Chemical-Recycling – Polymers 11-01-2023 - Arhive

Chemical-Recycling – Polymers

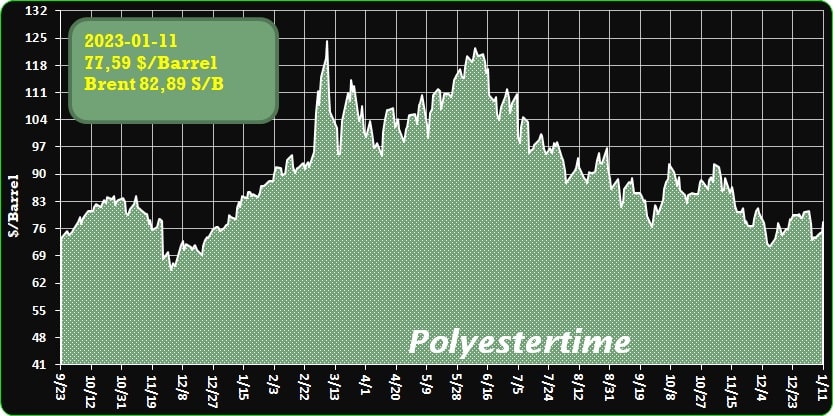

Crude Oil Prices Trend

Crude Oil Prices Trend Polyestertime

-India keeping tabs on possible extra EU sanctions on Russian crude oil

Moscow remains top oil exporter to India for the third month in a row in December

India is keeping close tabs on possible extra sanctions by the European Union on Russian crude as the price cap of $60 per barrel has had little impact on exports to India, oil ministry and industry officials said.

Sources said the cap has not impacted the import of Russian crude as the present price is $53-$56 per barrel.

However, the government is weighing up options if the price crosses $60 per barrel — purchases will then be restricted — or if the EU decides on imposing blanket secondary sanctions on countries purchasing Russian oil.

Russia remains the top oil exporter to India for the third month in a row in December, supplying 1.17 million barrels a day (mbd) of crude — an all-time high — energy intelligence firm Vortexa said.

Imports in December were 24 per cent higher than November, with the private sector refiners the major buyers.

Meanwhile, Russia has restored ONGC Videsh’s 20 per cent stake in Sakhalin-1 oil and gas fields, officials of stateowned exploration firms have confirmed.

R u s s i a n p r e s i d e n t Vladimir Putin in October last year disbanded Exxon Neftegaz — a regional subsidiary of US super-major ExxonMobil — as operator of the Sakhalin-1 field and transferred the project and all of its assets and equipment to a new operator.

The other former foreign shareholders in the project — Japan’s Sodeco consortium and ONGC Videsh — were asked to apply to the Russian government to regain their shareholdings in the project. OVL applied and has been given the same shareholding as it had previously, the official said.

Production from Sakhalin-1 stopped in April 2022 after Exxon Neftegaz declared force majeure at the project.

-The January contract price of MEG in Europe was reduced by EUR20 per ton

The January contract price of monoethylene glycol (MEG) in Europe has been agreed at EUR790 per tonne, eur60 per tonne less than in December, ICIS said.

The price was agreed on the terms of free shipping (FD) in Northwest Europe (NWE).

In order for agreements to be considered fully confirmed, a minimum configuration of two producers and two consumers is required.

The December contract price of MEGs in Europe was agreed at EUR20 per tonne lower compared to November. Chemical-Recycling – Polymers

MEG supply in Europe may decline earlier this year as local load rates remain low due to unfavorable sales conditions. Imports from the U.S. will be restricted early in the quarter following unplanned blackouts caused by winter storm Elliott.

Earlier it was reported that imports of monoethylene glycol (MEG) to China decreased by 9.3% compared with October to 546.29 thousand tons in November due to the continuing reduction in supplies. The sources said major Asian and Middle Eastern producers continued to restrict production due to low profitability, and expectations of low demand at the end of the year also reduced consumer interest in imported goods. Compared to November 2021, MEG imports into the country decreased by 26.5%. As for exports, the figure in November rose to 3.44 thousand tons compared with 1.49 thousand tons in October, as shown by data.

MEG, along with terephthalic acid (TPA), is one of the main raw materials for the production of polyethylene terephthalate (PET).

According to the ScanPlast review, the estimated consumption of PET in October of this year decreased by 16% compared to a year earlier and amounted to 58.53 thousand tons (against 69.28 thousand tons in October 2021). According to the results of ten months of 2022, 680.14 thousand tons of PET were processed in Russia, which is 1% less than the same indicator last year. Chemical-Recycling – Polymers

-Russia freezes Linde assets worth USD488 mln

A Russian court has ordered nearly USD500 mln of assets belonging to German industrial gases company Linde to be frozen at the request of a Russian joint venture building a gas complex at the Baltic Sea port of Ust-Luga, court filings showed, said Reuters.

RusKhimAlyans, the joint venture which is 50% owned by Russia’s Gazprom, asked the Court of Arbitration of St Petersburg and the Leningrad Region to freeze Linde assets worth USD488 mln as a preventative measure.

In 2021, Linde and Renaissance Heavy Industries signed an engineering, procurement and construction (EPC) contract with Gazprom and its partners for the Ust-Luga gas complex. Linde notified the customer in May and June 2022 that it had suspended work under the contract due to European Union sanctions imposed after Russia’s invasion of Ukraine.

RusKhimAlyans alleges, according to the document, that EU sanctions ban supplying equipment for the LNG plant but do not cover equipment required for the other part of the Ust-Luga complex – a gas processing plant.

RusKhimAlyans intends to apply to the Hong Kong International Arbitration Centre to recover advance payment and losses worth around 972 MM euros (USD1 bn) and 7.6 B roubles, according to the court filings. Chemical-Recycling – Polymers

Linde did not immediately respond to an email seeking comment.

We remind, Linde, the world’s largest industrial gases company, said on Tuesday it has started producing green hydrogen at its facilities in Greece. Green hydrogen is made from water by electrolysis using renewable wind and solar power. The U.S.-German company, which supplies gases such as oxygen, nitrogen and hydrogen to factories and hospitals, said it was the first green hydrogen production in Greece. Hydrogen is key in Europe’s energy transition to a sustainable environment and net zero emissions by 2050.

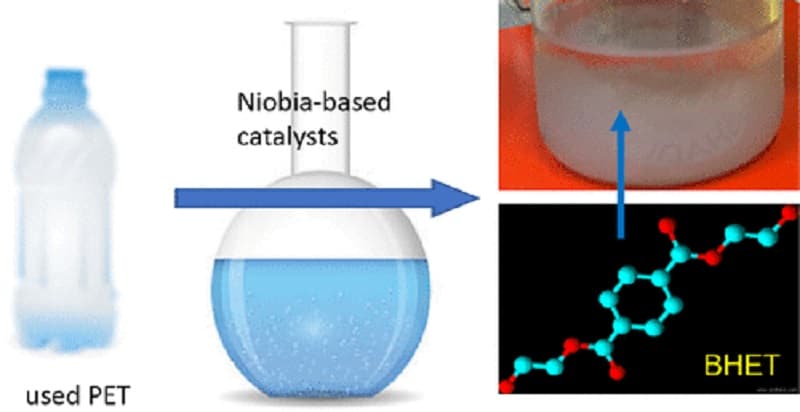

-Chemical Recycling of Used PET by Glycolysis Using Niobia-Based Catalysts

Plastic production has steadily increased worldwide at a staggering pace. The polymer industry is, unfortunately, C-intensive, and accumulation of plastics in the environment has become a major issue. Plastic waste valorization into fresh monomers for production of virgin plastics can reduce both the consumption of fossil feedstocks and the environmental pollution, making the plastic economy more sustainable. Recently, the chemical recycling of plastics has been studied as an innovative solution to achieve a fully sustainable cycle. In this way, plastics are depolymerized to their monomers or/and oligomers appropriate for repolymerization, closing the loop. In this work, PET was depolymerized to its bis(2-hydroxyethyl) terephthalate (BHET) monomer via glycolysis, using ethylene glycol (EG) in the presence of niobia-based catalysts. Using a sulfated niobia catalyst treated at 573 K, we obtained 100% conversion of PET and 85% yield toward BHET at 195 °C in 220 min. This approach allows recycling of the PET at reasonable conditions using an inexpensive and nontoxic material as a catalyst. Chemical-Recycling – Polymers

- Introduction

ARTICLE SECTIONSJump To

Polyethylene terephthalate (PET) is a semicrystalline thermoplastic polyester with excellent water resistance, transparency, and mechanical strength produced by the polycondensation reaction of terephthalic acid and ethylene glycol. (1−3) PET, due to its sturdy physicochemical and mechanical properties, low cost, and safe consumer use, has been widely used over the past decades in various applications and has become ubiquitous in our daily life. For instance, it can be used in the production of textile fibers, bioriented films, and packaging. (1,2,4) The durability of PET, its mass production, and poor end-of-life management, unfortunately, have caused a serious global environmental problem. (4)

Approximately, 73 million tons of PET were produced globally in 2020, whereas only 9% of PET was recycled. (5) Most of these disposable plastics ended up as trash accumulated in landfills or in the oceans, causing significant harm to the environment in terms of water, air, and land pollution. The decomposition of PET can take several decades; so, it is not surprising that biomagnification and bioaccumulation in oceans and other water bodies have transferred these materials to humans. (6) Recently, researchers at the Free University of Amsterdam reported the presence of micrometer-sized plastic particles, including PET, in blood samples of healthy individuals. (7) Similar results were reported by researchers at the Hull University on lung tissues. (8) Clearly, immediate action is vital to tackle this issue before it becomes global public health and environmental problems. (9) Also, PET plastics are produced from fossil-based raw materials, which increases the C intensity of the process. Therefore, developing technologies that can bring these materials back to the production cycle can reduce both the carbon footprint and the environmental pollution. (10) If one ton of plastic waste is recycled, (10) then seven barrels of oil could be saved; therefore, developing an efficient recycling strategy will reduce the energy and crude oil consumption.

Nonetheless, due to the economic and ecological concerns, depolymerization of PET has received scientists’ attention in the past years, which has led to significant attempts to recycle PET globally. (4) Mechanical recycling is one of the options but restricted to few cycles as the mechanical and physicochemical properties of the plastic degrade over time, ultimately limiting the economical value of the finished product. Chemical recycling allows for the complete recovery of the individual monomers employed in the manufacturing of PET, which facilitates the production of pristine plastic. As the price of pristine PET continues to be the same, the recycling technologies should be economical to produce cheaper PET, which can profit the industries. (2)

There are four different mechanical and chemical recycling methodologies of PET substances: Primary recycling is the reusing of preconsumed PET materials that are uncontaminated and clean; for instance, preconsumed PET bottles can be used to produce new PET bottles. (2) For secondary recycling, in this process, postconsumed PET materials undergo mechanical recycling, which includes different steps, the removal of contamination, drying, and melt reprocessing. (11) Tertiary recycling or chemical recycling includes depolymerization of PET materials to their monomer units. Chemical recycling can be achieved through pyrolysis or by solvolysis. (2) The pyrolysis process includes the depolymerization of PET materials by heat and in the absence of oxygen. In contrast, solvolysis is a process whereby PET material is depolymerized by solvents such as water (hydrolysis), alcohols (alcoholysis), amines (aminolysis), ammonia (ammonolysis), and glycol (glycolysis). (2,3) It has to be noted that PET materials are a type of polyester, which contain ester functional groups that can be split by different reagents. (3) For quaternary recycling, in this process, postconsumed PET materials get incinerated, and the produced energy content can be recovered. To illustrate this, wasted plastics, together with other municipal wastes, can get burned in advanced incinerators, and as a result, significant heat and steam will be generated, which can run the turbine blades and produce electricity.Chemical-Recycling – Polymers

Glycolysis, due to its advantages in terms of operating temperature, mild reaction conditions, yield, and scalability, is one of the most promising depolymerization processes for the chemical recycling of PET. (3,12−34) The obtained monomers, which are bis(2-hydroxyethyl) terephthalate (BHET) and ethylene glycol (EG), have diverse applications. (35) Among the different recycling processes, (36−40) we have chosen glycolysis to convert the PET into its monomers (Figure 1).

PET glycolysis can be carried out using diols, such as ethylene glycol (EG), propylene glycol (PG), and diethylene glycol (DG). In the absence of catalysts, the reaction is slow, leading to incomplete depolymerization of PET to BHET monomers. Instead, the formation of side products (oligomers) is significantly enhanced. The low reactivity of PET is associated to the high stability of the carboxylic group as electron delocalization is enhanced by the resonance with the aromatic ring. For this reason, solid Brønsted acid catalysts are required to activate the carboxyl group and facilitate the electrophilic attack of EG to C═O. (2)

The advantages of solid acid catalysts outweigh the homogeneous acid catalysts, as it is possible to separate them from the reaction products by filtration, and consequently, the production of the hazardous waste will be lower.

Also, solid acid catalysts are noncorrosive. Thus, the usage of solid acid catalysts in most industrial chemical reactions, as environmentally friendly catalysts, has been prevalent over the past decades. (3)Chemical-Recycling – Polymers

EG has a free electron pair that can start the reaction by attacking the carbonyl carbon of the ester group of PET. (41) Consequently, the hydroxyethyl group of EG forms a bond with the carbonyl carbon of PET (Figure 1), resulting in splitting the long-chain into short-chain oligomers and ultimately BHET. (41) Nonetheless, the rate of glycolysis of PET depends on variables such as the temperature, PET/EG ratio, time, and PET/catalyst ratio. For example, it has been reported that glycolysis of PET with a molar ratio of 1:6 (PET:EG) at temperatures ranging within 180–195 °C under a reflux condenser has the highest efficiency. (42) Currently, the solid catalysts either require a high temperature or pressure to get a high yield. For example, ZnMn2O4 is reported to be one of the best catalysts, yielding 92% BHET yield, but it requires 260 °C and 5.0 atm pressure.

(14) Another solid catalyst, γ-Fe2O3 yielded >90% BHET but required a temperature of 300 °C. (17) Moreover, for an economical operation, it is also required that the catalysts should be inexpensive and readily preparable and should have high mechanical and thermal stability. Chemical-Recycling – Polymers

-There isn’t enough recycled plastic for companies to meet commitments. What now?

Recycling and using recycled content alone won’t solve the waste crisis. We must design the idea of waste out of the system.

Many companies have made commitments to drastically increase their use of post-consumer recycled content (PCR) in their packaging or products. Take Nestlé, which pledged to reach 30 percent PCR in packaging by 2025, or L’Oréal, which pledged 50 percent. There are even laws taking effect that call for companies to incorporate more PCR, such as Assembly Bill 793 in California.Chemical-Recycling – Polymers

But there’s an elephant in the room: There’s not enough recycled plastic for companies to meet those mandates or their public commitments (let alone their private ambitions).

And we’re not moving in the right direction. Virgin versus PCR plastic use in packaging actually increased (by 2.5 percent) between 2020 and 2021.

Why is there not enough recycled content to meet the needs of companies?

We design products with a “virgin mentality”: Historically, we’ve designed our products and packages from virgin raw materials, because they’re low-cost, can be adapted for use in many applications and have been readily available. In other words, we’re actively designing from a “virgin mentality,” relying on the price and performance that new materials offer.

More recently, organizations are embracing — or in some cases, are required — to use recycled content. Since the systems to manufacture their products (packaging production lines) are already in place, they need to find recycled content that behaves the same as the virgin material they are trying to replace. If characteristics such as melt flow, color and grade (such as food grade) aren’t the same, they’ll have to modify their manufacturing processes (mold cycle times, wall thickness, color, etc.). That can make the product less desirable because of a higher cost or different look and performance.

So far, the only PCR that seems to allow companies to avoid changing their processes is made from beverage containers (polyethylene terephthalate, or PET, beverage bottles and high-density polyethylene, or HDPE, milk jugs).

Have you noticed that a T-shirt or a shampoo bottle made from rPET (recycled PET) is not made from other T-shirts or shampoo bottles but from soda bottles? This moves a food-grade clear plastic into a non-food grade application. Once it’s made into a T-shirt, it’s unlikely to be recycled again and would not technically be able to be made back into a soda bottle. Chemical-Recycling – Polymers

- The energy crisis is making recycled content less available: The energy crisis, sparked by the ongoing war in Ukraine, has shaken the global energy market. In Europe and the rest of the world, recycling facilities are heavily affected.In Italy, the national association of companies that recycle plastics announced the suspension of 40 percent of recycling activities. Plastics Recyclers Europe has even hinted that plastic recycling companies could be driven out of business, as energy represents up to 70 percent of operational costs. Governments would rather focus their energy reserves on heating and critical sectors.Many global companies rely on European recyclers to provide content for their packaging. With the cost of recycling going up, company commitments to integrate recycled content are not economically viable. (Although U.S. recycling companies have yet to be greatly affected by such a shift, the impact on their global business plans could impede any chance of catching up to timed brand commitments.)

- There’s a lack of government support: The failure of companies to achieve their voluntary commitments is more evidence of the need for governments to step in, say the Ellen McArthur Foundation (EMF), Greenpeace and more.Governments are beginning to mandate PCR use (such as through AB 793 in California or the European Commission’s Packaging and Packaging Waste Directive), but this is creating even more demand for the small pool of available PCR. What is really needed from governments is fiscal support of recycling infrastructure and technology, and pressure for systems to be closed loop. So, for example, soda bottle material stays in soda bottles, and T-shirts are made back into T-shirts.Chemical-Recycling – Polymers

So, what now?

The No. 1 way to address the issue is to design from a “waste mentality.” Designing based on material that’s already available in the waste stream — not just municipally sourced beverage containers — can be done through:

Closed-loop design: The best solution is to design packaging to be closed loop (having the ability to be made back into itself at its end of life). Let’s look at two examples of this in practice.

- HDPE shampoo bottle: First, examine the material characteristics of the available material, which means looking at a pile of shampoo bottles. Design something that fits those characteristics (opaque, perhaps gray in color, thicker-walled).

- Now that you have a closed-loop bottle design, find an input by calling recycling centers. You may find that recycling centers are sorting for natural-color HDPE (like milk jugs) but not darker HDPE (like shampoo bottles).

- Now see if you can pay them to start sorting for this new fraction. You’ll have the PCR you need, and you’ll have improved the recycling system by creating demand for more diverse types of material beyond clear PET and HDPE, preventing “less-desirable” packaging materials from ending up in an open-loop system.Chemical-Recycling – Polymers

- GPPS (general-purpose polystyrene) pen: You guessed it; start with a pile of pen waste and go from there. Once you have a design, you’ll need to figure out where to source the PCR. Unlike with shampoo bottles, you won’t be able to source material from the current recycling industry. You’ll need to set up your own supply chain through a take-back program.

Design from waste (not closed loop): This concept is similar to the above, but would not involve designing bottle-to-bottle or pen-to-pen. Instead, you’re turning one type of waste (not municipally sourced beverage containers) into another.

Source from recycling centers: Work with recycling centers to find an input (one they don’t currently sort for) that would fit the characteristics of the package you’re designing. That could be, say, dark PET or cosmetics packaging, if you’re designing a shampoo bottle. Pay the recycling centers to begin collecting and recycling this material.

Self-source: You can also collect materials yourself.Chemical-Recycling – Polymers

One way to go about this is by collecting “storied materials” — materials that carry a narrative and can be traced to point of origin. Collecting waste with a story (such as trash from the ocean or the top of Mount Everest) doesn’t seem economical at face value. But products created with storied material resonate with consumers and unlock added marketing value (from reaching sustainability goals, earning media placements and standing out on shelves) that traditional PCR can’t.

For instance, we worked with brand partner P&G to create shampoo bottles from ocean plastic. The response was so strong that P&G expanded this framework to its Herbal Essences line and to homecare with Fairy and Joy dish soap.

All of the above ideas represent only a step on the journey and not the answer. Recycling and using recycled content alone won’t solve the waste crisis. We must design the idea of waste out of the system.Chemical-Recycling – Polymers

It’s time to invest in new business models that enable a shift away from disposable to reusable. This will be a shift as big as moving from horse and buggy to gasoline-powered cars or from gas to electric cars. But solutions already exist to support companies in moving to reusable packaging. Some have a regional reach or are sector-specific (reusable cup programs in quick-serve restaurants in Canada and London), some are cross-sector and global (such as Loop, a division of TerraCycle), and there are also various bulk initiatives run by retailers (Asda and Carrefour, for example).

With all that said, the true solution is to stop waste at the source. We all need to vote for a better future by buying less.

-Loop Industries has target slashed by Roth

Roth Capital Partners has lowered its expectations on Canadian cleantech name Loop Industries (Loop Industries Stock Quote, Charts, News, Analysts, Financials NASDAQ:LOOP). Chemical-Recycling – Polymers

In a Thursday company note to clients, analyst Gerry Sweeney kept a “Buy” rating on the stock while dropping his 12-month target from $20.00 to $6.00 after assessing the company’s status regarding a recent pivot announcement.

Loop, which has patented tech to depolymerize no- and low-value waste PET plastic and polyester fibre to create virgin-quality, Loop-branded PET plastic resin and fibre suitable for food-grade packaging, announced last month a strategy pivot including the sale of its Becancour land, cost cutting, the departure of its CFO Drew Hickey and an overall focus of on its relationship with SK Geocentric (SKGC) for planned projects in Asia and Europe.

“These joint venture projects have a lower requirement for Loop equity investment and higher return on capital and leverage SKGC’s engineering and operational infrastructure. In addition, the joint venture projects will provide Loop with an annual technology licensing fee,” the company said in a December 22 press release.

“SKGC is committed to commercializing Loop’s technology as the underpinning of its sustainable plastics strategy. Loop is working collaboratively with SKGC to put in place the financing plan for the rollout of large-scale manufacturing in Asia and Europe, including the first Asian manufacturing facility in Ulsan, South Korea, which is planned to break ground in 2023,” Loop said. Chemical-Recycling – Polymers

Commenting on the moves, Sweeney said while the pivot should provide multiple years of cash, questions remain over the company’s total plant build-out as well as on equity splits in ownership and potential funding.

Sweeney said he believes Loop’s technology works as demonstrated at its Terrebonne facility and through the investment from SKGC, but he said he’s disappointed in how long it took management and the board to decide on the pivot.

“While there remains opportunity for the plant to be built in the future, it was one of the centerpieces of LOOP’s strategy and a key messaging point for the past two years. The SKGC relationship remains a key opportunity, however, LOOP is not in the driver’s seat and economics of how the relationship will develop remain unclear. There will be a royalty aspect, but not only does the equity portion remain uncertain, the funding of the equity is not clear as well. We would like to see a more definitive plan and timeline emerge for SKGC relationship,” Sweeney wrote. Chemical-Recycling – Polymers

-Polymers and plastics: the amount of recycled and renewable materials keeps growing – Totalenergies

Our polymer business activities around the world

By transforming oil, gas, biomass and plastic waste, we produce polymers, recycled polymers and biopolymers that can be incorporated in the plastic manufacturing process. Plastics and their properties can be harnessed to design products featuring a host of benefits (lightweight, hard-wearing, waterproof, etc.). Those qualities have cemented their status as an essential part of our everyday lives. As a leading producer of polymers, TotalEnergies has a role to play in improving how end-of-life plastics are managed and thereby preventing them from ending up in the natural environment. We are spearheading several projects to reduce the environmental impact of our polymers, promote recycling and produce polymers from renewable materials. Chemical-Recycling – Polymers

We are aiming to produce 30% recycled and renewable polymers by 2030.

Most of our customers are processing professionals who use our polymers — polyethylene, polypropylene, polystyrene, their recycled equivalents and our biopolymers — to manufacture plastic-based finished products for different markets:

- Automotive: fenders, airbags, fuel tanks, interior components, etc.

- Construction pipes, insulation panels, artificial turf, carpets, etc.

- Health & hygiene: IV bags, syringes, razors, etc.

- Electrics & electronics: televisions, refrigerators, cables, etc.

- Packaging: protective film, bottle stoppers, trays, etc.

- Industrial packaging: containers, paint cans, etc.

Using our polymers in these markets can help our customers reduce their carbon footprint by:

- Improving building insulation performance: installing plastic insulation in 50% of buildings could save 340 million tons of CO2. Chemical-Recycling – Polymers

- Reducing the weight of vehicles: plastic vehicle parts are

- 40 to 50% lighter than parts made from alternative materials, which can trim 200 kg off each vehicle and thereby save 0.5 L of fuel per 100 km.

- Curbing the impact of transporting food: if food products were packaged in materials other than plastic, the overall weight would be quadrupled, energy consumption would double and greenhouse gas emissions would triple.

Reduce the environmental impact of our polymers:

To help our customers rein in their CO2 emissions and stand out in their markets, our experts are working closely alongside them in pioneering innovative processes and rolling those processes out on an industrial scale. The objective is to produce high value-added polymers that can be used to create plastics offering superior environmental performance and enhanced properties (lightweight, resilient, flexible, etc.).

From production through to end use, we are focused on producing polymers with a reduced environmental footprint.Chemical-Recycling – Polymers

For example, we are continually enhancing our production processes to use less water and energy. We are also working on the properties of our polymers to help our customers continue scaling down their use of raw materials while guaranteeing equivalent or superior levels of performance. Eco-design principles are also influencing our efforts to engineer plastics that are easier to recycle.

Our ambition is to produce 30% recycled and renewable polymers by 2030.

Plastic waste management is a mission-critical challenge facing the sector. We are working closely alongside all the professionals in the value chain, including plastic manufacturers, research centers, waste collection and sorting companies, and their customers, to deliver tangible solutions, such as developing different plastic recycling processes and using renewable raw materials to produce bioplastics.

Developing plastic recycling processes

Mechanical recycling is a mature technology that is capable of treating high-purity waste from collective sorting and recycling centers, as well as other post-consumer waste. Plastic waste is sorted and cleaned before being crushed and melted do In December 2021, we signed a strategic partnership agreement with Plastic Omnium to mastermind new types of polypropylene meeting the standards that apply to the automotive industry.

Advanced recycling is a leading-edge technology that complements mechanical recycling and which is capable of treating waste that cannot be mechanically recycled, thereby serving applications in high value-added markets, such as food packaging.

Advanced recycling processes modify the molecular structure of plastic waste to create a basic raw material, namely monomers, which can be processed again into all-new polymers.Chemical-Recycling – Polymers

To accelerate this technology’s development, we are joining forces with professionals across the value chain to spearhead a number of large-scale projects:

For example, we have teamed up with Citeo, Saint-Gobain and Syndifrais as part of a project aimed at creating a polystyrene recycling channel in France. We are working alongside Citeo, Recycling Technologies, Mars and Nestlé to develop an advanced recycling channel in France.wn for reuse. It is perfectly suited to applications in a number of markets, such as the automotive and construction industries.

As trailblazers in the sector with our Circular Compounds® range, we produce polymers that contain no less than 50% of recycled materials while delivering similar performance levels to virgin polymers.

In 2019, we acquired Synova, the French leader in producing high-performance recycled polypropylene for applications in the automotive and construction sectors. Late September 2021, we announced that the plant had doubled its production capacity for mechanically recycled polymers to achieve nearly 45,000 t/year. Chemical-Recycling – Polymers

Chemical-Recycling – Polymers