The external fund manager backed by Berkshire Hathaway’s Charlie Munger, Li Lu, makes no bones about it when he says ‘The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.’ So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Piovan S.p.A. does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Hydrogen Cars

Ultimately, if the company can’t fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well – and to its own advantage. The first step when considering a company’s debt levels is to consider its cash and debt together.

How Much Debt Does Piovan Carry?

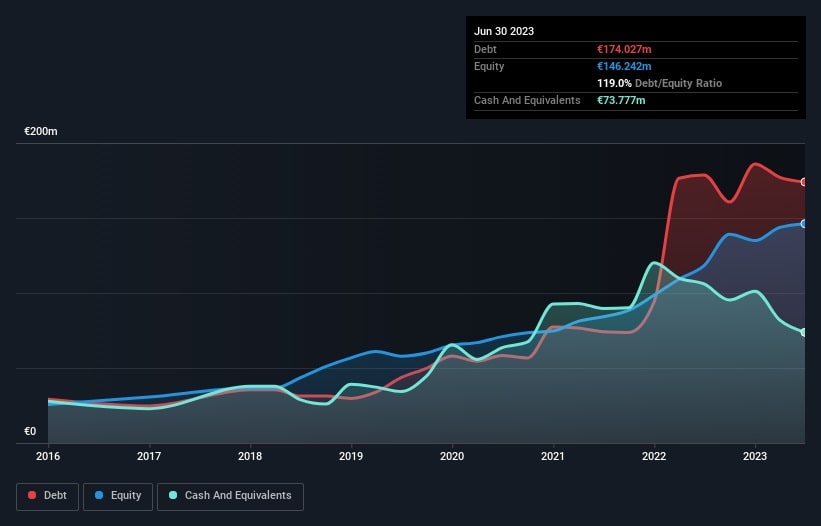

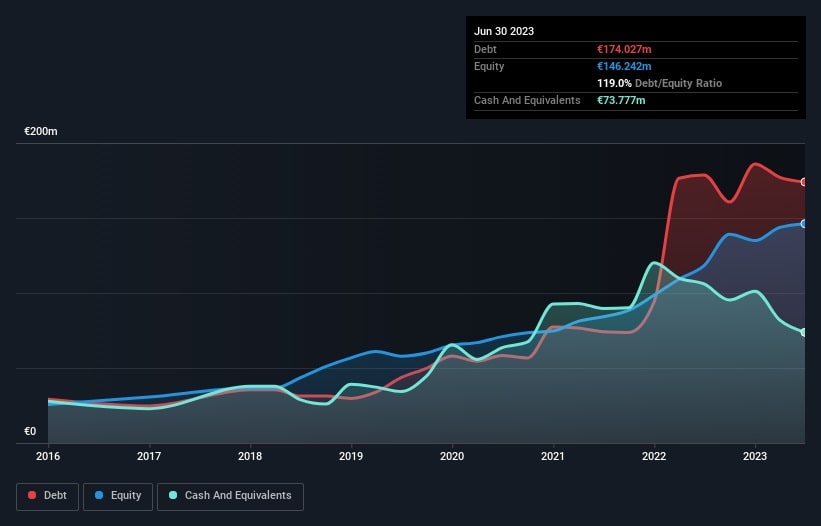

As you can see below, Piovan had €174.0m of debt, at June 2023, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of €73.8m, its net debt is less, at about €100.3m. Hydrogen Cars

A Look At Piovan’s Liabilities

According to the last reported balance sheet, Piovan had liabilities of €207.6m due within 12 months, and liabilities of €140.0m due beyond 12 months. Offsetting this, it had €73.8m in cash and €106.4m in receivables that were due within 12 months. So its liabilities total €167.4m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Piovan has a market capitalization of €469.5m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it’s clear that we should definitely closely examine whether it can manage its debt without dilution. Hydrogen Cars

In order to size up a company’s debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Piovan has a low net debt to EBITDA ratio of only 1.5. And its EBIT covers its interest expense a whopping 30.6 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On top of that, Piovan grew its EBIT by 69% over the last twelve months, and that growth will make it easier to handle its debt. There’s no doubt that we learn most about debt from the balance sheet. But it is Piovan’s earnings that will influence how the balance sheet holds up in the future. So when considering debt, it’s definitely worth looking at the earnings trend. Hydrogen Cars

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, Piovan recorded free cash flow worth 76% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

More…

Chlorophyll Water has transitioned to bottles made from 100% rPET with Clean Flake technology. These rPET bottles are manufactured from food-grade PET which is recycled as per the technologies approved by the US FDA and European Food Safety Authority (Efsa) for food-grade recycled material and repurposed into new PET bottles.

“As a brand, Chlorophyll Water is committed to sustainability and implementation of new ideas and technology which can improve the impact that packaging has on our environment,” explains founder Matt Levine, “in utilising bottles made from 100% recycled plastic, our intention is to make a meaningful environmental impact – addressing the plastic waste challenge, minimising our use of virgin, fossil-fuel based packaging.”

To accompany their bottle made from 100% recycled plastic, Chlorophyll Water selected Avery Dennison’s Clean Flake label technology as their label to help improve the yield of high-quality, food grade PET in the recycling process. Hydrogen Cars

The technology is built on a water-based adhesive technology that is claimed to separate cleanly from PET during the caustic wash stage of the recycling process.

Chlorophyll Water is a plant-powered purified water enhanced by nature with the addition of Chlorophyll, a key ingredient and the distinct green pigment in plant life. It is carbon-filtered using triple filtration and is UV-treated for a high level of purity.

More…