European thermoplastic prices 02-02-2023 - Arhive

European thermoplastic prices

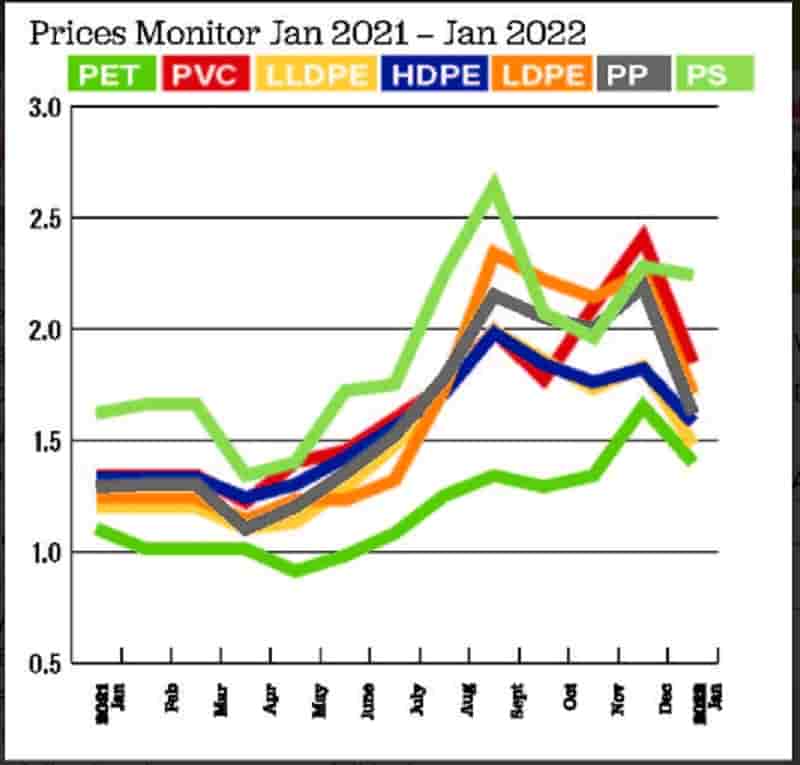

-Prices under pressure from weak demand and lower costs

In December, European standard thermoplastic prices declined across the board as a result of lower feedstock costs and weak demand. The already weak demand picture was further exacerbated by the short production month and converters reducing stock levels prior to preparation of the end-of-year balance sheet.

Polyethylene prices fell in line with the €25/tonne reductions in the ethylene reference price. Polypropylene prices were down by just less than the €30/tonne reduction in the propylene reference price. Base PVC prices fell for the eighth month in a row with a reduction of €60/tonne. Polystyrene prices saw a triple-digit reduction following the €132/tonne fall in the styrene monomer reference price.

PET prices declined by a mere €20/tonne as producers’ efforts to reduce stock levels appeared at last to be paying off. European thermoplastic prices

Demand very low

In December, polymer demand continued at a very low level across most end-use markets. While demand has picked up slightly for the food and pharmaceuticals packaging sectors, demand from most other markets is well below normal levels. In December, order activity was further constrained by the short production month and by converters reducing stock levels prior to preparation of their year-end balance sheets.

Supply tight

European producers have trimmed production and brought forward plant maintenance programmes to counteract the low demand. There is however sufficient material available to meet the needs of converters. Supply has also been supported by a steady inflow of imported material. The high European prices and lower freight rates are tempting producers to divert more of their cargoes to Europe.

A selection of the latest production developments is presented below:

Indorama Ventures reported that a fire stopped operations at the San Roque, Spain plant on New Year’s day. European thermoplastic prices

The company has subsequently announced that they were planning to complete safety protocols and plan to start production of PET and PTA sequentially, reaching full operations by end January

Four PP lines operated by Borealis in Belgium will undergo planned maintenance programmes commencing 2nd February and due to restart 2nd March

Trinseo plans to discontinue styrene production at its 300,000/tonnes/year plant at Böhlen site in Saxony, Germany. The plant is too small and unprofitable on an international scale, the company explained. High gas prices and competition from rivals’ new capacities have exacerbated the situation

A fire at the Versalis site at Dunkerque, France on the weekend of 10th December has shut down the cracker and also the polyolefin downstream plants

The LyondellBasell cracker in Berre, France, offline since a fire in August 2022, will not go back onstream until early 2023. European thermoplastic prices

January outlook

While few contract prices had been concluded at time of conducting the prices research during the first week of January, most market observers were expecting European standard thermoplastic price developments to show a mixed picture this month.Polyethylene and polypropylene prices are likely to fall sharply after both ethylene and propylene reference prices settled down by €95/tonne compared to the previous month. PVC prices are also likely to fall in line with the proportionate impact of the lower ethylene price on the PVC cost base.

PS prices, on the other hand, are expected to increase sharply this month following a surge of €115/tonne in the styrene monomer reference price. PET prices are expected to stabilise as costs fall, imports become scarcer and producers maintain strict production controls.

Supply remains tight across all polymer classes while demand should recover gradually as converters restock.

Western European standard thermoplastic prices, €/tonne European thermoplastic prices

L/LDPE

In December, L/LDPE prices fell €20-25/tonne due to the lower ethylene reference price (down €25/tonne), the short production month and very weak demand.

European producers maintained strict production controls and supply was generally low. Imports from the USA and Asia, however, plugged any gaps in the supply position. The already weak demand was made even worse by the short production month and converters not buying additional stock for accounting reasons.

A reduction of €95/tonne for the January ethylene reference cost heralds a sharp reduction for L/LDPE prices at the start of the New Year. While few deals had been concluded at time of writing, most market observers were expecting L/LDPE prices to tumble more or less in line with the lower cost settlement. Demand is likely to pick up slowly while higher imports are supporting supply.

HDPE

In December, HDPE prices fell due to weak demand and a reduction of €25/tonne for the ethylene reference price.

Blow moulding and blown film grades saw price reductions in the order of €20-25/tonne while injection moulding prices fell by €10/tonne. European thermoplastic prices

Material availability remained tight as producers maintained strict output controls. Any supply gaps was however made up by a steady inflow of imports from Asia.

The very weak demand position was made even worse by the short production month and converters buying the absolute minimum with an eye on their end-of-year stock position.

A reduction of €95/tonne for the January ethylene reference cost heralds a sharp reduction for HDPE prices at the start of the New Year. While few deals had been concluded at time of writing, most market observers were expecting HDPE prices to tumble more or less in line with the lower cost settlement. Demand is likely to pick up slowly while higher imports will support supply. European thermoplastic prices

PP

PP prices fell by €20/tonne in December as a result of weak demand and a reduction of €30/tonne for the propylene reference price.

Supply remained tight due to planned and unplanned plant maintenance turnarounds and the maintenance of strict production curbs. Any supply gaps were however adequately filled by a steady inflow of imports from Asia. The very weak demand position was exacerbated by the short production month and converters buying the absolute minimum with an eye on their end-of-year stock position.

A reduction of €95/tonne for the January propylene reference price heralds a sharp reduction for PP prices at the start of the New Year. While few deals had been concluded at time of writing, most market observers were expecting PP prices to tumble more or less in line with the lower propylene cost settlement. Demand is likely to pick up slowly while higher imports will support supply.

PVC

In December, base PVC prices declined €60/tonne compared to the previous month while flexible and rigid PVC compound prices slipped just €40-45/tonne as additive costs fell slightly. European thermoplastic prices

Material availability was adequate despite some planned plant maintenance turnarounds and strict production controls as any supply gaps were adequately filled by a steady inflow of imports from Asia. The very weak demand position was exacerbated by the short production month and converters buying the absolute minimum with an eye on their end-of-year stock position.

PVC prices remain under pressure in January as a result of the sharp €95/tonne reduction in the ethylene reference price and competition from inexpensive Asian imports. While few deals had been concluded at time of writing, most market observers were expecting base PVC prices to fall more or less in line with the lower cost base.

PS

In December, polystyrene producers were not prepared to give away more than a part of the €132/tonne reduction for the styrene monomer reference price due to rising energy costs. GPPS prices dipped by just over €100/tonne with HIPS prices down by €95/tonne.

Supply remains tight due to production cuts, yet there was sufficient material to meet the low demand.

Demand was weak because of the short production month and converters keeping an eye on stock levels for year-end accounting reasons. European thermoplastic prices

The January styrene monomer reference price settlement soared by €115/tonne due to tight supply and a surge in benzene costs. PS prices are expected to increase sharply this month and major producer have announced planned price hikes of €120-150/tonne. Supply remains tight while demand is expected to pick up as converters begin to replenish their inventories.

PET

The European PET market returned to calmer waters in December following the turmoil of the previous month. PET prices fell by around €20/tonne last month compared to a €40/tonne reduction for the November paraxylene contract price.

PET producers attempts to curb production and stabilise supply appears to be working as producers’ inventories finally moved downwards. There was also fewer competitively-priced Asian imports available last month.

PET demand was very low as December, a traditionally a weak month for beverage bottle production. European thermoplastic prices

There are signs that the European PET market may be about to turn a corner in January after the recent turbulence. PET prices are expected to stabilise as costs fall, imports become scarcer and producers maintain strict production controls. As demand reached rock bottom last month, producers are more optimistic about a gradual recovery in order activity.

European thermoplastic prices

Bioplastics Benefits – rPET-Fabric 01-02-2023