rHDPE-packaging – Gas-crisis – PX 12-12-2022 - Arhive

rHDPE-packaging – Gas-crisis – PX

-Polyester-DTY – Petrochemicals

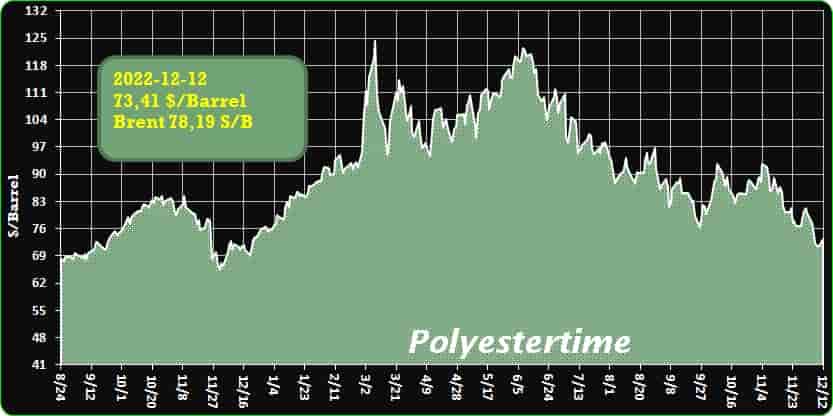

Crude Oil Prices Trend

Crude Oil Prices Trend Polyestertime

-Cadel Deinking becomes Keycycle Deinking

Keycycle fully integrates deinking process for printed plastics into product portfolio

Erema subsidiary Keycycle has acquired the trademark rights to the deinking technology pioneered by Spanish company Cadel Deinking. The process enables printing inks to be removed from the surface of plastics, making these more suitable for recycling.

The companies have already been collaborating intensively for two years and have several deinking lines in operation at customers’ sites, where they are used in processing printed in-house and post industrial film waste.

The process developed by Cadel is an environmentally friendly one: water-based chemical ingredients dissolve the ink from the surface of the shredded film or regrind material, after which the material is fed into the recycling extruder. Of the eight plants ordered since the market launch, five are now in operation at customers’ sites.

“We have already been exclusively responsible for the worldwide distribution of this patented technology since January 2021, including the operation of the pilot plant together with Cadel in Sant Vicente del Raspeig, in Alicante,” said Keycycle managing director Michal Prochazka. “We are now taking the final step of integrating this process technology into our product portfolio.” rHDPE-packaging – Gas-crisis – PX

He added that the product not only delivers ‘top quality,’ it now also meets industrial standards. The latter refers to the newest deinking line present at K 2022, with a throughput of 1,200 kilograms per hour. Such large scale capacities make the process suitable for application in the post consumer recycling segment, where the removal of printing inks will represent another significant quality upgrade for recycled pellets.

Following this acquisition of the Cadel Deinking brand, Keycycle will continue to develop the technology. It will be marketed under the Keycycle Deinking brand.

The Cadel company will continue to operate as Cadel Recycling Lab, dedicated to its core competence of developing new innovative technologies for plastics recycling plus laboratory and software techniques for decontamination assessment.

-Alpla announces100% rHDPE prototype beauty care packaging

A new prototype packaging system developed by packaging manufacturer Alpla promises a reduction in carbon emissions by 71 percent compared to conventional HDPE, the company has said. Called Canupak, it is an ultralight, 100 percent recyclable bottle weighing in total just 14 grams and specifically targeted at the beauty care sector

The recycled HDPE used to produce the bottle is sourced in full from the company’s own plants in the EU and produced exclusively using renewable energies. The project is aligned with the company’s aim to reduce emissions gradually and to expand its expertise in regards to sustainability across the board, from ‘processes, from design and production through to logistics’. “The carbon-optimised Canupak is the next milestone on the path to the sustainable packaging of the future,” said Karina Pölzl, Innovation Project Manager at ALPLA. rHDPE-packaging – Gas-crisis – PX

The carbon footprint of the prototype packaging was calculated in cooperation with ClimatePartner and encompasses all the emissions throughout a product’s life cycle, including its disposal.

According to Alpla, no clear standards currently exist for climate-neutral products and offsetting certificates, and ALPLA is therefore focusing on reducing emissions within its own sphere of influence, by focussing on further product optimisation and on achieving maximum recyclability based on design for recycling.

“There is increasing demand for sustainable products – among our customers as well as the end consumers. Carbon-optimised packaging has a key part to play here,” added Alpla CEO Philipp Lehner.

Next to undertaking projects in the carbon-optimised packaging space, the company is also investing in sustainable projects, renewable energy and the circular economy. Alpla’s packaging will be fully recyclable by 2025, with post-consumer recycled material accounting for 25 percent of the materials processed, the company said, and it is investing €50m a year in recycling activities to this end.

-War in Ukraine, gas crisis

The war in Ukraine first caused oil price volatility, which increased as surging COVID-19 cases in China led to fresh lockdowns, hitting demand and disrupting supply chains. China is the world’s second biggest economy and largest oil importer.

Now Russia’s decision to reduce flows of natural gas to Europe means the continent has entered a winter of potential rationing, which could hit chemical production. Tightened supply has also sent gas prices soaring, with high costs forcing production cuts, especially in fertilizers.

India is facing a shortage of fertilizers and edible oil amid wide-ranging trade disruptions as the Ukraine war rages on, with financial sanctions tightening on Russia.

Europe’s energy challenge is immense and put into stark relief by the response to Russia’s war in Ukraine. Cutting the ties that bind EU and non-EU nations to Russian gas and oil will be extremely painful this year and in years to come.

This topic page examines the impact of the Ukraine conflict on oil, gas, fertilizer and chemical markets. rHDPE-packaging – Gas-crisis – PX

GAS SUMMARY

- Gas storage over 90% in Europe, winter demand will be 30% higher than rest of year

- Record shipments of liquefied natural gas (LNG) to Europe so far in 2022

- LNG plus Norwegian, Algerian, Azerbaijani pipeline imports compensate for Russian supply shortfall

- Europe LNG processing operating at full capacity

- Nord Stream I and II pipelines damaged by explosions, zero flows to Europe

- EU implements voluntary 15% cut to consumption, industry may face much tougher reductions

AMMONIA SUMMARY

- Russia supplies 20% of global seaborne ammonia market

- Disrupted supply has pushed up fertilizer and food prices

OIL SUMMARY

- Friendship oil pipeline flows through Ukraine

- Russian oil feeds around a quarter of Europe demand

- Europe seeks to end reliance on Russian crude oil

- EU agrees ban on seaborne imports from 5 December 2022, petroleum products from 5 February 2023

- From 5 December Russian crude oil cargoes will only be insured if subject to price cap

CHEMICALS SUMMARY

- High Europe gas, electricity prices force capacity closures

- Volatile oil and feedstock prices dent chemical producer margins

- Elevated oil, gas prices dent consumer confidence and demand

- Prospect of recession, more cheap imports from Asia

- CEOs plan now for winter gas rationing

Europe is heavily reliant on Russian gas and exposed to disruptions in supply, but Russia is also an important oil exporter and a supplier of fossil fuel products, which find their way to international markets via Ukraine’s ports. rHDPE-packaging – Gas-crisis – PX

Sanctions and measures against Russian exports of oil and gas have sent shockwaves across the global economy, lifting the cost of living, impacting industrial and agricultural production and potentially leading to social unrest.

How vulnerable are energy and energy-related Russian supplies to disruptions?

Europe has historically depended for close to 40% of its annual gas consumption on Russian supplies, imported via four routes – Ukraine, Belarus-Poland as well as the Nord Stream 1 and TurkStream corridors linking Russia to Germany and Turkey via the Baltic and Black Sea, respectively.

Overall Russian pipeline supplies were limited throughout 2021, and since the beginning of this year producer Gazprom has shipped only one-third of the gas that it was expected to deliver to European consumers via Ukraine as part of a five-year transit agreement.

Russia has banned exports of gas to several EU countries, and the Nord Stream I and II pipelines have been damaged. European petrochemicals players face even higher gas prices as a result. Fertilizer companies – where gas can account for 80% of costs – have been forced to curtail production. Chemicals are also now affected, especially those with high exposure to gas prices through utilities or feedstocks.

If the conflict escalates, Ukraine transit pipelines may come under attack but disruptions could be limited because the infrastructure has been built to grant flexibility, allowing the operator to reroute flows away from potentially damaged segments.

AMMONIA IMPACT

The Togliatti-Azot pipeline, the world’s longest ammonia pipeline stretching 2,471km from the Togliatti Azot plant in Russian Samara Oblast to the Ukrainian Black Sea port of Yuzhny, could be caught up in the cross-fire. Russian ammonia supplies account for around 20% of the global seaborne merchant ammonia market each month.

Around two thirds of those volumes are exported via Yuzhny, with the rest reaching European and global markets via Baltic ports. Ammonia is a prime material for fertilizers, so curtailments could potentially lead to higher food prices and shortages.

Ammonia market players are scrambling to cover positions and assess options as the Russian invasion of Ukraine saw loadings at the key export hub of Yuzhny halted with immediate effect. rHDPE-packaging – Gas-crisis – PX

Russian nitrogen fertilizer major Togliatti confirmed the suspension of the transit of ammonia to the Black Sea port via pipeline to ensure the safety of people living in the vicinity of the lengthy conduit.

OIL PIPELINES VULNERABLE

Supplies on the world’s longest oil pipeline, the Friendship (Druzhba) pipeline, could be threatened if the conflict leads to tough sanctions. The pipeline carries oil from central Russia 4,000km west to Ukraine and Belarus and runs close to the Belarus-Ukraine border. Russia exports around 5m bbl/day, of which half are exported to Europe, including via this pipeline.

Russian oil accounts for about a quarter of Europe’s consumption, with the Druzhba pipeline carrying close to 1m bbl/day. Should sanctions be imposed and exports hindered, Europe will need to secure alternative cargoes from the global market.

Europe consumed most exports of Urals, Russia’s biggest export grade, in 2021 after Saudi Arabia boosted market share in China. Almost 10m tonnes of Urals went through Rotterdam in the first half of last year, up 2m tonnes on 2020.

Germany stands most exposed because it gets 25% of its oil from Russia.

CHEMICALS IMPACT

Gas and electricity are important components in the production costs of many chemicals. Surging gas and feedstock prices in Europe have caused big hikes in contract and spot prices. Now millions of tonnes of fertilizer and chemical capacity are offline in Europe.

-Researchers Develop Strong, Durable Bio-based Polyester

Simple method overcomes low reactivity of bio-based secondary material, resulting in high-molecular-weight polyester with mechanical and thermal properties that, in some cases, outperform fossil-fuel-based materials. rHDPE-packaging – Gas-crisis – PX

Researchers in the Netherlands have developed a method that enables the production of a strong, durable bio-based polyester. A simple synthesis strategy used by the Industrial Sustainable Chemistry group led by Prof. Gert-Jan Gruter at the University of Amsterdam reportedly overcomes the inherent low reactivity of bio-based secondary diols, resulting in a polyester with good mechanical and thermal properties as well as a high molecular weight. The research is described in a paper published in Nature Communications and an article on the University of Amsterdam website.

In general, polyester plastics are synthesized from small dialcohol and diacid molecules, explained the article on the university site. These monomers are coupled in a condensation reaction, resulting in a long polymer chain of molecular building blocks in an alternating fashion. The material properties result both from the number of building blocks that make up the polymer chain, and from the inherent properties of the monomers. In particular, their rigidity is key to a firm, strong, and durable plastic.

To achieve a bio-based material with similar properties, glucose-derived dialcohol isosorbide showed promise, as it has a very rigid molecular structure and is already industrially available. However, isosorbide is rather nonreactive, and in the past two decades it has proven quite challenging to obtain useful isosorbide-based polyesters, according to the article. It was nearly impossible to arrive at sufficiently long polymer chains (to achieve a certain ductility) while incorporating sufficiently high amounts of isosorbide (to arrive at a strong and durable material), it noted.

Daniel Weinland, PhD, first author of the paper in Nature Communications, and his colleagues found a solution by incorporating an aryl alcohol in the polymerization process. This leads to in situ formation of reactive aryl esters and a significant enhancement of end group reactivity during the final stage of polyester synthesis when the isosorbide’s low reactivity inhibits chain growth in traditional melt processes. As a result, high-molecular-weight materials could be produced with incorporation of high fractions of the bio-based, rigid secondary diol, even up to 100 mol%. For the first time, said the researchers, high-molecular-weight poly(isosorbide succinate) can be produced, the polyester obtained from isosorbide and succinic acid. The resulting strong plastics outperform existing plastics like PET in terms of heat resistance, an important attribute when washing re-usable bottles typically at 85°C (185°F). The isosorbide-based polymers also show promising barrier and mechanical properties that can outperform common fossil-based materials, according to the researchers. rHDPE-packaging – Gas-crisis – PX

The novel polymerization approach described in the paper is characterized by operational simplicity and the use of standard polyester synthesis equipment, noted the article on the university site. It suits both existing and novel polyester compositions, and the researchers foresee the application of similar methods in other classes of polymers, such as polyamides and polycarbonates.

This research was carried out within the RIBIPOL (Novel Rigid Bio-based Polyesters for potential large scale applications) project funded by the Dutch Research Council NWO with contributions from industry.

-US EPR adoption to drive up plastic recycling rates over time

The adoption of extended producer responsibility (EPR) laws in more US states will drive up plastic recycling rates over time, a consultant said.

“We’ve seen over the last 20 years a real explosion in the use of EPR as a policy tool for packaging and paper products [PPP]. It was in the EU and has now expanded to most of the industrialised world and starting to take hold in the US as well,” said Resa Dimino, managing principal at consultancy Resource Recycling Systems (RRS) and managing partner at RRS subsidiary Signalfire Group.

“We’ve come to the realisation in the US that our recycling system needs a stable and secure funding source,” she added, noting that China’s ‘National Sword’ policy exposed the fragility of the US recycling system. rHDPE-packaging – Gas-crisis – PX

China’s National Sword policy in 2017 banned imports of plastic waste and other waste, forcing other nations to deal with their own waste issues rather than exporting the problem.

Dimino spoke at the ICIS Recycled Polymers Conference in Atlanta, Georgia, US.

EPR is a policy approach where producers of a product or package – namely the brand owners rather than converters or resin producers – take responsibility to manage that product or package at the end of its useful life, explained Dimino.

The responsibility can be financial or operational, or often a combination of both, she added.

MOMENTUM BUILDING

In the US, EPR laws have been passed in four states so far: California (2022), Colorado (2022), Oregon (2021) and Maine (2021), with others having introduced legislation.

“We think most of these states are going to be active as we move into 2023 – states like Washington, New York, Minnesota, New Jersey and Maryland will all have very active EPR debates,” said Dimino.

Municipalities are not a resilient funding source for recycling, she argued, pointing out that when costs change dramatically, they are not ready to cover these costs.

US recycling rates have also been stagnant or dropping in recent years, she added.

“Clearly what we’re doing is not working…It’s not delivering the material needed,” said Dimino.

ROLE OF THE PRO

Typically, EPR programmes are managed by a producer responsibility organisation (PRO) – an entity created to fulfil the obligations of multiple producers – so that the municipality doesn’t have to deal with getting reimbursed by multiple individual brand owners, she explained.

The PRO essentially manages the recycling programme, coordinating among all the players in the chain – recycling service providers, waste haulers, material recovery facilities (MRFs), local governments, end markets and processors to achieve results. The brand owners pay fees into the PRO to fund it.

Thus, the government moves to the side, although the extent of participation differs state by state. rHDPE-packaging – Gas-crisis – PX

NOT A RATIONAL ECONOMIC MARKET

“You have municipalities who really don’t see their job as sitting at the beginning of a supply chain. They see their job as serving their residents to make sure recyclables are collected, so they may or may not be doing a serious job of playing their role in the supply chain,” said Dimino.

“When we have such high demand [for recycled plastics], it’s really critical to understand that municipal recycling is not a rational economic market – it’s not a supply/demand market. You can pay more but you’re not going to get more. Why is that? The municipality is not a rational economic actor,” she added.

While a brand owner may pay more for post-consumer resin (PCR) to a converter and a converter may pay more for PCR to the reclaimer which goes back to the MRF in terms of the bale price, the municipality may not see any of that revenue, she explained.

Plus, no financial signal goes to the consumer to compel them to recycle.

“When I’m in my kitchen rinsing out my HDPE [high density polyethylene] milk jug, I’m not likely to be thinking, this is worth $1/lb – I better put this in my recycling bin. That message is not getting across and it’s not driving people,” said Dimino.

EPR has been proven to drive up recycling rates wherever it’s been implemented for packaging around the world, according to a study conducted by the RRS for the state of Oregon.

“Where we could find comparable pre- and post-programme data, in every instance we found an increase in the recycling rate,” said Dimino.

ERP programmes will also take some time to make an impact, the consultant noted.

“For those of you that are looking for materials to come through these programmes, you won’t see any additional funded collection until 2026 or 2027, but the processes are starting already,” said Dimino. rHDPE-packaging – Gas-crisis – PX

KEY OBSTACLES

The key obstacles to implementing EPR more widely include entrenched interests in doing things the way they’re done now, along with hesitancy from brand owners to shoulder additional costs and the view that it’s the government’s job to ensure efficient recycling systems, she said.

“In any substantial change, there are going to be winners and losers, and no one wants to be a loser. So, it’s easier to keep things the way they are,” said Dimino.

-November contract prices for paraxylene in Europe still not agreed

November’s contract prices for paraxylene in Europe have still not been agreed on amid weak demand and lower prices in Asia, ICIS said.

According to market sources, negotiations between one major buyer and one of its regular European suppliers are ongoing. rHDPE-packaging – Gas-crisis – PX

Sources mentioned the initial agreement in which this consumer is trying to achieve a lower price for November due to weak demand from the purified terephthalic acid (TFC) sector, as well as the fall in paraxylene prices in the Asian market recently.

According to some sources, lower costs of mixed xylenes and lower energy prices in October and November will also put downward pressure on price discussions in Europe.

While manufacturers have significantly reduced load rates in recent months, availability is not an issue as orders from end users have also declined sharply.

Some market participants also mentioned the possibility of agreeing on a joint settlement for November and December in the coming days, similar to what happened with the calculation of the September and October contracts.

Earlier it was reported that the participants in the negotiation process to agree on the December contract prices of paraxylene in Asia could not reach an agreement for this month. Sellers’ offers were at USD1,000-1,070 per tonne, CFR (cost and freight) Asia versus buyers’ offers at USD800-850 per tonne, CFR Asia. This is the twelfth time this year that no agreement has been reached.

According to the ScanPlast review, the estimated consumption of PET in September of this year increased by 32% compared to a year earlier and amounted to 78.81 thousand tons. According to the results of the first nine months of this year, 621.61 thousand tons of PET were processed in Russia, which is 1% more than the same indicator in 2021.

rHDPE-packaging – Gas-crisis – PX