Petrochemicals PE Covid19 CrudeOil 20-04-2020 - Arhive

Petrochemicals PE Covid19 CrudeOil

Petrochemical Polymers Chemical RPolyester Trend

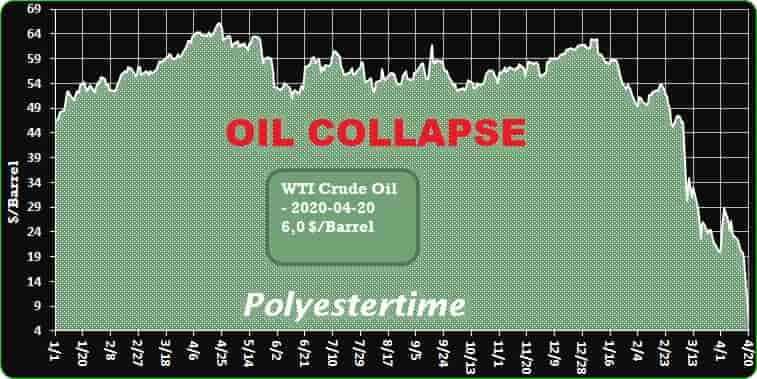

Crude Oil Prices Trend

-US crude oil price collapses as stocks near capacity

This morning’s collapse in the price of West Texas crude oil has left investors speculating whether US president Donald Trump might bail out the struggling shale industry, which has been decimated by the coronavirus crisis.

The US benchmark crude fell below $15 today, its lowest level in 21 years, amid fears that production would have to be halted due to storage space rapidly running out.

-The Oil Industry’s Recovery Lacks One Important Ingredient

The growing global oil and gas glut, partly caused by the coronavirus global lockdown but also due to mismanagement of the US shale sector and the OPEC+ price war fall-out, is causing mayhem in all energy sectors.

Most of the media’s attention goes to upstream oil and gas operators and financial institutions. As US shale companies drown in debt, bankruptcies are expected to pile up within the next months. US shale, offshore oil and gas operators and most non-OPEC producers are going to be struggling to keep some air in the balloon that was filled the last years.

In the next couple of months, due to OPEC++ production cuts and bankruptcies, a vast part of the overproduction will be removed, shrinking the glut to a much more acceptable level.

-Polymer inventories in China continue to fall

Polymer inventories in China are continuing to fall, signalling convertors’ return to resin buying after a months-long coronavirus-related lockdown in the country.

Inventories held by key state-controlled producers Sinopec and PetroChina were at 890,000t today, down by 100,000t from a week earlier, marking a fourth consecutive week of decline. Petrochemicals PE Covid19 CrudeOil

-Drastic demand for mask ear strap drives crazy nylon DTY market

A hot product appeared in recent gloomy nylon textile filament market- semi-dull nylon 6 DTY 140D/48F (i.e. double-strand nylon 6 DTY 70D/24F). This specification is one of the most regular products of nylon filament. The prices surged up greatly and supply was in extreme tightness. All that was because of the crazy demand for masks, or more specifically, mask ear strap.

- Why are mask ear straps suddenly so hot?

Due to the great outbreak of the coronavirus pandemic in China since February 2020 and the wide spread in countries and regions outside China since March, the global demand for masks has increased significantly. Petrochemicals PE Covid19 CrudeOil

-BOPP cut production on account of the bullish raw material PP

Recently, under the influence of intense speculation in fiber prices, the output of commodity-grade PP has been greatly reduced. PP futures rise to limited high continuously and PP price surges on the whole. However, the profits of downstream industry have been squeezed sharply. Take the most representative BOPP industry as an example, its profits have rapidly turned negative as PP price moves higher more than 3,000yuan/mt in nearly a wee Petrochemicals PE Covid19 CrudeOil

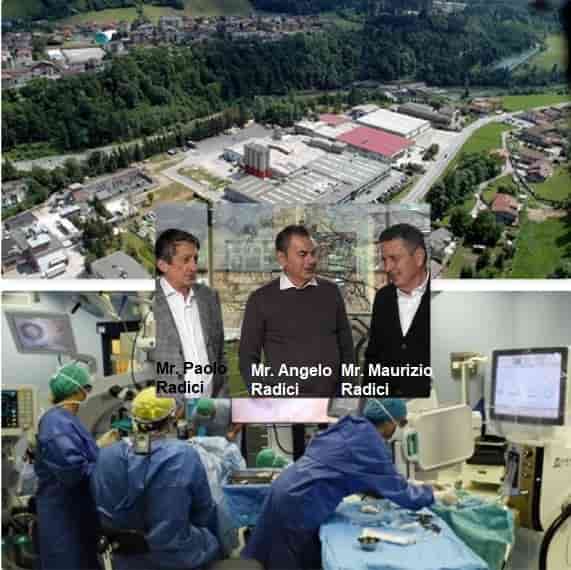

-Radici Group’s commitment to the fight against Covid-19 continues

Thanks to its know-how and experience in the production of high-performance materials, in the current difficult situation, Radici Group is continuing to prioritize operations to support the medical and healthcare industry for any standard production or development.

Radici Group is a manufacturer of a wide range of intermediate chemicals, polyamide polymers, technopolymers, synthetic and non-woven fibers. The strengths of the group are its chemical expertise, a vertically integrated European polyamide production, process control and the ability to provide tailor-made solutions for its customers.

It all started a month ago with the decision to produce lab coats for the Giovanni XXIII hospital in Bergamo. The raw material, the “non-woven fabric” is one of the company’s products, the fabric has been waterproofed and certified. Petrochemicals PE Covid19 CrudeOil

With the support of other local companies, protective equipment has been created for medical personnel

-Analysis: Is New Enzyme Technology Key to Solving Society’s Plastic Problem?

PET, or polyethylene terephthalate, comprises around 7% of the plastic we use today and is the fifth most commonly used plastic. It is used for a variety of purposes, but a common application is food packaging and plastic drinks bottles.

Although a lot of biodegradable plastics fall into the ‘polyester’ group, PET is quite difficult to break down. Enzymes that can break down PET have existed for a while, but were previously very inefficient. Petrochemicals PE Covid19 CrudeOil

-Tessutica produces furniture upholstery from recycled marine waste

Beaulieu International Group’s (BIG) Tessutica business has announced a new product line in upholstery. Greencare fabrics are created from pellets that come from marine plastic waste. The fabrics themselves can then be 100 per cent recycled into pellets again.

Karl Henderson, General Manager of Tessutica, said: “Greencare is our new collection with 100 per cent recycled and recyclable upholstery fabrics. It is certified under the Global Recycle Standard (GRS) label. We have engineered these fabrics with recycled yarns from regular post-consumer PET bottles from the oceans, landfills and upcycled cotton from garments.” Petrochemicals PE Covid19 CrudeOil

-Asia ACN loses 25% over 10 weeks; weak demand outweighs recent C3 gains

Asia’s acrylonitrile (ACN) prices have slumped by nearly 25% over the last 10 weeks on shrinking downstream demand amid the coronavirus pandemic, beating any uplift from recent strong gains in feedstock propylene (C3) market.

Spot ACN prices were assessed in the week ended 10 April at an average of $1,040/tonne CFR (cost & freight) China/NE (northeast) Asia, down by $55/tonne from the previous week, according to ICIS data.

Regional spot trades have been largely inactive, with buyers mostly relying on contract volumes.

Some end-users even reduced their contract volumes as they cut operation rates amid weak downstream demand. Petrochemicals PE Covid19 CrudeOil

-New sorting technology can help overcome recycling disruptions

The rapidly evolving effects from the coronavirus pandemic has governments and companies enacting unprecedented measures to protect lives and livelihoods.

Students are learning remotely and many are working from home, if at all. Meanwhile, some essential services workers are receiving increases to their hourly rates as hazard pay.

Deemed essential in many countries, the waste and recycling industries face virus-related impacts, as collection services and practices are being altered to protect workers. Receiving recyclable materials has a high rate of interaction with the public, and the recycling process often involves close worker interaction. Petrochemicals PE Covid19 CrudeOil

-Oil crashes below $19, falling to an 18-year low

President Donald Trump’s victory lap for convincing Russia and Saudi Arabia to cut production looks awfully premature.

President Donald Trump’s victory lap for convincing Russia and Saudi Arabia to cut production looks awfully premature.

US oil prices plunged another 8% Friday, finishing at a fresh 18-year low of $18.27 a barrel. At one point, crude dropped to $17.33 a barrel — the weakest price since November 2001.

The accelerating crash in the oil market reflects a realization that the record-setting OPEC+ output cuts aren’t nearly enough to offset the epic collapse in demand caused by the coronavirus crisis. Petrochemicals PE Covid19 CrudeOil

Petrochemicals PE Covid19CrudeOil