Saudi Dilemma: Output Boost Could Hurt Its Oil-Based Economy – Saudi Dilemma Output Oil Based Economy - Arhive

By Mohammed SergieSaudi Dilemma: Output Boost Could Hurt Its Oil-Based Economy

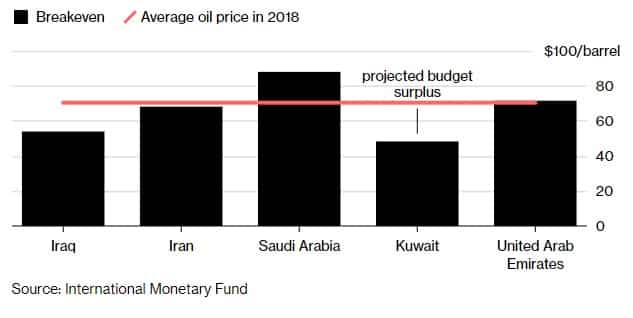

- Kingdom needs $87.90 a barrel oil to balance budget: IMF

- Most top OPEC members are in surplus or close to it at $70 oil

Saudi Arabia’s plan to halt the oil-price rally could hurt its economy, depriving the kingdom of billions of dollars in income that it needs more than many other OPEC members.

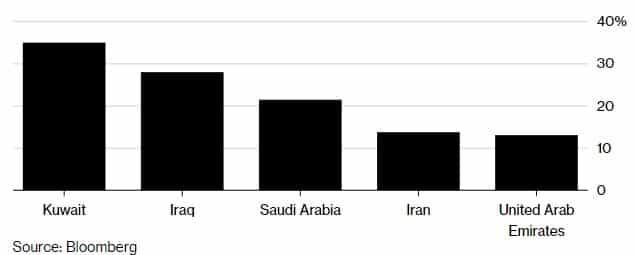

Although the country’s economy isn’t the most reliant on crude exports among the group’s five biggest producers — Kuwait gets that distinction — Saudi Arabia is the only member that will post a significant budget deficit despite higher-than-expected oil prices this year, according to Bloomberg calculations based on International Monetary Fund data.

A decline of just one dollar in average prices this year to $69 a barrel would wipe out any financial benefit for the kingdom if it boosts exports by about 500,000 barrels a day, according to the calculations.

Saudi Arabia has to juggle competing interests in this week’s meeting of the Organization of Petroleum Exporting Countries: maximizing oil revenue (without crimping demand), and placating its close ally U.S. President Donald Trump who blamed the group for sending oil prices “artificially Very High!” The kingdom’s plan to phase out 18 months of production cuts faces opposition within OPEC, starting with Iran, Iraq and Venezuela.

The Saudis are targeting an increase even though higher crude prices could boost the valuation of Saudi Aramco, the world’s biggest oil company, if the government carries out a planned initial public offering next year.

“Saudi Arabia benefits from higher oil prices but is pushing a plan that can drive them lower,” said Ziad Daoud, chief Middle East economist for Bloomberg Economics. “This paradox can’t be explained by economic interests alone.”

Crude Crutch

The contribution of oil exports to GDP for the top 5 OPEC producers

While Saudi Arabia wants to increase production to thwart shale oil’s expansion and spur demand for crude, it also wants to avoid Trump’s wrath, putting Riyadh in a bind to find a price suitable for everyone.

Read: Saudis More Confident OPEC Will Agree to Oil-Supply Increase

Here are some other economic indicators that could influence decisions at OPEC’s June 22 meeting in Vienna:

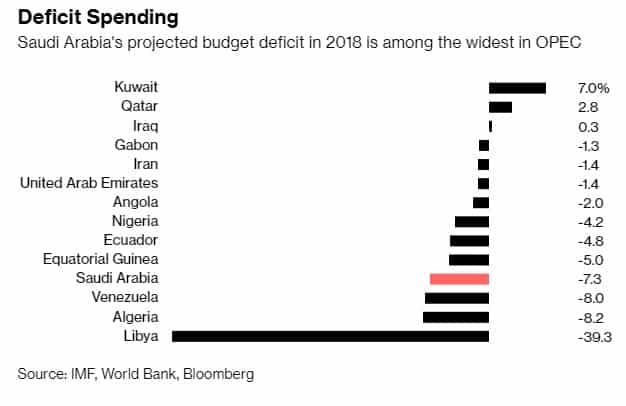

Deficit Spending

Saudi Arabia’s projected budget deficit in 2018 is among the widest in OPEC

Saudi Arabia has the biggest deficit among the group’s five largest producers, and any extra cash from oil could help pay for its economic transformation plan. It can also stem the bleeding of foreign reserves, which have swung from about $10 billion of declines a month in 2016 when oil was trading at about $45 a barrel, to an accumulation of $13 billion in March, the biggest inflow since late 2013. The nation pumped 10.01 million barrels a day last month and still has the most spare production capacity of any OPEC member.

Swing to Surplus

Oil’s rebound, if sustained this year, will help major exporters avoid deficits

Four of OPEC’s top five producers can meet their government spending goals with oil prices at about $70 a barrel. The exception is Saudi Arabia, which needs a price of $87.90 a barrel to balance its budget this year, according to the IMF, which forecasts crude to average $62.30 a barrel in 2018. Benchmark Brent fell 0.9 percent to $74.65 a barrel at 8:22 a.m. in London, after climbing 2.6 percent on Monday.

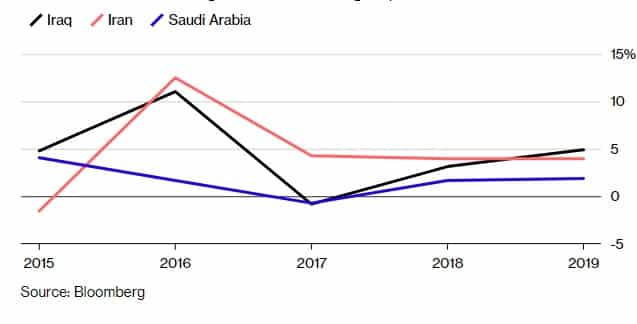

Regional Laggard

Saudi Arabia’s economic growth rate is trailing its peers

Economic growth rates for OPEC producers don’t fully reflect this year’s gains in oil prices, but Persian Gulf exporters are showing some wiggle room in their budgets. Governments have revamped previously shelved investment plans and introduced new stimulus packages. Abu Dhabi said in June that it will spend an additional $13.6 billion over three years to spur growth. Kuwait is developing a cluster of islands as a tourism and trade hub, and even Saudi Arabia gave government employees a $13.3 billion bonus in January.

— With assistance by Javier Blas

Related Topics