Plastic-Recyclers – Biopolymer-r-PET 15-09-2022 - Arhive

Plastic-Recyclers – Biopolymer-r-PET

Crude Oil Prices Trend

-Technologies partner to boost PET upcycling technology

Koch Technology Solutions, a Koch Engineered Solutions company, and Ioniqa Technologies B.V. announced a partnership to scale up and commercialize Ioniqa’s advanced PET recycle technology in the plastics industry. As part of this collaboration, KTS has committed to invest up to EUR30M in Ioniqa, said Petnology.

Ioniqa has developed an innovative process that utilizes low-grade post-consumer PET to infinitely produce a feedstock that displaces virgin raw materials used in the production of polyester products. Ioniqa has successfully demonstrated this technology in The Netherlands’ 10KTA production facility. Plastic-Recyclers – Biopolymer-r-PET

“KTS has a long history in the polyester industry, and we recognize the value proposition of this disruptive technology that will fundamentally change how recycling is done,” said Adam Sackett, President of KTS. “With an aligned vision on the future of PET recycling, we’re excited to launch this partnership with Ioniqa and leverage our complementary capabilities to advance solutions which are tailored to the needs of the market.”

KTS and Ioniqa’s partnership will work to address the growing demand for recycled content in the 30 million metric tonnes per annum PET market. Ioniqa’s technology offers a solution to PET waste that is currently non-recyclable, turning the waste into materials suitable for high quality food grade applications such as beverage bottles. KTS and Ioniqa consider the technology as a disruptor in the PET industry providing a sustainable economic recycle proposition to conventional manufacturing routes. The partnership will drive a circular process that addresses environmental impacts of the current PET industry.

-Polystyrene functional barrier safety confirmed

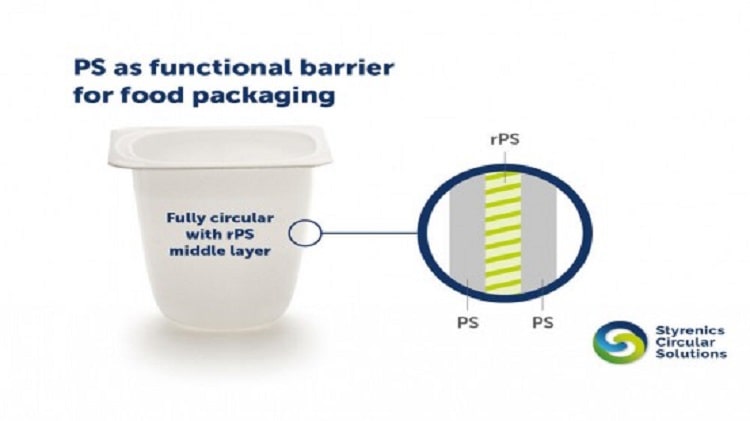

Styrenics Circular Solutions (SCS), the value chain initiative to realise the circular economy for styrenic polymers, has announced that polystyrene (PS) can be used as a safe functional barrier for mechanically recycled PS (rPS) in rigid food packaging.

Through findings supported by a scientific study performed by Fraunhofer IVV, the capacity of PS as a functional barrier by using purposely contaminated rPS as middle layer in a coextruded ABA structure was confirmed. The low diffusion properties of PS, similarly to PET, enable the safe use of mechanically recycled PS in food contact applications behind the PS functional barrier. Fraunhofer IVV performed rigorous testing on real yoghurt pots, proving the safety in an ABA structure with up to 50 per cent recycled polystyrene content. The results are applicable to all rigid thermoformed PS packaging.

Jens Kathmann, Secretary-General of SCS, said: “This is another significant step for SCS. Now, we have not only multiple recycling technologies in place, from food contact mechanical recycling, dissolution to the chemical recycling technology depolymerisation, all of which enable easy recycling of post-consumer PS waste to food contact material, over and over again. We also have multiple mechanical processes, like those of our partners NGR and Gneuss, which have proven to recycle PS to food grade standards. In addition, this study now demonstrates a second safe solution for incorporating mechanically recycled PS content in food contact materials. These results again broaden the range of circular options for the PS value chain.” Plastic-Recyclers – Biopolymer-r-PET

Claudio Bilotti, Polystyrene Marketing Manager of Versalis (ENI), added: “This is exciting news as the value chain now has another solution for incorporating rPS into food contact applications that can be placed on the market right away.

Repeats Group B.V. (“Repeats”), a pan-European plastics recycling platform focused on the production of high-quality recycled low-density polyethylene (“LDPE”) from post-industrial and commercial films, announced today that it has made an investment in Polimero Srl (“Polimero” or the “Company”), a producer of recycled LDPE located in northern Italy, close to Venice. The financial terms of the transaction were not disclosed. Repeats is a portfolio company of Ara Partners (“Ara”), a global private equity firm focused on industrial decarbonization.

Repeats’ investment in Polimero marks its expansion into Italy, an important step in building a pan-European plastics recycling platform. It follows Repeats’ recent two investments in Spain and the Netherlands, with expansion into other European countries planned for later this year.

Polimero uses a mechanical process to convert plastic waste into resin suitable for commercial and industrial applications. As part of Repeats, Polimero plans to continue expanding its production to meet the growing demand for recycled LDPE in Europe.

Polimero is led by Simonetta Tiberto, who has been with the company since 2010 and will continue to lead the Italian operations and execution of its growth plan.

“Polimero has a great reputation in the industry as an important player in the LDPE recycling environment in northern Italy,” said Greg Rung, CEO of Repeats. “We see significant opportunity for Polimero to further penetrate the Italian market by providing its clients with higher quality recycled resin. We are delighted that Simonetta and her team are joining Repeats and look forward to building on their success to date.”

“We share Repeats’ and Ara’s ambition to build one of the largest LDPE recyclers in Europe,” said Simonetta Tiberto, CEO of Polimero. “We are excited to have Repeats’ support as we continue to expand our business and geographic reach. All our efforts are aimed at creating a circular ecosystem and best serving customers who increasingly require high-quality recycled plastics.” Plastic-Recyclers – Biopolymer-r-PET

“We are excited for Repeats to enter the Italian market and partner with Simonetta,” said Tuan Tran, Partner at Ara Partners. “The Repeats platform is well positioned for rapid growth and plans to become the largest independent producer of recycled LDPE resins in Europe. We are pleased to support Repeats in its ongoing efforts to decarbonize the European plastics market.”

-Packaging tape with material made from recycled post-consumer PET

Tesa, international manufacturer of adhesive tapes and self-adhesive system solutions, is launching a new packaging adhesive tape. The new Tesa 60412 Recycled PET packaging tape has a waterborne acrylic adhesive system, and 70 per cent of the PET that makes up the backing comes from Post-Consumer Recycling (PCR). Tesa states that it can be disposed of together with the cardboard in the respective paper recycling bin without jeopardising the paper recycling process and is certified according to INGEDE method 12 (100/100). Plastic-Recyclers – Biopolymer-r-PET

The tape is intended for light- and medium-weight packaging applications up to 30 kg. It has a strong, abrasion-resistant backing and a consistent pressure-sensitive acrylic adhesive, a material combination that guarantees good adhesion on recycled cardboard as well as low-noise unwind. Thus, the new tape can be a suitable alternative to the commonly used packaging tapes made of polyvinyl chloride for many industries, such as the food and beverage industry, the pharmaceutical industry, or the logistics sector.

-Sustainability that goes beyond packaging

While the main focus for sustainability goals in food and drink has been on packaging, according to Multivac, there is a lot more that manufacturers can do throughout the processing and packaging chain to contribute to their sustainability story.

While the pressure is on, both from a legal and consumer perspective, for food and drink brands to achieve and exceed expectations on sustainability, it’s a confusing scene out there in the UK market.Plastic-Recyclers – Biopolymer-r-PET

A survey by Statista in August 2021, revealed that 13% of UK respondents would be willing to pay more than 10% extra for sustainable food1 and this is increasingly being demanded by the younger generation in particular. Meanwhile, the upcoming extended producer responsibility legislation (EPR), taking effect from 1 January next year, will tighten the rules on packaging and require compliance from relevant food and drink firms.

Sustainability Wheel resized

The big push to reduce plastic, which really began around five years ago, was ramped up two years ago when the Blue Planet II series aired the impact of marine plastic pollution. “Everyone wanted a panacea. They wanted to get rid of plastic, but not reduce shelf-life or have any on-cost or invest in any new kit,” says Elliot Chrisp, materials business unit manager at equipment supplier Multivac UK. “It wasn’t possible… or rather, it could be possible but you had to compromise on one of them.”

Pressure from brands’ marketing departments and from supermarkets, both responding to expectant consumers, created the perfect storm and the battle was on to satisfy those demands but create a balance that meant products continued to be protected through the supply chain and were afforded a reasonable shelf-life. In some ways, the pressure to reduce plastic became a race to the bottom.

By nature, recycled materials need to go mono and when a brand has traditionally used two polymers in its packaging, then the transition is not necessarily straightforward – as there was always a reason for those two different types of plastic in the first place, notes Chrisp.

A major problem that suppliers are now facing is the supply and demand of alternative packaging materials. While plastics can be replaced with additives such as EVOH (ethylene-vinyl alcohol copolymer -a clear, glossy thermoplastic copolymer) for barrier properties, the demand for EVOH has soared, with the result that supply has been restricted, with everyone on allocation.

“I don’t think the demand for EVOH would have gone through the roof if we hadn’t had this push for a mono approach,” says Chrisp, who suggests that the supermarkets have pushed the market down the mono route.Plastic-Recyclers – Biopolymer-r-PET

-Cellulose Powder–Filled PP Biocomposite Under Development

Nippon Paper and Mitsui Chemicals partner to produce biocomposite material for auto, home appliance, and other applications.

Japan’s Nippon Paper Industries and Mitsui Chemicals are set to partner in the development of a new biocomposite with a high cellulose powder content. The two companies intend to develop products and bring them to market at the earliest possible opportunity, with plans to expand into a range of fields, including consumer products, housewares, containers, building materials, household appliances, and automobile parts.

Aimed at bringing to market a new biocomposite that offers a high level of stability in terms of both quality and supply, the tie-up will see the partners tap into their material supply chains and leverage the advanced material manufacturing and development technologies they have cultivated over many years. Plastic-Recyclers – Biopolymer-r-PET

With cellulose powder as its principal ingredient, this new composite will boast the same processability as conventional plastic. Further, the composite’s use of woody biomass as its main constituent will help to cut greenhouse-gas emissions by minimizing the use of fossil-fuel-derived virgin material.

Japan is somewhat of a hotbed for development of biocomposites based on cellulose derivatives. Japanese auto parts maker Toyoda Gosei recently developed a cellulose nanofiber (CNF) reinforced polypropylene (PP) compound. Polyplastics, meanwhile, roped in regenerated cellulose in a long-fiber thermoplastic PP compound. Japanese pulp and paper companies have been working for some time on the development of cellulose fiber for composite applications.

Mitsui Chemicals aims to combine cellulose powder from Nippon Paper with the compounding technologies cultivated by the Mitsui Chemicals Group to develop a strong, readily workable biocomposite with a high cellulose powder content.

-Sulzer acquisition to scale up biopolymer production

Industrial giant Sulzer has acquired a stake in Netherland’s-based CELLiCON with the aim of scaling up the Dutch company’s pioneering technology for biopolymers.

Plant based nano structured cellulose offers an alternative to conventional petroleum oil-based polymers used in industry. However, while cellulose is an abundant biopolymer, its potential as a sustainable option has been limited by its high costs and footprint.

CELLiCON’s G2 technology is capable of reducing the costs in money and time as well as the environmental footprint of producing cellulose in its crystalline form – nanocrystalline structured cellulose, or nanocellulose. Plastic-Recyclers – Biopolymer-r-PET

The result is a building block for a range of industrial products including materials, superglues and transparent films, together with functioning as a starch or polystyrene alternative.

Swiss-based Sulzer has acquired a minority stake in the firm with an option to increase its holding. Its Sulzer Chemtech subsidiary will collaborate on scaling up and commercialising the nanocellulose technology.

Sulzer Chemtech Head of Strategy and Business Development Daniel Rytz explained the purchase would expand the firm’s processing technologies for bio-based and renewable feedstocks. It will also benefit production of the most popular bioplastic, polylactic acid, in which Sulzer plays a lead role worldwide.

A BIG QUESTION, immediately after the Russian invasion of Ukraine, was whether Europe would be able to maintain essential production of polyethylene (PE) and polypropylene (PP) because of energy-supply reductions. This led to speculation that Europe might have to import more polyolefins to ensure sufficient supplies of plastic films and bottles for medical and food-supply chains.Plastic-Recyclers – Biopolymer-r-PET

The chart below shows European dependence on Russian gas compared with country-by-country percentages of the region’s total PE capacity, Germany is the standout risk country as it has a nearly 50% reliance on Russia for its gas supplies with a total of more than 70% of Europe’s PE capacities across the three grades. In the case of the Netherlands, it is the location for just under 40% of capacities with its dependence on Russian gas at around 20%.

As you can see below, PP capacities are more evenly distributed across Europe. Germany accounts for some 20% of PP capacities with the Netherlands accounting for just under 10%.

But while, as I said, speculation over European production cutbacks occurred during the early days of the crisis, it was recognised that a far as durable end-use applications went, the dent in European demand was a bigger issue. PP is of course more vulnerable that PE, as a higher proportion of PP consumption goes into end-use markets such as automotives and white goods.

Energy costs could be a bigger issue than supply

The risk of supply production cutbacks forced on European producers by energy cutbacks certainly hasn’t gone away. But, as the Financial Times wrote in a 10 September article: “Confidence is growing in European capitals that Europe can get through the winter without severe economic and social dislocation or energy rationing. Von der Leyen said the EU had ‘weakened the grip that Russia had on our economy and our continent’.”

The newspaper added that gas storage in the EU was at 82%, well in advance of the 80% target the bloc set for the end of October. Member states had diversified supplies through increase pipeline imports from Norway, Algeria and Azerbaijan and LNG from the US and other producers. Nuclear, coal and renewables power generation is also being cranked up in order to hedge against the very real risk that Russia stops all gas supplies to Europe during the winter.Plastic-Recyclers – Biopolymer-r-PET

Russia could afford to do this, according to an 11 July Economist article. While the magazine said that oil exports had been worth 10% of Russian GDP over the previous five years (hence, all the efforts to maintain crude exports), gas exports were worth just 2% of GP over the same period.

Plastic-Recyclers – Biopolymer-r-PET