Petrochemicals CrudeOil Oxodegradable PA 08-07-2020 - Arhive

Petrochemicals CrudeOil Oxodegradable PA

Crude Oil Prices Trend

-Chinese industry federation joins the Alliance to End Plastic Waste

The Alliance to End Plastic Waste (the Alliance) today announced a strategic partnership with China Petroleum and Chemical Industry Federation (CPCIF) to jointly promote the reduction and elimination of plastic waste in the natural environment in China, said Endplasticwaste..

The new partnership will bring together the Alliance’s 47 leading global member companies and the strengths of CPCIF to jointly formulate a strategic approach to identify and collaboratively implement local solutions in China to address the plastic waste challenge.

“No one country, company or community can solve the plastic waste challenge on their own. The Alliance believes in the collaboration of governments through public-private partnerships and long term commitment focused on acting locally through projects that address a city’s specific challenges,” said Jacob Duer, President and CEO, Alliance to End Plastic Waste. “We are excited to have CPCIF as our partner and endeavour to make a meaningful and valuable contribution to China’s national effort to eliminate plastic waste from leaking into the environment.”

![]()

-ExxonMobil expects lower prices, margins to hit second-quarter results

ExxonMobil says lower oil and gas prices could negatively impact its upstream earnings in the second quarter by up to USD3.1 billion compared to the first quarter of 2020, while its chemical segment earnings will be relatively stable, according to Chemweek.

The company advises in a US regulatory filing that the quarter-on-quarter change in chemical margins in the second quarter could impact its chemical segment earnings within a range of plus or minus USD100 million. It also gave the same financial range for the estimated effects of planned changes in scheduled maintenance on the chemicals business. ExxonMobil’s chemicals segment in May reported first-quarter earnings of USD144 million, down 72% year on year (YOY).

Lower refining margins could also hit its downstream earnings by up to USD900 million, according to the filing. In the first quarter ExxonMobil reported a downstream profit of USD1.3 billion.

-Pertamina to resume production at PP unit in Indonesia after unplanned outage

Pertamina is in plans to bring on-stream its polypropylene (PP) unit early this week, according to Apic-online.

The company undertook an unplanned shutdown at the unit on June 26, 2020, following an unspecified technical glitch at the upstream RFCC unit that causes a disruption of the propylene feeds. Thus, the unit is to remain shut for around 10-12 days.

Located in Plaju, Indonesia, the PP unit has a production capacity of 45,000 mt/year.

As MRC informed earlier, in May 2016, PT Pertamina and Russia’s Rosneft OAO signed a cooperation agreement that includes a plan to build a new oil refinery in the Southeast Asian nation. Pertamina, which hasn’t built a new refinery since 1997, will be the majority shareholder in the facility at Tuban, East Java. The two companies may invest USD12 billion to USD13 billion in the refinery project which includes a petrochemical unit, Dwi Soetjipto, president director of Pertamina, told a press conference after signing the accord.

-Brüggemann announces new heat stabilizers to overcome performance limits of polyamides

Brüggemann has added BRUGGOLEN TP-H1607 and BRUGGOLEN TP-H1805 to its extensive additive portfolio for polyamides.

These newly developed antioxidant blends allow polyamide materials to exceed current performance limits and offer exciting opportunities for the compounding industry.

BRUGGOLEN TP-H1607 is a proprietary copper based stabilizer package which significantly extends long term mechanical property retention of polyamides to limits unmatched by existing classic copper salt based anti-oxidants.

-KraussMaffei opts against the familiar and usual active participation in FAKUMA 2020

KraussMaffei has announced it is opting against the familiar and usual active participation in FAKUMA 2020 trade fair, should the event take place.

This is due to the ongoing situation surrounding the new Corona virus (SARS-CoV-2) and its adverse effects on daily life and business.

The company says for KraussMaffei, the FAKUMA is one of the most important platforms for showcasing new products, solutions and services for the plastics industry, as well as for meeting existing and prospect customers.

However, even under the conditions of strict hygiene and safety measures, KraussMaffei does see no viable way to offer its customers and service providers a satisfactory trade show experience. Unfortunately, the risk of infection, present for all attendees including our employees, could not be eliminated.

-European automotive recovery a distant prospect

While there is some discussion of a V- or U-shaped recovery for some sectors of the global economy in the latter part of 2020, this remains far off on the horizon for the automotive industry.

The sector is in worse shape than many others in the wake of the pandemic, and slower production levels, higher unemployment and weaker demand are propelling each other in a vicious circle and acting as a drag on the market.

Output levels have continued to track down and show no signs of stopping. The most recent data from the European Automobile Association (ACEA) shows that total registration of new vehicles in May dropped 44.4% from the previous year.

-Asia naphtha poised to stay afloat on demand support; margins up

Asia naphtha markets are poised to stay buoyant on steady end-user demand that could keep spot cargo premiums and prices afloat, even as rising coronavirus cases in the world rattle fuel demand.

Open-specification naphtha prices for second-half August delivery averaged at around $421.25/tonne CFR (cost and freight) at noon session in Asia, little changed from 6 July after prices gained 4% from the previous close.

Spot prices are at their highest in four months at above $400/tonne CFR Japan, since early-March, ICIS data shows.

-Europe ethanol, IPA, PMMA sheets are bright spots in gloomy coronavirus world

Before coronavirus hit Europe in earnest, officials advised that effective hand washing and common sense could avoid an epidemic in the region.

Four months later and with some European countries’ health systems unable to cope at the peak of the pandemic, the hand washing mantra was unable to avoid the worst but it did strike a chord among consumers.

Since March, Europeans have flocked en-masse to buy hand sanitizers, in turn making one of its components, ethanol, one of the few stars to shine in the gloomy European petrochemicals markets.

Unprecedented demand outstripping supply caused a spike in prices, and the European traditional ethanol market, consisting of industrial 99% and beverage 96% grades, is anticipated to remain critically tight for the remainder of 2020.

-Clariant catalyst helps Duslo turn plastic waste into high-quality winter diesel

Clariant and Duslo’s research institute VUCHT are transforming waste into wealth. Using a proprietary technique and Clariant’s HYDEX E next-generation hydro-dewaxing catalyst, VUCHT has successfully converted plastic waste into premium winter fuel distillate, according to Hydrocarbonprocessing.

The efficacy of this groundbreaking process has now been proven in a pilot plant in Slovakia. As plastics and fuels are both mainly composed of natural gas or crude oil, turning one into the other has major implications for sustainable and lucrative fuel production.

Stefan Heuser, Senior Vice President & General Manager at Clariant Catalysts: “Upgrading gas oil fractions to more valuable products has become essential for improving refinery economics. Clariant is committed to supporting this customer need through innovations such as HYDEX E. We are honored to partner with VUCHT in their pioneering plastic waste-to-winter diesel technology, and very pleased about the outstanding performance of our next-generation catalyst in the process.”

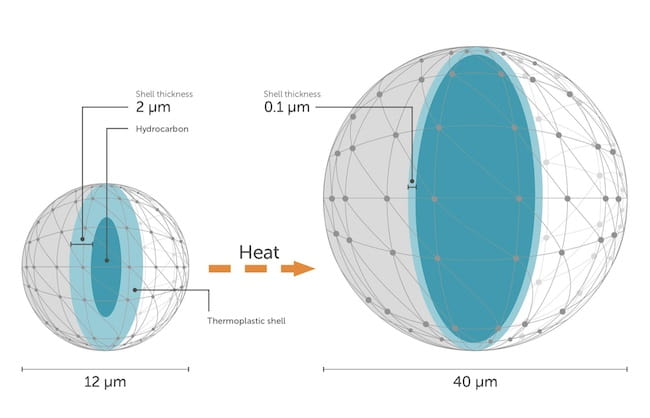

-The Next, ‘Natural’ Evolution in Thermoplastic Expandable Microspheres

Thermoplastic expandable microspheres (TEMS), launched in the early 1980s, are spherical particles that consist of a polymer shell that encapsulates gas. They are, in a sense, micro “balloons,” and upon heating, a tremendous volume and density change takes place.

This feature is a consequence of the tailor-made combination of:

- A thermoplastic shell softening at the glass transition temperature, and

- a blowing agent with a suitable boiling point (normally a hydrocarbon) simultaneously expanding when heated that, in turn, puts pressure on the shell walls. When inflated, this dramatic increase in volume of the microsphere makes it a great blowing agent, a filler providing surface effects, performance flexibility, and weight reduction.

TEMS are used in food packaging, elastomeric cool roof coatings, shoe soles, fiber and paper board, various applications in the automotive industry, and in products such as sealants, putties, and artificial marble. By combining monomers into various copolymers and the right blowing agent(s), expansion windows from 50° to 300°C can be achieved. Most commercially applicable products, however, expand around 100° to 200°C.

Petrochemicals CrudeOil Oxodegradable PA