Bamboo

Crude Oil Prices Trend

Crude Oil Prices Trend by Polyestertime

Bamboo is increasingly replacing plastic in China

Plastic in the oceans, plastic in the human body, plastic everywhere. Chinese scientists have now developed a new method to process bamboo into a biodegradable plastic substitute.

Henrik Bork, long-time China correspondent for Süddeutsche Zeitung and Frankfurter Rundschau, is the Managing Director at Asia Waypoint, a consulting agency specializing in China, based in Beijing. “China Market Insider” is a joint project of Vogel Communications Group, Würzburg, and Jigong Vogel Media Advertising in Beijing. Bamboo

The new “bamboo plastic” from China, as it is already being called in media reports, has for the first time plasticity and self-adhesive properties similar to those of PVC, write the Chinese scientists in a paper published in the magazine ACS Nano of the American Chemical Society.

“This study presents a viable approach to enhancing the plasticity of bamboo by selectively removing part of its lignin and disrupting the crystalline structure of the cellulose,” write the researchers from the “China National Bamboo Research Centre” at the University of Agriculture and Forestry in Fujian in their paper.

Similar properties to thermosetting plastic

Lignins are phenolic macromolecules that cause a kind of lignification of the plant cell walls, thereby providing their compressive strength and rigidity. The Chinese researchers have found a way to remove it and transform the thus “activated” bamboo into a substance resembling thermosetting plastic, it was stated. Bamboo

In a second production step, the already transformed cellulose was oxidized with sodium perborate. This increased the reactivity of the bamboo.

After a hot pressing process, the bamboo can then be transformed into a kind of thermosetting plastic (ABTP). It is highly water-resistant, has a tensile strength of 50 MPa and a flexural strength of 80 MPa, according to the researchers. A Shore hardness of almost 90 means that the new material is as hard as polystyrene (PS), phenolic resin, and PVC, reports the Chinese science portal Kexue Wang. Bamboo

More…

Dangerous chemicals from e-waste found in everyday black plastics, study finds

Everyday household items made with black plastics recycled from electronic waste have been found to contain high levels of toxic chemicals – and those items, including children’s toys and kitchen utensils, are being sold to unsuspecting US consumers, a new study warns.

The peer-reviewed study, published in the October issue of the Chemosphere scientific journal, was led by the US environmental health non-profit Toxic-Free Future and the Amsterdam Institute for Life and Environment. Bamboo

In the first-ever testing of its kind, researchers found “high levels of cancer-causing, hormone-disrupting flame retardant chemicals in a variety of household products made with black plastics.”

Nearly 85% of the items tested – including food service ware, kitchen utensils, toys, hair accessories, costume beads, travel games, sushi trays, and even spatulas – were found to contain the retardants, even though they do not require them. Bamboo

This results in “potentially high and unnecessary exposure,” the stated.

Health concerns related to flame retardants (FRs) include carcinogenicity, endocrine disruption, neurotoxicity, and reproductive and developmental toxicity, it said.

Most electronics and their plastic casings are manufactured using retardants to help protect products and devices from overheating, short-circuiting, and catching on fire.

The toxic chemicals are most likely entering plastic products through a back door via contaminated recycled plastic, “without the necessary transparency and restrictions to ensure safety,” Toxic-Free Future said.

Harmful levels 5-1200x greater than EU limits

The two most prevalent chemicals were identified as “brominated” flame retardants (BFRs) or “organophosphate” flame retardants (OPFRs), which are known to be used in high concentrations in electrical and electronic products. Bamboo

More…

Stellantis-Renault: A Merger with Political and Industrial Implications

A proposed merger between Stellantis and Renault is gaining attention, with backing from Emmanuel Macron and John Elkann. The goal is to create a European automotive giant capable of competing with U.S., Chinese, and Japanese manufacturers, notably Toyota and Volkswagen. Macron sees political advantages, while Elkann may prefer to shift focus to other sectors like healthcare and luxury. Bamboo

The potential merger raises concerns about antitrust regulations, though European Commission President Ursula von der Leyen seems inclined to support the formation of “European giants,” in line with Mario Draghi’s recommendations for fostering industrial champions.

While Stellantis denies merger talks, Elkann is reportedly shifting away from the auto sector, with Exor investing heavily in healthcare, including a 17.5% stake in Philips.

Stellantis, facing declining market share in Italy, saw registrations fall 32.4% in August. The company announced another production suspension for the Fiat 500 Bev at Mirafiori, citing weak demand for electric vehicles. Bamboo

If the merger proceeds, it would create an 18-brand entity, potentially benefiting France while sidelining Italy. Stellantis, however, is committed to investing in the Mirafiori Automotive Park and plans to expand its electric and hybrid vehicle production by 2026.

Meckesheim will present advanced recycling and compounding solutions at Fakuma 2024

The companies will showcase virtual simulations of integrated systems, including a recycling facility and compounding plant. Attendees can explore these simulations, gaining insight into key components and processes. Bamboo

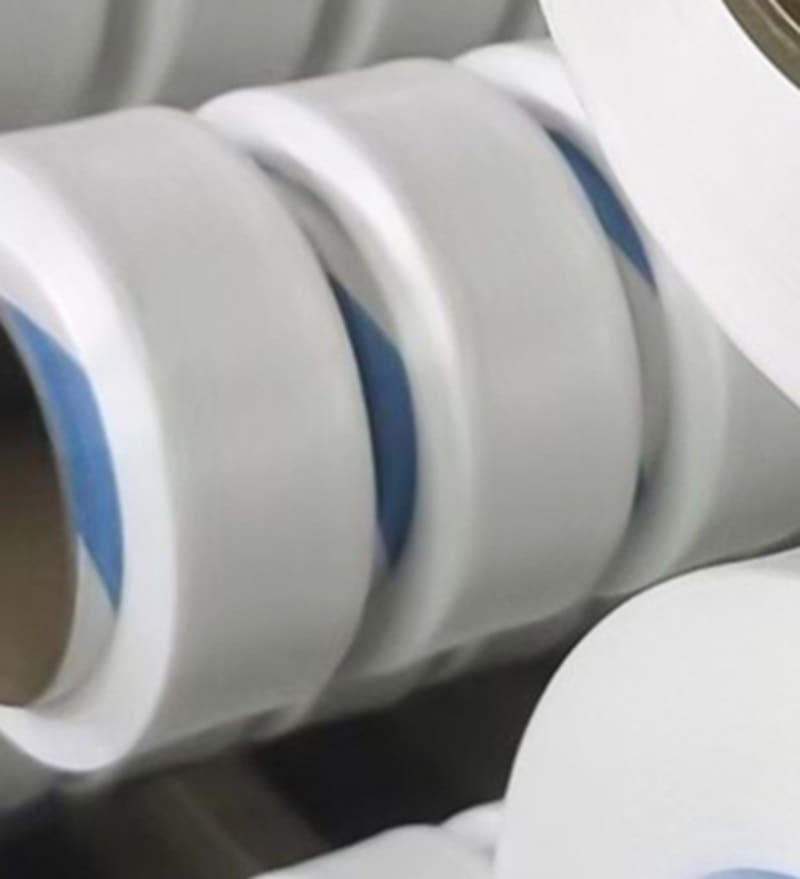

Herbold will also feature granulator rotors, emphasizing the efficiency of their cutting geometry for improved performance. Coperion will display advancements in twin screw extruders, including the ZSK 18 MEGAlab with a new feeding platform for enhanced flexibility. Their ProRate PLUS feeder line, designed for efficient powder additive feeding, will also be highlighted.

Together, Coperion and Herbold offer comprehensive systems covering the entire recycling process, from shredding and washing to extrusion and pelletizing. Bamboo

A key project involves creating a bottle-to-bottle PET recycling system for India’s Magpet Polymer Pvt Ltd.

Both companies provide Test Centres in Germany for testing recycling technologies. Herbold’s facility includes a full washing line, while Coperion’s Recycling Innovation Centre offers configurable recycling plants for hands-on experimentation.

Avantium Receives €3.5 Million EU Grant for CO2 Conversion Project

Avantium N.V., a leading company in renewable and circular polymer materials, has been awarded a €3.5 million grant from the EU Horizon Europe program for its participation in the research and development program ICONIC[1]. The ICONIC program aims to convert CO2 into formic acid, a key ingredient for sustainable protein production. Bamboo

The €3.5 million grant will be paid out in tranches to Avantium over a period of four years, starting in January 2025.

Avantium is known for its innovative technologies that turn biomass and CO2 into valuable materials. Its Volta Technology platform uses electrochemistry to transform CO2 into important chemical building blocks. In the ICONIC project, Avantium will further scale up the electrochemical cell to convert CO2 from refinery gases into formic acid. This formic acid will then be used to produce added value products such as proteins for animal feed and alternatives to palm oil. Bamboo

The ICONIC project, with a total EU grant of €15 million, will demonstrate the entire process from CO2 capture to the production of valuable end products. The project will run for four years and involves 12 partners, including Avantium, SINTEF (Norway), Tupras (Turkey), Cool Planet Technologies (UK), B.FAB (Germany), Procter & Gamble (Belgium/UK), Idener (Spain), NoPalm (Netherlands), Bio Base Europe Pilot Plant (Belgium), TNO (Netherlands), and CO2 Value Europe (Belgium).

Annelie Jongerius, Technology Manager Volta Technology at Avantium, comments: “Avantium is excited to collaborate with other like-minded organizations on the ICONIC project. Bamboo

More…

Twellium and Sidel launch beverage packaging facility in Ghana

The new facility houses two advanced PET packaging lines capable of producing a wide range of beverages.

Twellium Industrial Company, a leading beverage manufacturer in West Africa, has joined forces with Sidel, a global provider of packaging solutions, to establish a state-of-the-art production facility in Kumasi, Ghana. Bamboo

This strategic partnership aims to meet the growing demand for beverages in the region and strengthen Twellium’s position as a market leader.

The new facility houses two advanced polyethylene terephthalate (PET) packaging lines capable of producing a wide range of beverages, including still and carbonated water, soft drinks, and energy drinks.

Manufacturing of all kinds requires ready cash supplies to guarantee agility and mitigate risks. From automobiles to airplanes and computers to clothing, an approach with supply chain innovation at the heart is critical. Bamboo

Equipped with Sidel’s technology, the lines offer high-speed production, flexibility, and unmatched efficiency.

Sidel said one of the highlights of the facility is Africa’s fastest complete PET water line, capable of producing 80,000 bottles per hour.

More…

Resins – Geely is preparing to launch a hybrid car with an impressive 2,000 km range, though the specific models for this powertrain remain undisclosed, according to CarNewsChina 03-10-2024

Bamboo