Chemical PET recycling – Petrochemicals MEG rPET – Has Stellantis already lost the challenge with China in car batteries? 11-09-2023

Chemical PET recycling

Petrochemicals MEG rPET – Has Stellantis already lost the challenge with China in car batteries?

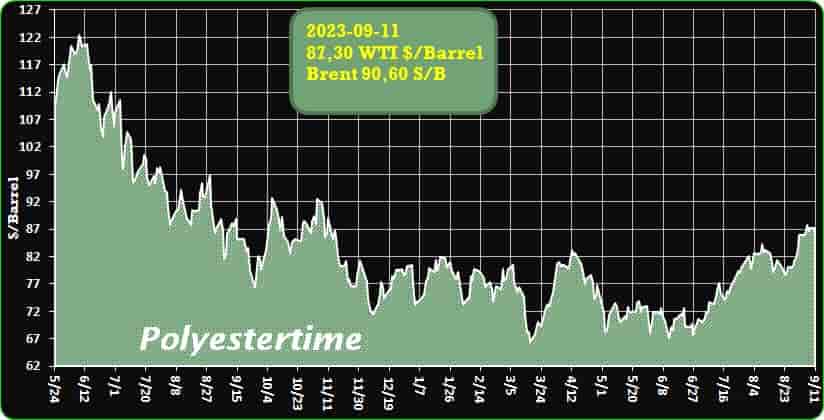

Crude Oil Prices Trend

Crude Oil Prices Trend by Polyestertime

Chemical PET recycling plant under construction

To strengthen its efforts in the area of sustainability, Köksan PET ve Plastik Ambalaj San. ve Tic. A.Ş., headquartered in Gaziantep, Turkiye, aims to construct the world’s biggest rPET plant based on chemical recycling of post consumed PET waste. It is intended to commence the production of 100% food grade rPET by the end of 2024.

The capacity of this plant is expected to be 110.000,00 metric t/a. According to the company, the process of recycling PET flakes through depolymerisation to BHET and subsequent 3-micron microfiltration results in a resin that is comparable to virgin monomer, making it suitable for food-grade applications. Chemical PET recycling

Köksan’s patent process to make high viscosity and lower than 1ppm AA level in resin without any SSP process is claimed to be suitable for bottle grade application, states the company: “This will be the first plant of this kind for 100% rPET resin for all food grade applications”. The plant is also designed to produce various qualities textile grade resin with 100% rPET or virgin resin production.

The primary benefit of depolymerisation through the glycolysis process is its low operating temperature, typically around 200 °C. This avoids the side reactions and generations of BPA and phthalates which is generally due to high temperature thermal process like mechanical recycling. Chemical PET recycling

The chemical depolymerisation to BHET level ensures the process is similar to virgin polycondensation reaction and product rPET is similar to virgin PET resin.

LC Packaging acquires a minority share of Bluepack

Danish company Bluepack is a manufacturer of packaging for agriculture and flexible intermediate bulk containers (FIBCs), also known as big bags.

Netherlands-based LC Packaging announced an agreement to acquire a minority share of Bluepack, a Danish company specialising in flexible intermediate bulk containers (FIBCs), also known as big bags.

Big bags allow for packing, handling, and transporting large quantities of goods. Bluepack manufactures the bags for the agricultural and pharmaceutical industries, among others, in Denmark and Sweden. FIBCs are often a flexible and cost-efficient solution for materials and products, such as mortar, sand, gravel, granite chippings, feed, grass seeds, and potatoes. Bluepack did not disclose the exact constitution of its big bags, but the products are often made of polypropylene (PP). Chemical PET recycling

According to the agreement, the Dutch manufacturer and distributor of flexible packaging holds the first option to acquire the remainder of the Bluepack shares at a later date. LC Packaging already has its own FIBCs production facilities, but the acquisition is expected to lead to shorter lead times for its big bag costumers in and around Scandinavia.

“This partnership makes great sense for LC Packaging, since it allows us to expand our activities in Scandinavia with regard to FIBCs and agri packaging,” said Lucas Lammers, CEO of LC Packaging. Chemical PET recycling

Chinese textile industry’s profit falls by 20.3% YoY in Jan-Jul 2023

INSIGHTS

- The total profits of industrial enterprises in China above the designated size reached 3,943.98 billion yuan between January and July this year—down by 15.5 per cent year on year (YoY).

- The profit of the manufacturing industry was 2,769.42 billion yuan during the period—down by 18.4 per cent YoY.

- The textile industry’s profit fell by 20.3 per cent YoY in the period.

The total profits of industrial enterprises in China above the designated size reached 3,943.98 billion yuan between January and July this year—down by 15.5 per cent year on year (YoY) and a fall of 1.3 percentage points narrower than that between January and June, according to official statistics. Chemical PET recycling

The profit of the manufacturing industry was 2,769.42 billion yuan during the seven-month period—down by 18.4 per cent YoY.

State-holding enterprises saw a profit of 1,380.59 billion yuan, a YoY decrease of 20.3 per cent.

The profit of share-holding enterprises was 2,883.56 billion yuan during the seven-month period—down by 16.6 per cent YoY. Enterprises funded by foreign investors and investors from Hong Kong, Macao and Taiwan saw a total profit of 935.57 billion yuan—down by 12.4 per cent YoY; private enterprises saw a profit of 1,022.66 billion yuan—down by 10.7 per cent YoY.

The Chinese textile industry’s profit decreased by 20.3 per cent YoY in the January-July period. Chemical PET recycling

From January to July, the revenue of industrial enterprises above the designated size was 73.22 trillion yuan—a decrease of 0.5 per cent YoY, an official press release said.

At the end of July, the assets of industrial enterprises above the designated size totaled 161.40 trillion yuan, a YoY increase of 6.5 per cent.

Drop in Polyethylene Sales in China Raises Concerns for Exporters

According to recent estimates, major exporters have lost around a billion dollars in polyethylene (PE) sales in China from January to July 2023, compared to the same period last year. This analysis is based on the records of imports from the big exporters provided by the China Customs department. The losses vary by grade of PE, with high density PE (HDPE) experiencing the greatest decline. Chemical PET recycling

Among the major losers in polyethylene sales to China were Iran, Saudi Arabia, the United Arab Emirates, and South Korea, while the United States was one of the few winners. This trend was unchanged from the previous period. The Middle East, which saw a significant number of turnarounds in the first half of the year, may potentially regain ground later in 2023 as production recovers. However, some turnarounds were reported to have been brought forward due to poor market conditions.

The profitability of polyethylene sales is also at record lows, with no signs of improvement in the current market conditions. The average China CFR PE price spread over CFR Japan naphtha costs is at its lowest level since 1993.

Rising prices do not necessarily indicate a stronger market if petrochemical producers are unable to pass on feedstock costs. Chemical PET recycling

In terms of demand, HDPE is projected to decline by 2% in 2023, while LDPE is expected to remain flat and LLDPE to increase by 4%. If these estimates hold true, China’s total PE demand in 2023 would be lower than the ICIS Base Case Forecast.

It is evident that the decline in polyethylene sales in China has raised concerns for exporters. Many producers who based their strategies on assumptions such as the rise of China’s middle class may face challenges, while those who considered demographic and debt factors may fare better. Global PE capacity may need to be adjusted to bring the market back into balance. Chemical PET recycling

Italian PET recycler launches new food-grade rPET brand

With two Starlinger Recostar PET bottle-to-bottle recycling lines, Piedmont-based Dentis Recycling Italy expanded its product portfolio and now offers food-grade rPET pellets in addition to hot-washed PET bottle flakes.

The Starlinger Recostar PET 330 HC iV+ bottle-to-bottle recycling lines produce bottle-grade rPET and have a production capacity of up to 3.3 tons per hour each. Copyright: Dentis Chemical PET recycling

In 2021, Italy’s biggest recycler of post-consumer PET bottles initiated a new project to extend its rPET production capacity and purchased two Starlinger Recostar PET 330 HC iV+ recycling systems. The new lines were commissioned in summer 2022 and are recycling used PET bottles into high-quality rPET pellets that Dentis sells under the new brand name Repeter. With a combined production capacity of 6.6 tons per hour, the total yearly output of the lines amounts to 50,000 tons of finest bottle-grade rPET pellets.

Dentis reaches an important project milestone this year: The company will recycle a total of 80,000 tons of post-consumer PET bottles collected through the Italian collection systems operated by Corepla and Coripet. After completion of the capacity extension in 2024, the potential recycling capacity of the Piedmont site will amount to approximately 130,000 tons of post-consumer PET bottles per year.

“We want to support the transition from a linear economy to a circular economy” said Roberto Dentis, co-owner of Dentis Recycling Italy. “With technology from Starlinger we can be sure that the recycled PET we produce meets the elevated standards of our customers in the food and beverage packaging sector. By producing high-quality food-grade recycled PET pellets we are able to maintain a closed loop for PET bottles and contribute effectively to achieving the European recycling targets, making post-consumer plastic packaging no longer a waste to be disposed of but turning it into an important resource for top-quality packaging.” Chemical PET recycling

The food-grade rPET pellets produced on the Starlinger lines and marketed under the brand name Repeter are available in several colours. Besides approvals for use in food packaging from numerous big brand owners, the Starlinger PET recycling process has received positive opinions from the European Food Safety Authority EFSA as well as LNOs from the US Food and Drug Administration FDA. Dentis supplies the food-grade rPET pellets to important brand owners in the food and beverage industry, as well as to local plastic packaging producers.

Source: Starlinger

RCA Engineering develops modular composite recycling systems

Modular plant configurations gives companies the option of mechanical or thermal processing of carbon and glass fibers to ensure zero waste and emissions, no noise and reduced construction costs.

With the exponential growth in the consumption of composite materials, their end-of-life recyclabilty has become an important topic to address. In this area, RCA Engineering (Barcelona, Spain) has sought to develop a modular composite recycling method for carbon and glass fibers from any sector using mechanical and thermal recycling processes. Chemical processing have been ruled out to eliminate the creation of toxic substances, such as cadmium and mercury, among others, which can further affect the environment. Chemical PET recycling

RCA has designed modular plants differentiated by their mechanical capacity (i.e., production capacity in tons/hour). All models are composed of two maritime containers and a baseplate frame which provides a horizontal platform. Container dimensions change depending on the models. The containers are assembled over a modular steel structure so that the bottom container, which stores the shredded material, can be easily replaced once full. RCA Engineering says it has begun implementing thermal cameras on all of its recycling systems.

Modular systems that are capable of mechanical or thermal recycling are offered to customers; three models are available for mechanical recycling and two models for thermal recycling. The mechanical system includes a shredder system inside the part of the process line, as well as a filter and particle separator depending on the type of laminates and pieces to be decommissioned (e.g., whether they are monolithic or sandwich laminates). Chemical PET recycling

A small conveyor is also included on the line.

Thermal systems include a pyrolysis oven inside the process line. Regenerative burners are used for better energy efficiency. Burners cycle continuously and heat-up ramps are programmed on the PLC. Oxygen (O2) analyzers are installed to control emissions, and same with the burners to control NOx emissions. Thermocouples control the system.

Configuration of the process line on the upper container can be adjusted as per the client. Each system is fed with an electrical battery system with a capacity that can go from 281 to 1,405 kilowatt-hours. There are no emissions to the atmosphere and no noise contamination. Each modular system is said to be zero waste, easy to transport and simplified for decommissioning uses; cost is reduced by about 30% compared to the construction of a traditional plant. In addition, these recycling systems are ideal for remote locations. Chemical PET recycling

Chemical PET recycling