It’s Trump Sanctions, Not OPEC, That’s Boosting Oil – Trump Sanctions OPEC Boosting crude Oil - Arhive

Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil

It’s Trump Sanctions, Not OPEC, That’s Boosting Oil

The threat of Iran’s oil output disappearing is driving up prices.

As OPEC oil ministers prepared to meet in Vienna later this week, President Trump fired another twitter-shot across their bows. But it is his decision to slap sanctions back on Iran that is the real driving force behind the rising price of oil.

The U.S. president has accused OPEC of being “at it again” for the second time in as many months through his favored 280-character diplomatic channel. Quite what “it” is, he has never specified.

I am always a bit confused about what people actually mean when they accuse the group of artificially raising the price of oil. OPEC doesn’t set it — and hasn’t done so for more than 30 years.

There is no reason that OPEC should pump as much oil as President Trump, or anyone else, wants. The organization exists to look after the interests of its members. Some of them might see appeasing the United States as being in their best interests. Others clearly do not.

It was less than two years ago that candidate Trump’s energy adviser Harold Hamm told Bloomberg Businessweek that OPEC was “irrelevant.” A little over a month later the same Harold Hamm said it was “high-time” for the irrelevant OPEC to agree on a production freeze to raise prices.

No-one expects politicians, or their advisors, to be consistent. And oil at $67 a barrel is very different to oil at $46. Back then, U.S. shale oil production was on the slide and needed a savior. It found one in Saudi Arabia’s then Deputy Crown Prince Mohammed Bin Salman and oil minister Khalid Al-Falih, who reversed the kingdom’s “pump-at-will” policy and began to set oil prices on the path to recovery.

Now Saudi Arabia is once again at the forefront of a group of OPEC countries urging other members to do as America wishes — this time by raising output. The about-face comes hard on the heels of Al-Falih’s assertion just eight weeks ago that OPEC’s market-balancing job wasn’t yet done and that output restraint needed to be prolonged.

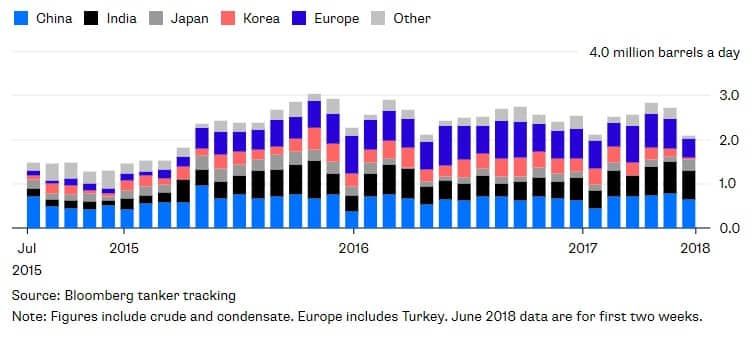

Buyers Beware

Buyers of Iranian crude are firmly in Donald Trump’s sights as sanctions may be starting to bite

Source: Bloomberg tanker tracking

Note: Figures include crude and condensate. Europe includes Turkey. June 2018 data are for first two weeks.

What changed in that eight weeks? The outlook for the availability of Iranian oil. Trump’s decision to pull out of the nuclear deal and re-impose sanctions will reduce the volume of crude available from the country by an unknown amount.

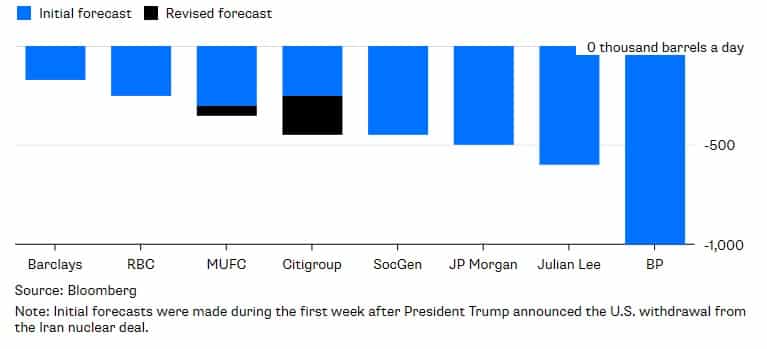

Getting Deeper

Some analysts have been increasing their forecasts of the volume of Iranian crude likely to be lost to renewed sanctions

Source: Bloomberg

Note: Initial forecasts were made during the first week after President Trump announced the U.S. withdrawal from the Iran nuclear deal.

I have said from the outset that the amount of Iranian oil that will be forced off the market will be more than when sanctions were previously in force — even without the EU bans on purchases that accompanied U.S. curbs last time around. Analysts are now starting to ratchet up their forecasts of the volume that could be lost.

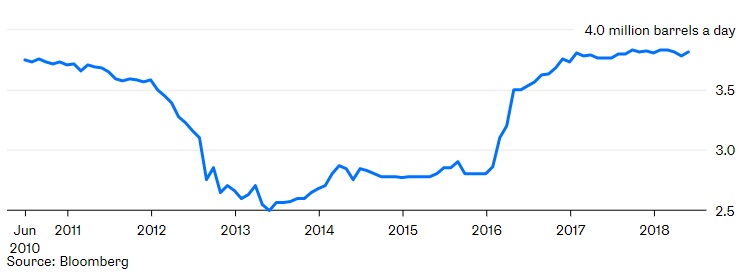

Hitting Iran

Obama’s sanctions cut Iran’s oil output by over a million barrels a day. Expect more this time.

Source: Bloomberg

The curbs will be more extensive than under President Obama — targeting Iran’s exports of condensates as well as crude oil — and waivers will be harder to come by. Tanker owners and insurers may already be reacting to the imposition of sanctions, even before they come into effect.

It is the fear that the world is about to lose as much a million barrels a day of Iranian crude oil exports by the end of the year, and possibly another 500,000 barrels from Venezuela, that has really driven oil prices higher — not OPEC.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the editor responsible for this story:

Edward Evans at eevans3@bloomberg.net

Before it’s here, it’s on the Bloomberg Terminal.

Related Topics

-Oil climbs over 2 percent, shrugs off API’s U.S. crude build – Crude Oil climbs API USA

–The surge is over — why $50 oil is now more likely than $100

Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil Trump Sanctions OPEC Boosting crude Oil