Petrochemicals Polyester Hydrogen 05-04-2021 - Arhive

Petrochemicals Polyester Hydrogen

Petrochemicals Naphtha PETRecycling PA Trend

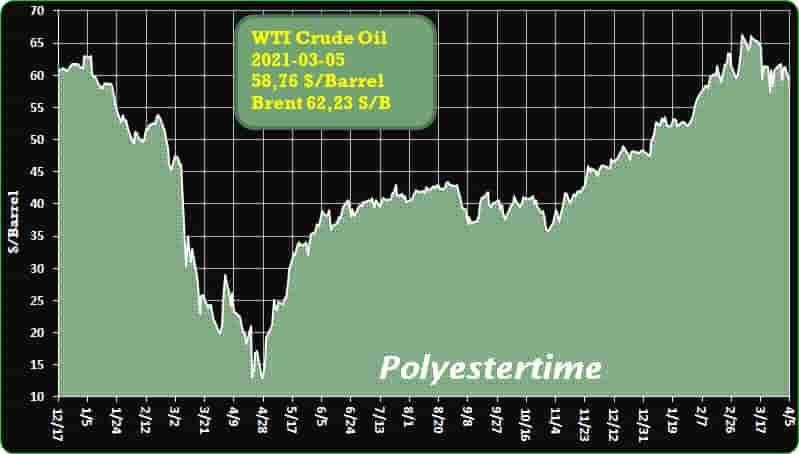

Crude Oil Prices Trend

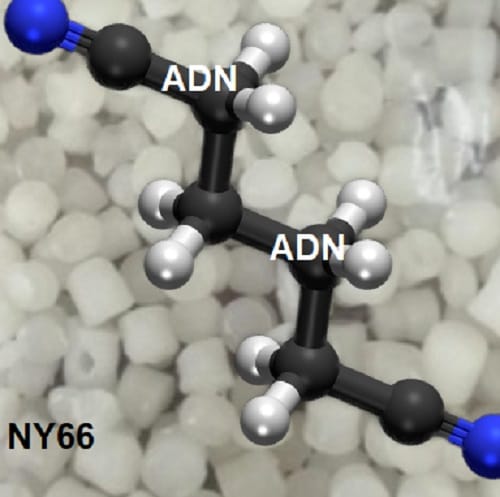

-ADN supply tension easing, nylon 66 chip sees a turning point

Nylon 66 chip price hiked on ADN supply crunch after the CNY holiday

The last week of March 2022 snapped the around two-quarter crazy increase in nylon 66 polymer prices in China, with China domestic prices consolidating at around 41,000yuan/mt, by cash, ex-works, and imported prices hovering around $4,300/mt CIF China, L/C at sight.

The price hike after the 2021 Chinese Lunar New Year holiday was directly buoyed by the news that Invista’s adiponitrile plant in Texas U.S. had stopped in the cold snap. The suspension caused huge impact on market mentality, as China’s ADN (the dominant intermediate to produce nylon 66 polymer) was heavily replying on imports, of which Invista took a significant proportion. Except for the supply issues, the nylon 66 industry was also on the upward swing as well as the overall energy and chemical market when the macro economic situation was facilitating prices up. In this period, most chemical products and downstream chemical fiber market were rising to different heights on the back of spurred crude oil prices in a moose monetary environment.

With both ADN and nylon 66 polymer imports restricted, supply of nylon 66 polymer became extremely tight. Suppliers only offered to their long-term cooperative customers, and traders with available stocks were selling even higher in the physical market. And downstream modified plastic plants still chased up to purchase at high rates, as they had expected the supply issue to last until April-May 2021.

-Plastic Mill recycles neglected small plastic waste

Korea is known for its high recycling rate, as most people in the country are familiar with basic waste-sorting practices separating general and recyclable waste. According to 2018 statistics compiled by the Ministry of Environment, Korea’s recycling rate is about 86 percent, which is one of the highest in the world.

However, experts say those numbers are illusory, because the ministry only counts the amount of recyclable waste collected. Petrochemicals Polyester Hydrogen

“After being collected, recyclable waste is sorted at a recycling plant or a materials recovery facility before actually being recycled. A sizable portion of the collected recyclable waste is classified as general waste at the facility as it falls short of the standard for recycling. The government’s statistics can’t tell how much of the recyclable materials are actually reused,” Hong Su-yeol of Resource Recycle Consulting said.

Companies throughout the nonwovens industry worked overtime to help save lives during the past 12 months Petrochemicals Polyester Hydrogen

During the past 12 months, the efforts of the nonwovens industry to help stop the spread of the Coronavirus and protect front line workers have been all encompassing. From the development of new materials to product donations to rapid investment in new capacity to meet global supply shortages of personal protective equipment, makers and converters of nonwoven materials moved quickly.

At the start of the pandemic, industry associations around the globe reached out to government officials to declare nonwovens a essential business, and as efforts move forward these same associations are urging that these bodies continue to support domestic manufacture of nonwovens and PPE going forward.

Last month, INDA, the Association of the Nonwoven Fabrics Industry, with a broad coalition of industry organizations and labor unions, representing a broad spectrum of manufacturers and workers who stepped up to make essential PPE and other products throughout Covid-19, sent a letter to U.S. President Joseph Biden and congressional leaders outlining recommendations on specific policy initiatives that must be adopted to re-establish a permanent PPE industry in the U.S.

Compounds with an additive that blocks bacterial and viral growth have been developed for extruded film applications.

Fluon+ EM-20010 from AGC Chemicals Americas is formulated from melt-processable copolymers composed of ethylene and tetrafluoroethylene (ETFE) along with a specialty additive that reportedly inhibits growth of the COVID-19 virus as well as other viruses and bacteria. The ready-to-use materials are suitable for coverings of high-touch surfaces such as walls, doors, and tables at hospitals, schools, office buildings, hotels, entertainment venues, and restaurants, said AGC. The compound is sold in pellet form and can be tailored to incorporate other resin systems or to meet a customer’s required antimicrobial properties. Petrochemicals Polyester Hydrogen

Plastic film laminates made with Fluon+ EM-20010 compounds are more cleanable and durable than other non-ETFE-based surface coverings, according to AGC.

-EU Makes a New Bet on Green Hydrogen

Green hydrogen to balance out volatile electricity generation from new renewable energy sources, integrate them into the energy system.

The European Commission has awarded the H2FUTURE project to a consortium made up of voestalpine, Siemens, VERBUND, and Austrian Power Grid (APG). Joining forces with them are research-partners K1-MET and ECN. The contract is for the construction of one of the world’s largest electrolysis plants for producing green hydrogen. Petrochemicals Polyester Hydrogen

The project partners will work and research cooperatively to develop an innovative hydrogen demonstration plant at the voestalpine site in Linz, Austria.

The project is based on a key assumption: both the industry at large and energy providers are confronted with serious energy policy challenges in Europe. The European Union’s (EU) climate and energy goals stipulate a 40% reduction of carbon dioxide emissions by 2030, which poses almost unsolvable problems for energy-intensive industries.

-Capacity expansion indicating outlook of direct-spun PSF in Q2

Direct-spun PSF has fallen back along with the quick decrease of polyester feedstock since Mar.

From the figure above, it can be seen that solid virgin PSF experienced the largest decline among the three products. In terms of the cash flow, all of them were compressed. Petrochemicals Polyester Hydrogen

However, HC virgin PSF will bear the brunt at first from the perspective of supply and demand despite relatively healthy cash flow.

Hengyi Hi-tech’s 50kt/yr and Zhejiang Shidai’s 30kt/yr HC virgin PSF units were put into operation in Mar and they were on trial at present. They will be in normal production from Apr. Ningbo Zhuocheng and Jinzhai Xinlun plan to launch 30kt/yr HC virgin PSF units respectively in May. Besides, there are more capacity expansion plans in the second half year. HC virgin PSF market will enter traditional slack season before Aug, and hence it will face supply length at that time. As a result, it will continue to squeeze re-PSF market by compressing the cash flow. If the inventory keeps rising, some plants may cut production.

On solid virgin PSF front, there is no capacity expansion plan at present. Shandong Chenghuijin will continue to improve production line in Apr, while other plants mostly run at full capacity, so there is no large room for supply to increase. In terms of demand, downstream replenishment demand exists in Apr, which is expected higher than that in Mar, but less than Feb. Therefore, solid virgin PSF has potential to rebound in Apr, but limitedly.

-Spot Resin Demand Sets Feverish Pace, Despite High Prices

Last week was, perhaps, the busiest in the spot resin market that the PlasticsExchange has ever experienced, reports the resin clearinghouse in its Market Update. High volumes of both polyethylene (PE) and polypropylene (PP) changed hands for prompt shipment as well as forward sales for delivery through April and May. Petrochemicals Polyester Hydrogen

A new wave of larger processors came to tap the spot market to supplement insufficient supplies allocated by resin producers, while others, previously repelled by sticker shock, came back to buy resin, as needed, according to the PlasticsExchange.

PE prices pushed another cent higher, while PP off-grade prices softened a bit amid better availability. Prime PP prices, however, snapped back up $0.04/lb after easing a tad during the first half of March. They ended the week just a penny below the peak levels seen during this massive rally. The market seemed to pause for a moment and some participants almost panicked, but after a day or so, with little Prime resin to be found, spot demand consistently re-appeared.

-Avantium proposes to re-appoint Tom van Aken as CEO

Avantium N.V., a leading technology company in renewable chemistry, announces that its Supervisory Board nominates Tom van Aken for re-appointment as CEO and member of the Management Board for a four-year term (May 2021 – May 2025).

The proposed re-appointment of Tom van Aken is subject to shareholder approval at the Annual General Meeting of Shareholders (AGM) that will be held on 19 May 2021.

Tom van Aken joined Avantium in 2002 as Vice President of Business Development. He later became Avantium’s Vice President of Global Marketing and Sales. In 2005, Tom was appointed as CEO. Prior to joining Avantium, he was Business Development Director at DSM Fine Chemicals, Inc. Tom has a Master’s degree in Chemistry from the University of Utrecht, the Netherlands. Petrochemicals Polyester Hydrogen

-US and Iran to initiate indirect treaty talks on April 6

- Vienna talks to include EU, Russia, China

- Iran will not directly participate, but talks could set roadmap

- Iranian oil volumes have risen in recent months

The United States will take the first steps toward indirect treaty talks with Iran on April 6 in Vienna as formal discussions begin with other nations involved in the 2015 nuclear agreement on how Iran can return to compliance.

While Iran is rejecting any direct talks for now without US concessions on lifting crude oil and other economic sanctions, the scheduled Vienna talks could lay out the road map for an eventual deal. Petrochemicals Polyester Hydrogen

The Biden administration has called former President Donald Trump’s so-called maximum pressure campaign a failure and President Joe Biden supports a return to something similar to the 2015 deal, but he has been clear that Iran must first take steps toward returning to compliance with the nuclear agreement.

The first public move toward any peace deal will be the Vienna talks with other nations involved in the 2015 deal, including European leaders, Russia and China, US State Department spokesman Ned Price said April 2.

“These remain early days, and we don’t anticipate an immediate breakthrough as there will be difficult discussions ahead. But we believe this is a healthy step forward,” Price said in a statement.

Petrochemicals Polyester Hydrogen