Textile-To-Textile -Petrochemicals 18-07-2022 - Arhive

Textile-To-Textile -Petrochemicals

Nylon6-chips-market – Petrochemicals

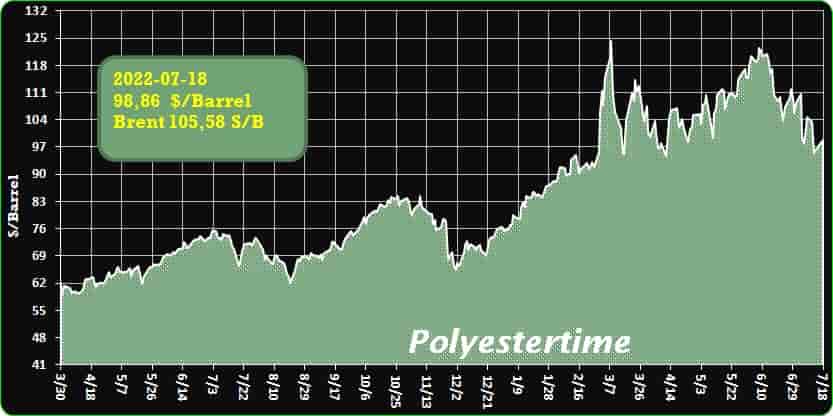

Crude Oil Prices Trend

-ESG criteria guide Radicigroup’s sustainability strategy

The new RadiciGroup Sustainability Report has been published. With the goal of continuous improvement, the 2021 report has a broader reporting boundary compared to prior years and takes into consideration all the Group companies, including sales and service companies. Over 30 sites located across Asia, North America, South America and Europe have provided their 2021 data on economic, social and environmental performance.

Not only indicators of a financial nature but also measures of environmental impact (E), social values (S) and good organizational governance (G): the latter so-called ESG criteria have become a priority for RadiciGroup, which is preparing for the new European Union non-financial reporting directive in order to contribute to the transition towards a fully sustainable economic system and increase the value of its companies.

“The Sustainability Report always offers me the opportunity to observe RadiciGroup from a privileged vantage point: a future perspective,” Angelo Radici, president of RadiciGroup, stated. “Today, the United Nations 2030 Agenda for Sustainable Development is our main guideline on sustainability issues. Textile-To-Textile -Petrochemicals

It shows us an ambitious scenario and urges us to confront a multitude of challenges that affect our enterprise from every point of view. We try to be quick to react and tenacious, staying faithful to our roots and our style, but expanding our perspective to become increasingly more competitive and proactive in the businesses we are engaged in. From the viewpoint of achieving less environmental impact in the future, we propose to be an enabler and facilitator for our stakeholders on themes such as the circular economy, where we see ourselves as protagonists in ecodesign and recycling, as well as innovation, which we put at the service of anyone who is processing and using our products, so as to offer real sustainability solutions together.”

The Sustainability Report is an important tool for understanding RadiciGroup’s results and implementing new improvement action plans. It is a document that is produced starting from the Group’s values expressed in the Code of Ethics, which is the true guideline for the various chapters of the Sustainability Report and the basis of RadiciGroup governance.

On the environmental front, the themes of climate change and decarbonization are RadiciGroup priorities and part of a policy aimed at the uncoupling of growth and resource usage. The Group undertakes to lower emissions from production and choose limited-impact energy sources. This commitment is confirmed by the numbers: in the 2011-2021 period, total emissions per metric ton produced were reduced by 60%, while renewable source energy used by the Group reached 51.7%.

Specific investments to decrease environmental impact are ongoing: in 2021, EUR 3.1 million were allocated to introduce best available techniques and improve emissions abatement and energy efficiency. Textile-To-Textile -Petrochemicals

-Consortium Explores Use of Hemp, Flax in Structural Composites

Interdisciplinary research team seeks to develop thermoformable thermoplastic composites using renewable bast fibers as reinforcement.

Germany’s government-funded DuroBast project is focused on the use of bast fibers for the production of composite structural components. The project aims to develop thermoformable thermoplastic composites employing renewable bast fibers as reinforcements for a range of applications in automotive and sports equipment. Initial research work has focused on composite components such as bus bellows, center consoles, and snowboards. Textile-To-Textile -Petrochemicals

Native bast plants such as flax, hemp, and nettle have been used for fiber production for centuries. Their fibers are characterized by an array of properties and are suitable for the manufacture of a variety of products. Besides clothing, these fibers historically were used for technical applications such as sacks, sails, ropes, and nets. Today, their lightweight construction potential makes bast fibers an interesting material alternative in the development of fuel-efficient cars and electro-mobile solutions. Another advantage of flax and hemp is their low tendency to splinter, a positive attribute especially in traffic accidents.

Under the leadership of the Fraunhofer Institute for Structural Durability and System Reliability LBF, an interdisciplinary research consortium with 11 partners from science and industry, is working on the development of innovative bio-based materials.

Members of the consortium are linking their expertise in all areas of the value chain and aim to transfer project results to concrete applications such as automotive interiors (door panels), sports equipment (snowboards), and public transport (bus bellows) in the near future. Textile-To-Textile -Petrochemicals

The project partners are Dräxlmaier GmbH & Co. KG, Gustav Gerster GmbH & Co. KG, Hübner GmbH & Co. KG, Institute for Textile Technology RWTH Aachen, Leibniz Institute for Composite Materials GmbH, nova-Institut für politische und ökologische Innovation GmbH, Rhenoflex GmbH, silbaerg GmbH, Wagenfelder Spinnereien GmbH and the Chair of Materials Test Engineering (WPT) of TU Dortmund University.

-Group wants firms to cut plastic production under EPR bill

An environmental group said Friday that they want provisions for reducing plastic production included in the extended producer’s responsibility (EPR) bill.

Under the EPR bill, obliged companies “have the responsibility for the proper and effective recovery, treatment, recycling or disposal of their products after they have been sold and used by consumers” to reduce waste generation and improve the recyclability of packaging, according to a Senate press release. Textile-To-Textile -Petrochemicals

Advocacy groups have been urging the Philippine president to veto the bill, which is now up for his signature. It lapses into law by the end of July if still unsigned by then.

But in the event that the bill is tackled by Congress again, EcoWaste Coalition campaigner Coleen Salamat said manufacturers of consumer brands must be made to cut plastic production entirely, instead of merely ensuring their recovery, treatment, and recycling.

“May clear targets for hindi lang offsetting, but…yung reduction sa production ng single-use plastics. Yun kasi yung patuloy pa rin eh. At nakikita natin ito na magiging leeway ito para maging business-as-usual pa rin yung mga big corporations,” she said.

(We want targets not just for offsetting, but for reducing the production of single-use plastics. Because it keeps on happening. This may be a leeway for big corporations to still go business-as-usual when it comes to plastic pollution.)

“So yung mga big corporations na ‘to sila rin naman yung nata-tag natin as big polluters, polluters na talaga na consistent dahil nagkakaroon tayo ng mga brand audit, sila at sila pa rin naman yung patuloy na lumalabas,” she noted.

(These big corporations are the ones we keep on tagging whenever we have a brand audit, it’s always their names that come up.)

A 2021 report by the World Bank said the Philippines was the third largest contributor of plastic pollution, with an estimated 0.75 million metric tons of mismanaged plastic entering the ocean every year. Textile-To-Textile -Petrochemicals

Salamat also said that a new EPR bill must specify what steps companies should take towards proper waste management.

“Dahil may inclusion ng may mga inclusion ng mga vague o mga broad na mga definition kung paano ang waste management natin, so dahil nga of course ang plastic po ay made of fossi fuels, kapag sinusunog o kapag mine-melt ho, kapag tinutunaw ho ito, mas nagpo-produce po tayo ng greenhouse gases,” she said.

(The current bill includes vague or broad definitions of waste management, but when you burn or melt plastic, we produce more greenhouse gases because plastic is made of fossil fuels.)

Sen. Cynthia Villar has previously said the EPR bill “is not a solution in itself, but it is a move in the right direction.”

“We need to rescue our country from being a marine litter culprit and demonstrate that a developing country can and will make this work,” Villar, chairperson of the Senate environment committee, said in January.

-Accelerating Circularity Europe Launches Polyester Textile-To-Textile Trials

Accelerating Circularity’s mission is to design and implement commercial systems in which textile waste is repurposed as raw material through reuse and recycling, and therefore ensure that they are not incinerated or sent to landfills.

For the last year, ACCELERATING CIRCULARITY EUROPE has been working with their European Steering Committee, Spent Textile, and Brand & Retailer Working Groups to research, map, and identify expertise and infrastructure to accelerate the move to circular systems; this work is now complete. Textile-To-Textile -Petrochemicals

The next step is to move into the trial phases to demonstrate what is possible at scale. The first trials will focus on post-consumer and post-industrial polyester textiles feedstocks. These will be the sources for both mechanically and chemically recycled fibers.

“According to the EU Commission Strategy1 by 2030, textile products placed on the EU market will be long-lived and recyclable, to a great extent made of recycled fibers,” shared Karla Magruder, Accelerating Circularity Founder and President. “The circular textiles ecosystem will be thriving, driven by sufficient capacities for innovative fiber-to-fiber recycling, while the incineration and landfilling of textiles will be reduced to the minimum. ACCELERATING CIRCULARITY EUROPE trials are completely aligned with this strategy.”

“Our work has been based on collaborative efforts of more than 80 members of our working groups representing all levels of the value chain from the EU-27 plus members from Norway, Switzerland, UK, Morocco, and Turkey,“ Magruder adds. “Our goal with the textile-to-textile polyester trials is to demonstrate circular systems at scale so our participants will be able to really demonstrate the feasibility.”

“To scale textile-to-textile recycling using post-consumer textile waste, we need collaboration to develop the corresponding value chains and the business case. With our participation in the ACCELERATING CIRCULARITY EUROPE trials, we want to help develop these systems and enable products to be produced with raw materials coming from post-consumer textile waste,” said Martin Böschen, CEO, TEXAID.

“To effectively close the loop of textile waste, at least national or even better international collection systems and infrastructures for end-of-life textiles have to be established. From an economic and efficiency perspective, but also from a consumer acceptance point of view, brand specific return systems only, will not be sufficient.

ACCELERATING CIRCULARITY EUROPE systems trials for polyester will bring various players of a future circular textile value chain together to test and validate polyester fiber-to-fiber recycling at scale, here in Europe, and thus perfectly fulfill these requirements,” said Dr. Martin Mayershofer, Research & Development at Sympatex, Focus Closing the Loop. “At Sympatex, we believe, an industry-wide, common pursuit of circularity and reclosing the textile loop together are indispensable,” he added.

Textile-To-Textile -Petrochemicals

-PX: a seesaw battle of strong fundamentals and weak expectation

In May-Jun, PX market spiked before pulling well back. PX price soared from $1208/mt in early May to as high as $1513/mt but then fell back to $1139/mt CFR China/Taiwan as of Jul 12. PX-naphtha spread also widened significantly from $303/mt to $685/mt but then squeezed to $342/mt over the same period.

With the market moving into the earlier price range, it would still be a seesaw battle of strong situation against weak expectation. Textile-To-Textile -Petrochemicals

- Strong situation

With PX-naphtha spread widening rapidly in Jun, PX plant operating rate rebounded fast, incentivized by good profits. However, China domestic PX supply increase fell short of expectation due to some unexpected shutdown and unplanned operating rate cuts. PX plant operating rate has dropped by about 6 percentage points from the high point of 85.6% in H1 Jun in China, which would lead to an obvious correction of production from earlier estimation.

In addition, with China domestic MX price recovering losses, PX-MX price spread on yuan basis has narrowed obviously. It squeezed from the high point of 2600yuan/mt in early Jun to the current 500yuan/mt, down 80%, reflecting losses for PX plants based on merchant feedstock MX. As a result, PX plants dependent on merchant MX and those plants who purchased MX to ramp up production earlier, may reduce the operating rates.

-Polyester market perceives some positive signals under pessimism

Collapsing polyester feedstock price weighed on the whole value chain recently. High inventory of PFY and fabrics has been obviously depreciated and the operating rate accelerated descending. Sales of fabric have almost been in stagnation when it is during off-season now and feedstock price kept decreasing. Sales of PFY sustained meager and stocks accumulated to yearly high, even higher than the level in 2020 when the pandemic started. Market players lacked confidence. Textile-To-Textile -Petrochemicals

However, there were some positive signals on the market recently: export orders increased slightly on the month in some regions. The stocks of fabric continued ascending slightly but the accumulation speed slowed down amid low run rate. Price of grey fabrics moved down but the theoretical profit of grey fabrics improved with falling PFY prices, especially DTY. The cash flow of conventional knitted fabrics has been turned to positive territory.

As for downstream business, the orders/sales of grey fabrics in the first half of 2022 was similar to those in 2020 while apparent divergence may appear in the second half of year. Domestic and export demand both rebounded sharply in the second half of 2020. In the first half of 2022, domestic demand rose weakly while export dropped, and overall upward momentum was slow. Jul and Aug are traditional slack season. Demand may not grow much, while speculative demand is likely to improve later if feedstock price stabilizes and demand weakly increases as current PFY stocks are low among downstream plants. We expect it may emerge in end-Jul or Aug and actual demand improvement needs to wait the coming of traditional peak season in Sep and Oct, while the increase in the peak season is likely to be lower than anticipated (high stocks need to be solved and demand may rise limitedly). Textile-To-Textile -Petrochemicals

-Shell Chemicals Accelerates Transition Towards Net-zero to Produce Sustainable Chemicals

A fresh investment has been announced by Shell Chemicals Park Moerdijk, a Shell subsidiary, in support of the company’s ambition to transform the chemicals park into a location that can meet evolving customer demands. More low-carbon and recycled-material items are sought after by consumers. Textile-To-Textile -Petrochemicals

A new pyrolysis oil upgrader facility will be constructed by Shell Moerdijk to enhance the quality of the liquid produced from difficult-to-recycle plastic trash and transform it into chemical feedstock for its manufacturing facilities. The investment is the first significant step in the park’s transformation to reaching net-zero emissions through the use of hydrogen and CCS, boosting the use of circular and bio-based feedstocks, and expanding its range of low-carbon products.

Subject to investment decisions and existing capital allocation frameworks, Shell expects to invest billions on Shell Moerdijk’s chemical complex over the next ten years in order to realise these goals.

“As our customers demand more low carbon and circular chemicals we are seeing the reinvention of the chemical industry. At Shell Moerdijk and across our global chemicals business, Shell is investing to be ready to meet our customers’ needs as they change. We are working together to deliver on shared decarbonisation and sustainability goals. This pyrolysis oil upgrader investment is part of our commitment to developing the chemical recycling industry, which can turn hard to recycle plastics into new and useful products, helping society tackle the key issue of plastic waste,” informs Robin Mooldijk, Executive Vice President, Shell Chemicals and Products.

A liquid created from plastic trash that cannot be mechanically recycled and would otherwise be burned is treated by the new pyrolysis oil upgrader machine. The facility, which is anticipated to begin production in 2024, will have an annual capacity of 50,000 tons, or the weight of around 7.8 billion plastic bags. This will help Shell’s goal of recycling one million tons of plastic trash in its chemicals plants by 2025.

Textile-To-Textile -Petrochemicals