BOPP Film fibre-to-fibre – High-quality recycling loops are best for circular economy 30-08-2023 - Arhive

BOPP Film fibre-to-fibre

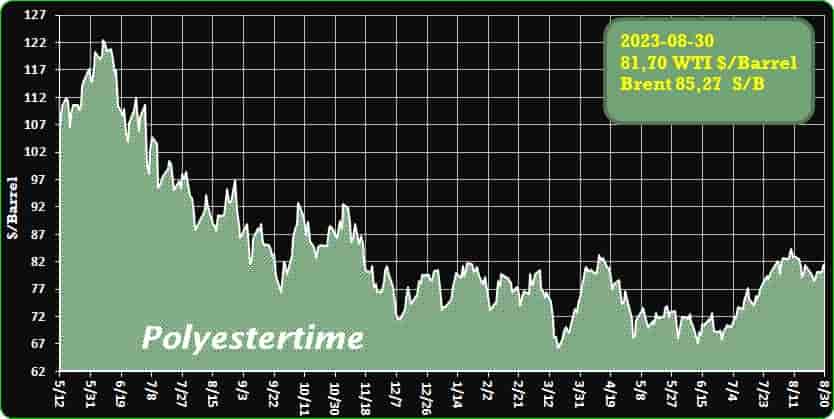

Crude Oil Prices Trend

Crude Oil Prices Trend by Polyestertime

Accord Signed for Treofan Terni: A New Chapter for BOPP Film Production

In a significant development, the BOPP (biaxially oriented polypropylene) film production plant in Umbria, Italy, will now be transitioning to the ownership of the Polish company Visopack. This momentous move comes as the Indian conglomerate Jindal, which had taken over the Treofan Terni plant three years ago, has finalized a preliminary agreement with Visopack for the transfer of the facility along with its specialized machinery dedicated to BOPP film production. The announcement, made recently by the UGL Chemical Workers Union, marks a turning point in the evolution of the plant and the future of its workforce.

Having reached a verbal agreement in June, the accord has now been officially ratified. However, the specifics of the industrial plan that Visopack has meticulously crafted to rejuvenate the Umbrian site are yet to be unveiled. The finer details of this plan will be presented during a meeting at the Ministry of Enterprises and “Made in Italy” (Mimit). The transition of ownership will be undertaken following discussions with relevant institutions and labor unions. BOPP Film fibre-to-fibre

“This solution represents the only option that, based on the skills and professionalism of the personnel, promotes the complete reintegration of the workers and ensures them the dignity that only a job can provide, thereby putting an end to the challenging situation of temporary layoff,” stated UGL Chemical Workers Union in a press release.

Headquartered in Torun, Poland, Visopack specializes in the production of BOPP films for flexible packaging and labels. The acquisition of the Terni facility by Visopack brings new prospects for the plant, its employees, and the local community. This transition holds the promise of preserving valuable employment opportunities and contributing positively to the region’s economic landscape.

The Terni plant had become a part of Jindal’s portfolio in 2018, as a result of its acquisition of Treofan’s European activities. This move had also included the facility in Battipaglia (SA), Italy, which was subsequently acquired by Jcoplastic in 2020. Notably, in Italy, Jindal Films Europe continues its plastic film production at sites in Brindisi and Cesano Maderno. Beyond Italy’s borders, the Indian conglomerate operates across Europe with facilities in Neunkirchen, Germany (formerly Treofan), Kerkrade, Netherlands, and Virton, Belgium, where a technological center is also situated. BOPP Film fibre-to-fibre

The agreement marks a significant step forward for both Visopack and the employees of the Terni plant. As the industrial landscape evolves, the partnership between Visopack and Jindal promises to infuse new energy and innovation into the BOPP film production sector. It holds the potential to revitalize the production plant and bolster the local economy, ultimately fostering stability and growth.

As the ownership transition unfolds, it underscores the importance of collaborative efforts between businesses, unions, and governmental bodies. The inclusion of all stakeholders in shaping the future of the Terni plant not only ensures a smoother transition but also aligns with the shared goal of preserving jobs and sustaining the plant’s role as a significant contributor to the industrial fabric of the region.

In conclusion, the signed agreement between Jindal and Visopack ushers in a new era for the Treofan Terni plant and its employees. The dedication to innovation, stability, and community growth will serve as the foundation for the transformation of the plant into a dynamic hub for BOPP film production, in turn bolstering the larger industrial landscape and promoting economic well-being. BOPP Film fibre-to-fibre

Toray develops fibre-to-fibre recycling for used nylon fishing nets

Toray, in collaboration with Nitto Seimo and Taiyo, has achieved a breakthrough in the realm of sustainability by pioneering a fiber-to-fiber recycling method tailored for repurposing used nylon fishing nets. In an industry-first initiative, the trio of Japanese companies is set to undertake trials involving purse seine nets composed of chemically recycled nylon fishing nets, with a particular focus on the Northern Pacific Ocean this November.

Toray Industries, renowned for its expertise in materials manufacturing, and Nitto Seimo, a prominent fishing net manufacturer, have jointly unveiled their innovative approach to recycling purse seine nets, with plans for field trials in the Northern Pacific Ocean in November. This significant advancement stems from a collaborative effort with fishing enterprise Taiyo A&F. Initially established in November 2022, this partnership was conceived to address the recycling of fishing nets crafted from nylon remnants and byproducts generated during net production. BOPP Film fibre-to-fibre

Now, the endeavor has expanded to encompass the reclamation of materials from utilized nylon fishing nets, marking a pioneering achievement in the domain of fiber-to-fiber recycling on a global scale.

While various initiatives have sought to recover nylon fishing nets, often referred to as “ghost nets” when abandoned at sea, these materials have typically been repurposed into alternative products such as swimwear, rPET, or rPA due to the challenges associated with their degradation during recycling. The exposure to debris and algae during their immersion in the sea has contributed to the deterioration of the fibers’ strength and resilience.

Toray has ingeniously harnessed its depolymerization chemical recycling technology to transform nylon sourced from ghost nets into a recycled fiber that reportedly rivals the quality of virgin material. Utilizing this recycled fiber, Nitto Seimo is now producing the purse seine nets, which will be put to the test aboard Taiyo A&F’s offshore fishing vessel, the Taiyo Maru No.21, in a trial slated to commence this November.

The three pioneering entities hold ambitious aspirations to validate the commercial viability of their novel fishing nets through these trials. Depending on the outcomes, they are eyeing the prospect of introducing the recycled fishing nets to the market as early as December 2023. BOPP Film fibre-to-fibre

Mitsuo Ohya, President of Toray, underscores the broader implications of this venture, stating, “This pursuit of nylon fiber-to-fiber recycling technology for fishing nets charts a course for the entire textile industry to contribute to the realization of a circular economy. By conserving and recycling resources while minimizing waste across the supply chain, we are poised to make a significant impact on the industry’s sustainability journey.”

India’s role in global oil consumption has encountered a substantial deceleration, triggering ramifications on the international oil market

Although the first seven months of 2023 witnessed a surge in petroleum consumption to an unprecedented level, this growth has markedly slowed down as the rebound from pandemic-induced lockdowns reaches its culmination, as per reports from Reuters.

The Indian economy finds itself ensnared in a confluence of challenges, grappling with swift inflation and a decelerating global trade environment, a predicament mirroring the struggles faced by other prominent economies spanning South and East Asia. During the initial seven months of 2023, petroleum consumption surged to a staggering 135 million metric tons, a discernible climb from the 128 million metric tons recorded in the corresponding period of 2022. BOPP Film fibre-to-fibre

This ascent, while still considerable, translates to an approximate 255,000 barrels per day (bpd), which constitutes a substantial retreat from the 415,000 bpd growth observed during the preceding year of 2021/22. The velocity of oil consumption expansion, typically hovering around 5% to 6% on a yearly basis, has conventionally aligned with the analogous growth noted in the manufacturing output sector.

In sharp contrast, this surge in India’s petroleum consumption pales when juxtaposed against the staggering growth, exceeding 1.0 million bpd, witnessed in U.S. oil production throughout the initial five months of 2023. Regrettably, India’s slower pace of consumption escalation has fallen short in absorbing the surplus crude supply and thereby tightening the global market, an especially critical need at a juncture when oil consumption has endured a lull across North America, Europe, and China.

Consequently, the relatively lackluster surge in India’s oil consumption has further compounded the downward pressure exerted on global crude oil prices throughout the course of 2023. BOPP Film fibre-to-fibre

It’s imperative to recollect that Hindustan Petroleum Corp Ltd (HPCL), a significant Indian refiner, has artfully addressed this conundrum by sourcing up to 23% of its oil requisites from heavily discounted Russian grades. This strategic move marks a stark departure from the erstwhile practice, wherein Indian refiners scarcely engaged in transactions involving Russian oil. The shift ensued after several Western nations opted to eschew purchases from Moscow due to its military intervention in Ukraine.

While HPCL’s utilization of Russian oil is subject to the constraints of its refineries’ configurations, the corporation has adeptly maximized the exploitation of these cost-effective “opportunity crudes.” This calculated maneuver not only assists in mitigating risks arising from elevated oil prices but also encapsulates a prudent effort to “ringfence” itself from potential market volatilities.

In summation, India’s once-surging petroleum consumption, although presently marked by a perceptible deceleration, retains significance within the global oil landscape. As the nation’s economic dynamics navigate the intricate interplay of inflation and trade fluctuations, its strategic approach to sourcing and refining oil continues to wield influence beyond its borders, illustrating the intricate web that ties together regional economic shifts and the worldwide energy sector. BOPP Film fibre-to-fibre

Chinese BYD and Xpeng acquire American companies

Denza, the Chinese brand that wants to challenge the big names in Europe

High-quality recycling loops are best for circular economy

Fibre-based packaging offers what is probably the best existing example of a high-quality recycling system, where recycling can take place from any type of packaging to another. Professional recyclers say the real challenge is not in these ‘material loops’ but in the separate collection of paper for recycling, which has yet to be streamlined across Europe.

On Europe’s journey to a circular economy, high quality recycling is essential. In fact, the recycling of fibre-based packaging constitutes one of the best examples. If you put your used paper products in the right recycling bin, you can count on them making their way to a facility that will recycle those materials so they can be used again many times to make packaging for breakfast cereal, boxes to carry your online deliveries, newspapers, and a whole host of other useful products. BOPP Film fibre-to-fibre

Currently, about 75 percent of the raw materials used for the fibres in our packaging come from recycling. The rest comes from sustainably-managed forests. Our packaging helps keep fossil fuels in the ground, playing its part in making our planet greener. This is why fibre-based materials are widely recognized as one of the most sustainable choices available for packaging.

This is why fibre-based materials are widely recognized as one of the most sustainable choices available for packaging.

The EU’s packaging waste regulation: a key chance to enhance recycling systems

At Fibre Packaging Europe we believe the upcoming Packaging and Packaging Waste Regulation (PPWR) has a key role in making recycling even better. We now have a chance to set an ambitious 90 percent separate collection target for all EU member countries. Here separate collection means transferring materials from your paper and board bin to the recycling plant. BOPP Film fibre-to-fibre

There is no better way to ensure that our packaging reaches recyclers after it has been used, and it will further increase an already-remarkable 81.5 percent recycling rate (Eurostat, 2020), higher by volume than plastic, metal and glass combined.

Where we see a risk in the PPWR is if the regulation gets the definition of ‘high-quality’ recycling twisted by restricting it only to what it calls ‘closed loops’. A closed loop means a cereal box would need to be recycled into another cereal box. When fibres are allowed to be recycled universally into any paper and board application and product, it is effective, it is resource efficient, and it reduces CO2 emissions through avoided transportation (to that cereal box factory). Most importantly, it is a good and simple way to continue increasing recycling rates.

Don’t get the loop twisted: why material loops make most sense for paper

But don’t just take it from us. We spoke to seasoned professionals in the recycling business that Fibre Packaging Europe represents to hear first-hand their thoughts on closed loops, the real challenges recyclers face and what can be done to overcome them.

Does closed-loop recycling have a role to play for fibre-based packaging? John Melia, strategy development and innovation director at DS Smith’s Recycling Division, is very clear on this point. BOPP Film fibre-to-fibre

“Closed-loop recycling of paper packaging would make no sense in a mature, well-functioning recycling system built on a thriving market for secondary raw materials. It would bring disruption to the market, reduce the quality and lifespan of fibre, and increase the use of fossil fuels in the supply chain. This would be a significant step back from the high-performing recycling system we have today.”

Recycling systems based on ‘material loops’, on the other hand, mean that the raw materials we get from recycling processes are used in way that is far more versatile. They can be used to make a wide range of sustainable products that we use every day. The system works, and there is already in Europe a unique, thriving market for secondary raw materials in the fibre-based industry.

In 2020, 56 million tons of ‘Paper for Recycling’ collected were transformed into equally high-quality new paper and board products. BOPP Film fibre-to-fibre

Saudi Arabia Polypropylene (PP) Market [GROWTH] Power of Multivariate Analysis Techniques for Analyzing Complex Data Sets

According to the report by Report Ocean, The “Saudi Arabia Polypropylene (PP) Market ” Research Report offers a comprehensive industry overview, encompassing pivotal trends, opportunities, risks, and drivers that significantly impact market growth. The report also outlines the market’s current CAGR status. The “Saudi Arabia Market ” is anticipated to rise at a considerable rate during the forecast period, between 2023 and 2032. In 2022, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

What is Saudi Arabia Polypropylene (PP) Market ?

The Saudi Arabia Polypropylene (PP) market plays a pivotal role in the country’s petrochemical and plastics sectors, with widespread applications across various industries. Polypropylene (PP) is a versatile thermoplastic polymer that is widely used for its excellent combination of properties, including high impact resistance, chemical resistance, low density, and versatility in processing. In Saudi Arabia, the PP market has a significant presence due to the country’s abundant petrochemical resources and advanced manufacturing capabilities. BOPP Film fibre-to-fibre

The packaging industry is a major consumer of PP in Saudi Arabia. PP is extensively used to produce a variety of packaging materials, including films, containers, bottles, and bags. Its durability, lightweight nature, and resistance to moisture and chemicals make it a preferred choice for packaging solutions.

The automotive sector also relies on PP for the manufacturing of automotive components and interior parts. PP-based materials are used in the production of bumpers, dashboards, door panels, and various other interior and exterior components. The automotive industry’s demand for lightweight, durable, and cost-effective materials has contributed to the growth of the PP market.

In addition to packaging and automotive applications, PP is used in the production of consumer goods, electrical appliances, textiles, and industrial products. Its versatility allows it to be modified with additives to enhance specific properties, making it suitable for a wide range of end-use applications. BOPP Film fibre-to-fibre

Market trends in the Saudi Arabia PP market are influenced by factors such as economic conditions, industrial growth, technological advancements, and consumer preferences. The availability of feedstock, feedstock prices, and global market dynamics also impact the industry’s performance.

Regulatory policies, trade agreements, and environmental considerations contribute to shaping the Saudi Arabia PP market. International competition, quality standards, and pricing trends in the global market play a significant role in determining the industry’s direction.

In summary, the Saudi Arabia Polypropylene (PP) market holds a crucial position in the petrochemical and plastics sectors, with its versatile properties and widespread applications. It is a key material in the packaging and automotive industries, offering durability, lightweight nature, and resistance to various environmental factors. The PP market’s trajectory is influenced by economic conditions, technological advancements, and consumer preferences.

Moreover, feedstock availability, regulatory policies, and global market trends collectively shape the landscape of the PP industry in Saudi Arabia. BOPP Film fibre-to-fibre

BOPP Film fibre-to-fibre