Microwave-chemical-recycling – PET-Resin 02-07-2022 - Arhive

Microwave-chemical-recycling – PET-Resin

-May industrial output falls 7.2% on month in Japan

Japan’s factory output posted the biggest monthly drop in two years in May as China’s COVID-19 lockdowns and semiconductor and other parts shortages hit manufacturers, adding more pressure on an economy struggling to mount a strong recovery, said Reuters.

Japan’s industrial output in May marked the steepest fall in two years, down 7.2 percent from the previous month, as the auto industry was hit by parts shortages due to a COVID-19 lockdown in Shanghai, government data showed Thursday. The seasonally adjusted index of production at factories and mines stood at 88.3 against the 2015 base of 100, the Ministry of Economy, Trade and Industry said. The decline followed a decrease of 1.5 percent in April.

With the sharpest fall since May 2020, the ministry also downgraded its basic assessment of industrial production for the second straight month to “weakening,” compared with “was pausing” in April. “Many Japanese companies said they were affected more severely by the lockdown in Shanghai in May than in April,” said a ministry official.

The ministry assumed logistics were disrupted for a full month in May, although the early part of April is believed to have escaped the lockdown’s impact as some parts for manufacturers had already been shipped out when the measure was put in place in the Chinese commercial hub in late March. Microwave-chemical-recycling – PET-Resin

Of the 15 industries covered by the survey, production in 13 declined. Automobile output dropped 8.0 percent from the previous month, including a 33.2 percent plunge in truck manufacturing, according to the data. Output of electronic components, such as lithium-ion batteries including those for automobiles, plummeted 11.3 percent and that of construction and production machinery fell 5.1 percent, the data showed.

Meanwhile, output of organic and inorganic chemical compounds rose 3.9 percent, and that of petroleum and coal products, such as diesel fuel and jet fuel, grew 8.9 percent. The index of industrial shipments declined 4.3 percent to 89.0, while that of inventories was down 0.1 percent at 98.5 for the third straight month of decline.

“We will continue to closely watch the effects of the development of coronavirus infections for domestic and overseas economies, shortages of parts, rising prices and the situation of Ukraine,” the official said. Based on a poll of manufacturers, the ministry expects output to grow 12.0 percent in June and climb 2.5 percent in July.

-Defra policies ‘not enough’ to unlock £1bn plastics recycling investment

A survey of plastics recycling investment firms has revealed volatile markets and short-term contracts are blocking infrastructure development in the UK.

Research for Viridor conducted by consultancy Anthesis suggested £1bn investment is needed to build 46 new plastics sorting and recycling facilities if the UK is to end plastic waste exports. Microwave-chemical-recycling – PET-Resin

This would equate to an extra 14 to 16 million tonnes of plastic recycled domestically over the next 25 years.

The report said the plastics recycling sector “does not benefit from long term, stable revenues supported by long term contracts and a predictable cashflow model”.

Anthesis spoke to investors including Hermes Infrastructure, Equitix, First Sentier Investors, CPPIB, and I Squared Capital.

The report said Defra expected reforms such as extended producer responsibility, consistent collections and the plastics packaging tax would be enough to “provide sufficient clarity” to develop the required recycling and reprocessing capacity.

But it concluded: “To date, the recycling market has delivered limited infrastructure measured by both capacity and quality. There is little to indicate that current reforms will address this issue without additional intervention.”

It added the north west of England had the most potential to benefit from investment in plastics recycling facilities and reprocessing as it is the region with the largest capacity gap. Microwave-chemical-recycling – PET-Resin

The report said investment in the north waste would contribute to the Government’s ‘Levelling up’ agenda.

Plastic collected for recycling in the UK is forecast to increase by 45% by 2035. Anthesis argued the plastics recycling infrastructure shortfall could reach 1.6 million tonnes and increase plastic waste exports if investment is not forthcoming.

It concluded: “This investment could deliver an extra 46 industrial facilities across all regions of the UK, create 1,100 permanent skilled green jobs and a further 975 in the supply chain, and deliver economic benefits of over £3bn across 25 years.”

Tim Rotheray, Viridor director of ESG, said: “When people put out their plastic recycling each week, they expect that material to be recycled in the UK. Ending plastic waste export is not only the right thing to do but also a major employment opportunity across the UK.

-Trinseo and GMP to Establish a Recycling Plant in Europe

To produce recycled food-contact polystyrene material, anticipated startup in 2024

Trinseo ,a specialty material solutions provider, and GMP Group (GMP), a circular business innovations company in the Netherlands, announced jointly today their intended concerted efforts in further unlocking the circularity of polystyrene (PS).

Food-contact PS is an ideal material for food packaging, and recycled food-contact PS helps contribute to the circularity of packaging materials, especially when packaging waste remains a concern in many domains. (Photo: Business Wire)

PS is a common material used in numerous applications, including packaging and consumer goods. Microwave-chemical-recycling – PET-Resin

Food-contact PS is an ideal material for food packaging, and recycled food-contact PS helps contribute to the circularity of packaging materials, especially when packaging waste remains a concern in many domains.

Trinseo and GMP’s collaboration aims at providing a framework for cooperation, on an exclusive basis, the construction and operation by GMP of an advanced pretreatment or regeneration plant with a minimum 25kt capacity in the Netherlands. The plant will purify PS waste and deliver high-quality recycled PS pellets via the Super Clean recycling process. Microwave-chemical-recycling – PET-Resin

The anticipated startup date of the plant in the Netherlands is 2024. There is also an intended execution of a long-term tolling and off-taking agreement.

-July contract prices of paraxylene in Asia are denominated at USD1,350-1,380 per tonne

Major Asian paraxylene producers have announced their contract prices for the material for July shipments at USD1,350-1,380 per tonne, market sources told ICIS.

Prices have been nominated on the terms of delivery of CFR Asia.

Thus, the Japanese Idemitsu Kosan and the South Korean SK Global Chemicals (SKGC) announced their contract prices for the material at the level of USD1,350 per ton, CFR Asia, the Japanese Eneos Corporation – at the level of USD1,380 per ton, and the Indian Ril announced it at the level of USD1,390 per ton, CFR Asia.

Spot transactions for August shipments were USD1,275-1,276 per tonne, Taiwan CFR and/or China’s major ports as of June 29 compared to transactions priced at USD1,305 per tonne, Taiwan CFR and/or China’s major ports the previous day.

Earlier it was reported that major Asian producers of paraxylene announced their contract prices for material for May supplies at the level of USD1,250-1,300 per ton, which is USD50-70 per ton lower than the level of April contract price offers.

Paraxylene is a raw material for the synthesis of terephthalic acid, an intermediate for the production of polyethylene terephthalate (PET). Microwave-chemical-recycling – PET-Resin

-Eneos has set the July contract price of benzene in Asia at USD1,320 per tonne

Eneos (formerly JXTG Nippon Oil & Energy), part of Eneos Holding, a major petrochemical producer in Japan, has set the July contract price of benzene in Asia at USD1,320 per tonne, USD15 per tonne higher than the June contract price, a company source told ICIS.

The price was approved on the terms of delivery of CFR Asia.

In June, the company set the price of benzene at USD1,305 per ton.

Earlier it was reported that Eneos set the May contract price of benzene in Asia at USD1,180 per ton, which is USD15 per ton lower compared to the contract price of April.

Benzene is the raw material for the production of styrene, which, in turn, serves as the main raw material for the production of polystyrene (PS).

According to MrC’s ScanPlast, in the first four months, the total estimated consumption of polystyrene and styrene plastics in Russia amounted to 186.02 thousand tons, which is 1% less than the same indicator in 2021. Microwave-chemical-recycling – PET-Resin

In April, total estimated consumption was 41.49 thousand tons, which is 15% lower than the volume of consumption in April 2021.

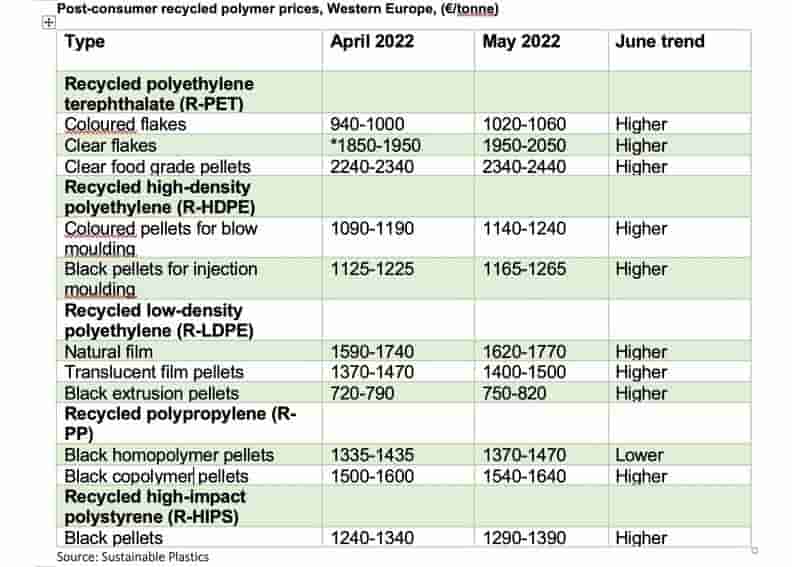

-Europe sees higher prices for recycled resins across the board

Limited availability and strong demand underpin upward price trend

Post-consumer recycled polymer prices, Western Europe, (€/tonne)

In May, all grades of recycled plastics sold in Europe saw price increases as a result of rising demand and limited supply. Material availability continues to be a major issue facing the sector. Microwave-chemical-recycling – PET-Resin

Indeed, Plastics Recyclers Europe has recently stated that “a lack of sorted plastics is undermining the businesses of European recyclate producers and the shortage is negatively impacting the operations of plastics recyclers across Europe.”

Recycled PET prices registered triple-digit price increases on continued strong sales. However, given such high recycled PET prices, some converters whose customers do not insist on using recycled material switched to virgin PET where prices had started to fall.

Recyclers of recycled high density polyethylene pushed through price increases of €40-50 per metric ton, recycled low density PE grades posted price hikes of €30-35/tonne and recycled polypropylene prices increased by €35-40/tonne. Recycled high impact polystyrene saw soaring demands due to sky-high standard HIPS prices, and recyclers were able to raise prices by €50/tonne.

There was sufficient material across most recycled plastics classes and types in May to fully meet demand from regular customers, although it was harder to find additional volumes required to serve new customers.

Demand was robust across all sectors, except for R-PET, where sales dwindled. The construction sector showed a significant increase in demand compared to previous months and the consumer goods sector was also very lively. The automotive sector has, however, not as yet awakened from the doldrums.

In June, recycled plastics prices are rising across the board, with the exception of R-PP homopolymer black. R-PET prices are rising at the fastest rate with triple-digit gains. Also showing significant gains are R-HIPS, up €70/tonne, R-LDPE natural film, up €60/tonne, and R-PP copolymers, also up by €60/tonne.

Recycled PET

In May, recycled PET prices continued on a strong upward trajectory amid a better-balanced market. Demand has however eased significantly as a result of the very high prices and the reduction in standard PET material. Meanwhile, supply of bottle scrap has improved with the start of the bottle making season and as more bottles are therefore being recovered. A higher volume of imported material was also evident.

PET recyclers were largely able to pass through their target price plans without much resistance in May. Clear food grade pellets and clear flake prices increased by €100/tonne compared to the previous month. Colored flake was in high demand and prices broke through the €1000/tonne barrier for the first time.

In June, PET prices are rising by triple-digit rates as strong demand meets limited availability. Microwave-chemical-recycling – PET-Resin

Recycled low density polyethylene

In May, higher scrap costs and rising energy prices led to a further increase in recycled LDPE prices. Natural film, translucent film pellets and black extrusion pellets posted price increases of between €30-35/tonne.

There was sufficient material to meet demand from existing customers but new customers often struggled to obtain material at short notice. Overall, demand continued at a solid level.

In June, recycled LDPE prices are rising further due to higher standard material prices and strong demand for recyclate from brand owners.

Recycled high density polyethylene

In May, recycled HDPE prices increased by €40-50/tonne with recyclers able to push through gains without much resistance from buyers due largely to a widening price gap with standard HDPE material and strong sales.

There was sufficient material available to serve regular customers although high quality grades were in shorter supply and more expensive.

High demand from the consumer gods sector and rising costs are supporting a further price increase in June.

Recycled polypropylene

Recycled PP prices increased between €35-40/tonne during May in a fairly balanced market. Overall, demand was very solid, especially given material shortages and the high primary PP prices. The automotive sector, however, continued to disappoint. Most regular customers were able to secure the material Microwave-chemical-recycling – PET-Resin

-PET recycling lessons can transform industry

Achieving circularity for plastic packaging is a big pursuit, but it’s possible. Let’s take a closer look at PET packaging, which is a prime example of effective plastic recycling.

PET is generally considered highly recyclable. In fact, PET beverage bottles are one the most recycled types of plastic packaging in the U.S., with billions of pounds of PET bottles – yes, billions – sent through a robust recycling system each year. There is a clear model for success here.

But to nurture a healthy planet for future generations, we need to demand more innovation and progress for plastic circularity. That call to action has materialized in The Recycling Partnership’s PET Recycling Coalition. We launched this coalition because we believe the next step in PET recycling evolution is the foundation for industry transformation. Enhancements made to PET recycling will provide the roadmap to help improve the system for all recyclable materials. Microwave-chemical-recycling – PET-Resin

In terms of deepening and broadening PET recycling, there are a few major opportunities. In today’s system, upwards of 15% of all the PET bottles that enter a MRF never come out the other side due to outdated and/or inefficient processes. We can confront this challenge head-on by implementing innovative sorting technology to capture even more material in the recycling stream. Additionally, we can increase the types of PET packaging that are accepted and sorted at recycling facilities. While clear, green and light blue bottles are the most recognized PET packaging, upwards of 25% of PET packaging doesn’t fit that description. There are established and emerging recycling opportunities for all the trays, clamshells, cups and opaque or pigmented PET items. Growing those opportunities and ensuring that more of those items can be recycled (today, only about half of the U.S. population can recycle PET trays, clamshells and cups) is another readily achievable way to increase recycling rates and complete the cycle of circularity by generating more valuable recycled PET for use in the manufacturing of new packaging.

-Showa Denko begins development of microwave-based chemical-recycling technology for plastics

Showa Denko K.K. (SDK; Tokyo) and Microwave Chemical Co., Ltd. (Osaka) have started joint development of a new microwave-based chemical recycling technology to directly transform used plastic into basic chemical feedstock. The two companies are implementing various steps to achieve carbon neutrality by 2050, and aim to commercialize the new technology soon. Microwave-chemical-recycling – PET-Resin

SDK and Microwave Chemical will aim to develop a technology that decomposes used plastic containers and packaging by irradiating microwave, thereby producing basic chemical feedstock such as ethylene and propylene. By the end of this year, the two companies will study conditions for formation of product through microwave heating, search for catalysts to improve the yield of targeted components, and try to optimize conditions and processes for decomposition to establish basic technology.

In the joint technology development, the two companies will use microwave heating, a kind of electric heating used also in a microwave oven. When an object is irradiated, microwave directly affects dielectric material, resulting in internal heating, selective heating and rapid rise in temperature. Compared with other heating methods, microwave heating is special in that it heats only the object. In the planned process, we will use microwave absorber (filler) to give energy in a focused way to used plastic, enabling efficient decomposition of used plastic into basic chemical feedstock. It will also reduce energy consumption for decomposition compared with conventional methods. Taking advantage of such characteristics of microwave heating, we will aim to transform used plastic directly into basic chemical feedstock with low energy consumption and high efficiency. Microwave-chemical-recycling – PET-Resin

SDK has been engaged in chemical recycling operations since 2003 at its Kawasaki Plant, producing clean hydrogen and ammonia through thermal decomposition of used plastic. As a result, SDK has accumulated overall know-how concerning procurement of raw materials, decomposition, and manufacture of final product. (Chart 2) With its high-level technologies and deep expertise in process development, Microwave Chemical has the capability to scale up microwave technologies. In the area of chemical recycling, the company has established “PlaWave,” a platform of microwave-based plastic decomposition technology, thereby dealing with various types of plastic.

Microwave-chemical-recycling – PET-Resin