Oil – Plastic – Economy 06-12-2022 - Arhive

Oil – Plastic – Economy

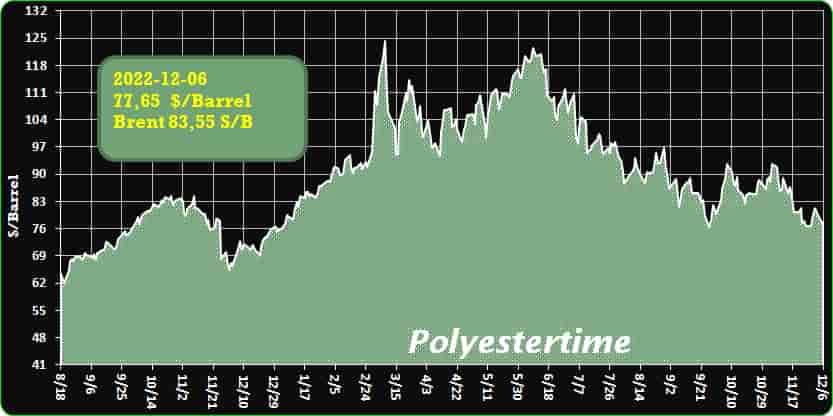

Crude Oil Prices Trend

Crude Oil Prices Trend Polyestertime

-Europe cuts gas demand by a quarter to shed reliance on Russia

Countries have been finding alternative sources and making changes to curb demand

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service.

EU countries cut gas demand by a quarter in November even as temperatures fell, in the latest evidence that the bloc is succeeding in reducing its reliance on Russian energy since Moscow’s full-scale invasion of Ukraine. Oil – Plastic – Economy

Provisional data from commodity analytics company ICIS showed gas demand in the EU was 24 per cent below the five-year average last month, following a similar fall in October.

European countries have been trying to pare back their reliance on Russian gas and oil by finding alternative sources or making changes to curb demand.

They have been helped by an unseasonably warm autumn, although in the past two weeks temperatures have dropped closer to normal levels.

In Germany and Italy, the EU’s two largest gas-consuming countries, demand fell 23 and 21 per cent respectively in November, ICIS found. In France and Spain it dropped more than a fifth and in the Netherlands by just over a third.

“Industry is proportionally driving the biggest reductions in gas consumption, and this is entirely the result of clear market pricing,” said Tom Marzec-Manser, lead European gas analyst at ICIS. The high gas price had “disincentivised” use, he added. In 2021, the EU imported 155bn cubic metres of natural gas from Russia, accounting for about 45 per cent of EU gas imports and close to 40 per cent of its total gas consumption.

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service.

Europe has also imposed sweeping new restrictions on Russia’s oil exports to limit its use of that energy source too.

The EU’s bar on seaborne Russian oil imports came into effect on Monday. G7 leaders, meanwhile, have agreed to launch a so-called price cap that aims to keep Russian oil flowing to countries such as India and China to avoid creating widespread shortages, but only if the crude is sold at less than $60 a barrel to crimp Moscow’s revenues.

Industry executives and analysts have warned, however, that without further declines in demand and more imports of LNG, gas shortages could persist for years in Europe.

“Demand will need to be lower than pre [Russia-Ukraine] war levels to get enough inventory” for next winter, said Alex Tuckett, head of economics at consultancy CRU Group. “The question is, how much demand reduction, and how painful it will be.”

The drop in demand meant gas storage facilities in the EU were at 95 per cent capacity in mid-November, according to industry body Gas Infrastructure Europe, close to an all-time high. Record inflows of LNG into the region also helped.

But colder weather in recent weeks has increased demand and storage facilities are now at about 93 per cent capacity. Oil – Plastic – Economy

At the same time, prices have risen. Dutch TTF gas futures, the benchmark European contract, are trading near €150 a megawatt hour, the highest in more than a month, but still only half the €300/MWh they briefly reached in August.

Higher gas prices are a burden on households and businesses, but they have enabled Europe to attract record volumes of LNG because of the premium it pays over other buyers.

ICIS data showed that Europe and the UK imported 11.14mn tonnes of LNG in November, a record monthly high, and are on course to receive 12.2mn tonnes in December.

Marzec-Manser added a note of caution on Europe’s planned cap on gas prices.

“Any move to cap wholesale gas prices could jeopardise Europe’s ability to secure [LNG] supply, not just this winter, but for next winter and beyond,” he said.

-Russia rejects oil price cap agreed by EU, G7

- Russia has rejected a $60 price cap on oil, agreed to by the EU, the G7 and Australia.

- The price cap comes into effect Monday, along with an EU embargo on Russian crude oil.

- The embargo will prevent Russian crude oil shipments to the EU, potentially cutting off earnings for the war.

- For more finance news, go to the News24 Business front page.

Russia on Saturday rejected a $60 price cap on its oil agreed by the EU, G7 and Australia, which Ukraine said would contribute to destruction of Russia’s economy.

“We will not accept this price cap,” Kremlin spokesman Dmitry Peskov told domestic news agencies, adding that Russia, the world’s second largest crude exporter, was “analysing” the move.

The $60 (~R1 053) oil price cap will come into effect on Monday or soon after, alongside an EU embargo on maritime deliveries of Russian crude oil.

The embargo will prevent seaborne shipments of Russian crude to the European Union, which account for two thirds of the bloc’s oil imports, potentially depriving Russia’s war chest of billions of euros. Oil – Plastic – Economy

Kyiv welcomes the price cap, which stops countries paying more than $60 a barrel for Russian oil deliveries by tanker vessel and is designed to make it harder for Russia to bypass EU sanctions by selling beyond the European Union at market prices.

“We always achieve our goal and the economy of Russia will be destroyed, and Russia itself will pay and be responsible for all crimes,” Ukraine’s presidential chief of staff Andriy Yermak said on Saturday.

The Kremlin also said Russian President Vladimir Putin would “in due time” visit the Donbas region of eastern Ukraine, which he claims to have annexed. But Peskov gave no indication of when this could happen.

Limit funds for the ‘war machine’

Poland had earlier refused to back the price cap over concerns the $60 ceiling was too high but confirmed its agreement on Friday evening.

Yermak noted a cap of “$30 would have destroyed it (the Russian economy) more quickly”.

The market price of a barrel of Russian Urals crude is currently around $65 dollars, just slightly higher than the $60 cap, indicating the measure may have only a limited impact in the short term.

The G7 said it was delivering on its vow “to prevent Russia from profiting from its war of aggression against Ukraine, to support stability in global energy markets and to minimise negative economic spillovers of Russia’s war of aggression”.

The White House described the cap as “welcome news” that would help limit Putin’s ability to fund the Kremlin’s “war machine”. Oil – Plastic – Economy

Russia has threatened not to deliver to countries that adopted the measure.

The G7 and Australia said they were prepared to ajust the price ceiling if necessary.

Russia has earned 67 billion euros ($71 billion) from the sale of oil to the European Union since the start of the war in February.

Its annual military budget amounts to around 60 billion, noted Phuc-Vinh Nguyen, an energy expert at the Institut Jacques-Delors in Paris.

The EU embargo on seaborne deliveries follows a decision by Germany and Poland to stop taking Russian oil via pipeline by the end of 2022.

-Cautious optimism as economy slowly comes back on track

Multiple projections suggest we may have left the worst behind

First the grim part – at least on the face of it. Government data released on 30 November 2022 shows that the Indian economy grew by 6.3% in the July-September quarter of 2022. This is way down from a 13.5% growth in the previous quarter of April-June. Last year, in the same July-September quarter, the GDP growth rate was 8.4%.

The government, however, paints a brighter picture. Chief economic adviser V Anantha Nageswaran told reporters that the Indian economy’s performance in the last quarter actually shows that it has maintained its momentum and that we are on track to grow by 6.8-7% in the current financial year. The IMF has projected the Indian economy to grow at 6.8% while the Reserve Bank of India’s estimates put it at 7%.

Economists also paint an optimistic picture. Business daily The Mint has quoted Aditi Nayar, Chief Economist at ICRA, as saying, “The Q2 FY2023 GDP growth of 6.3% was similar to our estimate of 6.5%, even as the GVA rise of 5.6% trailed our forecast (6.3%) by a wide margin, led by an unexpected contraction in manufacturing that seems to reflect the impact of high input prices on margins in certain sectors.” A few others spoke along similar lines. Oil – Plastic – Economy

A day before, on 29 November, Business Line quoted two reports – one by Nielsen IQ and another by BNP Paribas – on the growth pattern and new launches by FMCG companies. The Nielsen report says a few FMCG categories saw new launches in the quarter ending September compared to a year ago in the same period even as companies introduced new pack sizes amid inflationary pressures to make their products more accessible. Several new launches came from biggies such as Tata Consumer Products, Dabur India, and Britannia Industries

The BNP Paribas Consumer report says the FMCG industry’s three-year sales CAGR improved to 12.5%, led by price increases in some product categories. Godrej Consumer Products’ personal care segment rose 18% y-o-y, while HUL’s beauty and personal care division posted 11% y-o-y growth in Q2. Dabur’s foods and beverage segment saw 30% y-o-y sales growth, led by market size expansion. However, HUL’s food and refreshment business reported a 4% y-o-y growth in sales – impacted by muted health food drinks.

A primary inference that can be drawn from these reports is that it may spell good news for the packaging industry, which looks forward to a turnaround of the economy after the Covid disruption. The good responses and positive discussions at the Elite Conference in Mumbai, K2022 in Düsseldorf, and then again at the LabelExpo 2022 in Greater Noida certainly point to this optimism as we suggested in our last editorial even though raw material supplies and prices could be a bottleneck.

But we can also take refuge and seek hope in industry reports that paint an optimistic picture of the flexible packaging and paper packaging markets. Various industry estimates say that the global flexible packaging market is projected to grow at a CAGR of around 4.1 – 4.5% to reach between US$ 375 – 400 billion by 2029 from around US$ 252 billion in 2021.

Another report by Exactitude Consultancy, the market research and consulting wing of Ameliorate Digital Consultancy, says the Asia-Pacific, especially India and China, will lead the packaging market buoyed by rising economic value, and the rate of industrialization expansion. Another factor, as the report says, is that consumers now value packaging that is lightweight and effective because they are more cognizant of food safety. “The demand for flexible plastic packaging has increased in India due to the country’s growing understanding of the advantages of recycling and bioplastics,” the Exactitude report says. “Key market drivers will be the abundance of raw materials and the quickening pace of technical development in the flexible plastic packaging industry.”

Going on to a third report, India’s organized paper packaging, Crisil says, is likely to sustain its growth momentum, with revenue at 14-16% higher this fiscal after about a 35% growth in fiscal 2022, which was on a low base created in fiscal 2021 by the pandemic. Oil – Plastic – Economy

But even if we take all the estimates with a pinch of salt, one cannot discount the positive projections and optimism, (with the normal dose of caution), about the packaging industry in general expressed by most participants at LabelExpo 2022 and other events. And only hope that the usual bumps in the economy do not become cataclysmic disruptions.

The impact, resilience, and growth of responsible packaging in a wide region are daily chronicled by Packaging South Asia.

A multi-channel B2B publication and digital platform such as Packaging South Asia.is always aware of the prospect of new beginnings and renewal. Its 16-year-old print monthly, based in New Delhi, India has demonstrated its commitment to progress and growth. The Indian and Asian packaging industries have shown resilience in the face of ongoing challenges over the past three years.

As we present our publishing plan for 2023, India’s real GDP growth for the financial year ending 31 March 2023 will reach 6.3%. Packaging industry growth has exceeded GDP growth even when allowing for inflation in the past three years.

The capacity for flexible film manufacturing in India increased by 33% over the past three years. With orders in place, we expect another 33% capacity addition from 2023 to 2025. Capacities in monocartons, corrugation, aseptic liquid packaging, and labels have grown similarly. The numbers are positive for most of the economies in the region – our platform increasingly reaches and influences these.

Even given the disruptions of supply chains, raw material prices, and the challenge of responsible and sustainable packaging, packaging in all its creative forms and purposes has significant headroom to grow in India and Asia. Our context and coverage engulf the entire packaging supply chain – from concept to shelf and further – to waste collection and recycling. We target brand owners, product managers, raw material suppliers, packaging designers and converters, and recyclers. Oil – Plastic – Economy

-Advances in Dry-Cut Strand Pelletizing, Centrifugal Drying

At K 2022 in October, MAAG debuted three products for dry cut strand pelletizing and a new centrigual dryer for underwater pelletizing.

At K 2022 in October, MAAG debuted three products for dry cut strand pelletizing and a new centrigual dryer for underwater pelletizing. Compared to its PRIMO S iteration, MAAG’s Primo SI has a new base frame that reportedly simplifies the integration of downstream equipment and machine handling. With the open design, the area under the machine is completely visible and accessible from all sides. The cutting head — as a unit with the base plate, drive and sound insulation hood now — now sits directly on four custom-made vibration dampers.

As a result, the entire cutting head (including attachments) is completely decoupled from the base frame. In addition to the base frame, the acoustic hood has also been revised: narrower and with a slope in the front section. As a result, the entire machine looks slimmer and the noise level is further reduced. Oil – Plastic – Economy

The granulator is driven by an intelligent gear motor with integrated frequency converter and mini-PLC. This combination achieves optimum performance with extended technical features. In addition to various transfer signals and country-specific certificates, the drive comes with a Bluetooth interface that allows the operating parameters of the machine to be read live at any time.

Second, MAAG showed a strand pelletizing system for highly filled, hydroscopic and water-sensitive compounds. The EBG model reportedly offers a high degree of automation, gentle material processing and excellent product quality. From the die head to the granulator, the pelletizing system forms a unit that, despite its compact design, has features of a large compounding system. Automatic feeding in case of strand breaks, removal of melt residues on the die plate by the patented hot-air-knife and synchronization between conveyor belt and strand granulator to name a few.

Finall in strand-cut pelletizing, MAAG showed an AR model of a jet-stream JSG900 pelletizing system.

For pellet drying in underwater applications, MAAG’s eXso centrifugal dryer now includes additional features that were developed to increase reliability, reduce changeover time and improve product quality. A defining feature is its three-door housing, which allows greater access and visibility to the interior of the unit. This allows for faster and more effective cleaning and lowers the risk of cross-contamination. In addition, eXso required 23% less floor space compared to centrifugal dryers of similar capacity.

Centrifugal Dryer for Pellets

eXso centrifugal dryers are billed as ideal for compounders and recyclers that require a reliable pellet drying step prior to packaging. eXso dryers have been tested and validated for rates up to 8200 kg/hr.

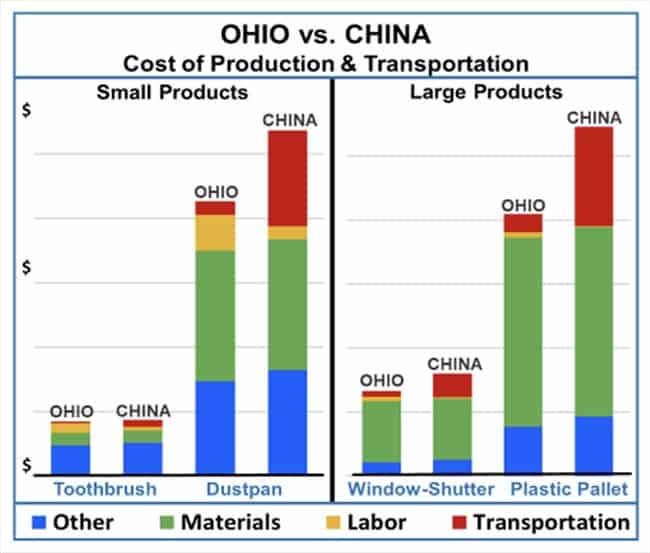

-It’s Cheaper to Manufacture Plastic Products in Ohio than in China, Report Claims

The long-held belief that it is cheaper to import plastic products than to make them domestically is no longer true, according to Shale Crescent USA.

The world isn’t as flat as it used to be. Back in 2005 when The World Is Flat: A Brief History of the Twenty-First Century by Thomas Friedman hit bookstores, the one-two punch of globalization and China’s emergence as the world’s workshop seemed an unstoppable force. The view is very different from the perspective of 2022, and a report from Shale Crescent USA (SCUSA) released last month makes the case that offshoring is a spent force. Oil – Plastic – Economy

“China has lost its manufacturing competitive advantage and the annual $25 billion of exported plastic-based goods from China represent a vulnerable and accessible market share opportunity for US operations,” states the report’s executive summary. The long-held belief that it is cheaper to import plastic products is no longer true because, states the summary, “feedstock/resin and transportation are the largest cost drivers of globally produced plastic-based goods.” If you are a regular reader of our Resin Pricing Report, this will not come as news. While some of these trends have been exacerbated by the pandemic, and supply chains are still reeling from its shockwaves, the SCUSA report claims that this shift is not transitory. “Close proximity to low-cost raw materials coupled with direct access to consumer markets provide US manufacturers with significant cost advantages over China-based competitors,” notes the executive summary. “These changes are fundamental, long term, and will continue for the foreseeable future,” it adds.

Now, it’s worth noting that SCUSA is not an unbiased observer. It is a not-for-profit organization established in 2016 to promote the region of Ohio, Pennsylvania, and West Virginia, which sits atop the Marcellus and Utica natural gas fields, deemed to be the most prolific such fields in the United States. (The Shell cracker plant near Pittsburgh, which began operation last month, uses ethane from shale gas producers in the Marcellus and Utica basins. It is the first major polyethylene manufacturing complex in the northeastern United States.)

While SCUSA has a dog in the US vs. China fight, that doesn’t mean the assertions made in this report are unfounded. Clearly, the astronomical cost of shipping, a crippled supply chain, and China’s bizarre zero-COVID policy — a self-inflicted wound on manufacturing and commerce — have radically changed the offshoring calculus. The question is, I suppose, whether this is a permanent reset or a temporary dislocation. We know where SCUSA lands on this question. But, in my opinion, that is not the only consideration.

If we can build it here, we should, because we simply should not be an accessory to China’s ambitions. Oil – Plastic – Economy

As Clare Goldsberry documented in PlasticsToday over the years in countless articles before she retired, China does not respect intellectual property rights. More recently, it has become a belligerent force, crushing dissent in Hong Kong, herding minority populations into “re-education” camps, and threatening the status of Taiwan.

Moreover, it doesn’t even make economic sense to manufacture products in China and ship them over here, according to the SCUSA report. Milacron helped the organization to develop a “production cash flow cost model” that compares the cost of manufacturing plastic products in Ohio versus China. As the graphic below shows, domestic production can be very competitive, and even cheaper in some cases, when transportation is factored in. The cost model is available to processors and can be tailored to take into account specific operation considerations, according to SCUSA.

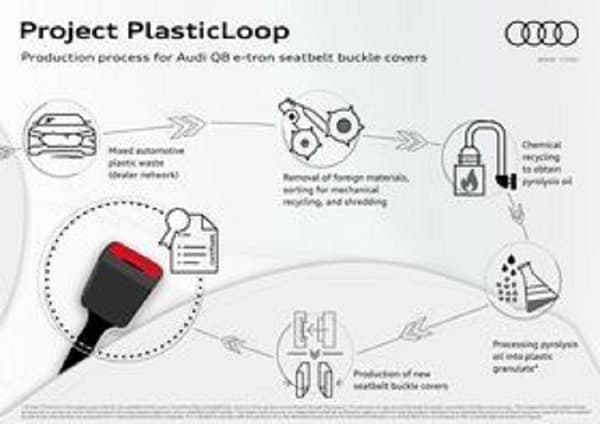

-LyondellBasell, Audi collaborate on sustainable seat buckle casings

Chemical recycling can close the loop for car components

LyondellBasell and Audi have collaborated on the development of a closed-loop process for mixed automotive plastic waste, the companies have announced. The project, part of Audi’s PlasticLoop project, will see the car maker installing plastic seatbelt buckle covers in its Q8 e-tron model that are made using chemically recycled plastic from LyondellBasell. It is the first time a stream of material which to date has been mostly only suitable for energy recovery, has been able to be recycled. Oil – Plastic – Economy

Plastic components from customer vehicles that can no longer be repaired are dismantled, shredded, and processed by chemical recycler SynCycle – a joint project of the Austrian companies Next Generation Group and BDI-BioEnergy International – into pyrolysis oil. The pyrolysis oil is then used as a raw material in LyondellBasell’s manufacturing process for the production of new plastics, replacing virgin fossil feedstocks. The recycled content is attributed to the Audi product via a mass balance approach.

“For the first time, we are using chemical recycling to recycle mixed automotive plastic waste into plastic granulate for automotive interior applications,” said Erik Licht, LyondellBasell Advanced Polymer Solutions New Business Development Director.

Materials produced from pyrolysis oil are of the same high quality as virgin materials and have the same properties. Chemical recycling offers an alternative to energy recovery and complements mechanical recycling.

“Audi’s vision is to use secondary materials wherever it is technically possible, economically viable and ecologically beneficial,” said Philipp Eder, Project Manager for Circular Economy in the Supply Chain at Audi.

“The PlasticLoop project is part of Audi’s circular economy strategy and a good example of cross-sector cooperation within the Audi supply chain. Findings from the project are also incorporated into the product development of future vehicle projects via the “Design for Recycling” approach.” Oil – Plastic – Economy

-Itero ranks first in TechRound 100

A win that reveals the ‘deeply felt desire for an end to plastic waste’

Chemical recycling company Itero Technologies has come out on top in the TechRound 100.

The TechRound 100 competition is organised by TechRound, a news platform for the latest UK start-up and technology news.

This year, over 3000 applications were received, with the judges ‘blown away by the quality of entries including startups that operate in multiple countries and have raised vast amounts through funding rounds’. Oil – Plastic – Economy

Itero Technologies converts non-recyclable plastic waste into chemical products used to produce new plastics, keeping plastic in the circular economy, diverting end-of-life plastics from landfill and incineration, and reducing reliance on and the consumption of crude oil.

The production of plastics is projected to triple by 2060 but existing recycling methods are limited in the types of plastics they can process and the quality of recycled products.

As Simon Hansford, CEO of Itero, said: “Across industries, we see a significant technology gap to reduce, reuse, and recycle plastic; our technology comes in at the recycle phase to solve for plastics that would otherwise be destined for landfill or incineration and makes a linear lifecycle circular.”

In addition to operating an R&D Facility located near Heathrow, UK, Itero are currently developing their first at-scale demonstration plant at the Brightlands Chemelot Campus in the Netherlands. The company recently raised €6m in funding, with €5m from Infinity Recycling’s Circular Plastics Fund (CPF), to support the design and construction of the new demonstration plant, increase their R&D activities in the UK, and ready themselves for their next funding round. The plant will process 27,000 tonnes of residual plastic waste annually, equivalent to the total amount of plastic packaging waste generated by the population of Amsterdam municipality per year.

According to the company, as much as 85% of plastic waste still ends up in landfill and incineration. “There is an urgent demand for solutions to plastic waste,” said Hansford.”Being named in the No.1 position shows that this issue is bigger than any one company and demonstrates the deeply felt desire for an end to plastic waste.”

Oil – Plastic – Economy