Tire-cord – Plastic – Recycling – rPET 03-12-2022 - Arhive

Tire-cord – Plastic – Recycling – rPET

-Kordsa to add tire cord capacity in Turkey

Kordsa opens new tire cord facility in Indonesia

Reinforcement materials supplier currently carrying out two expansion projects in Turkey, US

Istanbul, Turkey – Turkish supplier of reinforcement materials Kordsa has announced a new project to add production capacity for single-end polyester cord used in tire applications.

The company began its ‘single end cord – SEC dipping line expansion project’ in Turkey in the third quarter of 2022, CEO Ibrahim Ozgur Yildirim explained in a written statement to ERJ.

The $7-million investment in the second single-cord dipping unit, he said, is a “crucial part” of the company’s strategy to meet automotive industry demand for innovative raw materials. Tire-cord – Plastic – Recycling – rPET

The company expects to start production at the new line in the first quarter of 2024, Yildirim added.

In addition to this latest investment, Kordsa is currently carrying out two other expansion projects at its manufacturing plants in Izmit, Turkey and Chattanooga, Tennessee.

At Izmit, a $18-million (€18 million) investment in adding capacity for high modulus low shrinkage (HMLS) polyester yarn is expected to start operation in the third quarter of 2024, said Yildirim.

Started in 2019, the project will add 7 kilotonnes per annum (ktpa) of production capacity to bring total output for HMLS polyester yarns to 34ktpa at the Turkish plant.

The new capacity, according to Yildirim, will strengthen Kordsa’s position in producing new generation polyester yarn products for the tire industry.

Kordsa has also recently launched a $20-million investment project to double production capacity at its tire cord fabric manufacturing facility in Chattanooga.

“Our tire cord fabric production capacity in US today is 16 ktpa,” said Yildirim, “the new line will be adding 18kt, so doubling our capacity.”

According to the Kordsa official, the company’s production site in North America is currently running at full capacity “to locally support our customers in the region.”

-New Hi-Dura™ MED Nylon Based Products are Heat Stability

Press Release Summary:

- Features include high mechanical strength and rigidity

- Suitable for diagnostics, medical mobility, hygiene, medical packaging, surgical tools and medical housings

Ascend Performance Materials and Foster Corporation Announce New Hi-Dura™ MED Nylon Based Products for The Medical Market

Putnam, CT USA – (December 1, 2022) – Foster Corporation’s Distribution business, a leader in material solutions for the critical application healthcare market segment and Ascend Performance Materials, a leader in the manufacture and marketing of nylon-based materials and technologies, are pleased to announce Ascend’s new Hi-Dura™ MED grade nylon (PA) based materials for the high performance medical device market that Foster will distribute.

The initial Ascend medical product line launch consists of three products:

- Hi-Dura™ MED AG33 NT0862 (glass filled PA6,6)

- Hi-Dura™ MED AI1 NT0861 (impact modified PA6,6)

- Hi-Dura™ MED AP NT0860 (lubricated unfilled PA6,6)

All three of the above products have been tested, and passed, for compliance to ISO 10993-5. Ascend plans to launch further nylon based medical product introductions in 2023 to compliment, and expand the initial product line.

“Foster was appointed as a distributor for Ascend in the medical market earlier in 2022, and has worked closely with Ascend in the development of this product line and is pleased to be one of Ascend’s marketing partners for these products,” said Larry Johnson, President of Foster Distribution. “Nylon 6,6 has been an underused material resource in the medical device community, mainly because not many nylon 6,6 producers have addressed the market up until now. Ascend has done a great job in assessing medical customer needs and coming out with an initial product line that addresses the needs they observed.”

“Foster Corporation is a well- known name in the medical device industry with a strong reputation of providing quality products and technical service,” said Dhruv Shah, Ascend Global Business Manager Healthcare. “Ascend is proud to have established this relationship and we look forward to growing our healthcare business with their support.”

Nylon based products are recognized for their high-performance characteristics including high mechanical strength, rigidity, and heat stability. Applications segments include diagnostics, medical mobility, hygiene, medical packaging, surgical tools, medical housings as well as many others.

For more information about Ascend Performance Materials and Foster Corporation and its Distribution’s business please visit www.fosterpolymers.com.

About Ascend Performance Materials

Ascend Performance Materials makes high-performance materials for everyday essentials and new technologies. Our focus is on improving quality of life and inspiring a better tomorrow through innovation. Based in Houston, Texas, and with regional offices in Shanghai, Brussels and Detroit, we are a fully integrated material solutions provider with global manufacturing facilities in North America, Europe and Asia. Our 2,800-person global workforce makes the engineered materials, fabrics, fibers and chemicals used to make safer vehicles, cleaner energy, better medical devices, smarter appliances and longer-lasting apparel and consumer goods. We are committed to safety, sustainability, inclusion and diversity, and to the success of our customers and our communities. For more information visit www.ascendmaterials.com.

-HeiQ Mints Botanical Antimicrobial

Based on an extract of peppermint oil, the antimicrobial is effective on a range of polymers.

Switzerland’s HeiQ Group is introducing a new antimicrobial product for polymers based on the botanical extract peppermint oil. This is in response to consumer demand for greener solutions and increasing regulatory pressure on conventional antimicrobials such as silver and triclosan used in the plastics industry, said the company.

HeiQ’s Life Natural is a peppermint-based antimicrobial that demonstrates broad-spectrum efficacy against bacteria and can be used in a range of polymers, including transparent ones, such as polyethylene, polypropylene, polystyrene, ABS, and PVC. Life Natural keeps footwear odor-free, treating fabric linings (cotton, cellulosic, or polyester), foam insoles, leather, and PVC uppers. The antimicrobial conforms to the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). Tire-cord – Plastic – Recycling – rPET

Anders Olsson, Sales Director at HeiQ, explained: “We offer antimicrobial built-in solutions for plastics, and we typically work closely with compounders, masterbatch makers, and converters to address antimicrobial needs for end users in consumer, industrial, and medical applications.”

Olsson also described the company’s silver-based antimicrobial offering for elevated-temperature applications called HeiQ HyProTecht, which can be used in significantly lower dosages compared with conventional silver-based antimicrobials. “For example, in polycarbonate, the HeiQ HyProTecht silver-based additive is only used at one-third of the dosage required by competing products, which yields unbeatable cost and excellent transparency. Silver normally discolors resins such as polyester,” he added. Target applications include medical devices, home appliances, food handling and preparation surfaces, and footwear.

HeiQ has also developed HeiQ Ecos, a transparent electrically conductive and infrared reflective coating based on silver nanowire technology. The coating transmits up to 98% of visible light and can function as transparent heating layers, invisible wiring, conductive coatings, and printed electronics, or offer anti-static discharge protection of electronic components.

Coatings based on HeiQ Ecos silver nanowires are suitable for a variety of substrates, including rigid and flexible; glass and plastic; as well as plane and curved substrates. Compared with conductive polymers such as PEDOT/PSS, HeiQ ECOS can demonstrate significantly better conductivity with simultaneously higher optical transmission/transparency in the visible range (400 to 800 nm), according to the company. The silver nanowires demonstrate their strength for applications where 50 to 100 ohm/sq are required.

-December contract price of benzene in Europe decreased by EUR196 per ton

The December contract price of benzene in Europe has been agreed at EUR667 per tonne, down EUR196 per tonne from November,ICIS said.

This is the lowest figure since February 2021. The agreement was confirmed by three sellers and three buyers on Wednesday.

The price decline was the result of falling crude oil prices, weak demand in the spot market, as players seek to minimize inventory levels in 2023 amid disappointing macroeconomic forecasts for the coming quarter.

The December contract price was agreed in US dollars at USD691 per tonne and converted to euro at the agreed exchange rate EUR1=USD1,034.

At the same time, the price decreased by USD168 per ton compared to November in dollar terms.

The contract price was agreed on the basis of value, insurance and freight (CIF), Northwest Europe (NWE).

Earlierit was reported that the November contract price for benzene in Europe was agreed at the level of EUR863 per ton, which is EUR42 per ton higher than in October.

Benzene is the raw material for the production of styrene, which, in turn, is the main raw material for the production of polystyrene (PS).

According to theScanPlast review, the estimated consumption of polystyrene and styrene plastics in the first nine months of 2022 amounted to 402.93 thousand tons, which is 4% less than the volume of consumption for the same period last year.

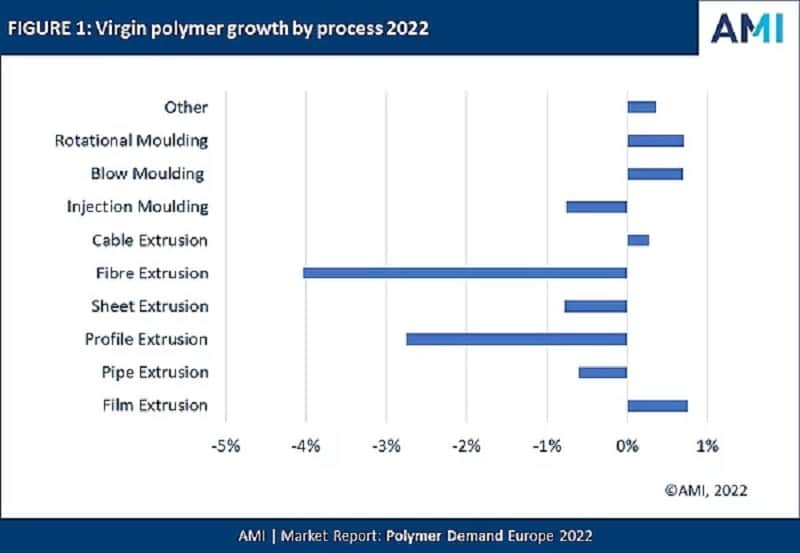

-AMI: New dataset – Tough year for polymer demand but underlying differences are strong

A new dataset from AMI Consulting shows the challenges facing the European plastics industry in 2022 and through to 2027. It covers all of Europe including Russia and former CIS countries.

GDP forecasts for 2022 still look quite healthy. The IMF in its October update forecast 2.6% growth for Europe in 2022, a figure that would be higher if Russia and Ukraine were excluded. Advanced Europe is expected to grow 3.2%.

However, the virgin polymer market looks less healthy with AMI forecasting a 0.4% decline in plastic consumption. This headline number hides wide differences between polymers, between processes, between countries and between applications.

The weakest process is fibre extrusion. There are two specific areas of fibres that are very weak 1) hygiene and medical nonwovens and 2) carpets. Hygiene nonwovens have been a very strong market – especially in 2020. Masks, other PPE like draps and gowns and hygiene wipes, all saw very strong demand.

Some of these were imported from Asia, but much was made in Europe and demand for spunbond machines was very strong. Now we are using less of this equipment demand is falling off. Carpet production in Europe has been weak for decades, but the energy crisis this year has further put up costs. Cheaper Asian products have taken another leap in share of the home carpet market. Automotive carpet volumes continue to be impacted by weak production in that market. Tire-cord – Plastic – Recycling – rPET

Injection moulding is the largest single process for virgin polymers in Europe. It is in the middle of the growth profile, with a small decline. However, there are strong differences between polymers, countries and applications. Some of the differences are due to sustainability concerns – for example inter-polymer substitution in packaging, changes in automotive components due to electrification and lightweighting. Others are due to economic change – for example the continued weakness in the automotive industry continues to bite.

The strongest (or perhaps least weak) polymer application is film. Film production tends to be less sensitive to economic hardships than other sectors of the polymer market. Growth through the Covid crisis was steady and that trend looks set to continue in 2022 and up to 2027 There are also substantial differences between different polymers with films – with sustainability and changing consumer trends driving differential performance.

Data set: Polymer Demand In Europe

-‘Nature has practiced closed-loop recycling for millions of years’

As the momentum for more sustainability continues to build, major players in the industry are exploring ways to reduce their environmental impact and in many cases, looking to nature to do so. Biotechnology is increasingly seen as one of the avenues available to become more environmentally responsible. As Markus Steilemann, CEO of Covestro pointed out: “Biotechnology has enormous potential to produce plastics in a more environmentally friendly and efficient way.”

With the expansion of its biotechnology competence centre, Covestro is further broadening its capabilities in industrial biotechnology. The centre, which opened four years ago, now also boasts a publicly funded research group, with more space and sophisticated equipment in a new laboratory that Covestro has built at its headquarters in Leverkusen.

This junior research group enzyme catalysis, or NEnzy for short, will receive a total of 2.5 million Euros in funding from the German Federal Ministry of Education and Research for five years and is cooperating closely with RWTH Aachen University in Germany. The group is exploring, among others, how to use microorganisms and enzymes to make Covestro’s products and processes even more sustainable. Tire-cord – Plastic – Recycling – rPET

The researchers are looking at how to recycle end-of-life products and plastic waste through enzymatic recycling as well as the use of enzymes to treat wastewater in plastics production. Another focus is the targeted and complete decomposition of used plastic in nature.

“We are taking nature as our model, which has created sensational processes and has practiced closed-loop recycling for millions of years,” said Dr. Gernot Jäger, who heads Covestro’s Biotechnology Competence Center.

Specifically, Covestro is already using biotechnology to research and develop new ways to produce sustainable aniline. This basic chemical has, until now, been obtained almost exclusively from fossil raw materials such as petroleum, which releases CO2. Covestro needs aniline to produce a precursor (MDI) that is used to make insulating foam for buildings and refrigeration equipment.

Together with partners from industry and science, Covestro has developed a pioneering process to produce aniline from plant-based raw materials such as straw or sugar beet plants in an environmentally compatible way using microorganisms. Fully biobased aniline has already been obtained in this way and successfully processed into test products. Now the process, which has already won several awards, is to be further developed on a larger scale. The project is funded with public funds from the German Federal Ministry of Food and Agriculture. Tire-cord – Plastic – Recycling – rPET

-European Commission on bio-based & biodegradable plastics: ‘Since they are called ‘bio’, consumers have the perception they are good for the environment – however, this is only true to a certain extent’

Bio-based, biodegradable and compostable plastics are often considered as the environmental heroes taking on conventional plastic – but the European Commission says such formats need to be approached carefully if they’re to live up to their promise.

Releasing its policy framework on bio-based, biodegradable and compostable plastics this week, the European Commission highlights that a number of conditions need to be met for such plastics to have a positive environmental impact – rather than exacerbating plastic pollution. Tire-cord – Plastic – Recycling – rPET

“Biobased, biodegradable and compostable plastics can bring advantages over conventional ones if designed for circularity, produced safely and from sustainably sourced feedstock, prioritizing the efficient use of secondary biomass, and compliant with relevant standards,” it says.

“However, these plastics also present challenges. It is important to ensure that they contribute to the circular economy, which aims to keep the value of resources, materials and products in the economy for as long as possible and to avoid waste.”

But European Bioplastics, which represents the European bioplastics industry, says that bio-based feedstocks will be a necessary part of the future if the European Union is to move away from plastic waste as per its wide-ranging Packaging and Packaging Waste Regulation (PPWR) proposals released this week.

A growing industry

Globally, bio-based, biodegradable and compostable plastics represent 1% of total plastic production capacity, for a volume of over two million tonnes per year.

That is not much: but production is expected to grow faster than in previous years and will double share of total plastic production capacity by 2025.

Asia accounts for nearly half of production capacity, but it’s an increasingly important area in Europe, with around a quarter. As the industry grows, the European Commission wants to ensure it grows in the right way.

A key, overriding problem with the sector, it says, is that consumers are misled into assuming anything with the word ‘bio’ in its is sustainable – while the full picture is much more complicated.

Bio-based plastics are essentially those which are made from biomass as opposed to fossil resources. Commonly used raw materials are sugarcane, cereal crops, oil crops, wood, cooking oil, bagasse and tall oil. Plastics can be fully or partially made from bio-based feedstock. Bio-based plastics can be either biodegradable or non-biodegradable.

Biodegradable plastics are those designed to decompose at the end of life by conversion of all organic constituents into carbon dioxide, water, new biomass, mineral salts, and, in the absence of oxygen, methane.

Compostable plastics, meanwhile, are a subset of biodegradable plastics designed to biodegrade under controlled conditions, typically through industrial composting in special facilities for composting or anaerobic digestion. Tire-cord – Plastic – Recycling – rPET

Biomass production

Production of biomass requires the use of natural resources (land and water) and the use of chemicals such as fertilisers and pesticides. That can create competition with crops needed for human consumption, or result in deforestation or ecosystem degradation.

“The circular economy action plan identifies the need to address emerging sustainability challenges related to sourcing, labelling and the use of bio-based plastics, based on assessing where the use of bio-based feedstock results in genuine environmental benefits, going beyond reduction in using fossil resources,” says the EC in its policy framework.

“This means also ensuring that the use of bio-based feedstock does not have negative impacts on biodiversity, ecosystems or land and water use.”

To tackle this, producers should prioritize the use of organic waste and by-products as feedstock, says the framework. And when this isn’t possible, biomass needs to be created in a sustainable way.

“As consumers expect bio-based plastics to be genuinely sustainable, whenever a product is made of bio-based content and carries a claim on bio-based content, the content must originate from sustainably sourced biomass.”

No certification

There is currently no mandatory minimum bio-based content nor agreed certification scheme for a plastic product to be labelled as ‘biobased’.

The EC wants to see this changed: when communicating on bio-based content, the policy will specify producers should refer to the exact and measurable share of biobased plastic content in the product (for example: ‘the product contains 50% bio-based plastic content’).

Radiocarbon-based methods should be preferred for measuring bio-based content.

Biodegradable plastics

The EC says that biodegradable plastics ‘must be approached with caution’.

A group of scientific advisors were charged with assessing the biodegradability of plastics in the open environment – with their resulting opinion going as far as to suggest limiting the use of biodegradable plastics in the open environment ‘only to specific applications for which reduction, reuse or recycling are not feasible’.

Much of this comes from concerns over whether products end up in the right environment in which they can biodegrade. Tire-cord – Plastic – Recycling – rPET

Another concern is the additives which are used for manufacturing biodegradable plastics and their potential toxicity – ‘a comparison with conventional plastics indicates that biodegradable plastics can be similarly toxic’.

Any plastics labelled ‘biodegradable’ should specify exactly what circumstances they will biodegrade in and how long it will take, says the policy framework.

“Biodegradable plastics have their place in a sustainable future, but they need to be directed to specific applications where their environmental benefits and value for the circular economy are proven.

“Biodegradable plastics should by no means provide a licence to litter. Also, they must be labelled to show how long they will take to biodegrade, under which circumstances and in which environment. Products that are likely to be littered including those covered by the Single-Use Plastics Directive cannot be claimed to be or labelled as biodegradable.”

“Industrially compostable plastics [the policy does not cover home composting] should only be used when they have environmental benefits, they do not negatively affect the quality of the compost and when there is a proper biowaste collection and treatment system in place. Industrially compostable packaging will only be allowed for tea bags, filter coffee pods and pads, fruit and vegetable stickers, and very light plastic bags. The products must always specify that they are certified for industrial composting, in line with EU standards.” Tire-cord – Plastic – Recycling – rPET

Industry association: ‘We would have expected stronger support’

European Bioplastics, which represents the interest of the European bioplastics industry, says the Commission has missed an opportunity to fully embrace a ‘necessary shift’ to bio-based feedstock.

It notes that the sustainability issues around bio-based plastics are complex – but that the EU’s packaging proposals to prioritize recycled content and recycling is simply not enough to replace the dependence on fossil resources.

“We appreciate the Commission’s first comprehensive policy framework on innovative bioplastic materials, acknowledging their potential to provide genuine environmental benefits. EUBP in particular commends the Commission’s endorsement of the important role of compostable plastic packaging in the proposed packaging rules in reaching the ambitious waste and climate targets,” says Hasso von Pogrell, Managing Director of EUBP, “however, we would have expected stronger support for the use of bio-based feedstock”.

“The Commission’s proposal for a Regulation on Packaging and Packaging Waste (PPWR) recognises the contributions of compostable plastics in increasing the volumes and quality of separately collected bio waste and reducing the contamination of (organic) waste streams. By making several packaging applications mandatory to be compostable in industrial composting facilities, including tea bags, filter coffee pods and pads, fruit stickers, and very lightweight plastic carrier bags, the Commission is taking a first step in the right direction. Tire-cord – Plastic – Recycling – rPET

“Unfortunately, a few persistent misconceptions remain in the Communication on the policy framework for bio-based, biodegradable and compostable plastics with regards to land-use, the methods used to evaluate environmental benefits, alleged risks of cross-contamination of waste streams, as well as biodegradability in different environments. It prevented the Commission from fully embracing the shift to bio-based products that would enable Europe to reduce its dependency on fossil resources and achieve its ambitious climate and circularity goals.”

Notably, the Commission’s proposal for a PPWR does not go as far as promoting bio-based content equally to recycled content through targets to help secure feedstock availability, to achieve recycled content targets, and to meet the strict requirements for contact-sensitive materials.

“We call on EU policymakers to show more ambition and clear vision in their political support to bio-based and compostable plastics by improving and further clarifying the proposal with the aim to decisively support innovation in the sector of sustainable materials and packaging solutions, ensuring that investments, jobs, and innovation remain in Europe”, concludes von Pogrell.

The European Commission’s policy framework on bio-based, biodegradable and compostable plastics will guide future EU work on this issue, for example Ecodesign requirements for sustainable products, funding programs and international discussions.

Tire-cord – Plastic – Recycling – rPET