Packaging-systems – Recycled-PE-PP 14-07-2022 - Arhive

Packaging-systems – Recycled-PE-PP

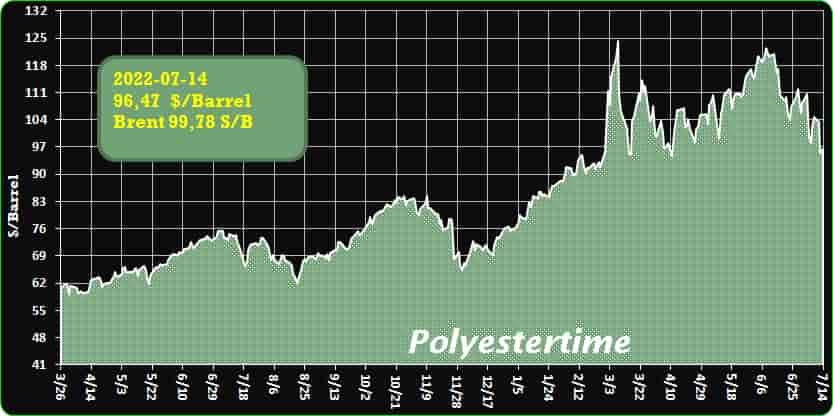

Crude Oil Prices Trend

-PET washing systems in demand

Herbold Meckesheim is satisfied with its results after IFAT 2022 in Munich. Despite the current economic uncertainties, the special machine builder has recorded a constant number of incoming orders. After many negotiations, the projects are now seen to get reality – almost 60 percent of these projects are located outside Germany. In addition to individual machine solutions, shredding technology and plastcompactors, dryers and, above all, complete plastic washing lines are the main areas of interest. In the case of the latter, film and PET washing systems continue to be in particularly high demand.

Herbold Meckesheim had focused on this with its range of information for the trade fair and placed washing lines in the spotlight. The hot washing for polyolefins was one of the product innovations presented at the fair. The common base of the recycling lines is a hydrocyclone stage with high density separation. Due to the controllable hot wash, the resulting recyclate qualities are suitable for its use in the food sector. The plant and machine solutions are tested and further developed in the company’s own technical lab, which is available for customer trials.Packaging-systems – Recycled-PE-PP

Messe München counted some 119,000 visitors during the five days of the trade fair – half of them from abroad, from 155 countries. 2984 exhibitors from 59 nations vied for visitors’ attention on the 260,000 square meters of exhibition space. The central theme of IFAT 2022 was the circular economy. Accordingly, Herbold Meckesheim had participated largely in the VDMA Plastics Recycling Theme World, which illustrated circular economy and plastics recycling with exhibits, film clips and recyclates at the booth of the Association of German Machine Builders.

The biggest event of the year is still to come: the K 2022 in Düsseldorf.

-PCEP increases 2025 recycled polyolefins target to 4m tonnes/year

The Polyolefin Circular Economy Platform (PCEP) has increased its voluntary plastic pledge to increase the amount of recycled polyolefins used in European products to 4m tonnes/year by 2025, the industry body announced in a press release.

This is an increase from its initial pledge of 3m tonnes/year made in 2018, which it said had been reached in 2021 according to its Polyolefin Material Flow Study.

The PCEP General Assembly has also approved a series of other pledges, which include

A 30% market share of the overall polyolefin market for recycled polyolefins by 2030. The PCEP estimates current market share at 10.5% as of 2021

The recycling of 60% of collected polyolefin packaging by 2030, which PCEP estimates at 28% as of 2021Packaging-systems – Recycled-PE-PP

The recycling of 50% total collected polyolefin waste by 2030, which it currently estimates at 50%

A review of targets every two years

PCEP has identified three enabling conditions to ensure its targets are met, which include:-

That all post-consumer polyolefin waste should be collected alongside other dry waste and sorted to standards PCEP will help establish

That all products and packaging across the supply chain should be designed in line with PCEP’s design principles

That product specifiers should make increasing recycled polyolefin content in their products a key strategic priority

PCEP also highlighted necessary changes to legislation to help enable increased recycled polyolefin use, including recognising all forms of recycling as counting towards recycling rates and recycled content targets.

Although not explicitly stated in the release, this is likely to refer to chemical recycling.

Current EU regulations typically use the definition of recycling set out in Directive 2008/98/EC, in which recycling is “any recovery operation by which waste materials are reprocessed into products, materials or substances whether for the original or other purposes. Packaging-systems – Recycled-PE-PP

It includes the reprocessing of organic material but does not include energy recovery and the reprocessing into materials that are to be used as fuels or for backfilling operations.” This leaves the regulatory status of chemical recycling under the proposals uncertain.

Nevertheless, many players in the market believe that chemical recycling may be the only viable rout to mass food-grade recycled polyolefin availability.

-Prime PE Prices Continue to Slide

PE and PP resin prices are squeezed amid falling monomer costs, lax demand, and growing bearish sentiment.

Spot resin market activity was a bit sluggish following the Fourth of July holiday, but by midweek a good flow of fresh off-grade and some Prime railcars rolled into the spot market. Sensing a challenging sales month ahead, resellers were looking to offload some of their July commitments.Packaging-systems – Recycled-PE-PP

Prime PE resin prices drop $0.02/lb

Prime polyethylene (PE) resin prices shed $0.02/lb last week, while $0.03/lb were squeezed from the polypropylene (PP) resin market at the PlasticsExchange trading desk, amid falling monomer costs, lax demand, and growing bearish sentiment. Many resellers and processors have been de-stocking their resin inventories to minimize exposure during this down leg of the resin pricing cycle, reports the PlasticsExchange in its weekly Market Report. Consequently, there is ongoing demand for quick shipments of packaged truckloads of resin, which helped to kick start the week, month, and quarter. Some of the sharply discounted off-grade PP railcars were also compelling to processors, who snagged some later in the week.

Spot resin market activity was a bit sluggish following the Fourth of July holiday, but by midweek a good flow of fresh off-grade and some Prime railcars rolled into the spot market. Sensing a challenging sales month ahead, resellers were looking to offload some of their July commitments.

Prime PE resin prices drop $0.02/lb

Prime polyethylene (PE) resin prices shed $0.02/lb last week, while $0.03/lb were squeezed from the polypropylene (PP) resin market at the PlasticsExchange trading desk, amid falling monomer costs, lax demand, and growing bearish sentiment. Many resellers and processors have been de-stocking their resin inventories to minimize exposure during this down leg of the resin pricing cycle, reports the PlasticsExchange in its weekly Market Report. Consequently, there is ongoing demand for quick shipments of packaged truckloads of resin, which helped to kick start the week, month, and quarter. Some of the sharply discounted off-grade PP railcars were also compelling to processors, who snagged some later in the week.

June PE resin contracts held flat, maintaining the $0.03/lb increase that was implemented in May. Despite more price increases on the table for July and August, PlasticsExchange writes that it might be difficult for sellers just to maintain current contract levels this month. PP contracts wiped away a solid dime in June, bringing the two-month drop to a hefty $0.17/lb. Polymer-grade propylene (PGP) monomer costs continued to erode, indicating another likely decrease for July PP contracts. While the market cools, the Gulf waters continue to heat up, and forecasters are still calling for a very active hurricane season.Packaging-systems – Recycled-PE-PP

-Six new partners join the Canada Plastics Pact and commit to tackling plastic waste

Canada Plastics Pact (CPP) has welcomed six new partners in Q2 of 2022 who are uniting under the CPP’s shared action plan to build a circular economy for plastics packaging in Canada.

New CPP partners include recyclers finding innovative ways to turn plastic waste into a resource for the circular economy, a leading grocery and fuel retailer, a government entity, and producer responsibility organizations.Packaging-systems – Recycled-PE-PP

The new signatory partners of the CPP are Aduro Clean Technologies, Co-op, and Heffco Elastomers Inc.

The new implementation partners of the CPP are the Government of Yukon; Recycle B.C., and Multi-Material Stewardship Western (MMSW).

“We are encouraged to see the growing interest from stakeholders across the entire plastic value chain and the broader ecosystem in Canada recognizing the work being done through our collaborative platform,” says Paul Shorthouse, Interim Managing Director, CPP. “We now have eight working groups that bring together the essential actors to tackle the key issues around plastic packaging waste and pollution, from the redesign of packaging, to making investments in critical collection and advanced recycling infrastructure, to supporting alternative models such as reusable and refillable packaging and compostables.”

It’s through the collaboration of diverse actors in the plastics industry that CPP is addressing one of the most pressing environmental issues of today. With approximately 90 partners, the CPP continues to work towards targets for circular plastic packaging in Canada.Packaging-systems – Recycled-PE-PP

-How bad is polyester filament yarn market compared with 2015?

Recently, some market players bear some questions in mind: how bad is PFY market now? How does it compare with history?

The operating rate of PFY, PSF and PET bottle chip plants is at 65.6%, 82.7% and 102.4% respectively now, with that of PSF factories under upward trend while that of PFY plants to fall further. The inventory of PSF is below 10 days but that of PFY has been above one month.Packaging-systems – Recycled-PE-PP

Last downtrend appeared near 2015 on PFY market. Price kept reducing and hit historic low in 2015, and PFY companies witnessed meager profit after inventory depreciated. The cash flow was during negative territory based on spot feedstock price. PFY producers cut operating rate with pressure from supply and demand, ending up with decreasing output and production value.

Compared with 2015, PFY factories saw more apparent pressure from inventory, profitability and supply in 2022.

The inventory of POY and FDY has been above 30 days for several months in 2022, hitting historic high, while the monthly high was only around 20 days in 2015.

-Eyes wide shut, EU industry faces energy efficiency reckoning

uropean industry has long failed to implement easy measures to reduce its energy use. As supplies become fraught and prices skyrocket, EU leaders seek to make it obligatory to reduce energy consumption by all means necessary.

In 2020, EU industry made up about 26% of the bloc’s final energy consumption.

As much of industrial energy demand is fed by fossil fuels, tackling industrial energy appetites has been a longtime policy goal in the shift away from pollutants. With energy prices sky-high and dependence on Russia on everyone’s mind, energy efficiency measures are receiving renewed attention.Packaging-systems – Recycled-PE-PP

At the end of June, EURACTIV wrote that energy efficiency was “the EU’s favourite fail.” Now, the tides may ever so slightly be changing. The most influential EU parties agreed on an ambitious target for energy efficiency, while the European Commission will present a plan to reduce energy demand on 20 July.

“The cheapest energy is the energy you never use,” explained a senior Commission spokesperson on 11 July. “The plan that we are working on, which will be announced in the middle of July, has more of a focus on industrial uses,” he added.

In Germany, the tide is changing as well. “A manager who does not implement efficiency measures now has to ask himself whether he is doing his job properly,” said Patrick Graichen, a top-level public official, in June.

Czechia too is seeking to make industry energy savings obligatory, the responsible minister said on Monday (11 July).

Industry, so far, has been largely reluctant to whole-heartedly engage with energy efficiency measures.

There are two narratives regarding energy efficiency in industry, explained Clemens Rohde, in charge of business energy efficiency at Fraunhofer ISI institute.

“On the one hand, the energy efficiency community has been pointing out considerable savings potential for years, on the other hand, the industry points out that it is subject to the market and is accordingly already geared towards efficiency.”

But in reality, energy efficiency measures had often been considered to be something negligible. Packaging-systems – Recycled-PE-PP

“Until now, energy costs usually only accounted for 1-2% of turnover, which is why they were often ignored,” said Rohde. With energy prices exploding, this has now changed.

“Energy costs have multiplied, which is why the issue has reached the boardroom and action is now expected,” he added.

Other associations dealing in industrial energy efficiency have noticed similar changes in the tides.

“Things are happening in the industrial sector,” said Andreas Guertler, director of the European Industrial Insulation Foundation (EiiF), whose association conducts company energy efficiency checks.

“At the moment, many companies where we carried out measurements years ago are coming forward and want to implement energy efficiency measures today,” he highlighted.

Now everyone wants to become more efficient and save energy. For companies, this is now also about strategic resilience; energy is no longer taken for granted, but is a strategic priority., Rohde highlighted.

The potential for savings is hard to estimate, especially in the short term. For thermal insulation in industry, EiiF is promising rather significant gas savings for relatively little effort.

-How plastic packaging can de-value perceptions of quality

Brand owners are being urged to embrace plastic-free packaging to avoid damaging the planet while also de-valuing their quality credentials.

According to Deloitte’s 2022 report on ‘Sustainability and Consumer Behaviour’, in the last 12 months, approximately 75% of consumers have recycled or composted waste whilst 64% of consumers have limited just how much single-use plastic they use.

However, despite notable changes in planet-friendly consumer behaviour, there are still amendments brand owners need to make to put the removal of plastic on the agenda

Luxury packaging provider Delta Global’s founder Robert Lockyer said: “Data such as this is proof that consumers’ needs and wants are changing, and it’s down to brands and businesses to ensure that these are being met.Packaging-systems – Recycled-PE-PP

If a consumer is actively avoiding using single-use plastic, but a brand is continuing to ship products using exactly that, then they’re not only going to lose customers, but they are simply de-valuing their brand.”

Lockyer explained: “A brand could provide the very best service or the highest quality product, but if they aren’t ethical, sustainable or at least recognised as trying to be, then the quality recognised elsewhere becomes obsolete.”

He added: “If a brand isn’t making those necessary changes to become more sustainable, or isn’t working towards a specific target, this is what it will become known for – irrespective of how popular or loved the products are.”

73% of consumers admit that they are willing to pay more for sustainable packaging, a number that reportedly rises to 83% among younger buyers

Other brands are innovating with fibre for secondary packaging. For instance, a recycled barley-straw six pack holder was introduced for the Corona beer brand and Saltwater Brewery based in Florida introduced an eco six pack ring called an E6PR, which has since been rolled out to a broad sweep of drinks companies to also use for their wares.

-Drinktec 2022: KHS will be presenting its latest machine and packaging systems

- Line Efficiency: KHS and Ferrum develop filler/seamer block

- Circular Packaging: PET bottle system for highly carbonated beverages

- Smart Operations: automated line changeovers boost system availability

- Reliable Services: digital systems improve machine efficiency

Experience the future of the beverage industry close up with KHS: at drinktec from September 12 to 16 the engineering company will be presenting its latest machine and packaging systems. The focus will be on the filler/seamer block SmartCan by KHS/Ferrum that provides clear benefits regarding hygiene, flexibility and simple operation. With its new Loop LITE PET bottle concept KHS is further helping to optimize the ecobalance of beverage packaging and promoting closed recycling loops. Furthermore, at its booth in Hall B4 the turnkey supplier will also be exhibiting a modular automation concept for PET lines plus its full range of services that include both on-site assignments and remote digital solutions. Packaging-systems – Recycled-PE-PP

After five long years, the wait is finally over: the beverage and liquid food industry can now again look forward to drinktec finally reopening its doors this September! Dr. Johannes T. Grobe, CSO of the KHS Group, is also eagerly anticipating the start of the trade show. “Messe München with drinktec is a close and indispensable partner for us. As the key innovative driver, this leading trade show enjoys a high standing in our branch of industry. True to this year’s KHS motto of ‘OUR PATH INTO YOUR FUTURE’, it’s the perfect platform on which to present our future-oriented systems and services to a large international audience.”

Dr. Grobe is especially delighted that drinktec can actually take place live in 2022. “In the past couple of years countless events have been canceled or staged in a purely virtual format. This was a difficult time for us all. Despite digital solutions, personal contact is essential. As one of the main exhibitors in Munich, we’re very pleased to be able to again welcome our customers and partners in person.”

Packaging-systems – Recycled-PE-PP