Plastic-Recycling – PSF-Polyester 15-11-2022 - Arhive

Plastic-Recycling – PSF-Polyester

-The world population has exceeded 8 billion, according to an official United Nations estimate.

It will reach 9 billion in 2037. A “milestone” in the history of humanity that presents challenges especially for the poorest countries

The world population, on 15 November 2022, passed the milestone of 8 billion inhabitants. This is revealed by a UN estimate, which warns, in the midst of COP27, of “our shared responsibility to take care of our planet”. For the UN, the “unprecedented growth” is the result of “a gradual increase in the duration of life thanks to progress in public health, nutrition, hygiene and medicine”, but also of the “high levels of fertility” of some countries”.

In 1950 the global population stood at 2.5 billion people, rising to about 7 billion in 2010. It took 12 years for it to grow to 8 billion and now the UN estimates that another 15 will be needed to reach 9 billion in 2037 “A sign – write the United Nations in a note – that the population growth rate is slowing down”. Plastic-Recycling – PSF-Polyester

The challenge for the poorest countries

It is the United Nations itself that underlines how the demographic boom also represents a social and economic challenge for the southern hemisphere. Countries with the highest fertility rates tend to be those with the lowest per capita income, meaning that population growth has been concentrated in the most fragile economies, largely in sub-Saharan Africa. The exploit of births, explains the UN, can compromise the achievement of the “green agenda” of the Sustainable Development Goals.

In any case, the UN points out, the main driver for “unsustainability” is not population growth, but income growth. Countries with the highest per capita levels of natural resource consumption and CO2 emissions tend to be those with the highest per capita incomes, not those with the fastest growing population. The achievement of the objectives enshrined in the Paris Agreement, the text that sets limits to the increase in temperatures, depends on cutting “unsustainable models of production and consumption”, even if a slowdown in population growth can reduce the environmental impact in the second mid century.

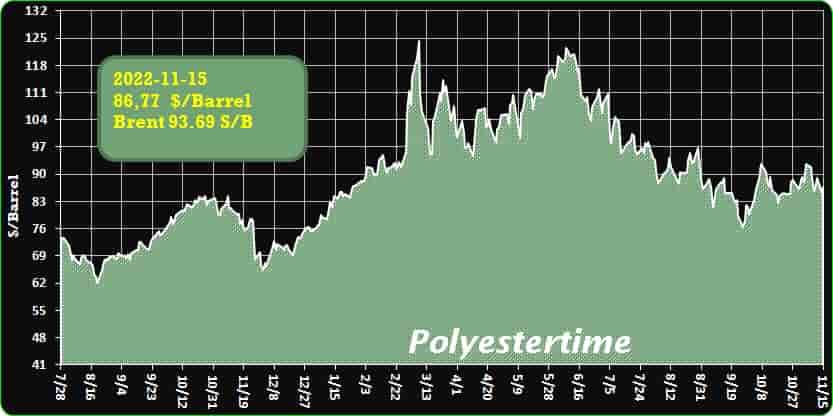

Crude Oil Prices Trend

Crude Oil Prices Trend Polyestertime

-Ingenia Polymers, IKA Group form JV for PVC additives

Headquartered in the Houston area, the venture will develop, produce and commercialize stabilizers and other additives for the PVC industry in North America.

Material suppliers Ingenia Polymers and IKA Group have formed a 50/50 joint venture to make and sell stabilizers and other additives for the PVC industry in North America.

The new JV will be located in the Houston area, where Ingenia is headquartered, the companies said in an Oct. 20 news release. Plastic-Recycling – PSF-Polyester

“After forming IKA Group in 2020 via a management buy-in, this important investment marks the next milestone for our ambitious international growth strategy,” IKA CEO Alexander Hofer said in the release.

IKA Group vice president Tony Butt will serve as president and chief executive of the new venture, the release said. He has more than 30 years of experience in stabilizers and other PVC additives. Plastic-Recycling – PSF-Polyester

“The teaming up of Ingenia and IKA is a perfect combination, as both groups enrich each other and will allow broad synergies,” Butt said.

Operations for the new JV are expected to begin in early 2023.

Ingenia was founded by John Lefas in 1986, under the original named WedTech Inc. Ingenia makes compounds as well as white, black, and colour masterbatches, and slip, antiblock, antioxidants, antistat and antifog additives, processing aids, ultraviolet stabilizers, and flame retardants.

-Beyond the bottle: Solutions for recycling challenging plastics

As demand for recycled content accelerates and the economics of recycling reaches a new level, there is an opportunity to bring challenging plastics into the recycling stream.

Although demand for recycled plastics continues to accelerate—driven, in part, by commitments from brand owners to incorporate recycled content into their products—the US Environmental Protection Agency indicates that the US recycling rate remains at around 9 percent.1 Together, several factors limit US recycling: consumer behavior, lack of access to recycling, the sortation of challenging plastics, and insufficient recycling capacity.2

Here, we focus on an important opportunity to resolve challenges regarding the sortation of so-called challenging plastics, which refers to non-bottle packaging materials such as films and flexible items, foams, and small-format items. Films, in particular, are sought by recyclers for use as feedstock for new technologies called “advanced recycling.”3 Although significant quantities of challenging plastics are available from the waste-management industry, only a limited volume is actually recycled today because of market disconnect: the quality of material available does not meet the input requirements for recyclers.

Although significant quantities of challenging plastics are available from the waste-management industry, only a limited volume is actually recycled today because of market disconnect. Plastic-Recycling – PSF-Polyester

This article outlines an opportunity to deploy a new generation of secondary sorting facilities, also called feedstock preparation facilities (FPFs), to resolve this market disconnect and enable a significant step forward in US plastic recycling. Our conclusion is that demand for recycled plastics is strong, there are large volumes of untapped feedstock available to meet this demand, and price premiums for recycled material make the economics attractive for the entire value chain to invest to collect and process this material to produce high-quality circular plastics.

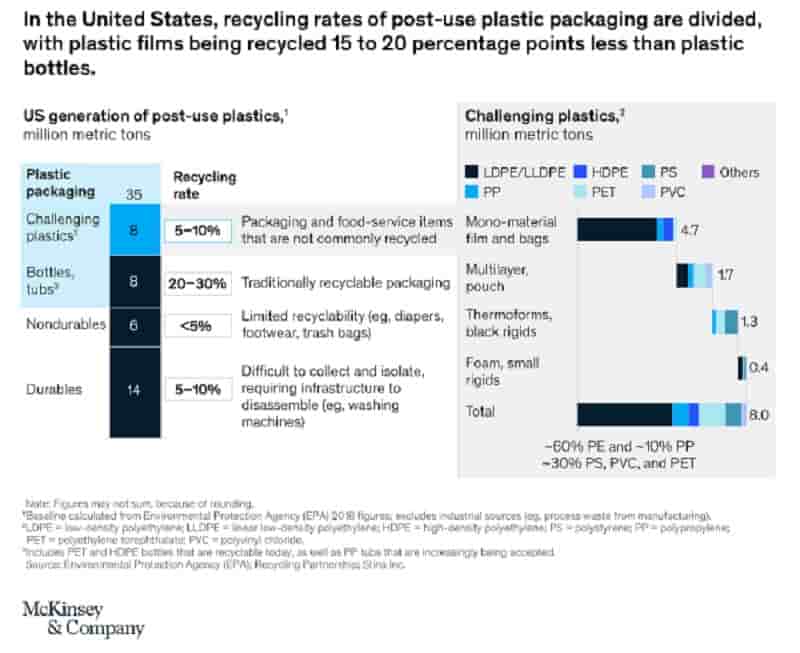

Recycling rates for post-use plastic packaging are not equal

Today, there is a wide range in the recycling rates of different plastics and forms of plastic. Plastic bottles and other large, rigid packaging forms—typically polyethylene terephthalate (PET) and high-density polyethylene (HDPE)—have the highest recycling rates of all plastics at 20 percent or more .

PET and HDPE bottles (for example, water bottles, milk jugs, and shampoo bottles) are widely accepted in household curbside recycling programs alongside paper, metal, and glass. Consequently, these bottles have stable systems in place for recovery, such as being easily sorted in material recycling facilities (MRFs), which can manage single-stream recyclables with automated sorters.

Other packaging segments, such as films, bags, and other food service items, which are largely made from polyethylene (PE), have recycling rates of less than 10 percent. Films and flexibles have low acceptance rates in curbside or residential programs and are mostly recovered by commercial back-of-store collection. Of the approximately 35 million metric tons (MT) of post-use plastics generated every year in the United States, these challenging forms of plastic packaging—such as PE films, multilayered packaging, thermoforms, foams, and small rigids—account for around eight metric tons per annum (MTPA). This plastic could serve as feedstock for recyclers but today remains largely untapped.

Market disconnect for films and flexibles

There is strong demand for recycled plastics, especially from consumer packaged goods (CPG) companies that need to use post-use plastics to meet recycling commitments. On this point, many CPG companies have committed to shifting 15 to 50 percent of their portfolios to be recycled plastics—in some cases, as soon as 2025 or 2030.4

This demand is evidenced by premiums for recycled plastics—especially for high-quality grades used in packaging, such as natural HDPE. Plastic-Recycling – PSF-Polyester

Despite this demand, low recycling rates for films and flexible-plastic material persist, and many programs do not collect these materials. Of the approximately 500 MRFs in the United States today, 20 to 30 percent have some capability to handle plastic films. These MRFs could produce what is known as a “MRF film bale”; however, the majority choose not to because of a perceived lack of an end market.

The disconnect is likely due to the quality of post-use plastic bales. Today, the quality of MRF film bales is typically low. Some are composed of 50 to 70 percent PE or polypropylene (PP); 10 to 20 percent other undesired plastics, such as PET or polyvinyl chloride (PVC); and 10 to 30 percent nonplastic materials, such as paper, metal, or food residues. The composition of the bales is also highly inconsistent, with high variability over time and by source, making it difficult to use them in downstream processing.

Downstream recyclers, even in more flexible advanced-recycling processes, require purity levels of 80 to 90 percent or higher. Mechanical recyclers require even higher-quality plastics, such as film grades of B or A/A+ in which clear PE is required to be more than 95 or 99 percent pure, respectively.

The quality and volume mismatch between supply (MRFs) and demand (advanced recyclers or CPGs) has resulted in market disconnect. On the one hand, there are plenty of unused low-quality flexible bales that go to landfills; on the other hand, there is limited feedstock to scale advanced recycling. Plastic-Recycling – PSF-Polyester

How to increase post-use plastics recovery

To resolve the market disconnects caused by mismatched quality of feedstock, the plastics recycling industry can invest in FPFs to upgrade the quality of bales. FPFs could serve to aggregate and upgrade plastic waste to meet the specifications of downstream processors. Premiums for recycled plastic enable reinvestment-level returns at each step. Building out this system will require collaboration between the (advanced) recycling industry and the waste industry. This proposed solution is outlined in more detail below.

Cleaning the waste stream by removing contaminants

To improve the quality of feedstock, the plastics recycling industry could invest in FPFs to increase polyolefin content to meet the specifications for advanced recycling and aggregate volume from MRFs to feed advanced recyclers. FPFs can also deploy sorters—for example, ballistics, eddy current, magnet, or optical—to remove other plastics and contaminants and can tailor the physical representation of the feedstock to the needs of each recycling facility, such as deploying shredding, densification, or extrusion to alter the physical form of feedstock to meet the requirements of specific recycling facilities.5

Moving forward, FPFs can redirect MRF films that would otherwise end up in a landfill, and the 20 to 30 percent of MRFs able to handle flexible films can begin to deploy their capabilities. After these MRF capacities are fully used, the industry can invest in additional MRF upgrades, such as new ballistic or optical sorters, to accept more films from residential and small commercial sources.

These changes require additional investment and create tiers of costs by source and method of recovery . Initially, low-cost post-use film can be recovered from large and midsize commercial sources through front-of-store consumer drop-offs and back-of-store baling. Construction of FPFs to upgrade films from MRFs would represent the next tier of cost. Other costs could stem from upgrading MRFs and building FPFs. Finally, some sources, such as rural locations, have no access to recycling, and providing access would require larger investments, such as purchasing new trucks or developing MRFs.

Supporting additional sortation costs through premiums for recycled plastic

Additional sortation would incur higher costs for post-use plastic feedstock than advanced recyclers have historically paid. Our research shows that the waste-management industry could supply films from commercial sources at less than $200 per MT, but demand increases could raise costs up to $300 to $500 per MT as more expensive tiers of plastic waste are required to meet demand (see sidebar “How feedstock preparation facilities can succeed”). Plastic-Recycling – PSF-Polyester

Over the past three years, however, the premium paid for recycled plastic compared with virgin material has been high—more than $1,500 per MT—and is more than enough to cover the additional sortation costs described above. These premiums can be passed across the value chain to encourage investment in upgrading the quality of bales.

Supporting collaboration between waste players and chemical players

The plastics recycling industry (including chemical producers) and waste-management industry can work together to scale recycling of these challenging plastics. Chemical players have the downstream assets and product portfolios; waste-management companies own the post-use plastic materials and are best positioned to deploy sortation technologies. To some extent, these companies are able to deploy such technologies today, though they do not yet have the economic incentives to do so.

As the demand for recycling films continues to grow, the plastics recycling industry can work with the waste-management industry to tap into broader sources of feedstock.

The chemical industry, in particular, can help signal a strong and growing demand for feedstock and can help to finance the mobilization of the waste-management industry, through either direct capital investment or offtake arrangements. This could help build confidence with the waste-management industry, which could then encourage further investment. Beyond just chemical producers and waste management, support from consumers, packaging converters, brand owners, and policy makers will be required to ensure success. Plastic-Recycling – PSF-Polyester

-Solid progress at second Ingeo plant

Site will have an annual capacity of 75,000 tons and produce the full portfolio of Ingeo grades.

NatureWorks, the world’s leading manufacturer of low-carbon polylactic acid (PLA) biopolymers made from renewable resources, has selected TTCL as the general contractor for procurement, construction, commissioning, and startup support services for its new Ingeo PLA manufacturing complex in Thailand. Plastic-Recycling – PSF-Polyester

The new facility is designed to be fully integrated and will include production of lactic acid, lactide and polymer. Located on the Nakhon Sawan Biocomplex (NBC) in Nakhon Sawan Province, the manufacturing site will have an annual capacity of 75,000 tons of Ingeo biopolymer and will produce the full portfolio of Ingeo grades.

In June 2022, site preparation for the new facility was completed and NatureWorks signed an agreement with Sino Thai Engineering and Construction (STECON) to begin early-works construction for piling, underground piping, storm water management and tank foundations. Currently underway, the early-works construction progress keeps completion of the facility on schedule for the second half of 2024. Plastic- Recycling – PSF-Polyester

“We are pleased to see the continued progress on the construction of our second Ingeo manufacturing complex that will help us address the increasing global market demand for sustainable materials,” said Steve Bray, VP of operations at NatureWorks. “With the selection of TTCL as our general contractor, we are looking forward to leveraging their expertise in executing large, highly technical capital projects in Thailand.”

NatureWorks expects to hold a cornerstone laying ceremony to honour the progress of site construction in February 2023.

In 2021, NatureWorks first announced the authorisation for initiating its global capacity expansion plan beginning with its second Ingeo biopolymer manufacturing facility. It became the first company to produce PLA biopolymers at commercial scale in 2002. NatureWorks expanded its flagship facility in Blair, Nebraska, to an annual total capacity of 150,000 metric tons in 2013.

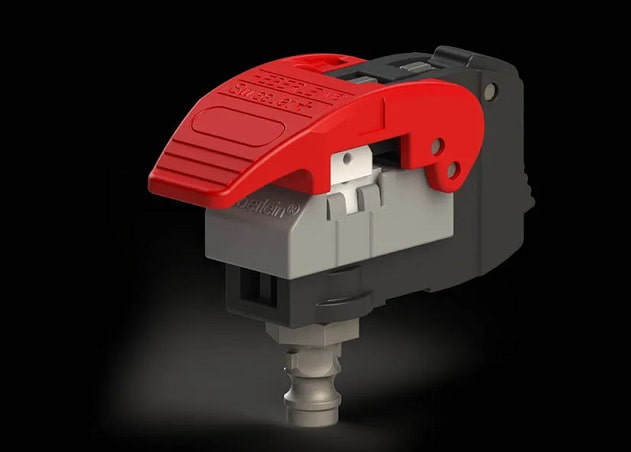

-Switzerland’s Heberlein to showcase products at ITME 2022

Swiss fabric manufacturer Heberlein is set to participate in India International Textile Machinery Exhibitions (ITME) 2022, which will be held in Greater Noida, Uttar Pradesh, from December 8–13, 2022. Visitors can hear first-hand about the latest product developments—as well as the company’s partner in India—at Heberlein’s booth 11F20 in hall 11.

Heberlein is known worldwide as a leading provider of air-interlacing and air-texturing jets for synthetic filament yarns. It is also a favourite brand in the Indian man-made yarn community, according to a press release. That position was achieved with the help of an excellent local partner and it is a story that Heberlein staff will share with visitors to the upcoming ITME show. Plastic-Recycling – PSF-Polyester

Heberlein’s history began in 1835 with a big idea and growing enthusiasm for the textile industry. The Swiss company had become well established in the European textile industry as a pioneer in mercerised yarns. Later, a kind of artificial silk known as Helanca, was developed in its laboratories. The final global breakthrough was the development of false-twist texturing machines. Heberlein’s continuing business success made expansion the logical next step, spanning many decades of technological and market growth.

As part of a programme to expand its sales territory into new regions, Heberlein started in India in 1990. A priority was to identify the right partner to ensure a successful market launch. Looking back now, Heberlein is delighted that its search led to Vivek Dhawan, a Bachelor of Textile graduate from Veermata Jijabai Technological Institute (VJTI), Mumbai. Dhawan immediately mounted a tireless effort to run trials all over India with intermingling jets. Customers were soon convinced of the benefits of Heberlein products, especially in Gujarat state where 90 per cent of India’s polyester yarn business is located.

Airotex LLP, the agency representing Heberlein in India, was founded by Dhawan at a time when manufacturers were switching from sizing to intermingled yarn for use in both warp and weft. Texturing was quite new then and producers saw intermingled yarn as a way to avoid the costly process of sizing. As Heberlein’s exclusive partner, Airotex LLP had both the sophisticated solution and the latest technology at hand.

Some Indian customers already knew Heberlein as a spare parts supplier. In components for ARCT/Lohia machines, the quality of spares like spinnerets and Vulkollan rolls supplied by Heberlein was regarded as the best. Later, when intermingling became fully established in the market, the Heberlein name stood out.

For Airotex LLP customers, there are great benefits to be had from in-plant trials of various Heberlein products, carried out by experienced Heberlein staff. These trials help existing and potential customers to evaluate results in terms of interlacing density, level of stability, regularity, or air consumption. The knowledgeable Heberlein support team can recommend the ideal products for specific processes. Such activities build a solid relationship of trust with the clients. And through Airotex LLP, customers benefit from continuous updates on Heberlein’s latest product developments.

Man-made yarn production in India has a 30-year history. In the 1990s, the market started to develop but it was the introduction of intermingling technology which provided the real boost for filament yarn. The market was seeking a definitive shift from sizing to air intermingling, so Heberlein—as a pioneer in air-influenced products—was a perfect partner in the new and growing texturing industry. Plastic-Recycling – PSF-Polyester

“Indian customers appreciate technology from Heberlein for the modification and treatment of synthetic yarns, particularly filament yarns,” said Vivek Dhawan, partner of Airotex LLP.

During the past three decades, Heberlein has been pre-eminent with innovative products such as air-interlacing or air-texturing jets for POY/FDY, AirSplicers, suction guns, or cutting heads for polyester staple fibre (PSF) plants.

The most popular products are air-interlacing jets for all deniers from 50 to 1,500 on texturing machines. In texturing jets for 50 to 3,000 den yarn, the company has a virtual monopoly.

Heberlein continuously invests in R&D, with sophisticated, original, and inspiring products and solutions. The company’s success is based on innovation and on customer trust, as Heberlein empowers business success. Knowledge and confidence have both grown, founded on 100 years of expertise. Today, customers rely on Heberlein solutions to meet the toughest processing needs—and create genuine added value. The Heberlein name is a seal of quality, with products renowned for durability, technology, and optimal cost-benefit ratio.

-Russian scientists have created antibacterial cotton wool

A source in the Russian Ministry of Education and Science said that scientists added zinc oxide and titanium nanoparticles to cotton fabric and obtained antibacterial cotton fabric.

It should be noted that nanoparticles of some metal oxides effectively suppress the vital activity of drug-resistant bacteria and fungi and, at the same time, are harmless to humans.

To increase the durability and stability of this antibacterial coating, the researchers used ultrasonic curing technology. Because this method ensures uniform distribution and spreading of nanoparticles over the surface, and also allows its wide application and low cost. Plastic-Recycling – PSF-Polyester

The researchers note that the addition of nanoparticles to cotton fabric did not change its consumer properties, and these nanoparticles can withstand at least 20 washing cycles.

The treated cotton fabric has been successfully tested on the outskirts of Hanoi, the capital of Vietnam, where high temperatures and humidity create favorable conditions for bacteria to thrive.

“The number of microorganisms on these tissues for three months was 30-100 times lower than in untreated tissues,” says Varvara Veselova, researcher at the Laboratory for Synthesis of Functional Materials and Processing of Mineral Raw Materials at the Institute of Inorganic General Chemistry. Microorganisms present on the fabrics during the test period indicated that unicellular fungi were the main cause of tissue deterioration in tropical climates, but zinc oxide was found to be an excellent fungicide as the treated fabric remained 20 percent stronger than raw fabric.

The researchers note that the processed cotton fabric can be used in the field of medicine and in the production of clothing.

Source: newspaper.ru

-Here’s Why Recycling Plastic Isn’t a Panacea

Hi, it’s Dasha in London. The world’s plastic mountain keeps growing, with ugly consequences for the planet and those who inhabit it. I’ve been looking into why pinning all hopes on recycling may not be the way forward. But first…

Today’s must-reads

- At least 500,000 British workers have dropped out of the labor market due to poor health since the start of the pandemic.

- Elon Musk’s first email to Twitter staff says `no way to sugarcoat the message.’ Remote work is over.

- The shrunken Mississippi river slows US food exports, just when the world needs them the most.

Here’s the rub with recycled plastics

As a reporter covering the world’s largest packaged-goods companies and their efforts to reduce the use of plastic, I have often wondered why I’m still seeing so many of the same old soda bottles around. Plastic-Recycling – PSF-Polyester

Switching to mostly recycled plastic might give bottles a cloudy look, but surely consumers could be persuaded to accept that in the name of saving the environment?

Here’s the rub, though: one of the lesser known challenges facing companies is that the recycling can cause some serious health risks.

That helps explain why most of the planet’s biggest plastic users look almost certain to miss a target of only using reusable, recyclable or compostable packaging by 2025, according to a report this month by the Ellen MacArthur Foundation and the UN Environment Program.

In fact, the report shows Coca-Cola Co., a controversial sponsor of the COP27 climate summit currently under way, and arch rival PepsiCo actually increased their use of newly-manufactured plastic, as did Mars.

We all know virgin plastics contain additives that have been linked to cancer, issues with brain function and a range of hormone-related effects like infertility and early puberty.

The issue with recycling is that that melting together different plastics can multiply the additives — and their potential health hazards.

A study published in the Journal of Hazardous Materials earlier this year found more of the offending additives leach from recycled PET bottles into their contents than from virgin plastic ones.

The recycled plastic may become tainted by chemicals when it’s collected and sorted, the researchers said, but it’s still unclear exactly how the contamination happens.

Switching to another material carries pitfalls, too. Flogging more pop in glass bottles may increase drinks’ companies’ carbon footprint, for example.

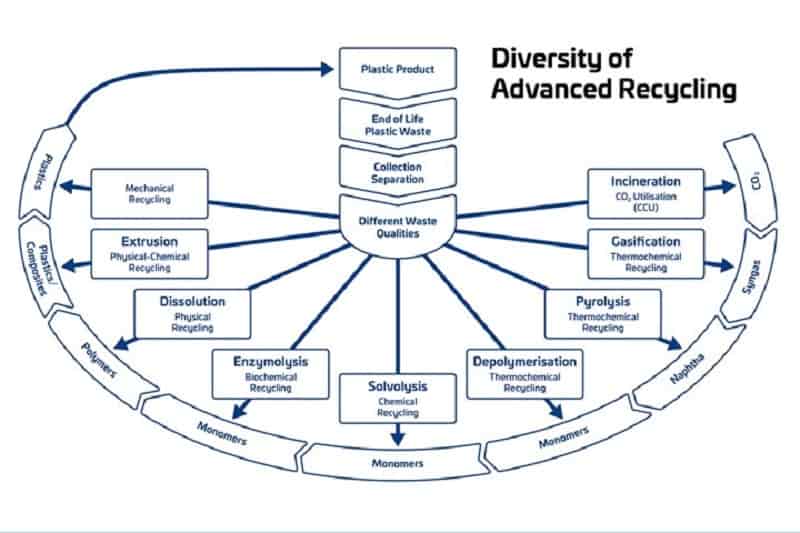

-Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

We are currently witnessing a growing acceptance of advanced chemical recycling technologies as complementary solutions to mechanical recycling. Brand owners in the FMCG (fast-moving consumer goods) sector acknowledge the role chemical recycling can play in unlocking the use of post-consumer recycled (PCR) content and we see several leading chemical companies investing in and/or partnering with advanced recycling technology providers. Plastic-Recycling – PSF-Polyester

All eyes are now on the ongoing legislative discussions and deliberations on the status of chemical recycling and mass-balance accounting. The industry is hoping for a well-defined and inclusive policy framework, as it is clear to the entire plastics value chain that achieving plastic circularity will require a whole gamut of solutions.

The diversity of advanced recycling solutions is akin to the complexity of plastic waste, which comprises different types of plastics with diverse polymer chemistries. The largest advanced recycling capacities are currently achieved only via thermochemical methods using gasification or pyrolysis. On account of tech maturity, the total number of tech providers, and the average plant size, pyrolysis sits at the top of the list. It can process streams of mixed polyolefin waste and transform them into virgin-equivalent recycled grades for food-contact applications. This has been an important factor driving its growth, with FMCG brands that rely heavily on PE- and PP-based packaging looking to meet the ambitious recycled-content targets for their product packaging.

-The first biodegradable water bottle is coming, for real this time

Company has raised $20 million since 2018 from luminaries like Salesforce co-founder

The Cove water bottle is a thin, sturdy cylinder, eggshell-white with a matching lid. It feels familiar. “If someone gave that to you,” offered Alex Totterman, Cove’s founder and chief executive, “you probably would have no idea that that wasn’t a plastic bottle.”

If someone does give you this bottle, it would be a remarkable achievement. Scientists and businesses have spent many years and much money trying to replace everyday packaging with natural materials that don’t pollute the Earth “- so far, that’s given us little beyond compostable straws.

But the challenge hasn’t deterred Cove from its own five-year journey to producing the first “fully biodegradable” bottle of water. In the coming months, Totterman says Cove’s creation will finally hit stores at $2.99 a pop. Plastic-Recycling – PSF-Polyester

Totterman has also said this before. In February 2019, he told Fast Company Cove’s bottles were arriving in stores later that month. They didn’t. In October 2020, Totterman told the Los Angeles Times his bottles were arriving after the new year. Still nope. Pandemic delays and supply chain bottlenecks have repeatedly derailed the startup’s plans, as has the chemistry involved in its mission. Plastic-Recycling – PSF-Polyester

Cove’s investors are still on board. The company has raised $20 million since 2018 from luminaries like Salesforce co-founder Marc Benioff; media heir James Murdoch; and Valor Equity Partners, an early backer of Tesla Inc. Totterman also bagged investment from singer Ellie Goulding, DJ Diplo, and Palm Tree Crew, a holding company co-founded by DJ Kygo “- plus a few pop stars he wouldn’t name. By his telling, grocers, music festivals and corporate campuses are waiting with bated breath, and checkbooks in hand, for someone to produce a water bottle that people won’t feel guilty about tossing out, and Cove is nearly ready to produce 20 million bottles a year to meet interest from “pretty much every major retailer and brand,” Totterman said. (Whole Foods is the only named customer.)

Cove’s bottles start in kitchens. RWDC Industries, a chemical supplier with US headquarters in Georgia, first collects cooking oil from restaurants and ferments it into polyhydroxyalkanoates, or PHA, a polymer meant to dissolve in water or soil without any toxic residue. RWDC ships this creation to Cove’s warehouse north of Los Angeles, where it arrives as tiny round pellets that look and feel like bits of Styrofoam. RWDC “- the only PHA supplier of Cove’s that the startup would name “- adds secret ingredients to its concoction, but Blake Lindsey, the company’s chief commercial officer, said that there’s nothing synthetic involved.

From there, the PHA pellets move to Cove’s 25,000-square-foot factory, where they are sent through machinery to vacuum away moisture, sift out metal, and stretch, cut and mold the material into a hollow canister fit for water. A label is then printed directly onto each bottle (“Cove’s plastic-free, renewable bottles” ). The ink, made from algae, is meant to biodegrade, too. Water from a purification plant nearby is poured in. By Cove’s estimates, its bottles will disintegrate in water and soil in under five years.

After starting in 2018, Cove cycled through at least one approach to making its bottles that didn’t pan out. When the company decided to open its own factory, in early 2021, Cove quickly discovered the unpredictability of its Goldilocks material. If PHA gets too cold, it becomes too brittle; if it’s too hot, it goes soft. During one test run, the ingredient overheated, and Cove’s factory floor erupted in steam and a pungent aroma of caramel that one early employee described as “especially vivid.” (The unique properties of PHA mean that different batches produce different scents; during a visit in early October, Cove’s factory floor smelled strongly of buttery popcorn.) Plastic-Recycling – PSF-Polyester

Every piece of bottling equipment Cove bought also needed to be modified to handle the fickle material, and most took forever to show up. Steel pipes to transport the pellets between machines and a temperature sensor tool didn’t arrive for more than a year. Still today, one of Cove’s 12 employees manually sorts bottles rolling off the assembly line because a mechanical sorter is en route. “We ordered [it] back in January. It was promised to be here in April,” explained Cove’s vice president of technology Jim Shepherd, shouting over the machine din. “We’re now in October and basically waiting on a robot.”

When Cove first started production, it would ship PHA pellets to laboratories to test their physical properties, intending to wait on the results before forging them into bottles. “It wasn’t fast enough,” said Agnes Steckler, Cove’s research director. So the company built Steckler her own lab, a room with eight machines to measure resilience, melting points and molecular weight of the PHA. The lab cost the startup more time and “millions of dollars,” Totterman said. But it was worthwhile: “We had to take a step back to take two steps forward.” Plastic-Recycling – PSF-Polyester

Even that wasn’t the last hurdle. Once Cove finally began churning out bottles, most weren’t strong enough to withstand a tight grip, or a drop from a few feet. “It turns out, it’s very difficult to bring a new technology to market,” said Peter Rahal, an early investor.

Others have tried to crack the biodegradable bottle. In 1990, the British industrial firm ICI announced a biodegradable plastic made from a mixture of bacteria and glucose that took 15 years to develop. ICI said the material absorbed enough carbon dioxide to match emissions from production, and rolled it out first as shampoo bottles in Germany. But the material was expanded to few other items and six years later ICI sold the invention patents to Monsanto, which soon pawned off the biodegradables division to a company called Metabolix. It, too, tried remaking plastics, failed, then steered the research into agriculture. Plastic-Recycling – PSF-Polyester

Meanwhile, every food and beverage giant, under significant pressure to get off plastic, has experimented with natural substitutes. Few projects have left the lab. Last year, Coca-Cola Co. abandoned its plans for plant-based packaging in favor of 100% recyclables, arguing that consumers were demanding reusable bottles.

Such corporate efforts underestimate the expense and headache of converting organic materials into a viable plastic replacement, according to Ramani Narayan, a professor at Michigan State University and expert on bioplastics. He has seen a parade of companies try harvesting various chemical mixtures, only to give up or fall short of bold promises “- and he’s wary of RWDC’s claims about PHA. “Every third person comes around, ‘Oh, I’ve got this magic stuff now. I can save the world’s problems,'” Narayan said.

Danimer Scientific Inc., a company planning to make straws, Skittles bags and rum bottles using plant-based PHA, was last year accused by scientists “- and short sellers “- of overstating biodegradability claims. (Danimer argued its process met international testing standards.) Cove’s key ingredients from RWDC have been approved as biodegradable by certification body TA.25v Austria, and Totterman says his company is awaiting similar approval for its bottle.

After initially working with contractors, Totterman decided to bring Cove’s process in-house, recruiting a small team of material scientists and manufacturing veterans “- though none of them are PHA experts. Before Cove, Totterman worked for a water purification startup in his native UK. Shepherd is a molecular scientist who spent decades at Coca-Cola and Procter & Gamble, although he hadn’t worked with PHA until joining last year. “We’re figuring out the standards,” said Totterman. “Because there isn’t a blueprint.”

Investors like this temerity. “Experience can be a burden,” says Rahal, who created RxBar, the health food brand. “If you know too much and you’re too smart, you don’t jump. And you’ve got to jump.” Plastic-Recycling – PSF-Polyester

More hurdles remain. Recent environmental legislation in California categorizes PHA as a plastic, limiting the amount of material Cove can use in production. (Ben Kogan, Cove’s policy lead, is working on a counterproposal.) And pricing is in flux. Two years ago, Cove promised a $2.29 bottle, but it has since added 70 cents to that price in response to price hikes on raw materials. Totterman thinks expecting consumers to reuse bottles or recycle more often is naAve. Expecting people to pay more for compostable bottles sounds naAve, too, but Cove sees validation in Liquid Death, an aluminum can water brand worth an eye-watering $700 million.

The company also takes inspiration from another premium product: An investor deck from this summer describes Cove’s strategy as “the Tesla playbook” “- sell an expensive item that conscious consumers will buy, driving down production costs. Pricey water is merely a “Trojan Horse” for a range of compostable consumer goods, Totterman said, hinting at future Cove shampoo bottles and other home care products.

Plastic-Recycling – PSF-Polyester