Petrochemical Biochemicals ShaleOil 06-01-2021 - Arhive

Petrochemical Biochemicals ShaleOil

Crude Oil Prices Trend

-Jindal takes over the Italian films of Domo (Italian Language Only)

The Indian group finds an agreement to acquire the Brianza-based company DOMO Films Solutions from the Belgian group, active in the production of BOPA and CPA.

Jindal Films, a company active in flexible packaging part of the Indian group Jindal, has signed an agreement to acquire from the Belgian group DOMO Chemicals 100% of the Brianza-based DOMO Films Solutions (DFS), based in Cesano Maderno (MB), specialized in production of polyamide films, produced by cast extrusion (CPA) and in double bubble with biorientation (BOPA).

The transaction, subject to a series of regulatory clearances, is expected to close towards the end of the first quarter of this year.

Founded in the early seventies under the name Caffaro, then in the SNIA group, DOMO Films Solutions over the years has specialized in the production of BOPA films, among the first to use “double bubble” extrusion technology. In 2002 it moved to the Bridgepoint Capital fund, changing its company name to CFP Flexible Packaging and, in 2014, it became part of the DOMO Chemicals group with its current name. With 110 employees, it produces 8,500 tons of BOPA film and about 5,000 t / y of cast film per year.

US chemicals and materials giant Dow (Midland, Michigan; www.dow.com) has announced the extension of its partnership with Kenyan recycling company Mr. Green Africa (Nairobi; www.mrgreenafrica.com) to further tackle plastics waste in the African country and advance a circular economy for plastics on the continent.Petrochemical Biochemicals ShaleOil

Dow first began working with Mr. Green Africa in 2019 to raise awareness about plastics waste and to invest in recycling initiatives and waste disposal solutions in Kenya. Approximately 30 t of hard-to-recycle flexible plastics waste is currently processed every two months through the waste stream established by the companies.

-Eurozone manufacturing makes continued gains in December

Eurozone manufacturing in December reached its strongest point in more than two years, according to the latest purchasing managers’ index (PMI) data released by IHS Markit on Monday.Petrochemical Biochemicals ShaleOil

All three market segments in the eurozone marked an improvement in operating conditions on November’s levels, but the rate of growth differed between segments.

Those producing investment goods recorded the strongest growth in operating conditions, followed by the intermediate goods segment, while consumer goods’ producers tracked marginal strength on the previous month.

Strength in upstream manufacturing highlights the relative buoyancy of the chemicals sector compared to other industries.

Manufacturing PMI in the eurozone has maintained growth above the 50.0 neutral-mark for sixth consecutive months, following the crash in the second quarter as lockdowns swept the continent

-Researchers transform CO2 into jet fuel

In the United Kingdom, Oxford University researchers turned carbon dioxide into jet fuel using novel, inexpensive iron-based catalysts – an organic combustion-synthesized Fe-Mn-K catalyst.Petrochemical Biochemicals ShaleOil

This catalytic process provides an attractive route not only to mitigate carbon dioxide emissions but also to produce renewable and sustainable jet fuel.

They prepared the Fe-Mn-K catalyst by the so-called Organic Combustion Method, and the catalyst shows a carbon dioxide conversion through hydrogenation to hydrocarbons in the aviation jet fuel range of 38.2%, with a yield of 17.2%, and a selectivity of 47.8%, and with an attendant low carbon monoxide (5.6%) and methane selectivity (10.4%).

Company is considering three locations in the northeast, and it should complete site selection in the first quarter of 2021 Petrochemical Biochemicals ShaleOil

Braskem, the largest polyolefins producer in the Americas and leading producer of biopolymers in the world, today announces its collaboration with Encina Development Group (“Encina”), a leading provider of solutions to produce renewable chemicals, to develop a long-term relationship enabling the production of circular, recycled polypropylene (PP).

Encina’s technology is able to produce renewable chemicals made from post-consumer plastic and the company is targeting to break ground on a new facility in the second half of 2021. Once completed, the facility is targeted to process 175,000 tons of plastic waste, converting it into more than 90,000 tons of recycled chemicals per year. The plant will be designed to expand to 350,000 tons of incoming plastic waste in future phases. Encina’s new facility will leverage its proprietary technology that economically extracts chemicals from plastic through catalytic pyrolysis. The process utilizes mixed plastics from post-consumer sources, which are currently costly to recycle and often destined for landfills.

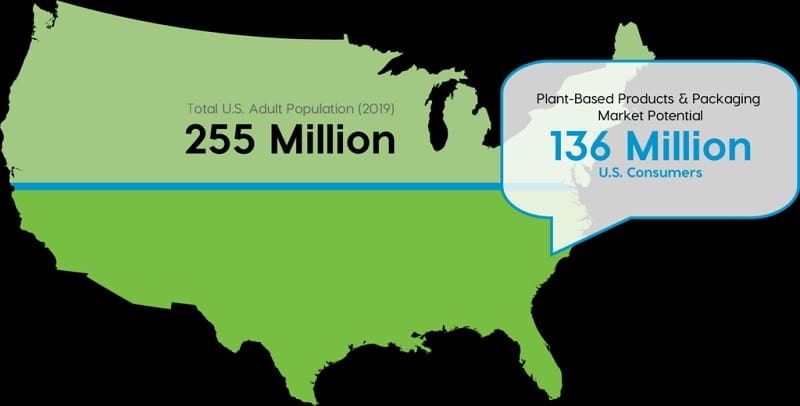

-New Research Reveals Massive Market Potential Exists for Plant-Based Products and Packaging

Majority of Consumers Receptive to Products and Packaging Made from Plants

New research out today from the Plant Based Products Council (PBPC) shows the majority of U.S. consumers are receptive to plant based products and packaging, with 54% viewing them favorably and 59% expressing interest. According to the report, the potential market size for plant-based products is estimated to be over 136 million U.S. consumers.

“There is clear consumer desire to support and promote innovation in the plant-based products and packaging arena,” said Jessica Bowman, Executive Director of the Plant Based Products Council. “PBPC and our members stand ready to embrace the opportunity to educate consumers on the many benefits of plant-based products as we work to guide the global economy toward more sustainable and responsible consumer products and packaging.” Petrochemical Biochemicals ShaleOil

In addition to being receptive, more than half (54 percent) of U.S. consumers are likely to purchase plant-based products in the next three months, with just less than half (49 percent) also self-reporting as likely to recommend these products to others.

- PX price slumps to record low

With the outbreak of COVID-19 pandemic, prices of petrochemicals plunged to record lows in the first quarter of 2020, as demand evaporated. WTI crude oil futures nosedived to record low of -$37.63/bbl on Apr 20 under supply glut. On Apr 22, Asian PX price slumped to refresh new low of $439/mt CFR China/Taiwan, a whopping drop of 93.6% from $850/mt CFR on Jan 6 2020. Petrochemical Biochemicals ShaleOil

- PX margins declines to new low

PX margins had been reducing since the last quarter of 2018, as China PX capacity expansion outpaced demand growth in recent years. PX-naphtha spread and PX-MX spread kept shrinking to hit record lows in 2020. PX-naphtha spread dropped to as low as $122/mt on Oct 9, and PX-MX spread to $44/mt on May 29. On annual basis, the average spread of PX-naphtha and PX-MX shrank to $198/mt and $88/mt respectively in 2020, down 48% and 54% year-on-year.

-Major events of China PP market in 2020

In 2020, for the PP industry chain, is destined to be an extraordinary year, from PP non-woven fabrics, to BOPP, and to PP raw materials, all of them perform wonderfully to varying degrees, and they are all in the limelight. Let’s briefly combs the operation of the PP industry chain in 2020 in chronological order.

Since late January, COVID-19 has gradually spread, and pandemic prevention measures have been implemented throughout China. Petrochemical Biochemicals ShaleOil

In February, under the pandemic, the transportation of logistics across the country has blocked on a large scale after the Spring Festival holiday, and the work resumption of enterprises have postponed. In terms of new start-ups, Zhejiang Petroleum & Chemical, Hengli Petrochemical II and Hebei Lihe Zhixin I have been put into production. As for the downstream, market price of meltblown nonwoven fabric surged, which have moved to 600,000yuan/mt. With the gradual control of the China domestic epidemic, the price have dropped to 300,000yuan/mt. In addition, Sinopec urgently built 10 production lines to produce meltblown nonwoven fabric.

-Ascend purchases Eurostar Engineering Plastics

Acquisition will expand Ascend’s flame-retardant portfolio and European footprint

Ascend Performance Materials has purchased Eurostar Engineering Plastics, a France-based compounder with a broad portfolio of flame-retardant engineered plastics and expertise in halogen-free formulations.

“Eurostar’s experience in compounded polyamides fits well within our own portfolio and manufacturing capabilities,” said John Saunders, Ascend’s vice president for Europe. “Their Starflam® materials are enabling the transitions to clean energy and transportation, and smarter devices.” Petrochemical Biochemicals ShaleOil

Last year, Ascend acquired the Italian firms Poliblend and Esseti Plast, as well as a compounding facility in China.

“We are following through on our strategy of becoming a more global, diversified and reliable supplier to our customers,” said Phil McDivitt, Ascend’s president and CEO. “While the past 10 months have been challenging, we have remained focused on providing our customers with the solutions and support they need to continue growing.”

-Recycled polyester threatened by China waste ban

PET from clear plastic water bottles is the raw material for recycled polyester

A ban on solid waste imports into China could mean more upheaval for the recycled polyester market, raising the spectre of supply bottlenecks and price increases.

A ban on all the import of all materials classified by the Chinese Ministry of Ecology and Environment as “solid waste” – including recovered fibre – came into effect on 1 January 2021. Petrochemical Biochemicals ShaleOil

Industry consultants fear this may end imports of high-end recycled polyethylene terephthalate (PET) flakes, which are especially valuable to make functional fabrics and footwear, as well as stuffed toys, pillows and cushions.

A partial import ban on solid waste was implemented in January 2018 and has already blocked large volumes of recycled PET flake imports – although high-grade recycled PET flakes were allowed back in in May the same year. The looming ban of all solid waste imports may reverse this regulative easing.

Use of recycled fibres in garments and footwear is seen as one of the key ways to achieve sustainability in the apparel industry, given that waste PET bottles create serious disposal problems as they are not biodegradable.

Petrochemical Biochemicals ShaleOil