Biobased polymer – Investment in polyester DTY machine rebounds, more difficult for independent DTY plants 11-07-2024 - Arhive

Biobased polymer

The EU-funded Polymeer research project, with a grant of 4.8 million euros, is spearheaded by the University of Perugia

The initiative aims to transform waste from beer production, specifically brewer’s grains, into new polymers, co-polymers, and biobased polymer blends. Brewer’s grains, a major by-product of the beer industry, consist of barley grain husks, pericarps, and seed coatings leftover from the mashing phase. These grains are composed primarily of fibers (70%), proteins (20%), and phenolic compounds. Europe produces approximately 8 million of the 40 million tonnes of brewer’s grains generated globally each year. Managing this waste is challenging due to its high volume, moisture content, and microbial load, which significantly shortens its shelf life. Biobased polymer

The project aims to convert these wastes into recyclable and biodegradable materials tailored for specific technical applications in various sectors. These include agriculture, where UV resistance, soil biodegradability, and barrier properties are needed; packaging, including within the beer supply chain; and the textile sector, particularly for automotive uses, where flame retardancy, antimicrobial properties, UV resistance, hydrophobicity, and oleophobicity are essential. Biobased polymer

The four-year project is led by Prof. Assunta Marrocchi from the Department of Chemistry, Biology, and Biotechnology and Prof. Ombretta Marconi from the Department of Agricultural, Food, and Environmental Sciences. The funding is part of the Horizon call “Development of novel, high-performance bio-based polymers and co-polymers,” promoted by Circular Bio-based Europe Joint Undertaking. Starting in September, the project involves 13 partners, including universities, research organizations, and companies across Europe, coordinated by the University of Perugia. Biobased polymer

Global PP Market Shows Stability in Early July 2024 post June Surge

In the first week of July 2024, the price of Polypropylene (PP) in the US market remained stable, reflecting a balanced demand-supply dynamic. However, on a monthly basis, the price surged by approximately 17.5%, driven by increased production costs due to higher feedstock propylene prices. A regional plant shutdown created a short-term material shortage, further influencing the US PP market. Additionally, rising freight rates impacted the price of PP this month. Biobased polymer

Throughout June 2024, the supply of PP in the US fluctuated from moderate to low levels due to a series of unplanned plant shutdowns. Major manufacturers of PP, such as Phillips 66, faced operational disruptions, leading to material shortages. Concurrently, the price of feedstock Propylene increased by approximately 6%, elevating production costs and contributing to a bullish trend in PP prices. These supply challenges were compounded by a significant surge in global freight rates. Container freight rates on key north-south and east-west Brazilian routes soared due to strong demand and capacity shortages for shipments to and from South America. Biobased polymer

Brazilian forwarders reported that rates from Brazil to North America reached their highest level in a year, while rates on the Asia-East Coast South America trade were at a near two-year high.

AkzoNobel has significantly upgraded its Suzhou facility in China, launching an automated production line as part of a €14 million ($15.12 million) investment aimed at doubling its marine and protective coatings capacity by 2025

This upgrade will immediately boost daily production by over 40%, with plans for further enhancements to three additional lines, ensuring the facility’s capacity doubles by next year. Biobased polymer

These upgrades come in response to the growing demand in China’s shipbuilding market, where high-performance antifoulings and wind power solutions are in increasing demand. AkzoNobel’s Suzhou site, operational since 2008, has been crucial in meeting this demand, supplying products like International, Intersleek, RELEST, and Chartek.

Simon Parker, director of AkzoNobel’s Marine and Protective Coatings business, emphasizes the company’s commitment to delivering superior solutions and adapting swiftly to the dynamic Chinese market. Biobased polymer

Similarly, Karen-Marie Katholm, AkzoNobel’s chief integrated supply chain officer, highlights the efficiency and capacity improvements, which enhance local production and supply chain capabilities.

The recent upgrades include automation of waste gas treatment, filling, and grinding systems. Future improvements will focus on transitioning Suzhou to 100% renewable electricity by 2025, contributing to AkzoNobel’s goal of halving carbon emissions across its value chain by 2030. Biobased polymer

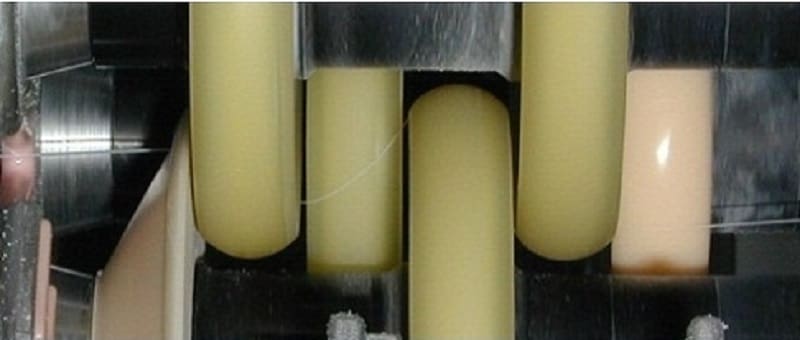

Investment in polyester DTY machine rebounds, more difficult for independent DTY plants

In 2023, the increase of polyester DTY machine decelerated compared with 2021-2022, with growth rate dropping from nearly 10% to around 4%. It was earlier thought that under the fierce competition among retail investors in DTY machines, the growth in 2024 would still not be very optimistic, however, according to the investigation, the increase of polyester DTY machines in 2024 is expected to pick up compared with 2023, with growth rate expected to rebound to around 6% in 2024. Biobased polymer

The growth of polyester DTY machine in 2024 has several remarkable characteristics:

- More manufacturers emerge

The established DTY machine manufacturers are mainly Barmag, TMT, Jingwei, Rongteng, Jinggong, Yuejian, etc. And in 2024, there emerge other manufacturers with large supply quantity, such as Taitan and Jinyi (Hongyi). Biobased polymer

- The demand for small machines breaks out

From the perspective of orders for machines, some mainstream suppliers receive orders for large machines until the end of the third quarter, while orders for small machines will last until next year. This year’s mainstream models of large machines remain the same, but small machines see upgrade from 800 and 868 type to 900 type. It is reported that the 900 type is cheaper and more cost-effective. Biobased polymer

Nylon 66 chip suppliers determine to hold prices steady

In the second week of June, the price of nylon 66 chips started to stabilize, ending the previous downward trend. This round of downward adjustments started in April and lasted for about two and a half months. Taking the general-plastic-grade nylon 66 chip as an example, the price dropped from a peak of 22,500yuan/mt to around 20,000yuan/mt currently, representing a decrease of over 10%. This almost offset the previous increase since Invista announced the maintenance plan. Biobased polymer

During recent decline, most downstream manufacturers anticipated the bottom to be around the previous low of 19,000yuan/mt. Despite downstream inventories being close to depletion and expecting replenishment in June, the market sentiment remained somewhat pessimistic due to the anticipation of over 200,000 tons of new capacities by enterprises like Invista, Shanghai Shenma, China Resources, and Haoyuan. However, after the price fell just below the 20,000yuan/mt, prices began to stabilize and even saw a slight rebound, defying market expectations.

This was mainly due to cost pressures. Biobased polymer

As shown in the chart above, butadiene, a primary raw material for C4 process ADN/HMDA, has been consistently rising since the beginning of the year. It stabilized around 11,500yuan/mt before accelerating to 13,500yuan/mt by mid-May. This significant cost pressure for C4 process ADN, with butadiene alone seeing a cost increase of 3,500-4,000yuan/mt since the beginning of the year. The strength of butadiene stems not only from the restart of the Tianchen’s ADN plant but also from strong demand in the rubber market this year, which shows potential for the entire year. Biobased polymer

Biobased polymer