Nylon6 HS chip chaos - Arhive

Nylon 6 HS chip: the chaos has just begun Nylon6 HS chip chaos

Recently, nylon 6 high-speed spinning chip market has seen continuous rising stocks, price declines in mixed conditions, reducing profits and so on.

Oversupply is more obvious against weak demand, while still many new projects are to be started in late market, including Yichen, Fangyuan, Luxi, Jinjiang and Shenyuan, etc. It is hard to strike balance in a short run in HS chip market, and for chip producers, the competition has just begun. Nylon6 HS chip chaos

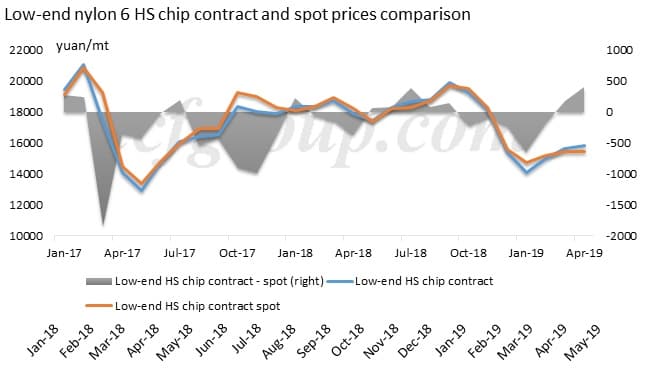

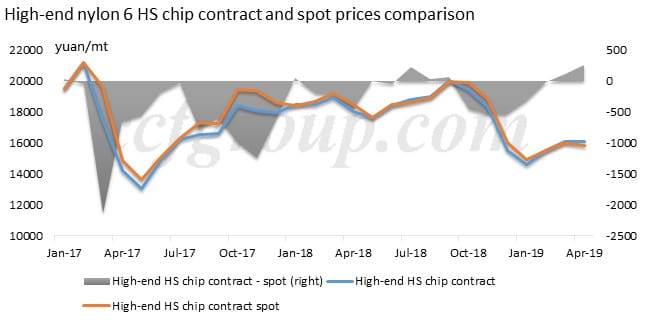

(1) Widening contract and spot price spread, contract trading fails

In April, low-end HS chip plants plans to cancel the discounts for contract buyers. For instance, Shenghong plans to raise the processing fee from 1,200yuan/mt to 1,500yuan/mt, and Meibang plans to raise form 1,450yuan/mt to 1,600yaun/mt. But demand for low-end DTY in Zhejiang and Jiangsu is sluggish, and filament plants are mostly suffering losses due to payment arrears or discounted sales. They already feel hard to strike balance at the cost of Mar contract, not to mention about Apr cost, when Sinopec’s contract price is evidently higher, and rising processing fee of nylon 6 chip will be a definite unacceptable term.

On the contrary, spot price of Luxi has continued to be low (minimum to 14,300yuan/mt, by cash, ex-works). Based on the evident contract-spot spread, and chip stocks in plants, nylon filament producers rarely purchased the low-end HS chip in contract form in H1 Apr. When Sinopec settles the Apr contract at 14,550yuan/mt, some filament producers choose not to purchase the contract chip. Therefore, contract trading in the beginning of the second quarter of 2019 is basically canceled.

As for high-end HS chip market, the contract trading is relatively stable. But with the rapid increase of new production capacity, some new plants offer more affordable levels to attract buyers.Nylon6 HS chip chaos

A new chip plant in Zhejiang, capable to produce around 210kt/year nylon 6 HS chip, has reduced their spot offers to 15,500-15,600 yuan/mt, 6 months payment, short-distance delivered. With 210kt/year capacity of nylon 6 semi-dull HS chip, it is a largest manufacturer in the country, and the sufficient supply of low-price spot cargoes has gradually broken the high-end HS chip market pattern. By mid-Apr, contract chip plants have cut their processing fee from 1,750-1,800yaun/mt to around 1,500yuan/mt, but still, the contract prices are as high as 16,000-16,050yuan/mt, 6 months payment, delivered, around 500yuan/mt higher than low spot. It is why filament plants are strongly resisting to purchase from contract suppliers. Nylon6 HS chip chaos

In fact, previous price advantages of contract nylon 6 chip have gone, in comparison with spot cargoes, and the advantage of “stable supply” under contract mode has become a new burden to filament makers, who are suffering inventory pressure.

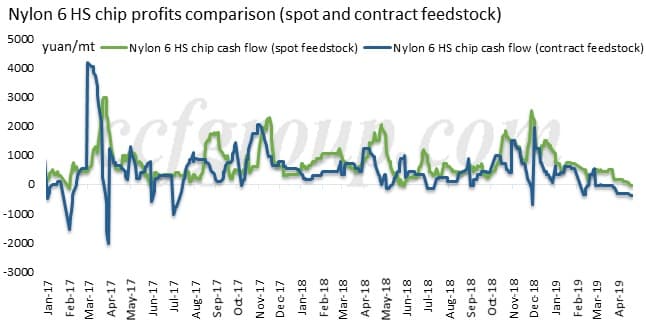

(2) The profit margin of nylon 6 chip has been significantly compressed, and rising supply surplus may lead to production cut.

So far, the profit of spot nylon 6 chip is near or below the break-even line, and it is hard to bear further price decline.Nylon6 HS chip chaos

It becomes a dilemma for nylon 6 chip plants, to lose buyers if cut production, or to lose profit if continue to produce and sell at low rates. In the fear of losing customers, still many chip plants with heavy inventory burdens continue production. But this situation may not last long, as downstream filament plants also faces quickly rising stocks and are considering cutting or have cut production. Finally, chip plants will be forced to curtail production.

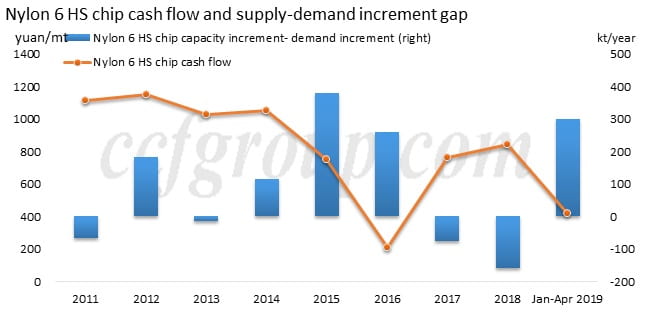

(3) Capacity expansion is still going on, and low profit or staged losses will become normal in the short term. Nylon6 HS chip chaos

Based on capacity increment of nylon 6 HS chip and actual increment in downstream consumption, there is a “supply-demand increment gap”. In 2011-2014, supply surplus of nylon 6 HS chip was not heavy and the profits were relatively high. In 2015-2016, profits quickly fell under rapidly expanding “supply-demand increment gap”. In 2015-2016, when “supply-demand increment gap” was revised down below 0, profits of chip had been evidently pulled up. Nylon6 HS chip chaos

Looking at the present, “supply-demand increment gap” in January-April 2019 is approaching the level of 2015. Before the end of 2019, at least 500kt/year of new capacity is planned to be put into production, and the gap continues widening. The overall profit of nylon 6 HS chip may be lingering around the break-even line.

Above all, the chaos in the high-speed spinning chip market is mainly due to imbalanced between supply and demand, especially the spot low-price impact of new investment projects.Nylon6 HS chip chaos

The market share of contract trading has dropped from over 80% last year to around 50%, and may fall further in the short run.

As the terminal demand keeps weakening and finally affects upstream sectors. First, nylon 6 chip plants may largely shut production under heavy stock burden, and this may force down CPL prices and gradually achieve a new balance. This new balance includes not only supply and demand volume, but also the re-distribution of profits. This circle may be repeated several times in this year.