Sustainability - Arhive

Sustainability

Avantium N.V., a prominent company specializing in renewable and circular polymer materials, has announced the official opening ceremony for its FDCA Flagship Plant on October 22, 2024, in Delfzijl

Invited guests will receive invitations for this significant event. Additionally, Avantium will host an Avantium Retail Investor Day on October 23, 2024, allowing interested shareholders to tour the FDCA Flagship Plant.

Avantium focuses on innovative technologies for producing materials from sustainable carbon feedstocks, including biomass and CO2.Sustainability

Their YXY® Technology converts plant-based sugars into furandicarboxylic acid (FDCA), a crucial component of the sustainable plastic PEF (polyethylene furanoate).

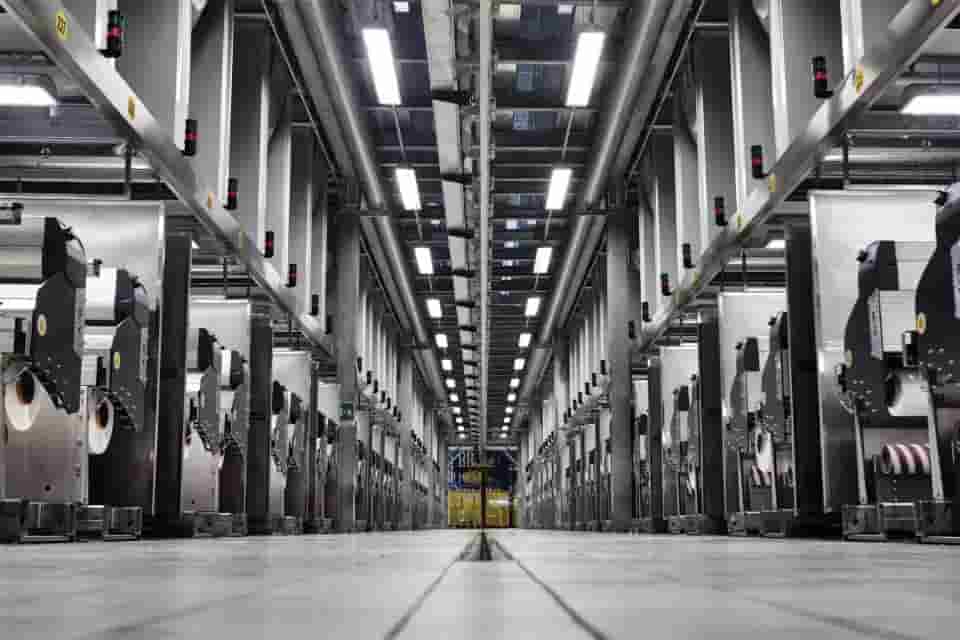

Avantium has successfully demonstrated this technology at its pilot plant in Geleen, the Netherlands, and is currently constructing the world’s first commercial FDCA plant in Delfzijl.

The company also provides R&D solutions in sustainable chemistry and offers advanced catalyst testing services.

Avantium collaborates with like-minded companies globally to advance renewable chemistry solutions. Sustainability

Avantium’s shares are listed on Euronext Amsterdam and Euronext Brussels (symbol: AVTX), and the company is part of the Euronext Amsterdam SmallCap Index (AScX). Its headquarters are in Amsterdam, the Netherlands

Fulgar Launches Q-GEO Biobased Polyamide Yarn

Fulgar, an innovative Italian company dedicated to environmental sustainability, has unveiled Q-GEO, a new biobased polyamide yarn poised to transform the textile industry. This yarn aligns with the rising demand for eco-friendly, advanced fabrics, making it ideal for large-scale ecological production.

The textiles and clothing industries are increasingly adopting next-generation materials—manmade polymers that are recyclable and derived from renewable sources. These materials aim to reduce reliance on fossil fuels, supporting the fashion industry’s shift towards sustainable practices with minimal environmental impact. Sustainability

Q-GEO represents a significant advancement in Fulgar’s pursuit of combining natural fibre benefits with high-tech yarn performance. Unlike traditional polyamides, Q-GEO is 46% biobased, produced from non-edible corn deemed unfit for nutritional use. This corn is grown on land unsuitable for food crops, reducing environmental impact by minimizing water usage and greenhouse gas emissions compared to traditional cotton and standard polyamide production.

This innovative yarn offers several technical advantages. It provides the comfort of traditional polyamides while featuring superior body humidity management with 50% greater absorbency and enhanced breathability. Sustainability

Q-GEO maintains the durability and toughness expected of polyamides, with additional benefits like ultra-rapid drying and flame-retardant properties without additives.

Q-GEO is certified under Oeko-Tex Std 100 Class I appendix 6 and Din Certco, following the ASTM D 6866:2022 R.N 8C376 method. An LCA (Life Cycle Assessment) study confirms Fulgar’s commitment to a transparent and sustainable supply chain, reinforcing its leadership in eco-friendly textile innovation.Sustainability

Sustainability