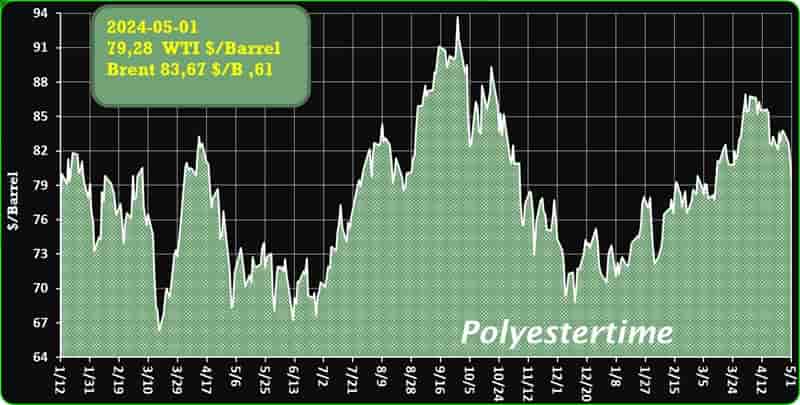

Crude oil price – Crude Oil Price Forecast 2024: Navigating Through Geopolitical Tides and Market Dynamics 01-05-2024

Crude oil price

Crude Oil Prices Trend

Crude Oil Prices Trend by Polyestertime

Crude Oil Price Forecast 2024: Navigating Through Geopolitical Tides and Market Dynamics

As we venture into the second quarter of 2024, the global economy continues to grapple with the ever-changing landscape of crude oil prices. The year has been marked by a series of geopolitical events and supply-demand fluctuations, which have significantly influenced the trajectory of oil prices. This article aims to provide an insightful forecast into the crude oil market for the remainder of 2024, drawing upon recent trends and expert analyses. Crude oil price

The Current State of Crude Oil Prices

The first quarter of 2024 saw a surge in oil prices, with both U.S. and European benchmark crude futures reaching five-month highs. The West Texas Intermediate (WTI) futures contract rose by 16.1%, closing at $83.20, while Brent crude increased by 13%, closing the quarter at $87.501. This upward trend was propelled by a tightening supply-demand outlook and heightened geopolitical concerns.

Factors Influencing the Price Surge

Several factors have contributed to the rise in crude oil prices:

- Geopolitical Tensions: Incidents such as Iran’s attack on Israel have led to increased market volatility, although they have not directly impacted oil production2. Crude oil price

- Supply Constraints: Ongoing supply restrictions have played a crucial role in the price hike.

- Economic Recovery: As the global economy recovers from the pandemic, there has been a resurgence in energy demand.

Market Predictions for the Second Quarter

Analysts predict that the buying pressure on crude oil is likely to outweigh selling pressure in the longer term3. The markets are expected to remain noisy, with prices continuing to sort themselves out amid the larger consolidation area4.

Expert Forecasts for 2024

The U.S. Energy Information Administration (EIA) forecasts that the Brent crude oil spot price will average $90 per barrel in the second quarter of 2024, with an annual average of $89 per barrel5. This reflects expectations of strong global oil inventory draws during this quarter and ongoing geopolitical risks.

Potential Price Shocks and Economic Impacts

While the World Bank and Fitch Ratings warn of a potential oil price shock of $120 per barrel due to supply restrictions and regional conflicts, this would have significant implications for global growth and inflation1. Crude oil price

Long-Term Outlook

Looking beyond 2024, some analysts expect that the demand for fossil fuels could fall, leading to a lower oil price in the next 5-10 years. The EIA projects average Brent crude prices at $61 per barrel in 2025 and $73 per barrel in 20301. Crude oil price

Implications for Investors and Consumers

The fluctuating oil prices have had varied impacts on different sectors:

- Energy Producers: Major oil and gas producers have seen a good quarter, with significant returns on investments1.

- Refineries and Marketers: Companies in the downstream sector have witnessed larger gains due to the faster rise in wholesale petrol prices compared to crude prices1.

- Consumers: The rise in oil prices has led to increased costs for consumers, particularly in terms of fuel prices. Crude oil price

Conclusion

The crude oil market in 2024 is characterized by a complex interplay of geopolitical, economic, and market dynamics. While the short-term forecast indicates continued price rises, the long-term outlook remains uncertain. Stakeholders in the oil industry must remain vigilant and adaptable to navigate through these turbulent waters.

This article provides a snapshot of the current state and future predictions of crude oil prices, offering a blend of data-driven insights and expert opinions. The information presented is based on the latest available data and forecasts, which are subject to change as new information emerges. For the most up-to-date information, readers are encouraged to consult the latest market reports and analyses.