European-polyethylene – Carbon-black 19-03-2022 - Arhive

European-polyethylene – Carbon-black

-HIGH YIELD, MATTE WHITE, IN-MOULD LABELLING FILM

Innovia Films is launching RayoForm™ EUP60, a white BOPP film for in-mould labelling (IML). Produced in Europe at one of our state-of-the art production facilities, EUP60 is a very high opacity, high yield product, having a density as low as 0.55 g/cm3. Combined with its specially formulated and printable matte surface, EUP60 is engineered to give outstanding high-speed sheet feeding and adhesion for both UV and oxidative inks.

EUP60 is designed with special features that make it suitable for any shape container or lid without risk of distortion to the container or lid. This film is perfect for use on small-to-medium size, thin or thick wall PP or PE containers, providing a tactile ‘soft-touch’ finish after moulding. European-polyethylene – Carbon-black

It also means a finished, polyolefin mono-material container can be produced, making the final pack fully recyclable, and meeting the Plastic Recyclers Europe packaging design recommendations.

Alasdair McEwen, Product Manager, Labels explains “As well as the technical performance of EUP60, we can produce reels for the customer that are longer than anything else in the marketplace. More linear metres in a reel leads to less changeovers and improved printing efficiency, with printing speeds of up to 14,000 sheets per hour being realised. This applies to either roll-to-roll or roll-to-sheet conversion processes and customers can choose either horizontal or large diameter vertical reel packing, depending on their requirements”.

-European polyethylene: Ukraine and the supply risks

ICIS reports that the impact of Russia’s invasion of Ukraine on oil and gas supplies is likely to have consequences for European production, exports, and imports of polyethylene (PE), and while imports from elsewhere could make up for shortfalls, the situation remains volatile.

Russian energy in Europe

According to ICIS, a key concern when it comes to the supply of PE with relation to Russia’s invasion of Ukraine is the availability of oil and gas. Polyolefins plants rely on sufficient energy supplies, and the sanctions imposed on Russia could destabilise access to this. European-polyethylene – Carbon-black

While targeting oil and gas is generally considered an essential part of building an effective set of embargos against Russia, some governments were initially cautious over fears of exacerbating the energy shortages and surging prices already unfolding before Russia’s invasion of Ukraine. The UK, for example, says it will begin a slow phase out with the aim of eliminating Russian oil from its imports by the end of 2022. The European Commission is planning to rescind its dependency on Russian fossil fuels before 2030 with plans to fill shortfalls with alternative, ‘clean’ energy supplies.

50% of European naphtha is supplied by Russia, as well as around 27% of Europe’s crude oil, claims ICIS. According to Ajay Parmar, senior oil market analyst at ICIS, “we have the lowest Amsterdam-Rotterdam-Antwerp (ARA) inventories of naphtha that we’ve seen since 2016, it’s extremely low. […] This conflict is a direct threat to the naphtha market as well as the crude oil market.” Even before sanctions were introduced, Russian exports of oil and gas dropped.

In the case of PE, ICIS provides the example of the Druzhba oil pipeline, which runs from Russia to Hungary, Poland, Czechia, Slovakia, and eastern Germany, and has reportedly continued to flow since Russia’s invasion of Ukraine in February. Around 11% of total European ethylene capacity (an estimated 2.79 tonnes) and 12% of total European propylene capacity (approximately 2.34 tonnes) rely on refineries located along this pipeline.

“It is unlikely that normal levels of operations could be maintained if Druzhba crude supplies were interrupted,” says John Richardson, Senior Consultant, Asia, at ICIS. Amrita Sen, founding partner at Energy Aspects, told the Wall Street Journal earlier this week that “it’s just not going to be possible to replace those pipes” in the case of sanctions. European-polyethylene – Carbon-black

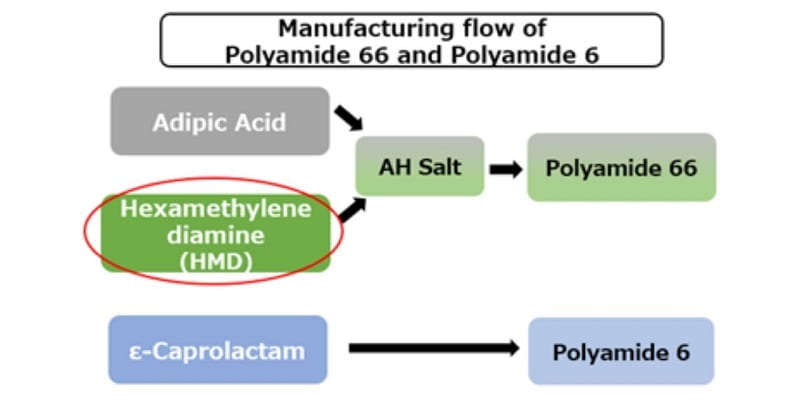

-Asahi Kasei to accelerate trials for commercialization of polyamide 66

Asahi Kasei has formed a strategic partnership with USbased Genomatica regarding hexamethylenediamine (HMD) based on biomass-derived raw materials (bio-HMD), said Hydrocarbonprocessing. European-polyethylene – Carbon-black

Asahi Kasei currently uses fossil fuel–derived HMD as an intermediate to manufacture Leona polyamide 66 an engineering plastic featuring heat resistance and rigidity. Polyamide 66 is used for plastic parts in automotive and electronics applications, as well as yarn for airbag fabric. Demand for polyamide 66 is expected to increase worldwide.

As the world moves toward carbon neutrality, attention is increasingly focused on solutions for reducing GHG emissions from chemical products derived from fossil fuels. The strategic alliance with Genomatica provides Asahi Kasei with preferential rights to access the early volume of bio-HMD to evaluate the possibility as a feedstock of polyamide 66, enabling Asahi Kasei to accelerate trials of polyamide 66 made using biomass-derived intermediate.

Genomatica has an established track record of commercializing manufacturing technology for various chemical products using biotechnology. By using this bio-HMD with its own polyamide 66 polymerization technology, Asahi Kasei aims to support its goal to be first-to-market with more sustainable polyamide 66 made using biomass-derived intermediate for the automotive and electronics application of plastics components and industrial fiber. European-polyethylene – Carbon-black

Asahi Kasei moreover expects that this use of biotechnology will contribute to reaching its goal of becoming carbon neutral by 2050, while also alleviating the environmental burden throughout the life cycle of customers’ products.

-Conflict Brings Higher Interest in Enviro

Enviro has noted a sharp increase of interest in purchasing the Carbon Black and oil that Enviro recovers from end-of-life tyres since the Russian invasion of Ukraine on February 24th. The increased interest has been observed among old and new customers, but the company cannot yet assess what this will mean in terms of specific orders or supply agreements. European-polyethylene – Carbon-black

“The increase in interest entails that we will need to set priorities carefully, while it also confirms that we were wise not to be in a hurry to sign long-term supply agreements connected to our expansion plan,” says Thomas Sörensson, CEO of Enviro.

According to a U.S. market research company, Russia, Ukraine, and Belarus produce a significant part of all Carbon Black used in Europe. At the same time, Europe wants to reduce its dependence on Russian oil and, because oil is a raw material used in Carbon Black production, this could also influence supply.

“Accordingly, the war is likely to have a major impact on the supply of Carbon Black in Europe and globally, and it is obvious that this is causing concern among tyre and rubber manufacturers that shortages will occur,” says Thomas Sörensson, CEO of Enviro.

According to Thomas Sörensson, the increased interest was apparent more or less immediately after the Russian invasion. There has been a strong increase in the number of new and existing customers contacting Enviro to investigate the possibilities of receiving deliveries of Carbon Black from the company.

“Our expansion plan comprises the establishment of a total recycling capacity of 900,000 tonnes of end-of-life tyres by 2030. At the heart of the implementation of the expansion plan is the establishment of long-term supply agreements for recovered materials and end-of-life tyres. The strong rise in interest means that we now need to set our priorities carefully,” says Thomas Sörensson.

Enviro is currently unable to assess the implications of the increased interest for the company’s future development. The interest applies to both deliveries of Carbon Black and recovered oil, referred to as pyrolysis oil. Since the company is conducting several discussions with investors, contractors, and partners regarding the planned facility in Uddevalla, the company wants to be transparent towards the capital market about the way in which interest in the company’s recycling technology and recovered products has risen due to the war. European-polyethylene – Carbon-black

-Impact of Russia-Ukraine conflict on CPL & PA6 import and supply

The conflict between Russia and Ukraine has not only generated a greater impact on energy prices including natural gas and crude oil, but also has certain degree of import on CPL and nylon 6 market, since Russia has been the largest source of CPL imports in the Chinese market for a long time. European-polyethylene – Carbon-black

The three caprolactam manufacturers in Russia are KuibyshevAzot (190kt/year), Grodno Khimvolokno (120kt/year) and Shchekinoazot (66kt/year), a total of 376kt/year CPL capacity and 350kt/year of nylon 6 chip capacity.

Based on the historical data, the annual CPL import volumes from Russia had peaked in 2011-2012, reaching 140,000-170,000 tons, and the monthly average import was close to 3,100-3,900 tons.

The annual import of nylon 6 chip from Russia was waving around 40,000 tons during 2011-2014, and the monthly average import was close to 12-14,000 tons.

But in 2021, the import of both CPL and nylon 6 chip reduced evidently, with annual import of CPL dropping to 61,000 tons, and import of nylon 6 chip to 27,000 tons

In the past 6 years, the proportion of CPL imports from Russia has been maintained at around 50%. Moreover, as a cost-effective import source, Russian suppliers have maintained good business relations with China domestic buyers for a long time. Jiangsu and Zhejiang, where the production capacity of nylon 6 conventional spinning chips is concentrated, has always been their main consumption regions.

With the disturbance of the pandemic, the divergence of energy costs in different regions, and the continuous expanded capacity in China, CPL supply pattern has changed in China. The import volume has fluctuated greatly. It is not difficult to find that the change in the quantity of imported CPL from Russia has always been consistent with the change trend of the total CPL import of China.

From the perspective of proportion, with the reduction of CPL sources in Western Europe and the withdrawal of American sources, Russia’s share has increased steadily. Therefore, from the long-term historical experience, CPL from Russia is the absolute main force in China’s imported CPL. European-polyethylene – Carbon-black

Avient today launched Nymax BIO Formulations, a line of bio-based polyamide materials that help customers reach their sustainability goals. These new materials also solve the long-standing problem of undesirable water absorption levels in other bio-derived polyamide materials available today. European-polyethylene – Carbon-black

Formulated in glass fiber-filled and unfilled options, Nymax BIO materials include between 16 and 47 percent natural filler from renewable plant sources, including corn, straw, and wheat. Renewable, plant-based raw materials, have been shown to offer significantly lower product carbon footprint values than typical petroleum-based feedstock.

Compared with traditional PA66 glass fiber-filled materials, these bio-derived solutions offer lower warpage plus excellent surface appearance and colorability. Nymax BIO low-water-absorption polyamide formulations deliver excellent dimensional stability and property retention after conditioning, providing a solution to the problem of water uptake (hygroscopy) for finished parts.

‘Sustainability is a high priority for consumer brands. Most have initiatives built around bringing more environmentally friendly products to market,’ said Matt Mitchell, Director, Global Marketing, Specialty Engineered Materials at Avient. ‘Our new Nymax BIO line of bio-based polyamide formulations exemplifies our continuous innovation in developing sustainable materials, and expands the material choices for design engineers while mitigating the risk of water absorption.’

Nymax BIO materials are applicable for automotive, consumer, industrial, and building and construction applications and for both injection molding and extrusion processes. They can also be customized for specific performance needs, such as laser welding and flame retardant properties. European-polyethylene – Carbon-black

European-polyethylene – Carbon-black