Oxo-degradable products – Corsair Bangkok Company Ltd (CORSAIR), a plastic waste recycling firm, has inked a significant agreement with Shell Singapore Pte Ltd (SSPL) to supply pyrolysis oil, a mixed plastic waste feedstock 13-02-2024

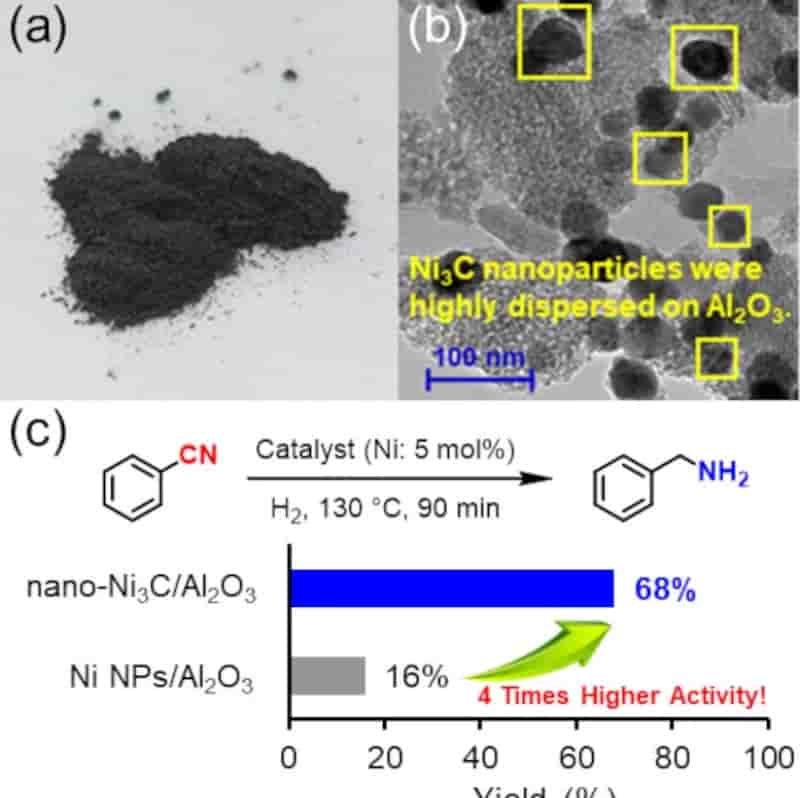

New Catalyst Discovery Cuts Costs and Boosts Green Chemistry

Osaka University researchers have developed a more sustainable and cost-effective catalyst for chemical synthesis, significantly reducing the need for rare and expensive metals. Oxo-degradable products

Their nickel carbide nanoparticle catalyst efficiently converts nitriles to primary amines under mild conditions, offering a promising solution for the environmentally friendly production of pharmaceuticals and everyday products.

A team from Osaka University, along with their collaborators, has created a cost-effective catalyst for a key chemical process, potentially paving the way for further initiatives to reduce expenses within the chemical sector.

The chemical industry often relies on scarce and costly metals to manufacture pharmaceuticals and other crucial materials.

Substituting these metals with more readily available and affordable alternatives could enhance environmental sustainability, reduce expenses, and decrease the likelihood of supply chain interruptions. Oxo-degradable products

Now, in a study recently published in Chemistry – A European Journal, researchers from Osaka University and collaborating partners have met this need in their work on an industrially useful chemical transformation. The simple, gentle reaction conditions reported here might inspire researchers who are working to reduce use of expensive metals for as many chemical reactions as possible.

The Role of Noble Metals and Alternatives

So-called noble metals are especially versatile materials. For example, palladium is a metal of choice for catalyzing a chemical transformation – converting nitriles into primary amines – that is a common step in nylon and plastics production. However, such metals are rare and costly. Substitutes based on common metals such as nickel could be cheaper catalysts. Oxo-degradable products

Avantium announces the successful completion of its €70 million capital raise

- Avantium secures funding for the completion, commissioning and start-up of the FDCA Flagship Plant and the acceleration of its commercial deployment

- The gross proceeds from the rights offering is €50.5 million, resulting in the issue of 27,018,772 new ordinary shares

- 24,467,905 new ordinary shares were subscribed through exercise of rights, representing a 90.6% take-up in the rights offering

- The rump offering was fully subscribed Oxo-degradable products

- Additional upsize offering of €19.5 million, resulting in the issue of 9,376,981 new ordinary shares

- The cornerstone investors and pre-committed shareholders were allocated €9.1 million at the issue price

- New investors were allocated €10.4 million at a price of €2.30, representing a 3.2% discount to the closing price on 8 February 2024

Avantium N.V. announces it has raised a total of €70 million through the successful completion of its capital increase by means of a fully underwritten rights offering, for an amount of €50.5 million, and the completion of a €19.5 million institutional upsize offering.

Tom van Aken, Chief Executive Officer of Avantium, comments: “We are very pleased with this successful €70 million capital raise, exceeding the €50 million equity capital that Avantium was initially targeting. Oxo-degradable products

This transaction allows us to remain well capitalised until our FDCA Flagship Plant is commercially operational. It also enables us to strengthen our balance sheet and to accelerate our technology licensing strategy. The increased issue size of €70 million, the high exercise percentage of the rights, the commitment of our larger existing shareholders and the entry of new strategic investors reflect an increasing and broadening interest in Avantium. I would like to thank our shareholders for putting their trust in us through their contributions to this capital increase.

With their support, we help realising a renewable and circular plastics economy, and create long-term, sustainable value for all our stakeholders.” Oxo-degradable products

The relentless race towards the “perfect” battery for electric cars raises crucial questions about the price accessible to all

Toyota solid state battery

Oxo-degradable products