Recycled content – In the initial half of January 2024, the German polyamide market witnessed a notable decline in prices, primarily attributed to feeble demand in key downstream industries 20-01-2024 - Arhive

Recycled content

ALPLA Group, a leading global packaging entity, is significantly elevating its processing capabilities for recycled PET and HDPE, marking a crucial step towards achieving its 2025 voluntary recycled content goals

In a comprehensive review of its 2023 activities, the Austrian-based plastic packaging and recycling firm reported processing 386,000 short tons of recycled resin in-house, doubling the amount from just two years prior, showcasing a robust commitment to sustainability. ALPLA plans additional investments in 2024 to further strengthen its recycling capabilities.

In a notable achievement, the company integrated 20% recycled content into its packaging materials in 2023, underlining its dedication to advancing sustainable practices. ALPLA is strategically concentrating on internally processing higher-quality recycled PET and HDPE to achieve its ambitious target of 25% recycled content in packaging materials by 2025. Recycled content

To spearhead this effort, the company established a dedicated recycling-focused branch in 2023, named ALPLArecycling.

The company’s commitment to recycling growth is evident in its actions, actively expanding capacities to emphasize sustainable practices and circular economy principles. The surge in demand for recycled HDPE validates the effectiveness of ALPLA’s strategy, with the company expressing confidence in its approach.

ALPLA’s recent strides in recycling underscore its continuous dedication to integrating recycled materials into production processes. In 2022, the company used 361,000 short tons of recycled resin, and in 2021, this figure was 311,000 short tons, emphasizing the ongoing commitment to increasing the utilization of recycled materials and fostering a circular approach to plastics. Recycled content

ALPLA’s recycling operations have a global footprint, with PET and HDPE recycling plants strategically located in Austria, Germany, Italy, Mexico, Poland, Romania, Spain, and Thailand. This extensive presence positions ALPLA as a key player in advancing global recycling practices and contributing to the circular economy.

As ALPLA advances its recycling initiatives, the company stands at the forefront of the packaging industry’s transition to more sustainable and environmentally friendly practices. Strategic decisions to enhance in-house processing capacities, establish a dedicated recycling branch, and set ambitious recycled content targets underline ALPLA’s leadership in embracing a circular economy model. These efforts not only align with evolving consumer preferences for eco-conscious products but also position ALPLA as a trailblazer in sustainable packaging solutions. Recycled content

Black Swan Graphene announces a range of Graphene Enhanced Masterbatch (“GEM”) products

Black Swan Graphene has announced a range of Graphene Enhanced Masterbatch (“GEM”) products. These GEMs offer different performance and attributes of products aimed at multiple applications in the polymer industry. This announcement follows a recent commercial agreement ratified with Hubron International, a global leader in black masterbatch manufacturing. Recycled content

Black Swan stated that its products are the results of extensive internal development efforts, including independent verification using the expertise at the Graphene Engineering Innovation Centre (“GEIC”) and a strategic partnership with Hubron. The primary objective of the product development endeavors extends beyond performance; it strives for consistency, a pivotal factor in the commercialization of additive products.

Initial production volumes are focused on polypropylene; a widely used polymer known for its versatility and cost-effectiveness. However, its relatively low impact resistance has often posed a challenge in various applications. By incorporating only 1% of graphene into the polypropylene (loading ratio), an impressive 30% improvement in impact resistance was achieved in a Notched Izod test, which assesses the amount of energy absorbed by a material when struck by a notched sample. Recycled content

Graphene enhanced products, with the addition of Black Swan’s product, reportedly demonstrate multiple performance benefits, including enhanced processability and therefore cost-effectiveness. Masterbatches with a loading ratio of up to 20% are available in various polymers. This repeatable performance in enhancing the impact resistance of polypropylene enables new possibilities across multiple industries, notably for different packaging and lightweighting in the transportation industry, a key driver for range increase and fuel efficiency.

Hubron and Black Swan are also working with the polymer matrix of a world-leading industrial polymer manufacturer, which launched an aggressive initiative to develop plastic materials for electric vehicles aimed at reduced weight, expand design freedom, reduce complexity, enhance thermal management, and reduce environmental impact. The development program resulted thus far in a 20% improvement in tensile strength, based on a loading ratio of only 0.2%. Recycled content

Robert Laurent, Technical Director at Hubron, commented: “These results further add weight to the potential benefits of incorporating graphene materials into thermoplastics. A 30% impact resistance improvement is exciting, and we are looking to expand these trials into commercial applications. We are also able to fine-tune compound properties to deliver customer specific solutions.”

Simon Marcotte, President and Chief Executive Officer of Black Swan, commented: “This development marks a substantial leap in advancing the performance of polymer materials. The enhanced capabilities of graphene-enhanced polypropylene not only signify a breakthrough but also have the potential to reshape entire industries. We are confident that this innovation will spark creativity and drive transformative solutions across a diverse range of products and applications.” Recycled content

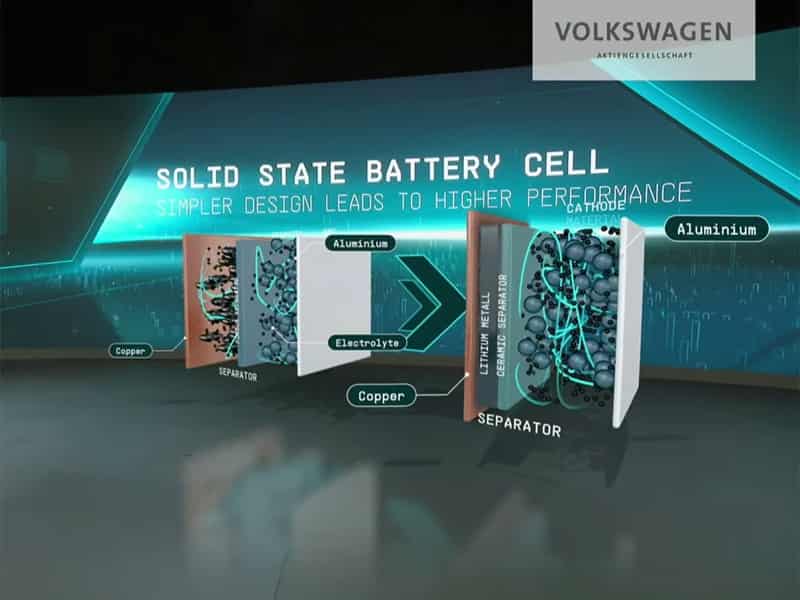

Volkswagen is intensifying its pursuit of solid-state batteries, doubling down on its commitment after a strategic partnership with QuantumScape

The German automaker is now engaging in negotiations with Blue Solutions to expedite the development process.

Seeking to avoid delays experienced with QuantumScape, in which Volkswagen has invested, the company aims to secure a reliable source for solid-state batteries.

Blue Solutions, associated with the Bolloré group, already holds a contract to supply these batteries to Mercedes for use in electric buses. Recycled content

The negotiations between Volkswagen and Blue Solutions, as reported by Reuters from insider sources, center on a collaborative effort to develop solid-state batteries.

These batteries, based on the technology utilized in Mercedes buses, will be adapted for integration into Volkswagen’s electric vehicles.

The lithium-metal battery, known for its flexible structure called FlexFrame, addresses the stresses encountered during charging and discharging phases.

In a video presentation, QuantumScape’s executives, including Chief Product Officer Chris Dekmezian and Senior Director of Cell Design and Manufacturing Daniel Braithwaite, along with University of Michigan’s Associate Professor Venkat Viswanathan, shed light on the battery’s chemistry and architecture. Recycled content

Volkswagen’s determination to advance solid-state battery technology underscores its commitment to the electrification of its vehicle fleet, emphasizing a proactive approach to secure a robust and timely supply chain.

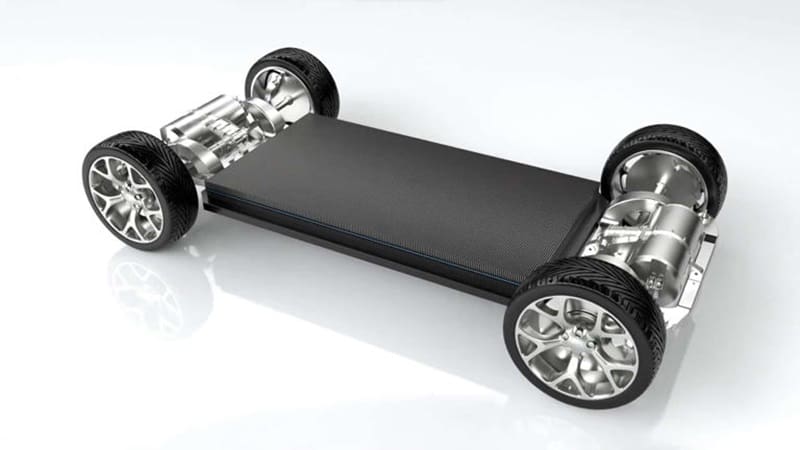

StoreDot has introduced a groundbreaking advancement in extreme fast charging (XFC) technology with its innovative I-Beam XFC cell-to-pack (CTP) concept

At the heart of this concept lies StoreDot’s exclusive 100in5 cell technology, capable of providing a remarkable 100 miles (160 kilometers) of range in just 5 minutes of charging. The 100in5 electrodes are intricately integrated into the newly developed I-Beam XFC cells, designed for direct incorporation into the battery pack.

While conventional cell-to-pack architectures primarily target enhancing range and energy density, StoreDot’s focus extends to the acceleration of extreme fast charging. The I-Beam XFC concept overcomes the complexities and cost challenges associated with integrating XFC capability at the vehicle level, facilitating even faster charging for electric vehicles (EVs). Recycled content

Diverging from traditional cooling systems, the I-Beam XFC introduces the patented Structural Cooling concept embedded within each cell’s structure. This innovative thermal management approach prevents localized hotspots, ensuring uniform temperatures throughout the battery pack. This capability allows the acceptance of ultra-high currents required for fast charging, minimizing system overhead. Recycled content

Although currently a conceptual framework, StoreDot has already secured multiple patents related to the I-Beam XFC architecture. The company perceives this design as pivotal in unlocking the full potential of XFC technology on a mass scale. Dr. Doron Myersdorf, CEO of StoreDot, affirms their commitment to advancing XFC battery technology from the cell level to the vehicle level, with the I-Beam XFC representing a holistic approach to improving packing efficiency, battery life cycle, and enabling rapid EV charging, likening it to the speed of refueling with petrol. As part of its ambitious plans for 2024, StoreDot aims to demonstrate the world’s first EV equipped with XFC technology, ship prismatic B-samples to OEMs, and expand operations in the US. Recycled content

In the initial half of January 2024, the German polyamide market witnessed a notable decline in prices, primarily attributed to feeble demand in key downstream industries

Over the past fortnight, the pricing trajectory of polyamide has been unfavorably impacted by subdued consumption in sectors vital to Germany’s economy, including textiles, electrical, and automotive.

This downturn has given rise to a bearish market environment, exerting downward pressure on polyamide prices.

The consumption patterns and pricing trends of polyamide are intricately linked to various factors, encompassing economic conditions, industrial activities, and global market dynamics. Recycled content

A pivotal factor contributing to this market shift is the weakness observed in feedstock prices, particularly Adipic Acid and Caprolactam, which has reverberated through the largest economy in the Eurozone.

This influence has permeated downstream derivative sectors, such as Polyamide 6 and 66. The subdued pricing of essential components like Adipic Acid and Caprolactam has cast a broader impact on the dynamics of Polyamide 6 and 66.

Consequently, the German Polyamide market found itself in a situation where ample supply met domestic requirements, prompting merchants to operate based on existing stock levels, leading to a decline in fresh orders. Recycled content

The abundance of supply and reliance on existing stock fostered a cautious approach among merchants, thereby hampering the generation of new orders in the market.

The European market, in general, is grappling with the repercussions of global economic volatility and diminished purchasing power due to elevated interest rates and inflation.

The decline in purchasing activity observed in December 2023 extended into January 2024, as manufacturers sought to optimize their stock levels.

Notably, the automotive sector experienced a sharp reduction in new car registrations, with 241,883 fewer registrations nationwide compared to the previous year, marking a substantial 23% decline. Recycled content

Authorities in the industry attributed this disruption to the premature discontinuation of incentives for purchasing electric cars, contributing to a year-long decline in registrations. These events signify a decreased utilization of Polyamide in the automotive industry during this specific timeframe.

Forecasts indicate that the demand for Polyamide from downstream sectors, particularly automotive and textiles, is expected to further decrease in the coming weeks.

This projection is grounded in the prevailing weak demand conditions across Europe, influenced by ongoing economic factors and market dynamics.

The anticipation is that subdued demand will lead to a reduction in the utilization of Polyamide within sectors such as automotive and textiles. Recycled content

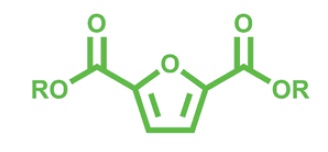

Avantium, Helios Resins sign multi-year FDCA agreement

Helios plans to partially or fully replace petro-based terephthalic acid, the key building block for polyester resins, with FDCA

Renewable chemistry company Avantium and Helios, a Slovenia-based manufacturer of coating resins, composite resins, and polyester polyols for PU flexible foams, have signed a ‘multi-year’ capacity reservation agreement. Avantium will supply Helios with FDCA (furandicarboxylic acid) from its flagship plant that is currently under construction in Delfzijl, the Netherlands. Recycled content

Production at the new facility – the world’s first commercial facility for the production of FDCA from plant-based sugars – is expected to commence in 2024.

Avantium has developed a proprietary YXY technology that uses catalysts to convert plant-based sugar (fructose) into FDCA, the key building block for a wide range of plant-based chemicals and plastics such as polyethylene furanoate (PEF). PEF is a 100% plant-based and recyclable plastic. Applications include polyesters, polyamides and polyurethanes, as well as coating resins, plasticisers, and other chemical products.

Avantium will sell FDCA and PEF directly from its FDCA flagship plant to its customers, in parallel to selling technology licences to industrial partners.

Helios plans to partially or fully replace petro-based terephthalic acid, the key building block for polyester resins, with FDCA. Recycled content

“This capacity reservation for FDCA developed by Avantium provides assurance that we can use FDCA widely in the future for our resins and coatings,” said Dr. Martin Ocepek, director R&D synthetic resins at Helios Resins.

Loop Industries, a Canadian company specializing in chemical recycling technology for PET and polyester fiber waste, is set to receive a significant boost with a $66 million investment from Reed Management

This strategic collaboration aims to propel the adoption of Loop’s innovative depolymerization process in Europe.

Reed Management’s investment, outlined in a non-binding memorandum of understanding, includes a $11 million equity investment in a joint venture to acquire commercialization rights for Loop’s technology in Europe. Recycled content

Additionally, a $22 million loan from the joint venture to Loop, divided into two tranches, will further support the company’s initiatives.

The remaining $33 million commitment will cover the initial costs of chemical recycling projects in Europe, including a joint venture with Suez and SK Geo Centric for a new plant in Saint-Avold, France.

Loop Industries Founder and CEO, Daniel Solomita, highlights the strategic significance of the partnership with Reed, leveraging their financial relationships and experience in major capital investments. Recycled content

This collaboration aims to facilitate Loop’s penetration of the European market, aligning with stringent regulatory requirements for plastic material recycling.

Solomita emphasizes the financial structure’s accretive nature to shareholder value, minimizing dilution while maximizing the potential for future projects.

Loop Industries’ innovative technology focuses on depolymerizing PET and polyester waste, transforming it into high-quality monomers suitable for polymerization into new, virgin-like polyester, providing a sustainable solution for the plastics industry.

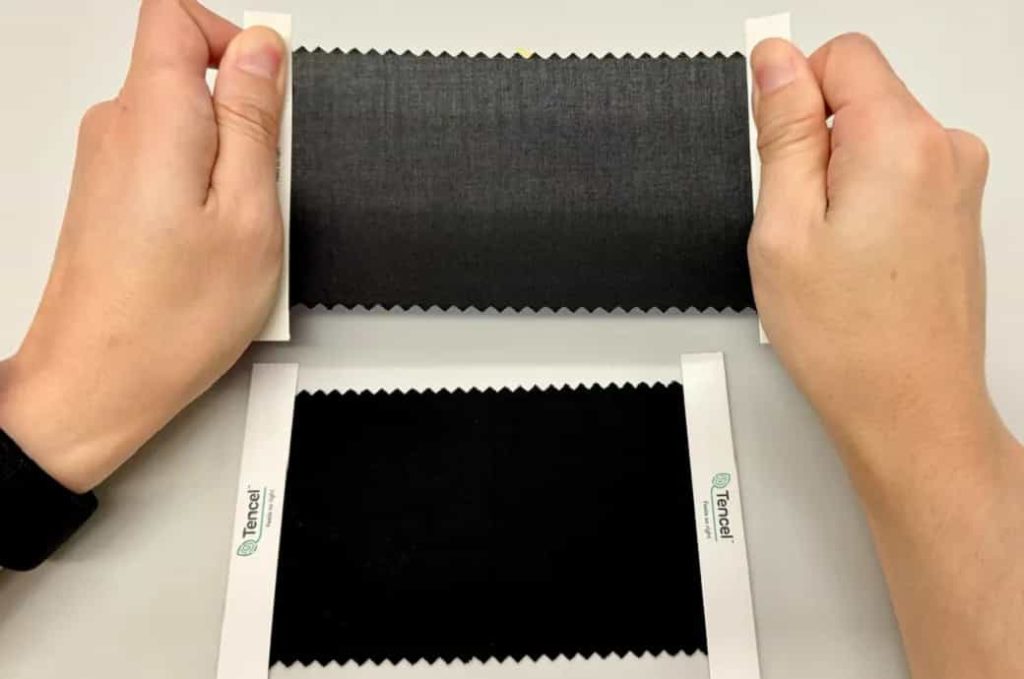

Austria’s Lenzing introduces an innovative processing technique for TENCEL Lyocell fibers, designed specifically for stretch fabrics with enhanced recovery properties

These fabrics, known for their ease of care, not only provide superior comfort but also open up endless design possibilities for lightweight apparel. Lenzing actively supports its mill partners in achieving the “BS EN 14704-1” standard for TENCEL Lyocell stretch fabrics, demonstrating a commitment to quality and industry standards. Recycled content

The groundbreaking processing technique involves the re-engineering of woven fabric composed of TENCEL Lyocell fibers, combined with a fabric pre-treatment. This technique results in increased yarn crimps in the widthwise direction during the wet process, leading to exceptional stretch and recovery properties. The fabric maintains a smooth appearance even after home laundering, showcasing its durability and resistance to shrinkage or wrinkles.

Rex Mok, Vice President of Fiber Technical Marketing and Development at Lenzing, emphasizes the technical innovation’s ability to unlock the inherent potential of TENCEL Lyocell fibers, providing stretch fabrics that move harmoniously with the body.

This not only enhances comfort but also aligns with responsible production practices, offering a fossil-free alternative that adheres to sustainable and transparent supply chain principles. Recycled content

Lenzing extends comprehensive support to its mill partners, ensuring that the stretch fabrics made with TENCEL Lyocell fibers meet international standards for fabric stretch and recovery properties. This collaboration empowers mills and brands to explore unlimited design possibilities, meeting the growing consumer demand for comfortable and responsibly produced apparel across various sectors.

TENCEL Lyocell fibers used in these stretch fabrics serve as a sustainable alternative to conventional synthetic materials. Derived from certified wood sources and produced through a resource-saving closed-loop process, these fibers contribute to reduced carbon emissions and water consumption. The traceability of these fibers back to their sources ensures greater accountability and transparency in the textile supply chain, aligning with Lenzing’s commitment to sustainable practices. Recycled cont Recycled contentent

Recycled content