PP Market Chemical Recycling biodegradable batteries China oil 29-12-2021 - Arhive

PP Market Chemical Recycling biodegradable batteries China oil

In 2021, the overall China domestic PP granule market shows an “M” trend, with two price peaks throughout the whole year, the first peak in early March and the second in mid-October, which is the highest since 2019.

In mid-to-late February, PP prices rose sharply. On the one hand, it was related to the rising futures, on the other hand, many foreign plants shut due to the extreme weather. The short-term mismatch of supply and demand caused imported PP market to rise sharply. China domestic export arbitrage window opened, and RMB spot prices rose accordingly

In September, PP price surged, mainly due to the rapid transmission of the dual control policy in the market at the end of August, the price driving factor transferred from supply and demand to cost, and the cash flow of each production process was in full loss, especially in coal-based PP and methanol-based PP.

Capacity

From the perspective of new start-ups, it’s still a year of rapid expansion of production capacity in 2021. Although the new production capacity is not as good as the 3.8 million tons/year in 2020, the new capacity still exceeds 3 million tons/year, reaching 3.15 million tons/year and the total production capacity reaches 31.405 million tons/year. It is reported that the 450kt/year PP plant #1 of Zhejiang Petroleum & Chemical II has been trial-run in the near future, and it is expected to start commercial production at the end of December/early January.

In terms of distribution area, the production of the new PP plant is mainly concentrated in Northeast China (850kt/year), North China (850kt/year) and East China (800kt/year)., and there is no new production capacity in Northwest and Southwest regions. PP Market Chemical Recycling biodegradable batteries China oil

-Circular Economy for Plastics – 5 Chemical Recycling Solutions of 2021

The global plastic recycling market stood at 162.5 million tons in 2020 and is forecast to reach 263.08 million tons by 2030, growing at a healthy CAGR of 4.49 % until 2030, according to a report by Research and Markets. Chemical recycling is definitely one of the most popular processes in recent times which will aid the plastic recycling industry to transform into a greener and more sustainable circular economy. In this background, PROCESS Worldwide shares with you the top 5 chemical recycling solutions which have been in the news this year.

More than 400 million tons of plastic is produced every year and about 25 % of plastic waste is incinerated and 56 % is disposed of in landfills leading to rising environmental concerns. The solution to this problem: chemical recycling of plastics which will help to reduce CO2 emissions and lead to the creation of a circular economy.PP Market Chemical Recycling biodegradable batteries China oil

Europe is one such region that is actively working towards this goal and has also set up a Circular Plastics Alliance with an aim to recycle about 10 million tons of plastic by 2025. “Chemical Recycling is essential to make the circular economy work,” said Dr. Klaus Schäfer, Chief Technology Officer, Covestro at this year’s virtual Achema Pulse session. There is a huge potential for chemical recycling solutions across the globe and hence, companies are racing towards developing these technologies/solutions to ensure a circular economy.

PlaWave Microwave-Based Plastic Degradation Technology

Microwave Chemical’sPlaWave microwave-based plastic degradation technology directly breaks down plastics that have conventionally been tricky to recycle such as automotive shredder residue (ASR) and sheet molding compound (SMC) products into raw monomers.PP Market Chemical Recycling biodegradable batteries China oil

Mitsui Chemicals and Microwave Chemical have launched a new initiative aimed at commercializing the use of this microwave technology in the chemical recycling of plastic waste. As the technology eliminates an intermediate step, direct monomerization is a more efficient means of recycling plastic waste into plastic than the conventional approach, which involves turning the waste into oil before monomerization. The technique also promises to reduce CO2 emissions through the use of electricity generated from renewable energy to power the decomposition process.

-Price Erosion Continues in Spot Resin Market

The tide may turn in early January with a possible uptick in spot pricing, according to the PlasticsExchange. PP Market Chemical Recycling biodegradable batteries China oil

The spot resin market was somewhat quiet in the holiday-shortened week heading into Christmas, and overall spot prime pricing was flat to as much as $0.05/lb lower, reports the PlasticsExchange in its Market Update.

Just one week earlier, very active trading was prompted by several waves of railcar offers canvasing most commodity polyethylene (PE) and polypropylene (PP) grades. The material was aggressively priced at steeply discounted levels and made available to the Houston export market as well as for domestic delivery. The likes of these well-discounted holiday-type specials had not been seen for several years. Mid-month buyers mostly stayed on the sidelines watching prices erode with pleasure. While some did pick away with orders, the offerings seemed to accumulate as December wore on. Most low-mid melt homo- and co-polymer PP grades were amply available and priced to move. The heaviest PE offerings were for high-density (HD) PE Blow Mold and Injection; low-density (LD) PE Film grades were also well represented, and some LDPE Injection high flow, which had been scarce, also began to appear. Linear-low-density (LLD) PE Film grades were only lightly available and were snatched up quickly by both processors and traders.

As January PE price increases began to issue, market chatter was that producers would purge material, as needed, and some would likely begin to close out their annual books, so buyers swooped in to procure many of these relativity well-priced railcars. There were no fresh producer PE export offers the past few days, as many took an early holiday leave, though some Houston exporters and traders had some material to sell. Prime PE offers were scarcely available, and a dwindling number of off-grade PE railcars were still unsold. PP Market Chemical Recycling biodegradable batteries China oil

Resin contracts decrease again in December

Resin contracts are taking another large decrease in December: PE is declining $0.05 to 0.07/lb and PP by as much as $0.15/lb. Producers intended to liquidate much of their burdensome supplies into the export market during December and, indeed, priced their material to sell. However, an unprecedented number of containers were sent back to Asia empty in September and November, as ocean freight carriers sought to get additional material to Europe by year end. Consequently, producers, exporters, and traders alike all reported frustration in their ability to physically move material for lack of containers, personnel, and ship space. Large exporters also report that most upcoming sailings are already full, with the next significant capacity not available until late January. Even though a good surge of buying materialized mid-month, unless producers slow production rates or somehow exported more material than it appears, spot material probably will be available after the first week in January as much of the recent purge was ultimately sold to domestic buyers, writes the PlasticsExchange.PP Market Chemical Recycling biodegradable batteries China oil

Still, producers could enter the new year with more comfortable inventory positions and be less aggressive with their offerings, but it remains to be seen if it has been enough to turn the market for January. Some stellar resin buying opportunities were available in December and those that grabbed them should be pleased with their purchases several weeks from now, according to the PlasticsExchange.

-Viewpoint: Colombia leads WCSA’s plastics recovery

Colombia is expected to continue to lead the west coast of South America’s (WCSA) plastics market recovery in 2022, as the country looks ahead to new investments in sustainability initiatives as well as new plastics recycling capacity.

The Colombian polymers industry is making significant investments in moving towards a more circular economy — where recycled materials become feedstocks for future products — which is creating optimism for the future, according to Daniel Mitchell, head of the country’s petrochemical and plastics manufacturers association Acoplásticos. PP Market Chemical Recycling biodegradable batteries China oil

“Investments to increase the installed capacity in the recycling of plastics have been growing at a strong rate,” Mitchell said.

Plastics-related machinery purchases grew by about 10pc in 2020, despite the pandemic, and by more than 40pc in 2021, he said. In the last few months alone, the industry has announced plans to invest in nearly 50,000 tonnes (t) of capacity to recycle polyethylene terephtalate (PET), polypropylene (PP), polyethylene (PE), and polystyrene (PS).

The investments in new capacity and sustainability in 2022 are a continuation of the Colombian plastics and petrochemical industries’ strong recovery from the blow suffered in 2020-21 from the global pandemic and political turmoil across the country.

“This rebound in economic data represents the thrust of petrochemical-plastic industries users, such as food and beverages, textiles and clothing, cleaning products, health and cosmetics, automotive and construction, among others,” Mitchell said. PP Market Chemical Recycling biodegradable batteries China oil

Colombia, together with Chile, Peru, and Ecuador, make up WCSA, a region hit particularly hard by the pandemic, with most of the region under strict lockdowns during 2020 and 2021. The region was also impacted by social unrest, including June blockades of the Colombian Pacific Ocean port of Buenaventura that cost the country’s polymers industry an estimated Ps350bn ($100mn).

The entire regions’ petrochemical industry, including polymers output and trade flows, were hurt by the blockades, especially during a period when global freight prices, port congestion and the lack of vessel space disturbed the world’s supply chain.

But for Colombia, WCSA’s strongest economy, a sharp rebound occurred in the past year. Colombia’s basic chemical industry, which includes the manufacturing of plastics in primary forms, grew in the third quarter by about 29pc from a year earlier. The same sector posted a 1.3pc output decline in 2020, when compared to the previous year, according to Acoplásticos.

In plastic products alone, Colombia’s third quarter output increased by 24pc from a year earlier, after a 6.8pc drop in 2020.

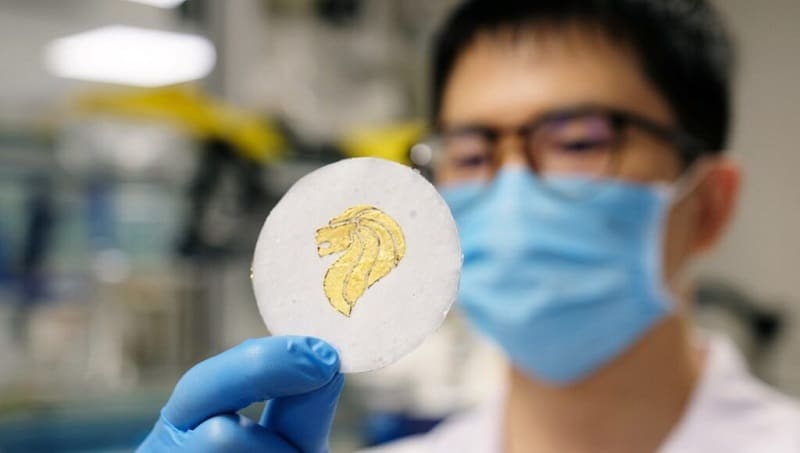

-Scientists create biodegradable batteries that can be buried in soil after use!

Scientists have created biodegradable batteries that can actually be safely buried in the ground after use. The paper-thin batteries could one day become an environmentally sustainable option for powering smartphones and flexible wearable electronic devices. PP Market Chemical Recycling biodegradable batteries China oil

Researchers from The Nanyang Technological University (NTU) developed zinc batteries made up of electrodes (through which the electrical current leaves or enters the battery) screen-printed onto both sides of a piece of cellulose paper that has been reinforced with hydrogel. Once the battery has been expended, it can be buried in soil, where it breaks down completely within a month.

In a proof-of-concept experiment described in scientific journal Advanced Science, the NTU team demonstrated how a 4cm x 4cm square of printed paper battery could power a small electric fan for at least 45 minutes. Bending or twisting the battery did not interrupt the power supply.

In another experiment using a 4cm x 4cm battery to power an LED, the scientists showed that despite cutting away parts of the paper battery, the LED remained lit. This indicates that cutting does not affect the functionality of the battery.

The scientists think their biodegradable battery could be integrated into flexible electronics such as foldable smartphones that are already on the market, or biomedical sensors for health monitoring.

“Traditional batteries come in a variety of models and sizes, and choosing the right type for your device could be a cumbersome process. Through our study, we showed a simpler, cheaper way of manufacturing batteries, by developing a single large piece of battery that can be cut to desired shapes and sizes without loss of efficiency,” explains co-lead author Fan Hongjin, a professor from the NTU School of Physical and Mathematical Sciences, in a statement. “These features make our paper batteries ideal for integration in the sorts of flexible electronics that are gradually being developed.” PP Market Chemical Recycling biodegradable batteries China oil

-China oil consumption to keep growing by 2030 on robust petrochemical demand

China’s oil consumption is expected to keep growing for a decade on robust chemical demand, reaching a peak of about 780 MMtpy by 2030, reported Reuters with reference to a statement of a research institute affiliated with China National Petroleum Corp (CNPC) on Sunday.

Last year, the research group, called the CNPC Economics & Technology Research Institute (ETRI), said that China’s oil demand would peak at 730 MMtpy by around 2025. PP Market Chemical Recycling biodegradable batteries China oil

In its latest report, the ETRI said diesel fuel, gasoline and kerosene consumption are forecast to peak sometime around 2025 at about 390 MMtpy. The strong petrochemical demand will support rising consumption through to 2030.

Overall oil demand will fall after 2030 as transportation consumption declines amid the electrification of vehicles while chemical demand remains stable during the period, the ETRI said.

The ETRI also revised the peak of China’s total primary energy consumption to 6.01 Btpy of standard coal by around 2030, from 5.6 Btpy by around 2035 previously.

“Coal consumption in China would enter a plateau at around 3.6-4 B tons in 2021-2030,” the ETRI said, adding that the use of the dirty fossil fuel would decrease steadily in 2031-2050 as coal-fired power plants become a back-up energy source.

This follows plans from the government to reduce coal consumption in China, the world’s biggest emitter of greenhouse gases, in an “orderly” manner as part of its drive to reach a peak in carbon emissions.

China’s top leaders said at an agenda-setting meeting this month that the “gradual withdrawal of traditional energy sources should be based on the establishment of safe and reliable of new energy sources.”

As MRC wrote previously, China’s crude throughput rose 0.8% to 13.81 million b/d in October from a 17-month low in September.

PP Market Chemical Recycling biodegradable batteries China oil