Spandex market multiend spinning - Arhive

Spandex market multiend spinning

Spandex market lacks momentum to rise

Source : CCFGroup

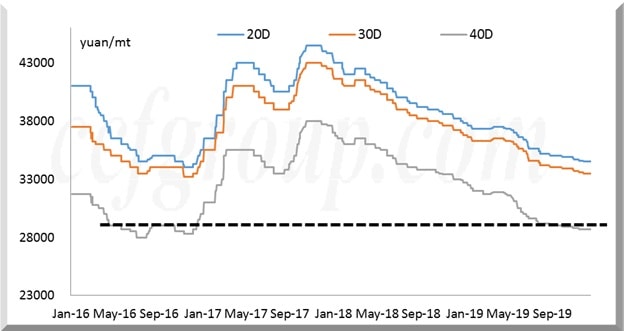

In the first half of 2019, spandex price continuously moved down, and the decline of spandex slightly slowed down in the second half of this year. 40D price gradually decreased to near the historical low of the third quarter of 2016. In early December, under the losses pressure, partial spandex prices were adjusted up by 1,000yuan/mt. However, affected by various factors such as inventory reduction and payment collection at the end of the year, spandex market was in the sentiment of stable sales on the whole, while several resources were priced higher by 300-500yuan/mt.

Obvious cost support

From the spandex 40D price index, the current price slightly increased by 700yuan/mt to 28,700yuan/mt compared with the historical low.Spandex market multiend spinning

However, resources that have been stocked for a long term, new products and dumping goods were priced evidently low at around 27,000yuan/mt, and cost of main raw materials for spandex production ascended by above 3,000tyuan/mt from the cost in the third quarter of 2016.

Thus, the increase in spandex 40D price was significantly smaller than that in main raw materials. Old units in the East for 40D production were under the greater cost pressure, while the cash flow loss of 32-end units for 40D production reached a historical high. Spandex market multiend spinning

Nevertheless, domestic 60-end and above units for 40D production were still meagerly profitable. With the development of multi-end spinning units and the capacity growth of newly added multi-end spinning units, the average production cost of industry declined.

| Spandex raw materials | ||||||

| 40D | MMDI | PTMEG | Main raw material cost | |||

| July-16 | 28,000 | 16,300 | 12,600 | 12,762 | ||

| December-19 | 28,700 | 19,000 | 15,850 | 15,783 | ||

| Change (yuan/mt) | 700 | 2,700 | 3,250 | 3,021 | ||

| Change (%) | 2.5% | 16.6% | 25.8% | 23.7% | ||

Rigid demand with partial agents preparing inventory

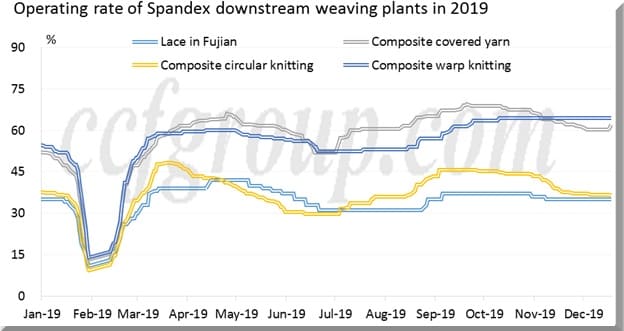

The Sino-US trade relationship slightly eased recently, coupled with the significant decrease in price of raw materials for textile garments in 2019, the sales of downstream weaving plants for preparing stock modestly accelerated. At the end of the year, orders of domestic trade and foreign trade meagerly ascended. Spandex market multiend spinning

In the first half of December, operating rate of downstream weaving plants had no big change, while several units such as air covered yarn units ran at a slightly higher rate. Run rate of downstream weavers is estimated to keep steady in late this month. With the Spring Festival approaching, more and more downstream plants may start to take a holiday after the beginning of January, so the possibility of weakening rigid demand may exist. The condition of preparing inventory of downstream agents and weaving plants should be paid attention in 2020.Spandex market multiend spinning

At the end of the year, spandex downstream weaving plants largely purchased spandex for rigid demand, while agents merely prepared a small amount of inventory of low-price and promoted resources, so the overall preparing inventory sentiment remained cautious. Sellers were active in pressing for payment at the end of this year. However, the difficulty of payment collection was larger compared with the same period of last year, and the progress was relatively slow. Spandex market multiend spinning

The payment collection of several downstream resources may be postponed to before the Spring Festival. At present, downstream weaving plants ran at 30-70%, and the operation rate of air covered yarn was at around 70%. The business of air covered yarn modestly rebounded this week, and the inventory reduction obviously accelerated, with the rising rigid demand for spandex. Spandex market multiend spinning

Run rate of cotton core-spun covered yarn and conventional covered yarn maintained unchanged provisionally. Operating rate of warp knitting kept at around 60-70%, and circular knitting run rate in Jiangsu, Zhejiang and Guangdong is at around 30-50%. Orders for double-faced circular knitting and foreign trade (rib fabric, Koti grain and air layer) slightly ascended, and sales of domestic trade orders for double-faced orders were considerable. Production of single-faced circular knitting continued. Operating rate of lace in Fujian was at 30-40%. Spandex market multiend spinning

Market Outlook Spandex market multiend spinning

Spandex cost support strengthens. Driven by firm BDO, PTMEG price stabilize, and spandex old units in the middle and the East are under the significant cost pressure. Around the Spring Festival, several units may shut down or cut output.

For demand, the intention of spandex downstream to continuously build inventory is likely to be low, and operating rate of weavers is estimated to decrease further at the end of this month and the beginning of January. Under the losses pressure, spandex price is anticipated to be in stable adjustment. Spandex market multiend spinning

Mainstream resources are sold for payment collection, while several resources that have been stocked for a long term or new products may still be priced low.

Spandex market multiend spinning

Polyester downstream market largely pessimistic, requiring time to improve