Packaging-waste – rPET-bottles 25-10-2022 - Arhive

Packaging-waste – rPET-bottles

Crude Oil Prices Trend

Crude Oil Prices Trend Polyestertime

-Braskem and Sojitz Corporation launch Sustainea

Braskem, the market leader and pioneer in bioproducts production on an industrial scale, and Sojitz, a Japan-oriented global trading company, have announced the launch of Sustainea, which will produce and market bioMEG (monoethylene glycol) and bioMPG (monopropylene glycol), said Polymerupdate.

The market launch of the brand follows the approval of the joint venture (the process began in March 2022) by antitrust authorities.

The business plan envisages the construction of three industrial plants, with the first unit slated for operational startup in 2025, taking advantage of market opportunities and feedstock availability. The locations where the industrial units will be built have not been defined yet and could be in Europe, Asia, the United States or Brazil. The expectation in the business plan is that, once the technology is approved, the plants will have a combined production capacity of up to 700,000 thousand tons per year of bioMEG.

Sustainea will combine Braskem’s expertise in the industrial production and sale of chemicals and plastics made from renewable sources with Sojitz’s strong presence in Asia, a region that concentrates 80% of the global MEG market and where its consumption registered the highest growth. “This new company represents the joint efforts of both companies, which consider investments in renewable businesses of strategic importance. Braskem has a comprehensive and global strategy of growth in the green sector, with the plan to increase its capacity in 1 million tons of bioproducts until 2030 Sojitz has a strong presence in Asia and has been Braskem’s partner for over 10 years in this segment,” said Gustavo Sergi, CEO of Sustainea Bioglycols.

One of the project’s goals is to be the global market leader in bioMEG, a raw material used in the production of PET (polyethylene terephthalate). “Sustainea is born as a disruptive initiative in the petrochemicals market. We wish to positively impact the polyester and PET markets, which are continuing to grow, especially in Asia, driving the strong demand for sustainable and renewable products. Sustainea will also establish an entire production chain to ensure the supply of sustainable and competitive feedstock, as well as a logistics operation that ensures the lowest possible carbon footprint,” he explained.

-ETRMA, EU bodies warn of energy crisis impact on automotive industry

EU hopeful on US automotive-tariff threat

Grouping of five associations calls for political action to support “backbone of the EU economy”

Brussels – Five major European industry associations* have jointly sounded an alarm over the level of strain being placed on the EU’s automotive ‘ecosystem’ by rising energy prices and increased production costs.

Without “significant political action” to address the issue, it will become “increasingly difficult to make the case for manufacturing and investments in the EU,” said the grouping, which include the European Tyre & Rubber Manufacturers’ Association (ETRMA).

“Additional political initiative is urgently needed to avoid new import dependencies and to ensure access to affordable energy,” the associations further cautioned in a 21 Oct statement.

Spelling out the challenges currently faced by the industry, they said rising energy prices, coupled with high costs of raw materials and other components, were negatively impacting the sector as well as customers.

“Costs of production are therefore skyrocketing, undermining profitability and putting investments and the very survival of critical industries within the automotive ecosystem at risk,” the European bodies added.

Industry, they pointed out, cannot absorb such high costs in the long-term, especially in the face of competition from other major markets such as the US or China.

With energy prices in Europe being seven to eight times higher than in the US, the associations warned that the EU car industry could not be competitive and required “a comprehensive and coordinated policy response.”

High costs also jeopardise employment in an industry that supports 11.5% of EU manufacturing labour, noted the statement, which also called for equal conditions across the EU.

“Single market and state aid rules must not undermine fair competition between production sites in different member states,” said the statement, noting the “essential role” of the European Commission in this area.

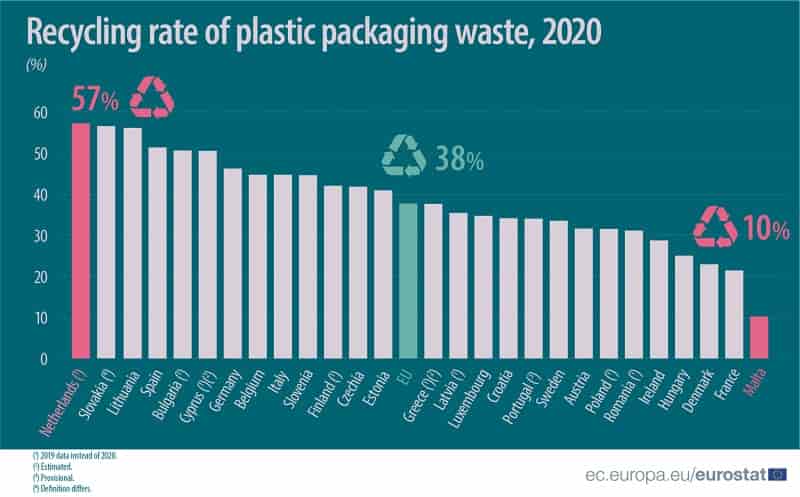

-Plastic packaging waste: 38% recycled in 2020

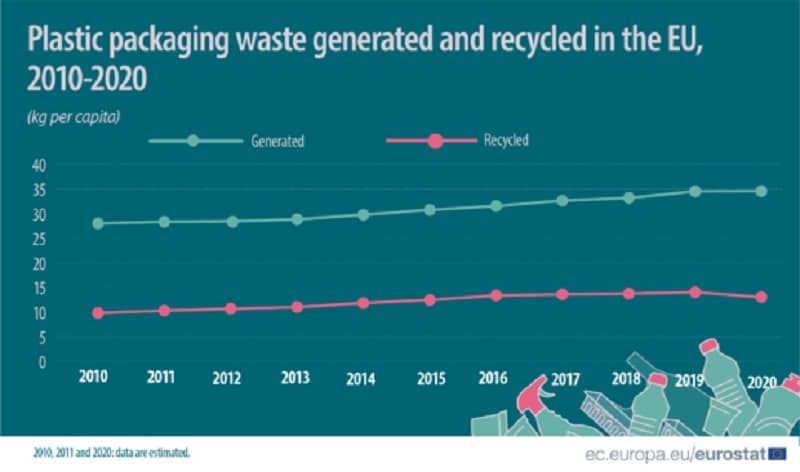

In 2020, each person living in the EU generated 34.6 kg of plastic packaging waste on average. Out of these, 13.0 kg were recycled.

This information comes from data on packaging waste published by Eurostat.

Between 2010 and 2020, the volume of plastic packaging waste generated per inhabitant increased by 23% (+6.5 kg). The recycled volume of plastic packaging waste increased over the same period, by 32% (+3.2 kg). Despite this improvement, the amount of plastic packaging that wasn’t recycled increased by 3.4 kg per inhabitant since 2010 due to the greater increase in the absolute amount of plastic packaging waste generated.

Less plastic recycling due to change in method

In 2020, stricter rules for reporting recycling entered into force. These include a harmonised calculation point for recycling and stricter accounting of composite packaging material fractions. Due to that, a provisional decrease of 3 percentage points was observed (from 41% in 2019 to an estimated 38% in 2020).

The Netherlands, Lithuania, Slovakia, Spain, Bulgaria and Cyprus recycled more than half of their plastic packaging waste generated. In contrast, less than one-third of plastic packaging waste was recycled in Malta, France, Denmark, Hungary, Ireland, Romania, Poland and Austria.

Source: Eurostat

∼∼∼∼∼∼∼∼∼∼∼∼∼∼∼∼∼∼∼∼

-Ukraine’s PET Technologies intent on more than survival

Many exhibitors at K 2022 have had a challenging year, with high material prices, supply chain issues and the continued recovery from the global pandemic among the hit list.

Then there’s PET Technologies Ltd., a blow molding machinery producer exhibiting at K 2022. Its biggest challenge comes from where it is based: Ukraine.

“You have seen the news and all that is happening around us,” CEO Maxim Poliansky said in an interview at a booth tucked into a small corner of Hall 14. “The most important thing for us is purely to survive, not only as a company but as a country. It is what we have to do.”

PET Technologies is Ukraine’s largest blow molding machinery and blow mold supplier and has served the surrounding region, including Russia, since its founding in 1999. The company is based in Chernihiv, Ukraine, dangerously positioned in the north of the country, less than 45 miles from the Russian border.

Before Russia invaded the country in February 2022, PET Technologies employed 240 people at its 10,000-square-foot plant. Then the bombing began near its factory. While the plant was miraculously unscathed in the constant air attacks, the area around it was in places reduced to ashes and some buildings became damaged shells.

The company had a decision to make, Poliansky said. Many of its fellow businesses were relocating out of Ukraine, moving to the western part of the country, where bombing was not as fierce, or closing entirely. PET Technologies briefly considered moving to a safer haven, but it decided to stay put.

The decision was as much about taking a symbolic stand against terror as it was in continuing production and maintaining consistency, he said.

“We decided to be part of rebuilding the local area and pay our taxes to support the government and its fight,” Poliansky said. “It was difficult but not impossible to do that. We saw the worst of it and survived through it. Spring was taxing, and we lost a good part of our business. Now, we are intent on not only surviving but growing.”

The company decided to explore new markets to replace some of the 30 percent of its business that was sent to Ukrainian processors before the war. With many of those businesses in lockdown or closed, it was a must to focus on global work, Poliansky said.

The company had one advantage: For the last seven years: it had already made inroads into the Americas, both North and South, and in central Asia. It had supplied machinery and molds to 55 countries, growing its overseas business considerably. Both 2020 and 2021 had been extremely good years, Poliansky said.

-KHS offers glued-in handles for rPET bottles, intending to reduce emissions and increase efficiency

KHS has announced the development of a glued-in process for the handles of its rPET containers, intended to contribute a recycled and recyclable bottle design to the home care and food sectors.

Following a year-and-a-half-long partnership with Logoplaste Innovation Lab, the company has developed a 2.3-liter PET bottle with a glued-in handle, designed to produce the smallest possible carbon footprint and package home care products. It is said to facilitate such perks as compatibility with existing heating methods and a simpler contour design than its clip-in alternatives; 10% less material is used to produce a glued-in handle than a clip-in one, it is claimed, and 30% fewer resources are used in the manufacturing process.

Glue-in handles purportedly allow manufacturers to switch from extrusion blow molding to stretch blow molding, which is said to be a more energy-efficient process – thus increasing efficiency in the bottles’ production.

Customers are reportedly able to design bespoke bottles through the KHS Bottles & Shapes service programme, with the transparency of the PET material expected to be beneficial for displaying the products inside the packaging. Where irregular or complex bottle designs are concerned, the heating process is said to permit the homogenous distribution of the material during stretch blow moulding, which is thought to reduce the resources used and ensure the stability of the bottle.

Manufacturers can also utilise the millimetre accuracy for neck alignment and achieve precision through oriented spout caps, according to KHS. It assures that the bottles resulting from this process are durable, as their lack of seams are suggested to have ensured their strength during in-house drop tests.

“Our adhesive technology enables us to cut down on the amount of energy and material used in production and manufacture a container that’s both more stable and visually more appealing than the standard products currently available on the market,” says Sebastian Wenderdel, PET sales business development manager at KHS in Hamburg, Germany. “We provide a circular container whose bottle body and handle consist of 100% recyclate and are themselves fully recyclable. This is still fairly unusual for containers with an integral grip.

“The growing demand for environmentally-friendly packaging and stricter legal requirements governing the use of recycled plastics are perfectly met by our latest development.”

Various brands have embraced what claim to be 100% rPET bottles in their products, from Henkel’s Pril dishwashing liquid to evian’s prototype water bottle. P&G was a finalist in the Sustainability Awards 2022 for the digitally watermarked rPET laundry bottles packaging products under its Lenor laundry brand.

-K 2022 – PureCycle Develops Fully Circular Polypropylene Concentrate

PureCycle Technologies announced today that its longstanding partnership with Milliken has achieved a new milestone with the development of the first fully sustainable polypropylene concentrate on the market.

PureCycle Technologies announced today at K 2022 that its longstanding partnership with Milliken has achieved a new milestone with the development of what it calls the first fully sustainable polypropylene (PP) concentrate on the market.

“Typically, plastics contain 2 to 3% additives,” said PureCycle Technologies CEO Dustin Olson during a press conference at the trade show in Düsseldorf, Germany. “This product achieves full circularity, even with additives, thanks to the PureCycle process,” he noted. Also, when used in combination with PureCycle’s recycled PP, the concentrate has a carbon footprint that is approximately 35% lower than virgin PP, said Olson.

The PureCycle process doesn’t fall neatly into either of the current recycling buckets. It’s neither purely mechanical, nor is it chemical recycling, because no de-polymerization is involved. Olson put it this way: “We basically dry clean the molecule.”

Invented by P&G, the PureCycle process essentially removes all contaminants from waste PP such that the end result is a material that is akin to virgin PP. The technology, incidentally, puts PureCycle in regulatory purgatory, which can be problematic from a legislative perspective, Olson noted as an aside. Be that as it may, it has allowed PureCycle to develop a new concentrate that fully realizes circularity.

Product samples will be made available near the beginning of the year in North America and Europe, with commercialization to follow.

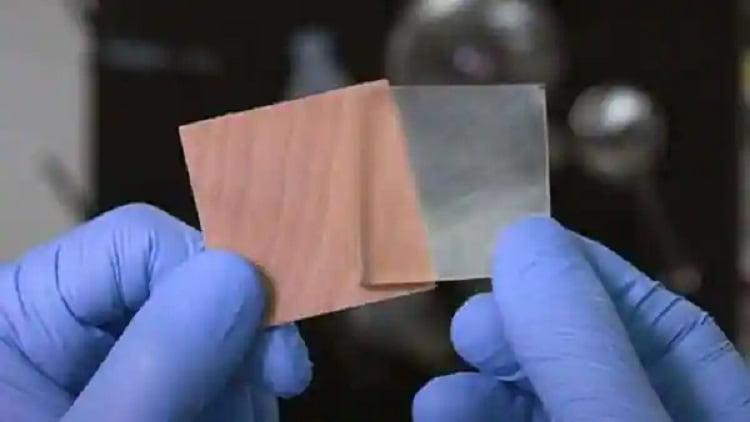

Transparent wood holds potential as an eco-friendly alternative to glass or plastic used to create biomedical equipment, see-through packaging, and automotive windshields, according to a study.

Transparent wood is created by eliminating the lignin content of wood and substituting it with transparent, plastic materials. It was first created in 1992 by German scientist Siegfried Fink and has subsequently been refined by other researchers. In contrast to plastics, lignin is a naturally occurring biopolymer that supports plant tissue and is non-toxic.

The amount of single-use plastic that is currently used and then wasted globally amounts to over 400 million tonnes per year. One of the most promising replacement materials for the future is translucent wood, which is now appearing, according to the UN Environment Program.

The majority of the time, tiny slices of wood are used to create transparent wood, which is stronger than conventional wood but lighter in weight. It is a distinctive bio-based substrate with a wide range of applications due to the potential for incorporating specialised materials to impart diverse and advanced features.

Prodyut Dhar, a study author and assistant professor at the Indian Institute of Technology’s biochemical engineering department, claimed that transparent wood can take the place of petroleum-based plastics that are harmful to the environment, such as polypropylene, polyvinyl chloride (PVC), acrylic, polyethylene, and so on, reported phys.org.

The study, which was published in the journal Science of The Total Ecosystem, claimed that translucent wood’s renewable and biodegradable qualities helped it have fewer negative ecological effects on the environment.

-Resin Price Report: Prime PE, PP Resin Prices Slip Some More

While the lower part of the polyethylene (PE) pricing spectrum again held firm the week of Oct. 11, the top end of the polyethylene (PE) market continued to trim, reports the PlasticsExchange in its Market Update. Prime prices sliced off a couple of cents, as processors shopped and suppliers competed for orders, compressing margins. Polypropylene (PP) prices remained under considerable pressure, and lopped off another $0.03/lb. Spot polymer-grade propylene (PGP) prices eroded further, and the resin market remained oversupplied even as operating rates have been cut.

Hurricane season: So far, so good

The petrochemical industry has so far skated through the majority of the hurricane season without a scratch, though there is a bit more to go. Just in case, PE producers have kept price increases on the table. However, barring a disruptive storm, processors will again push for a price decrease in October to find further relief after decreases in both August and September. PP contracts will see another large drop in October contracts, some attributed to a cost decrease while more should also come through as a margin reduction, according to the PlasticsExchange.

PE was the dominant resin to transact in the PlasticsExchange marketplace heading into mid-month, and trading was a bit busier than the previous week. Spot sales were spread across all PE commodity resins — high-density, low-density, and linear-low-density PE. Film grades were in greater demand than Injection, with Blow Molding picking up the rear. PE producers’ efforts to rebalance supply/demand is showing evidence of success, as dramatically reduced reactor rates and near-record export sales during September translated into a massive inventory drawdown of more than 575 million pounds, according to the American Chemistry Council. The two-month tally was more than 700 million pounds, even as September domestic PE sales were lackluster at 120 million pounds below the trailing 12-month average, reports the PlasticsExchange. This brought producers’ collective PE inventories down to a level nearly 150 million pounds below where they stood at the start of 2022. So the huge discounting to encourage export sales along disciplined production is starting to have a statistical impact, even though barely noticed in the domestic market, where resin supplies remain ample.

Spot PE pricing erodes faster than contracts

The freefall in PE pricing appears over though bottoming action continues, and sentiment has shifted from bearish to neutral, but not yet bullish. Spot pricing eroded quicker than contracts, so top-end pricing still has some room to slide and another contract decrease is quite possible this month. There has been an uptick in Asian resin prices; despite competitive international offers and a strong US dollar, export interest from the United States remained strong during the first part of October. If elevated exports persist and producers continue to run reactors at significantly reduced rates, supply and demand should rebalance during Q4, leading into Q1 with typical seasonally stronger pricing. In the meantime, new capacity coming on stream will add to complexities, though it is not unexpected.

Spot PP prices finish week down a few cents

PP activity trailed off after a decent start to the month. While completed volumes at the PlasticsExchange trading desk were healthy, much of the activity was concentrated in a series of off-grade railcar transactions rather than spread out among a wider group of buyers. Some business was done in Prime co-polymer PP, but it was mostly truckload transactions, so it was a smaller volume in comparison. Spot PP prices followed PGP lower and finished the week down a few cents. Homo-polymer PP pricing has come off $0.15/lb in the past month or so, while co-polymer PP has shed $0.20/lb, returning toward a more normal price relationship. PP producers also throttled back reactor rates dramatically in September, producing the third lowest quantity of resin in 32 months, which includes the hurricane and freeze markets.