Plastic-eating-bacteria – BRICS 25-04-2023 - Arhive

Plastic-eating-bacteria – BRICS

Crude Oil Prices Trend

Crude Oil Prices Trend by Polyestertime

-Plastic-eating bacteria are amazing. But they aren’t going to save the planet

Every so often, a new study about plastic-eating bacteria gets published in a scientific journal. Shortly thereafter, it flashes across the internet as it gets picked up by a flurry of environmental blogs, science and tech websites, and even national news outlets. But no matter what scientists may have discovered in this particular study, the stories you see in the media always seem to take the same spin: some variation of “these new plastic-eating bacteria will help us save the world from plastic pollution!”

Now don’t get me wrong – that’s an extremely exciting prospect, and it’s easy to see why that angle resonates with readers. But it’s also disingenuous to the point of being problematic. Plastic-eating-bacteria – BRICS

I hate to be the bearer of bad news, but plastic-degrading bacteria aren’t going to save the planet. They are an amazing discovery that, unfortunately, isn’t likely to make a significant dent in Earth’s pollution problem anytime soon – and definitely isn’t going to save us from the impending climate catastrophe.

Here’s why plastic-eating bacteria aren’t the silver bullet that most headlines seem to suggest they are.

Off the rails on a crazy strain

Perhaps the most significant reason that plastic-eating bacteria haven’t rid the world of plastic pollution yet (and probably won’t do so in your lifetime) is that we’ve only identified a small handful that can significantly degrade plastic.

Arguably the most well-known and widely publicized one is Ideonella sakaiensis, a strain of bacteria that was discovered in 2016 in soil samples taken outside of a plastic bottle recycling facility in Japan. Ideonella is exciting because it’s particularly adept at breaking down polyethylene terephthalate (PET) – the plastic we use to make things like plastic bottles and synthetic fleece. In the right conditions, scientists have shown that these microbes can fully degrade PET in about six weeks. Plastic-eating-bacteria – BRICS

But despite how promising this might sound, it’s important to understand that Ideonella is just one microbe that eats one type of plastic – and there are thousands of different plastics in the world. PET only accounts for a small fraction of global plastic waste.

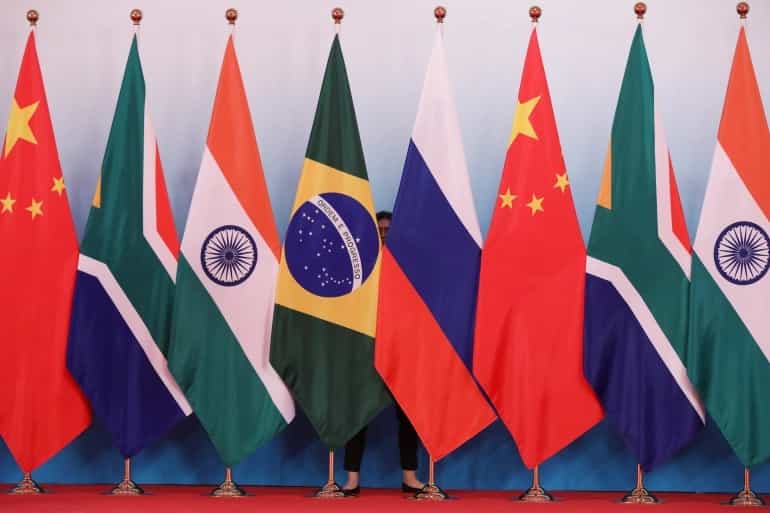

-BRICS: Reshaping the Global Economic and Political Order

The BRICS term refers to a group of five nations, namely Brazil, Russia, India, China, and South Africa. The first summit of this alliance in 2009 sparked debates on its geopolitical and geo-economic significance. The political pundits view it as a new political world order and a shift in power from the ‘Global North’ to the ‘Global South’. The member nations account for almost half of the world’s population and reports suggest that their combined Gross Domestic Product (GDP) is 31.5%, surpassing the G7’s contribution of 30.7%. Despite their differences in political, economic, and cultural spares, BRICS countries have launched the New Development Bank with seed money of $50 billion to boost their greater integration and strengthen their position in the international arena.

Initially, BRICS was recognized as a forward-thinking economic forum, but its focus shifted after the Russia-Ukraine conflict. Plastic-eating-bacteria – BRICS

The forum is now pointing out critical matters such as trade, finance, climate change, and energy security, and its impact extends to shaping the global economic landscape. As a result, it is going to challenge the dominance of Western-backed the World Bank and the International Monetary Fund (IMF).

The magic bone for BRICS to bring them together is its diversity. Each member country brings a unique set of economic and political landscapes to the forum, which has created a rich tapestry of interests and perspectives. For example, Brazil is a major agricultural exporter, while Russia is a leading energy exporter. India is an emerging economic power which has a large and growing middle class, while China is a global economic and manufacturing superpower. South Africa, meanwhile, is a leading player in the mining industry. This diversity has strengthened BRICS to explore its resources and expertise to pursue the shared challenges of its own development path. Plastic-eating-bacteria – BRICS

BRICS is also an outcome of challenging the monopoly and questioning the legitimacy of existing West-backed monetary Institutions and frameworks. The IMF and World Bank were established after World War II to dominate global trade and market access by the West. These Institutions are facing criticism globally. It works as an expansion tool for the ‘Global North’ by considering political concerns rather than an acute crisis for loan facilities. Even nowadays, they use democracy and Human Rights as a fig leaf to masquerade the Western political agenda. However, BRICS has sought to establish new trading relationships and agreements outside the Western-dominated system, which will curtail the advantages of the West’s so long-enjoyed trade agreements and market access. BRICS has the potential to help poorer countries as it does not pursue any political agenda nor indirectly manipulate and control local economics. Moreover, NDB and Asian Infrastructure Investment Bank(AIIB) are more reflective of their priorities to represent the interests of emerging economies. Plastic-eating-bacteria – BRICS

Western Monopoly in geopolitics, the recently Russia-Ukraine war has exposed the necessity of massive expansion in BRICS. The success of BRICS has made other economic giants like Argentina, UAE, Saudi Arabia, Algeria, and Mexico interested to invest in this bloc. Recently, some Western countries are going through a tremendous economic crisis.

-Polyolefins yield to lower costs and weak demand

Repsol

In March, polyolefin prices more or less mirrored the rise in ethylene and propylene costs, although the rise did not always match the increase in monomer. LDPE prices increased by just €10/tonne compared to the €30/tonne rise in ethylene costs largely because of weak demand. LLDPE prices, on the other hand, increased in line with the monomer cost rise because of reduced availability. HDPE prices increased by just less than the €30/tonne rise in the ethylene reference price. PP producers attempted to pass on the €30/tonne increase in propylene costs but their efforts were largely unsuccessful with deals also settling on average at just less than the increase in monomer.

PVC producers attempted to factor in the proportionate €15/tonne rise in the cost of ethylene. Base PVC prices, in most cases, were however rolled over from the previous month because of ongoing demand weakness. Polystyrene prices fell by €80-90/tonne, which was less than the €113/tonne reduction for the styrene monomer reference price. Bottle-grade PET prices began to stabilise and were largely unchanged from the previous month. Plastic-eating-bacteria – BRICS

In April, polyolefin prices turned downward following a decline of €40/tonne for both the C2 and C3 contract prices. Base PVC prices fell by more than the proportionate €20/tonne impact of the lower ethylene on the PVC cost base because of ongoing demand weakness. Polystyrene prices increased on average by €10/tonne following a rise of €19/tonne for the styrene monomer reference price. PET prices firmed slightly because of higher import prices and an upturn in seasonal demand.

Supply adequate

There was sufficient material available across all polymer classes to meet demand during the last two months despite production curbs and a series of planned and unplanned plant outages.

A summary of selected production issues for European polymer plants are summarised below.

- The LyondellBasell cracker at Berne, France was shut down 3rd April due to a fire

- The Ineos PP plant at Lavera, France was taken offline 6th April and force majeure was declared due to strikes. The plant was restarted as of 13th April while force majeure remained in place

- Kem One declared force majeure on PVC output from Balan, France on 23rd March due to VCM issues stemming from strikes. Force majeure was lifted on 14th April

- Borealis shut down PP production plants in Belgium on 28th March with restart to be announced

- Repsol Quimica shut down its styrene plant in Spain on 30th March with restart to be announced Plastic-eating-bacteria – BRICS

- TotalEnergies declared force majeure on 20th March for polystyrene, citing supply restrictions due to the escalating nationwide strikes.

Demand low

Demand remained below what would normally be expected at the time of year throughout the last two months. In March, converters bought just sufficient material to meet their immediate production needs as prices were expected to fall in April. The Easter break also put a dampener on demand in early April. There has however been a small upturn in seasonal demand during April across the agricultural, building and beverage sectors.

May outlook

At the time of writing (mid-April) crude oil prices and spot monomer prices are rising, which could lead to higher monomer cost settlements in May. With the pressure from rising costs, polymer producers are likely to press for higher prices. Whether or not they can successfully pass through the higher costs will depend largely on demand. Perhaps, the low buying appetite in several end user markets will keep the volumes of demand at modest levels.In March, polyolefin prices more or less mirrored the rise in ethylene and propylene costs,

PET

PET buyers were able to gain discounts of €40-50/tonne in early March but the market tightened as the month progressed. Paraxylene costs fell by less than anticipated (down €20/tonne) and Chinese imports became more expensive. Consequently, European PET prices began to stabilise and largely remained unchanged from the previous month.

Material availability improved slightly as production cutbacks were eased. Demand still remained below normal for the time of year despite an upturn in seasonal demand.

In April, bottle-grade PET prices are firming slightly because of higher import prices and higher demand. The European Commission has initiated an antidumping investigation on PET imports from China and regional buyers have been avoiding this origin as antidumping duty will be applicable on en-route cargos as well. Plastic-eating-bacteria – BRICS

Meanwhile, buying activity has improved in line with a normal seasonal demand upturn.

-Indorama Ventures remains committed to supply North American lithium-ion battery market

Indorama Ventures Public Company Limited (IVL), a global sustainable chemical company, is continuing to assess plans to build and operate a world-class lithium-ion battery solvents plant at one of its petrochemical facilities in the U.S. Gulf Coast, including sourcing new license partners to speed up the development of the technology, said the company.

Indorama Ventures’ Integrated Oxides & Derivatives (IOD) business segment is exploring licensing opportunities with a range of technology partners, after withdrawing from an initial non-binding agreement with Capchem Technology USA Inc.

Entering the lithium-ion battery market will reinforce the company’s downstream specialty products portfolio, serving attractive end-market applications.

Indorama Ventures is leveraging its global integrated petrochemicals model by investing in adjacent businesses that offer High Value Add (HVA) products that contribute to a more sustainable world. Plastic-eating-bacteria – BRICS

Alastair Port, Executive President, Integrated Oxides and Derivatives (IOD), IVL, said, “The EV market is a significant opportunity for Indorama Ventures to leverage our world-class petrochemical assets in the U.S. Gulf Coast, which are ready to host a new world-class lithium-ion battery solvents plant. From our base near Houston, our Integrated Oxides & Derivatives business has a successful track record of working with technology license partners to benefit the high-growth North American market.”

-Asia likely to see disinflation in coming months: Nomura report

- Asia is likely to see disinflation in the coming months, driven by weaker underlying inflation momentum and helped by base effects, according to Japan-based global financial services group Nomura.

- Reasons include base effects, easing food and energy prices, no wage-price spiral, goods disinflation and likely moderation in services inflation.

Asia is likely to witness disinflation, or a slower pace of inflation, in the coming months, driven by weaker underlying inflation momentum and helped by base effects, according to Japan-based global financial services group Nomura’s Asia Economic Monthly.

By mid-year, inflation momentum, as measured on a month-on-month (MoM), seasonally-adjusted basis, should be closer to central bank targets in most economies following the monetary tightening phase last year, it said. Plastic-eating-bacteria – BRICS

Most Asian central banks are now in a policy pause phase and, if underlying inflation moderates accordingly, the window to monetary easing will open up later this year, it noted.

There are seven reasons why Nomura sees faster disinflation in Asia. First, Asia’s inflation is driven more by supply than demand-side factors. Lower oil and global food prices, abating currency depreciation pressures and the full normalisation of pandemic-driven supply chain bottlenecks point to easing supply-side pressures.

Nomura believes the lagged effects of these easing supply-side pressures will materialise in Asia’s inflation readings in coming months.

The second reason is base effects. Comparing this year’s inflation to last year’s high levels on a monthly basis gives rise to base effects that serve to dampen inflation in specific months.

The third is easing food and energy prices should lower headline and core inflation. In Asia’s emerging markets, food and fuel prices drive headline inflation and can spill into core inflation due to second-round effects. Lower food and energy prices should also curtail household inflation expectations. Plastic-eating-bacteria – BRICS

The fourth is no wage-price spiral in Asia. Wage spikes caused by mass layoffs and early retirements in the United States are not evident in Asia, where labour markets are less flexible.

Instead, wage growth is starting to moderate, even in economies with tight labour markets like Singapore. Export and manufacturing slowdowns should spill into a weaker labour market and exert downward pressure on wage growth, especially for open economies in the region, Nomura noted.

The fifth reason is goods disinflation. Weaker goods demand and softening input costs will likely result in a slower rise in prices of core goods.

The sisth is likely moderation in services inflation. The post-pandemic release of pent-up demand for services has been exhausted. Moderating wage growth should soothe services inflation. Plastic-eating-bacteria – BRICS

China’s unlikelihood to be a source of inflation is the last reason. China’s growth cycle is desynchronised from the rest of the world, and it is not a material source of inflation risk, either to itself or globally. China’s pent-up consumption demand from its reopening is likely to disappoint market expectations, the Nomura report added.

-Aluula Partners with University to Recycle UHMWPE Composites

Panels made with recycled polymer composites reportedly are 10 times stronger than panels molded from virgin resin.

Composite materials innovator Aluula, which uses a patented no-glue fusion process, has found a way to reuse its products to form panels 10 times stronger than those molded from virgin material.

In a preliminary trial with the University of British Columbia (UBC), end-of-life and off-cut Aluula composites were compressed into new, uniquely light and durable panels — without altering the original fibers made of ultra-high molecular weight polyethylene (UHMWPE).

Aluula, based in Victoria, BC, uses its proprietary method to fuse fibers and films at the molecular level. These components exhibit eight times the strength-to-weight ratio of steel while remaining lighter than nylon, polyester, or aramid. Plastic-eating-bacteria – BRICS

The new panels, created jointly with the Composites Research Network at UBC Vancouver, are intended for multiple recycling iterations. Ideal applications will be those that require strength, abrasion resistance, and low friction — items like backpack back panels and low-friction wear plates.

“Working with UBC students on applications for these ultra-strong and ultra-durable products is proving to be invaluable as we refine our processes to ensure the recyclability of Aluula materials,” said Aluula Composites Material Scientist Sam White.

Reuse of polymer composites is particularly important, Aluula explained, because the amount of waste they generate is expected to reach 683,000 tons a year by 2025 — the equivalent of 785 swimming pools filled with composite waste.

Aluula’s Durlyte, Gold, and Graflyte products exhibit a range of benefits, including resistance to water, UV damage, and bacterial growth.

The company’s materials have been used in wind sports, aerospace, outdoor, and sailing applications. Plastic-eating-bacteria – BRICS

-Recycling plastic can be a little confusing. Here’s what the numbers inside the recycling symbol mean

KEY POINTS:

- Plastics labeled with a number 1 inside the recycling symbol are about 20.9% likely to be reprocessed, according to Greenpeace.

- Plastics numbered 3 through 7 have a reprocessing rate of less than 5%, according to the Greenpeace report.

Only 4.7% of plastic produced by U.S. households in 2021 was recycled, according to a Greenpeace USA report.

But that’s not for lack of consumer participation. Greenpeace said most plastics simply cannot be recycled in the U.S., and since China has increased its standards for accepting recyclables, less plastic is getting reprocessed. Plastic-eating-bacteria – BRICS

In honor of Earth Day, here’s what you should know about the different types of plastics and which ones are likely to be reprocessed.

There are seven different types of plastics in consumer products, two of which are considered the most recyclable: PET, represented by the number 1 inside the recycling symbol, and HDPE, represented by the number 2.

Plastics labeled with a number 1 are about 20.9% likely to be reprocessed, according to the Greenpeace report.

These typically include soda bottles, peanut butter jars and other types of clear plastics. PET stands for polyethylene terephthalate.

Greenpeace found that plastics with the number 2 inside the symbol are half as likely as number 1 to be reprocessed, at 10.3%.

Examples of HDPE, which stands for high-density polyethylene, include laundry detergent bottles, shampoo bottles and other types of solid-colored plastics.

After that, plastics numbered 3 through 7 have a reprocessing rate of less than 5%, according to the Greenpeace report.

It is still important to know the difference between the types of plastics, since municipalities handle each type of plastic differently.

Plastics labeled number 3 are polyvinyl chloride, which is used to make items such as vinyl records and PVC pipes, according to the New York State Department of Environmental Conservation. Plastic-eating-bacteria – BRICS

LDPE, or low-density polyethylene, is labeled with the number 4 and can be used to make bread bags, bubble wrap, cling wrap and more. This type of plastic film is often collected separately from plastics labeled 1 and 2. In New York City, for example, large grocery stores are required to have a collection bin for these types of plastics, which should not be collected in curbside recycling bins.

Plastics labeled number 5 are polypropylene, or PP, which can be used to make yogurt containers and other dairy product tubs, according to the conservation department.