Circular Textile Pyrolysis PSF 30-09-2022 - Arhive

Crude Oil Prices Trend

-Symphony Environmental sees ‘significant increase’ in Indian sales

The developer of technology to make ordinary plastic biodegradable said legal changes designed to combat plastic pollution is driving demand

Symphony Environmental Technologies PLC said its joint venture in India reported a “significant increase” in sales of its d2w biodegradable technology after being formed last November.

The d2w masterbatch technology being sold by the joint venture with Indorama Corporation enables the manufacturing of non-biodegradable plastics into biodegradable and environmentally safe products.

Sales are expected to increase to more than £250,000 per month from early 2023, the AIM-listed company said, based on current enquiry and order activity.

Further investment is being made by Symphony India to enhance its marketing and sales capability, with five new experienced employees expected to join shortly in order to try and win a greater share of a market that the pair estimate could generate over £10mln in annual sales during the course of 2024.

Symphony said the demand is being driven by legal changes in July that permit government-approved biodegradable plastic products to be exempted from restrictions that would ban most plastic film products unless they are above a certain thickness.

Manufacturers and brand owners using certified biodegradable plastic materials will be free from this obligation, it said, meaning d2w technology has “a competitive advantage in a country with a population of circa 1.4bn”.

Michael Laurier, CEO of Symphony, said: “India is a country whose environment suffers from serious plastic pollution, but plastics are vital for food safety in this populous nation. These progressive regulations are therefore a welcome step in combatting plastic pollution.

-Indian PSF producers may get respite as ban on PET flake import eased

Indian polyester staple fibre producers can expect better supply of raw materials as the Union government has eased imports of PET flake chip (HS code 39076110 and 39076930) with some conditions. Earlier, the imports of PET bottle waste/scrap/PET flake made from used PET bottles were totally restricted by the ministry of environment to control dumping of scrap.

During the Sustainable Textiles Summit 2022 in New Delhi last week, some experts had raised concerns about the tight supply of used PET bottle and its downstream products. They said that sustainability in the textile sector demands technological development and a proactive approach towards the entire value chain. Earlier, India generated thousands of tons of used PET bottles for reuse. The technological developments increased its consumption and today the supply has become tighter for the polyester value chain.

The upward trend seen in the global markets also paints the same picture. According to data from Fibre2Fashion’s market insight tool TexPro, now re-PET bottle flake prices increased to CNY 5,400 per MT in the Chinese market from CNY 4,000 per MT during COVID-19. In the beginning of this year, it was priced at CNY 4,800 per MT. Therefore, the product’s price increased by more than 10 per cent this year. It had recorded the highest price of CNY 7,400 per MT in 2018.

The government issued a notification in mid-September which permitted imports of the product by the consumer industry on certain conditions. PET flake chip can be imported under authorisation from Director General of Foreign Trade (DGFT) and subject to NOC from the ministry of environment in accordance. A unit will be eligible for import only if it has used domestic waste to the extent of at least 70 per cent of the capacity in the previous year. The unit can import up to 20 per cent of its production in 2021-22.

◊◊◊◊◊◊◊◊◊◊◊◊◊◊◊◊◊

-Arkema increases its global Pebax® elastomer capacity expansion for 2023 to +40%

Arkema boosts its previously announced global Pebax® elastomer capacity expansion at its Serquigny, France site from +25% to +40% in two separate phases, firstly in Q1 2023 by raising global capacity by 15%, the additional 25% starting in Q3 2023.

The greater increase in Pebax® elastomer capacity will support the strong demand from partner customers in the sports, consumer electronics, medical and industrial markets, who recognize the highly specialized Pebax® grades’ lightweight, flexibility and exceptional energy return. Applications range from ultra-fast running shoes to catheters or flexible device screens.

Beyond this new capacity expansion in France and to support the growth of its global customers, the Group is currently assessing further investment opportunities, including in Asia.

As customer demand is increasingly driven by sustainability and social responsibility, over the last few years Arkema has benefited from strong growth in particular for its bio-based Pebax® Rnew® grades, derived from renewable castor beans. These materials have a significantly lower carbon footprint thanks to their bio-based content and can be fully recycled as part of Arkema’s Virtucycle® recycling program for advanced polymers.

The Group continues to innovate and invest to further improve its materials’ carbon footprint.

-Lotte Chemical produces polycarbonate using pyrolysis oil-based naphtha

Lotte Chemical, a major chemical company based in South Korea, has produced polycarbonate, a high-value-added petrochemical product, by using pyrolysis oil-based naphtha made by recycling waste plastic. polycarbonates are strong, tough materials with many applications. They are easily worked, molded, and thermoformed.

Pyrolysis is a chemical recycling process that can convert plastics into high-quality oil using extreme heat and pressure. Recycled oil is processed into medium crude and light oil. Previously, pyrolysis oil has not been used as a raw material for the production of petrochemical products due to impurities and concerns over air pollution. Previously, pyrolysis oil has not been used as a raw material for the production of petrochemical products due to impurities and concerns over air pollution.

Waste plastic pyrolysis oil can be recycled as naphtha, a basic raw material for petrochemical products, through a post-treatment process of removing impurities. Lotte Chemical has received waste plastic pyrolysis naphtha from Hyundai Oilbank, a petroleum and refining company affiliated with South Korea’s Hyundai shipbuilding group, and put it into the naphtha cracking center in its plant in the southern industrial port city of Yeosu.

Polycarbonates produced by Lotte Chemical carry ISCC PLUS certification, a sustainability certification program for bio-based and circular raw materials. “We will expand the chemical recycling business, including the production of pyrolysis naphtha-based products, and take the lead in building a virtuous cycle of resources,” Lotte Chemical’s basic materials business head Hwang Jin-gu said in a statement on December 28.

◊◊◊◊◊◊◊◊◊◊◊◊◊◊◊◊◊

Summary Of The Technology

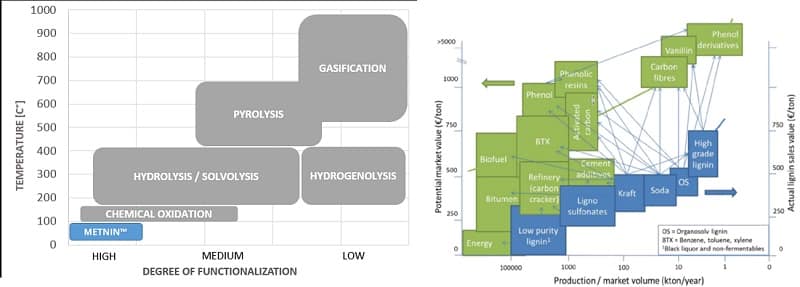

METNIN™ Technology is developed to refine lignin to end-user specific characteristics. Our technology is agnostic to lignin source and provides the missing link in the value-chain between crude lignin and high value lignin fractions for specific end user products. Metnin™ is enabling lignin valorisation towards wide range of drop-in sustainable solutions in e.g. coatings, resins, plasticizers, polyurethanes, and moisture/humidity resistance packaging. MetGen’s technology has been proven in multiple pre-commercial installations and enables cost-efficient conversion of lignin into cascade of intermediate building blocks of specific molecular size.Basic engineering package, CAPEX and OPEX estimate available.

Details Of The Technology Offer

Together with sugars and proteins, and to a lesser extent oils and fibres, lignin as a lignocellulosic biomass derived intermediate is one of the pillars of the foundation of the European Circular Bioeconomy. The EU-28 Bioeconomy market sectors were worth €2100 billion in turnover and accounted for more than 18 million jobs in 2013. To ensure its position in the increased global competition, involved industrial sectors need to innovate and further diversify, making the sustainable use of lignin as renewable resource extremely relevant.

Biobased chemicals and raw materials are expected to grow significantly and increase their market share. An assessment done by the European Commission has indicated that bio-based products and biofuels represent approximately € 57 billion in annual revenue and involve 300,000 jobs. According to forecasts, the biobased share of all chemical sales will rise to 22% by 2020, with a compounded annual growth rate of close to 20% (EC Europa, ec.europa.eu/growth/sectors/biotechnology/bio-based-products_en). To realise the required shift from fossil-based industries to real bioeconomy and biobased industries, there is an urgent demand for biobased chemical, materials, and fuels as sustainable and renewable alternatives.

The total market value for lignin-derived products is at $3.3B, with energy capturing about 89 % of the market. Lignin is currently being used for low and medium-value applications (e.g. binding and dispersing agents), representing a market of $730 million. Other markets include vanillin production ($192M) and cement additives ($176M). The market has both high-value applications, such as carbon fibres and phenols, as well as lower value applications such as binders and activated carbon. The lowest value use of lignin is its use as solid fuel as energy content of the lignin is in the range of 22 MJ/kg. Today, the commercial sales of lignin are limited but growing. Even though the pulp & paper industry produces about 50 million tons of lignin in a year, as defined by Lux Research, most of this is burned for power; only 1 million ton reaches the chemicals market. Thus, the supply of lignin from other sources is set to grow, as the growing need for lignin for the production of renewable biochemicals from lignocellulosic feedstocks alone is projected to grow up to 2.9 million MT in 2017. This brings huge opportunities for the creation of higher-value chemicals such as polyurethanes, epoxy resins, and lignin-based phenol-formaldehyde resins. Lignin is suitable for the production of a variety of straight chain, cyclic and aromatic chemicals, with market sizes ranging from tens of millions of dollars up to hundred-billion-dollar range. The potential market value of new lignin-based products is estimated to be about $13.9B by 2020-2025, with lignin-based phenols and carbon fibre poised to capture the largest market potential in the future. The market for carbon fibre composites and bioplastics is estimated to be over $20 B by 2020, and the phenol market in 2010 was $100 B.

-EURATEX & partners launch CISUTAC to aid circular textile sector

A consortium of 27 partners including EURATEX (European Apparel and Textile Confederation) has launched the new Horizon Europe project CISUTAC (Circular and Sustainable Textiles and Clothing) to support the transition to a circular and sustainable textile sector and economy. CISUTAC aims to remove current bottlenecks in order to increase textile circularity in Europe.

The objective of the project is to minimise the sector’s total environmental impact by developing new, sustainable, and integrated large-scale European value chains, according to a press release by EURATEX.

The project will include most parts of the textile sector: comprising the two groups of fibres that represent almost 90 per cent of all textile fibres (polyester and cotton/cellulose) and focusing on products from three sub-sectors experiencing most circularity bottlenecks (fashion garments, sports and outdoor goods, and workwear).

CISUTAC will follow a holistic approach covering the technical, sectoral, and socio-economic aspects of textile value chain, and will perform three pilot phases to demonstrate the feasibility and value of repair and disassembling; sorting (for reuse and recycling); and circular garments through fibre-to-fibre recycling and design for circularity.

To realise these pilots, the consortium partners will develop semi-automated workstations, analyse infrastructure and material flows, digitally enhance sorting operations (for reuse and recycling), and raise awareness among consumers and the textile industry.

-Report: Sorting for circularity Europe

Today, Fashion for Good concludes the „Sorting for Circularity Europe“ project, and in collaboration with Circle Economy, releases a report detailing the findings of the 16-month analysis.

The analysis indicates that 74%, a total of 494,000 tonnes, of low-value, post-consumer textiles is readily available for fibre-to-fibre recycling in six European countries. This represents the potential to generate an additional €74 million per year in value by reintroducing sorted and recycled textiles back into the value chain.

The Sorting for Circularity Europe Project was initiated to address this knowledge gap, exploring post-consumer textiles in depth, providing meaningful information on which to base investment decisions, policy developments and next steps towards circularity. Furthermore, the project aims to increase harmonisation between the sorting and recycling industry, stimulating a recycling market for unwanted textiles that can generate new revenue streams for sorters and unlock demand for recyclers and brands.

Conducting the analyses across Europe, in Belgium, Germany, the Netherlands, Poland, Spain, and the United Kingdom, the project provides the most comprehensive and representative snapshot of textile waste composition in Europe to date. The results point to promising opportunities for recapturing value while diverting textiles from downcycling and incineration. The results also inform brands of the best circular design practises to adopt, as well as textile collection agencies and organisations to build the necessary infrastructure and better educate and engage consumers on proper sorting and disposal practices.

Leaping forward through technology

Using innovative Near Infrared (NIR) technology to determine garment composition, traditionally a task performed manually, the project analysed a total of 21 tonnes of post-consumer garments. On-the-ground examinations were performed over two time periods, autumn/winter 2021 and spring/summer 2022, to account for seasonal changes in the types of garments entering sorting facilities.

Cotton was found to be the dominant fibre (42%), followed by a large presence of material blends (32%), almost half of which consisted of polycottons (12%). Based on three characteristics, material composition, presence of disruptors, such as zippers and buttons, and colour, 21% of the materials analysed are deemed suitable as feedstock for mechanical recycling, while 53% are suitable for chemical recycling. This presents a significant opportunity for circularity, as currently only 2% of post consumer textiles are diverted to fibre-to-fibre recycling.

◊◊◊◊◊◊◊◊◊◊◊◊◊◊◊◊◊

-White beetle inspired natural pigment offers replacement for titanium dioxide

Cambridge-based biotech start-up, Impossible Materials, has developed a sustainable cellulose-derived white pigment to replace “unsafe” titanium dioxide (TiO2) across food and pharma industries.

The novel compound, inspired by the white Cyphochilus beetle, offers a 100% natural ingredient at a time when businesses are actively seeking plant-based alternatives, following an EU ban on TiO2, says Dr Lukas Schertel, CEO & Co-founder at Impossible Materials.

“Producers of plant-based foods and dairy products are under immense pressure to replace TiO2 whilst no high-performance, plant-based solution is available.

“Our material comes with appealing properties for these markets, for example, it is tasteless, and cellulose is already used in plant-based food formulations. It could also be used in higher doses than other white pigments in these segments as it does not affect the formulation properties.”

Circular process

The proprietary compound developed by Impossible Materials mimics the activity of Cyphochilus beetle scales that scatter light giving the insect a bright white colour.

Plant-based cellulose performs a similar function and is safe for human consumption. It is widely available, biocompatible and easy to process. In addition, it has high opacity and stability, and the circular development process offers a sustainable substitute with superior performance, according to Dr Schertel.

While still in early development, sample testing has demonstrated product performance in wet and dry applications.

Dr Schertel confirms the company is currently working with a number of customers in major healthcare sectors and expects cost-competitive commercial scale production will be achieved by 2024/25.

“We are focused on value generation through putting effort in the circularity of the process and turning waste streams into high value products as well as working closely with customers to solve their pain points,” he explains.

“This might challenge time to scale but will improve the techno-economics at scale and the impact (environmental and health) of our products.”

Safety concerns

Titanium dioxide is routinely added to bakery products, soups, broths, sauces, salads, and processed nuts, as well as confectionery and food supplements to make products visually appealing and provide whiteness and opacity.

However, the European Food Safety Authority (EFS) implemented a ban on TiO2 as a food additive (E171) last year after ruling the compound unsafe due to possible links with inflammation and neurotoxicity.

Member states have since removed the ingredient from food products, although the UK is standing firm and both the Food Standards Agency (FSA) and Food Standards Scotland (FSS) have resisted imposing a similar ban, which creates disruption and complications for manufacturers.

◊◊◊◊◊◊◊◊◊◊◊◊◊◊◊◊◊