PET-flakes – European-chemicals – EV 22-11-2022 - Arhive

PET-flakes – European-chemicals – EV

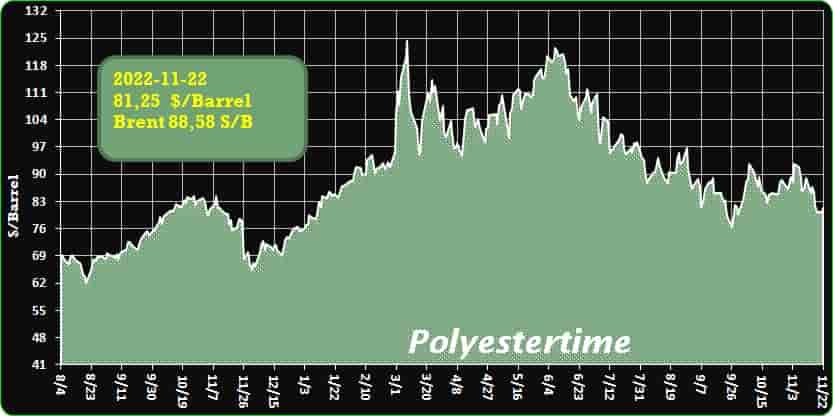

Crude Oil Prices Trend

Crude Oil Prices Trend Polyestertime

-Resilux Group acquired 70% shares of Greentech Ltd

The Resilux Group – through its recycling division Poly Recycling Switzerland – has acquired 70% shares of the Serbian PET recycling company Greentech Ltd, said the company.

It gives Resilux significant additional recycling capacity as well as enhanced post-consumer bottle collection and sorting capability.

Since its foundation in 2005, Greentech has been a pioneer and leading PET packaging recycling company in the country. Its recycling facility, located in Mladenovo, Serbia, processes up to 10,000 tons of waste PET packaging per year to produce hot washed PET flakes. In addition to the recycling facility, Poly Recycling has also acquired 70 percent shares in Greentech’s collection and sorting facility in Skopje, North Macedonia. This facility is capable of sorting used PET products by color and type before they are passed on for recycling at Mladenovo. PET-flakes – European-chemicals – EV

The acquisition means Resilux has secured a local supply of A-grade PET flakes to serve its existing preform and bottling plant Resilux Adriatic in Lajkovac, Serbia.

According to Resilux COO Marcel van de Sande: “The acquisition expands our operations in the Adriatic region by securing a local supply of used PET. And it continues our ongoing expansion plans for recycling activities by the Resilux Group as we establish a more sustainable and truly circular economy for PET.”

Mihail Mateski remains as General Manager and 30% nt shareholder in Greentech Serbia and North Macedonia. He states: “By becoming members of Resilux group we have secured transfer of know-how and technology for top quality recycled PET bottles for food contact. Combined with Greentech’s expertise of over 20 years in PET collection and recycling, it is the perfect match to provide full circularity of the PET bottles and further development of our recycling operations in the whole West Balkan/Adriatic region.“

We remind, Resilux, a leading PET bottle and preform producer, has announced a major new technology investment which will result in them doubling their bottle-to-bottle PET recycling capacity. Using state of the art equipment from Erema, it is Resilux’s latest step in their drive to create a truly circular economy in PET.

-Chandra Asri and Borouge Explore Circular Economy-Based Polyolefin Waste Business Potential

Chandra Asri announced their collaboration with Borouge, a petrochemical company from the United Arab Emirates, at the B20 (Business 20) event in Nusa Dua, Bali, Monday (14/11/2022). The commitment agreed by both of petrochemical companies were based on a joint circular economy initiative which cover the management of polyolefin waste and recycling facilities to produce new products; as well as opportunities in co-marketing and market development initiatives, including developing non-metallic applications in certain market segments in oil and gas amalgamation, automotive, construction, and else, to promote the use of polyolefins. PET-flakes – European-chemicals – EV

The announcement of the commitment was attended by President of the Republic of Indonesia Joko Widodo, President of the United Arab Emirates Mohammed bin Zayed Al Nahyan, Coordinating Minister for Maritime Affairs and Investment Luhut Binsar Pandjaitan, Minister of Foreign Affairs Retno LP Marsudi, Minister of Environment and Forestry Siti Nurbaya Bakar, Minister of Public Works and Public Housing Basuki Hadimuljono and Minister of Industry Airlangga Hartarto and CEO of Masdar Mohammed Jameel Al Ramahi.

-Why European chemicals can emerge from this crisis as a winner

Aromatics, China, Environment, Europe, European economy, European petrochemicals, Fibre Intermediates, India, Indonesia, Innnovation, Malaysia, Methanol & Derivatives, Middle East, Naphtha & other feedstocks, Oil & Gas, Olefins, Philippines, Polyolefins, Singapore, South Korea, Styrenics, Sustainability, Taiwan, Technology, Thailand, US

IT REALLY ISN’T doom and gloom if you take the longer-term view. Instead, for the chemical companies with the right strategies, the opportunities to build new sustainable business models are huge. The winners will make an awful lot of money while also doing the right things for humanity and our natural environment.

The cynics, or perhaps more generously the sceptics, argue that this is just another downcycle and that like previous downcycles, everything will return to the Old Normal.

China will resume its journey to being a middle-class country by Western standards as it consumes enormous volumes of new things made from chemicals and polymers, they say. Even if percentage growth is lower in China as the country’s economy evolves, this will still deliver many millions of tonnes of extra demand because of the high base effect, they contend. PET-flakes – European-chemicals – EV

Meanwhile, record-high levels of inflation in the rest of the world will soon decline to much more manageable levels, they add.

Maybe. I am still not convinced that the best remedy for high prices isn’t high prices, especially for crude oil. Some of the supply-chain related inflation, the result of strong demand for durable goods during the pandemic, is easing. Container freight rates, for instance, keep falling.

But will geopolitics really return to the 1989-2017 comfort zone? Will the US and China reach a pragmatic accommodation because it is impossible to dis-assemble incredibly complex global supply chains? I don’t think so.

As last week’s G20 statement indicated, there are areas of cooperation that are in the interests of both Superpowers such as climate change. But the geopolitically driven desire for supply chain security in the West, given added momentum by the Russian invasion of Ukraine, will I think lead to the dis-assembly of global supply chains.

US and China economies may separate

Breaking up global supply chains will also satisfy the “local jobs for local people” push. Renewable energy is local as is plastics recycling – and both are obviously sustainable.

This doesn’t mean that the worst outcome is going to happen. It is just that we might end up with two trading and geopolitical zones, one led by the US and the other by China that could coexist but with limited economic interdependence.

I will never write off the capacity of China’s government to build a highly successful new growth model. Beijing has done this before with spectacular success so why not again? It is just that I see a successful new growth model being entirely different from the existing model. PET-flakes – European-chemicals – EV

Real estate, worth 29% of the country’s GDP, can no longer be as bigger a driver of growth because of excessive debts and economic inequality created by the property bubble. The Common Prosperity reforms aim to reduce inequality. The ICIS data show that real estate has been the main driver of the gargantuan Chinese chemicals demand boom since 2009.

China is no longer interested in “growth for growth’s sake”. It wants a more environmentally sustainable growth model that is less commodity intensive.

This means that China’s chemicals demand growth is, I believe, going to be substantially lower than conventional thinking suggests. Because China is so important to global markets, this will create a giant-sized hole in standard global growth forecasts over the next 10-20 years.

Or China may fail to escape its middle-income trap. The result would be the same – much lower growth than is commonly anticipated. Of the 19 countries that have escaped middle-income traps since the Second World War Two, only two had shrinking working-age populations. China’s working-age population started to decline in 2015.

What also makes this chemicals downturn different from all the others is that it is being partly driven by China’s rising chemicals self-sufficiency.

The list of products where China has moved from being a major importer to being entirely or almost entirely self-sufficient is growing longer. Polyester fibres and polyethylene terephthalate (PET) film and bottle grade started the trend. Then came purified terephthalic acid (PTA). Styrene imports are close to disappearing and by as soon as next year, China could become a polypropylene (PP) net exporter.

Climate change: The economic and social costs

This trend won’t reverse once the downturn is over because increased self-sufficiency is a cornerstone of government policy. The big China export markets will continue to diminish, which is bad news for all the overseas cracker and derivatives plants built on the opposite assumption.

The cynics or sceptics of the end of the Old Normal argue that humankind is incredibly adaptive, giving us permission to carry on burning fossil fuels with abandon.

Humans are incredibly adaptive, but adaptation can only happen if we are prepared to pay the economic and a political cost. There is a risk that the developing world not including China, as China is no longer a typical developing country, won’t get the investment needed to adequately compensate for climate change. PET-flakes – European-chemicals – EV

An important 2020 McKinsey study, Climate risk and response: Physical hazards and socioeconomic impacts, highlighted the threats to crop yields and water and energy supply from climate change – along with the potential costs of increased flooding and droughts.

“The poorest communities and populations within each of our cases typically are the most vulnerable. Climate risk creates spatial inequality, as it may simultaneously benefit some regions while hurting others,” wrote McKinsey.

“While companies and communities have been adapting to reduce climate risk, the pace and scale of adaptation are likely to need to significantly increase to manage rising levels of physical climate risk. Adaptation is likely to entail rising costs and tough choices that may include whether to invest in hardening or relocate people and assets,” the consultancy added.

Climate change isn’t going to go away when this downturn is over. Around one-third of chemicals demand is derived from the developing world, with a large proportion of incremental growth forecast to be generated by the region over the next 10-20 years. As with China, growth in the developing world may be lower than is widely expected, creating another hole in global growth forecasts.

How will consumers in general behave when this downturn is over? Will they “shop until they drop” once inflation declines or are attitudes towards discretionary spending changing?

I am sure there will be a big surge in spending in China when the zero-COVID regulations are lifted because of a big rise in savings rates. We might see the same elsewhere when inflation is no longer keeping the shops empty.

But attitudes among young people have changed. Experiences are becoming more valued than things. Experiences require fewer physical things than before because of lives lived online.

A major brand owner says that knowledge of climate change and plastic waste has spread globally among young middle class people via smartphones. Fast fashion is becoming increasingly unpopular. The rise of plastics recycling and re-use and redesign in the West is largely the result of consumers putting pressure on regulators and brand owners.

A great opportunity for the European chemicals industry

The European chemicals industry has had a bad rap for a long time because of what are said to be poor economies of scale and hydrocarbon feedstock-cost disadvantages.

I have argued for a long time that these oversimplifications. Old crackers have become virtually new crackers through additions of new furnaces and mixed-feed technologies have further supported cost-per-tonne economics. These technologies make use of low value refinery products from the bottom of distillation columns.

This ability to innovate is now being focused on innovation in carbon mitigation through, for instance, the BASF, Linde and SABIC work on developing electric furnaces that are said to reduce carbon emissions versus standard crackers by 80%.

Shell no longer talks about refining, but instead refers to energy as it adapts to the electrification of transport. In July this year, Shell took a final investment decision to build Europe’s largest renewable hydrogen plant in Rotterdam. The plant will produce up to 60,000kgs of renewable hydrogen per day when it comes onstream in 2025.

“INEOS’ most significant investment, the Project One ethane cracker in Antwerp, Belgium is planned to start manufacturing in 2027,” wrote my colleague, Nigel Davis,in this 7 October ICIS Insight article. PET-flakes – European-chemicals – EV

“The cracker will have a 50% lower carbon footprint compared with the next best cracker in Europe and be 60% more carbon efficient than the average,’ he added.

“That efficiency is based on modern ethane to ethylene technology and designing with the expectation of the need to transition to net zero. A credible transition to net zero would involve the use of hydrogen as supply develops and of carbon capture,” he said.

It is important to stress that the chemicals companies listed above have global sustainability strategies. But my message here is about Europe and why its recovery from the downturn can be very strong if it focuses on sustainability:

- The EU is firmly committed to reducing carbon through its carbon trading system. A carbon border adjustment mechanism may eventually apply to chemicals and polymer imports. And, of course, oil, gas and chemicals producers face pressure globally from investors to decarbonise.

- Europe’s plastic recycling industry is growing rapidly, again because of EU regulations – along with commitments from brand owners who are reacting to public pressure. “Brussels is expected to boost the demand for recycled plastic by broadening recycled content targets from plastic bottles to all plastic packaging,” wrote EURACTIV in this 3 November 2022 article. The EU27 is likely to set a mandatory 55% recycled content target for single use packaging by 2030.

The European chemicals industry can occupy a position far to the right of a new global green cost curve that I see emerging over the next 5-10 years.

-Lukoil urged to keep Sicilian refinery running as talks drag on

Italy is urging Lukoil to keep supporting its refinery in Sicily until the government brokers a sale, two sources close to the matter told Reuters on Thursday, as looming European Union sanctions against Moscow threaten the plant’s survival, said Reuters.

A European embargo on seaborne Russian oil comes into effect on Dec. 5 and the Italian government pledged to rescue the ISAB plant, which accounts for a fifth of Italy’s refining capacity and employs about 1,000 workers. PET-flakes – European-chemicals – EV

The plant has had to rely solely on Russian oil provided by Lukoil after its creditor banks halted financing and stopped providing guarantees needed to buy oil from alternative suppliers.

As talks to sell the plant to a non-Russian buyer drag on, sources have said Rome is pushing on Lukoil’s Litasco, which owns the refinery, to provide oil and financing beyond the December deadline.

Reuters reported last month that Litasco had moved part of it operations to Dubai in an effort to elude sanctions that will soon prevent European and Swiss entities from buying Russian seaborne crude oil.

A third source said the ISAB refinery is not planning to halt operations on Dec. 5, though time is running out. The plant refines about 1 million tonnes of crude a month and would not be able to carry on for long without fresh oil supplies.

State-backed financing to support the refinery is still an option being discussed, but banks remain reluctant to deal with a Russian entity, one of the sources said, despite Lukoil and Litasco not being subject to European sanctions.

A meeting involving refinery and government representatives will take place in Rome on Friday, with unions warning a shutdown of the plant would have devastating effects on one of Italy’s most depressed regions.

“We will ensure that the plant remains operational,” Industry Minister Adolfo Urso said on Thursday without detailing the government’s plans. Litasco this month rejected a preliminary bid from U.S. fund Crossbridge. PET-flakes – European-chemicals – EV

Urso said the government would be ready to use its special powers to block a foreign takeover of the refinery to protect national interests.

We remind, Lukoil finished construction of a Petroleum Residue Recycling Facility with production capacity of 2.1 million tonnes per year at its LUKOIL-Nizhegorodnefteorgsintez LLC refinery. The facility is comprised of a delayed coking unit, diesel fuel and gasoline hydrotreatment unit, fractioning column, hydrogen and sulphur production unit, as well as infrastructure facilities.

-How Plastics Are Driving EV Proliferation

From charging infrastructure and battery performance to automotive safety, plastic-based solutions are accelerating EV adoption.

The European Union is the global frontrunner in the adoption of electric vehicles (EVs): Member countries are responsible for more than a quarter of the world’s EV production, and EVs represented roughly 20% of its new-car sales in 2021.

Yet a larger uptake of EVs will require a major build-out of Europe’s EV-charging infrastructure. In 2021, the continent had an estimated 375,000 charging stations.

But a recent analysis by McKinsey, conducted for a report from the European Automobile Manufacturers Association (ACEA), suggests that — in even the most conservative scenario — the EU-27 will need at least 3.4 million operational public charging points by 2030.

Wireless EV charging a reality with engineering plastics

Wireless charging technology is one piece of the puzzle that may enable faster rollout of EV charging infrastructure. Wired and wireless are actually complementary, according to Richard Cheung, Global Strategic Marketing Manager, Transportation & Advanced Polymers, at DuPont (now Celanese).PET-flakes – European-chemicals – EV

“Wireless makes sense where there is limited space, as the charging transmitter is embedded in the ground and the vehicle pad [receiver] is mounted on the underside of the vehicle. As it operates via induction, it is safer,” he says. “It may even enable charging on the fly in autonomous vehicles traveling at 20 to 30 km/hour over charging transmitters embedded in the road.”

Another key advantage of wireless is that it removes the need for compatible plugs. DuPont has developed various polyamide materials for the EV sector, including a 30% glass-filled polyphthalamide (PPA) material designated as HTNFR53G30NH that resists damage from stone impact and realizes surface aesthetics that enable the elimination of paint.

Battery systems and, indeed, EVs as a whole are also a fertile area of development for thermoplastic vulcanizates (TPVs), according to Ivo Oerlemans, Global P&L for Santoprene at Celanese, which acquired the business from ExxonMobil Chemical in 2021. “With the lower temperature requirements of EV coolant systems, TPV hoses and tubes are a credible alternative to polyamides and elastomers such as EPDM. We also see opportunities in EV charging infrastructure, such as cables and sealants for outdoor charging systems.” For internal battery systems, stiff and semi-stiff Santoprene grades of 73 Shore A to 50 Shore D are recommended, while external battery system flexible hoses typically use Santoprene TPV grades that range from 64 Shore A to 80 Shore A.

Taking the heat in thermal management

Without fast-charging batteries boasting high energy density, however, potential purchasers of EVs may be put off by range anxiety. Plastic solutions, once again, are charging to the rescue.PET-flakes – European-chemicals – EV

One example of performance-boosting in batteries is highly filled, thermoconductive Makrolon TC polycarbonate materials from Covestro, which are being used by low-pressure injection molding machine supplier X2F to over-mold heat sinks onto lithium-ion batteries. “Our controlled viscosity [injection] process pressure is 70 to 90% lower than conventional injection molding, so we can over-mold sensitive electronic components that wouldn’t survive much higher pressures,” says X2F CEO Mike Slowik. “And replacing aluminum heat sinks also leads to significant weight and cost savings.”

Covestro’s online heat-sink screener smooths the transition from aluminum to polymer.

Covestro has also developed an online heat sink screener portal to assist engineers in making the switch from aluminum to plastics by entering design parameters such as thermal conductivity, input power level, and number of fins for an LED heat sink, also molded using X2F technology. “This screener has proved to be a valuable engagement tool and very helpful to get traction with initial customers,” says Paul Platte, Senior Marketing Manager, Mobility Automotive, at Covestro.

Safety first for fires

While statistics point to a lower likelihood of fires occurring in EVs versus internal combustion engine (ICE) vehicles, the spectacular nature of thermal runaway events has highlighted the importance of flame retardance for polymers employed in batteries, as well as the criticality of coloring electrical components in a high-voltage orange color. Non-halogenated flame-retardant grades are at the forefront of achieving these objectives with base resins of polyamide and PBT. “We developed these materials to help designers achieve safety — flame retardance, electrical performance, and, when applicable, also stable high-voltage color — without compromising performance,” said Giacomo Parisi, Global Marketing Director for Automotive Electrification, Mobility & Materials at DuPont. In addition, grades deliver the high chemical resistance needed to stand up to brand-new oils and fluids now being used for e-mobility applications.

The color orange

The color orange is mandatory as a safety feature for high-voltage components. This color is increasingly being used to mark live cables in electric and hybrid vehicles as well as components for high-voltage applications. The signal color is intended to alert mechanics and emergency services to the potential danger of electric shock.

To permanently color plastics with the standard RAL 2003 shade of orange, Lanxess has developed a soluble organic dye, shown in the feature image at the top of this article, which is highly heat-stable, light fast, and weather resistant, and further offers outstanding color strength and brilliance.PET-flakes – European-chemicals – EV

Unlike most conventional colorants, halogen-free Macrolex Orange HT is perfect not only for use in polyamide, but also for other common plastic types such as polycarbonate or polyphenylene sulfide. Because of their high processing temperatures, these materials typically pose a challenge for standard colorants.

Milliken is also getting in on the safety act with its Resist XTR series of colorants delivering high chromatic orange color at low loading. Compounders can formulate the desired RAL 2003 shade using Resist XTR Orange 9798 with multiple high-performance polymers, including polyamide 6, polyamide 66, polyamide 46, polybutylene terephthalate (PBT), polyphthalamide (PPA), and polysulfone (PSU), among others to meet RAL 2003 requirements for multiple polymers and applications. This latest grade meets the color and performance requirements of both short- and long-term thermal stability tests such as 1,000 hours at 120°C.

-Shell´s new 1.6-million-tonnes-year polyethylene plant starts operations

Shell´s new 1.6-million-tonnes polyethylene plant starts operations

Shell Chemical Appalachia, a Shell subsidiary, said on Nov. 15 that “it has commenced operations” of its plastic resin project in Pennsylvania with 1.6-million-tonnes-per-year of polyethylene capacity and with full running rates on schedule for the second half of 2023.

“Building this world-class facility is a fantastic achievement and one the team can be proud of. it’s a showcase of Shell’s project delivery expertise,” said Huibert Vigeveno, Shell Downstream Director. The plant is within a 30-mile driving distance from Pittsburgh.

The plant is the first large scale plastic resin project in the Northeast based on ethane from shale deposits in that region, plentiful thanks to the nearby Utica and Marcellus basins.

Shell has said that its location, within a 700-mile radius of 70% of the U.S. polyethylene market, may provide a geographic market advantage. Currently most resin production, based in the U.S. Gulf Coast, is shipped by rail north to serve plastic converters in that region. PET-flakes – European-chemicals – EV

No information on costs

Shell started construction in April 2017 of the complex where ethane is turned into ethylene and then polymerized into the polyethylene plastic resin commonly seen shaped as supermarket bags or shampoo containers.

The statement said that the plant “is the first major polyethylene manufacturing complex in the Northeastern United States.”

The statement did not provide information as to the final construction cost.

Around 2019, some sources had estimated it could be anywhere from $6 billion to nearly $10 billion, when considering all related pipeline work.

While it is true that in recent decades most new large plastic resin manufacturing capacity in the U.S. has been built in the U.S. Gulf Coast, the world´s petrochemical industry originated in the Northeast.

The world’s first petrochemical operation was established in 1920 in Clendenin, West Virginia and one of its products was precisely polyethylene. The Union Carbide plant production included ethylene, oxide-glycol, alcohols, and olefins.

Another project in the region that has been considered for several years is owned by Thailand´s PTTGC and located in Ohio. An FID on that project is still possible.

The eastern Ohio project is similar in that it plans to tap plentiful shale resources in that region of the country to produce polyethylene. PET-flakes – European-chemicals – EV

The PTTGC plant would be located on the border with Pennsylvania, up the Ohio river from Beaver County, Pennsylvania, where the Shell plant is located.

Some market sources had speculated that the completion of work by Shell could free up a workforce already experienced in building a cracker and a polymerization plant, potentially for PTTGC´s project as well.

Shell completed the construction in early Aug. 2022.

-PET flakes market under pressure amid weak recycled chemical fibers

In Nov, recycled chemical fiber market sales have been constantly thin and prices generally move downward or discussing space expands.

For close virgin PSF, some producers adjusted lower the offers by 100-200yuan/mt with lower virgin PSF market, and some producers maintained. The sales were under negotiation overall. Producers reflected that sales slowed down, and inventory accumulated. In Hebei, some plants cut production or suspended operation impacted by the epidemic. PET-flakes – European-chemicals – EV

HC virgin PSF prices lowered successively since Nov, weighing on HC re-PSF market. HC re-PSF trading prices were flexible, and could be lower for big deals. Plants focused on selling. In Zhejiang, prices were dampened with fierce competition, even lower than the neighboring cities’. End-user orders lacked, and downstream buyers and traders mostly stood on the sidelines, and purchased for pressing demand.

Recycled PFY, especially high-end and eco-friendly re-PFY, has seen prices lower continually in the second half of the year. Moreover, market demand was soft and operating rate was low. It was heard that some plants only ran at around 20-30%.

Under the continual outbreaks of epidemic in many regions, especially in some key textile markets, the transportation and downstream plant production was impacted, further impacting the sales of recycled chemical fiber sales. Meanwhile, the consumption of soft drinks and mineral water reduced, especially in some tourism cities, recycling volumes of rough bottles decreased. Some regions were under continual COVID control measures, making further reduction of rough bottles and rough bottle bales. Moreover, entering winter season, temperature has dropped quickly and bottles continued to reduce.

In early Nov, bottle bales in Fujian and Suzhou moved up, and PET flakes prices were flat. But affected by lower recycled chemical fiber prices and weak demand, prices in Anhui and North Jiangsu lowered by 200-300yuan/mt, and hot washed blue and white flake prices in Zhejiang reduced by 50-100yuan/mt. The supply and demand sides of PET flakes were at a deadlock somewhat. PET-flakes – European-chemicals – EV

For late market, with on-going epidemic, market demand keeps weak. Virgin polyester product prices are still likely to weaken. Recycled chemical fiber inventory keeps accumulating. Though PET flake supply is tight, buying enthusiasm is hard to improve in short. PET flakes prices are under pressure.

-Plastics in landfill may be worth millions — if we switch to a circular economy

With the collapse of REDcycle, Australia’s largest plastic bag recycling program, concerns have emerged on how to prevent plastics ending up in landfill.

Subsequently, Environment minister Tanya Plibersek announced their ambitious target to recycle or reuse 100 per cent of plastic waste by 2040. However, so many of our current recycling systems have been inefficient, and with such ambitious targets in place – government adopts a systems-level approach in tackling this – and the circular economy model might just allow us to make our waste our own treasure.

The latest report on Australia’s Plastic consumption and recycling stated that a total of 3.4 million tonnes of plastic were consumed by Australia, but less than 10 per cent of it was recycled. PET-flakes – European-chemicals – EV

Whilst the convenience and versatility of plastics are great, its accumulation in our landfills not only poses a significant threat to our climate, but raises major human health concerns. Notably, there is documented evidence of carcinogenic, developmental and endocrine-disrupting impacts due to the ingestion and inhalation of chemicals in plastics.

However, a damning report led by Centre of Environment International Law stated that our unsustainable rates of plastic use is a global health crisis due to its distinct risks to human health at every stage of its lifecycle. This highlights the urgent need for innovative solutions for plastics management.

Our current approach to plastic management follows the linear economy model, whereby we extract natural resources to produce plastic, and following its use, then dispose of it. This model assumes that natural resources are infinite and there are infinite spaces for our unwanted materials without causing any harm.

However, our rising levels of plastic production and its accumulation in our landfills could account for up to 56 gigatons of carbon emissions between now and 2050. The circular economy offers an alternative approach to plastics management, with promising health, social and economic benefits.

The circular economy

Whilst there is no universally adopted definition, a circular economy is a model that aims to maintain the value of products and materials in the economy for as long as possible. Keeping materials and resources in closed loops would reduce the need to extract more resources for production, whilst also limiting the generation of waste.

With concerns around the environmental impact of plastics, the circular economy’s focus on the re-utilisation and recovery of plastics offers a viable alternative. Given that the origins of plastic production is from the extraction of fossil fuels, an enhanced focus on recycling plastic waste would reduce fossil fuel emissions.

In addition, this aids in the reduction of consumer plastic waste pollution, which accounts for 4,600 million tonnes globally in our landfills. This has downstream impacts by reducing the leeching of plastic into marine environments and reducing biodiversity loss, both of which are crucial to our sustenance. PET-flakes – European-chemicals – EV

Research suggests that the re-introduction of plastic in our economy can provide an annual saving of up to 3.5 billion barrels of oil per year and take 15 million cars off the road. With recent shortages of oil commodities globally, there is an urgent need to diversify and transition towards newer models.

The environmental gains offered by a circular economy have downstream impacts on human health. Most directly, the removal of plastics in landfill and its subsequent leaching into the marine environment would reduce the disruption of the marine food chain and water supplies.

This not only lowers contamination of drinking water but also increases food safety for populations who rely on seafood as a key food source. In addition, it reduces the facilitation of antibiotic resistance and the spread of pathogens which form breeding grounds for infectious diseases to emerge.

Furthermore, there are numerous indirect mental health benefits that can emerge from growing technologies that enhance the circular economy, such as by providing new avenues of employment and higher incomes. However, further research is yet to be done to strongly establish these links.

There is no better time to look towards a circular economy approach, especially if we want a strong and greener economic recovery post-COVID. Encouraging economies to become less reliant on natural resource extraction for plastic production opens up employment and entrepreneurial opportunities in key areas such as plastic recycling technologies and waste management. PET-flakes – European-chemicals – EV

The latest report by the World Business Council for Sustainable Development stated that implementing a circular economy for plastics has the potential to unlock $6 trillion worth of business opportunities that help fulfil the Paris Agreement.

This is great for Australia’s tourism and fishing industry, as plastic pollution costs the industry up to $13 billion in economic losses due to the destruction of the Great Barrier Reef and marine environments. Moreover, this offers a great opportunity for developing countries that are in the infancy of waste management and industrialisation process to adopt an approach that has great economic potential, but also a more sustainable developmental pathway.

The catch?

Whilst a circular economy for plastics offers exciting potential, there are a few concerns about its practicality.

Plastics nowadays often have a mix of different polymers and additives, and some of these contain persistent organic pollutants (POPs) such as polychlorinated biphenyls (PCB). In addition, they contain endocrine disruptors such as bisphenol (BPAs) and phthalate. POPs and chemical additives are linked to health issues such as cancer, and reproductive and developmental diseases. PET-flakes – European-chemicals – EV

There are concerns that the re-utilisation of plastics with this approach increases toxicity risks and pose health concerns, such as if POPs are re-entered into the food chain via marine fauna. Moreover, there are suggestions that long-term exposure to chemical additives in plastics may contribute to further disease and dysfunction, which we don’t know of just yet.

Furthermore, it is argued that recycling processes can reversely contribute towards increased emissions due to the input of non-renewables in such processes, along with emissions generated in transportation. There is limited research on the environmental consequences of the continuous re-introduction of plastics into the economy, raising concerns about whether this approach would cause long-term consequences.

Secondly, plastic designs that combine different polymers complicate recycling feasibility, which proves to be economically taxing for industries. Given that no compounds in plastic are recyclable, the process of fractioning plastics to find compounds which are recyclable and disassembling them is costly. PET-flakes – European-chemicals – EV

In addition, the contamination of plastic waste with other materials such as food residues means that sorting, collecting and transport costs can be higher than the value of the plastic waste collected.

PET-flakes – European-chemicals – EV