks bound for 3D printers. “We’ve optimized the ink rheology to show that it is printable,” he said, noting the inks have no more than 10% graphene mixed in. Mechanical testing of printed objects is forthcoming, he said. Hydrogen – Biomass – Enzymes

The research was funded by the Alberta Innovates for Carbon Fiber Grand Challenge programs, the Air Force Office of Scientific Research, the US Army Corps of Engineers, and the National Science Foundation.

-Resin Price Report: Increases on the Table for January

PE producers may seek a $0.06 to 0.08/lb price hike in the new year.

Unlike the local mall, the resin market tends to slow down this time of year. True to form, there was relatively little interest among market participants last week, although a handful of polypropylene (PP) railcars and groups of polyethylene (PE) truckloads and railcars managed to transact through the PlasticsExchange marketplace.

Prime resin pricing held steady at the Chicago-based resin clearinghouse, following the two-cent drop earlier this month, which priced in additional discounts that have become more widespread. Producers have tightened up supplies for both PE and PP by throttling back operating rates and reducing stockpiles via discounting and aggressive export sales, notes the PlasticsExchange in its Market Update. Hydrogen – Biomass – Enzymes

Still, upstream inventories for most grades remain adequate as producers continue to work through the glut of supply in the face of limited physical railcars, high warehouse storage costs, and the approaching year-end inventory tax. However, Shell’s new PE plant in Pennsylvania and ExxonMobil’s expanded PP plant in Louisiana continue to ramp up, bringing added supply into the resin market.

Texas power grid on storm watch

Meanwhile, all eyes are on the Texas power grid, as a bone-chilling winter blast is forecast to pass through the state. We all remember winter storm Uri in February 2021, which shut down the Texas power grid as well as refining, petrochemicals/plastics production, and logistics systems, and sent resin prices soaring. Ercot, the state’s power grid operator, has been making improvements to the grid over the past 18 months and expects to meet forecasted demand. Still, we would expect to see some producers proactively shut down certain plants as a cautionary step ahead of the polar system, writes the PlasticsExchange.

PE trading took a back seat to PP this past week, as activity and volumes fell short of the pace set in late November and early December.

The lighter activity was not just from slack demand, but also from a lack of offers, which can be attributed in part to lower producer operating rates. Also, resellers had already liquidated substantial portions of their unallocated inventory ahead of year-end, according to the PlasticsExchange. Hydrogen – Biomass – Enzymes

Hefty PE price increase on deck for January

Although trading was on the light side, it remained well spread across PE commodity grades, which transacted through a combination of railcars and truckloads. In the meantime, PE producers still have December nickel increases on the table in case any major disruptions occur, especially as below-freezing temperatures move across the Gulf Coast. The PlasticsExchange expects another rollover in December, but notes that producers plan to come out strong in 2023 with $0.06 to 0.08/lb increases on the table for January.

PGP rally drives PP buying

PP was the more dominant resin changing hands this past week, as buyers that had been waiting for another wave of lower prices, instead paid up to secure material. Activity picked up significantly in the back half of the week, and completed volumes finished strong, fueled by a polymer-grade propylene (PGP) rally of nearly three cents. Volume was heavily skewed toward fresh railcars, as larger players stepped in and made some sharp purchases, thinking that higher prices will come along with the new year, reports the PlasticsExchange.

PP prices have come down a long way, and some buyers are starting to rebuild their inventories, but overall demand has been lethargic. Producers have already seen their wide margins erode because of oversupply and have taken aggressive action to rebalance the situation by reducing production, which is having an impact.

With PGP monomer rallying back and inventories falling off substantially high levels, the PlasticsExchange said it would not be surprised to see price increases start to percolate in January. However, there is also plenty of geopolitical and economic uncertainty at hand while the Fed continues to force the economy to slow through higher interest rates and by tightening the money supply. That said, the PlasticsExchange is cautiously anticipating a Q1 recovery in PP prices. Hydrogen – Biomass – Enzymes

Hydrogen – Biomass – Enzymes